5 Lessons I Learned After Reading 50 Years of Berkshire Hathaway Letters

What I learned from reading every Berkshire Hathaway letter since 1974...

Hi, Investor 👋

I’m Jimmy, and welcome back to Jimmy’s Journal. Over the past months, I’ve read all 50 years of Warren Buffett’s Berkshire Hathaway letters - page by page.

In this post, I’ve distilled the timeless principles that have shaped Buffett’s success into 5 key lessons every investor should know.

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

Reading 50 years of Warren Buffett’s annual letters is nothing like an MBA.

It’s more like having a private mentor in investing, business, and human behavior for half a century - without exams, but with real-world examples and results.

What’s most striking is not the number of new ideas, but the consistent repetition of the same principles applied in different market contexts.

Time has only refined the wording and strengthened the conviction.

Here are the five most valuable lessons I’ve taken from this continuous reading.

1. Value Investing is More About Value Than Price:

"Price is what you pay, value is what you get."

— Berkshire Hathaway Letter to Shareholders (2008)

Value investing began with Ben Graham’s idea of buying companies below liquidation value - often troubled businesses - and waiting for the market to reprice them.

Buffett followed this approach early on, buying “cigar butts” with one last puff of profit.

It worked, but it required constant work and lacked scalability.

The turning point came with Charlie Munger’s philosophy: buy high-quality businesses, even at above-average multiples, as long as intrinsic value compounds over time.

How to measure that “value”?

Buffett and Munger look for:

ROIC consistently above the cost of capital.

Stable or expanding gross and operating margins.

High reinvestment capacity at attractive returns.

A durable moat to protect profitability from competition.

Example: See’s Candies, acquired in 1972. The business had just $30 million in revenue but exceptional margins, loyal customers, and a strong brand.

They paid $25 million - a high multiple for the time - and See’s has since generated over $2 billion for Berkshire without additional capital.

True value investing isn’t buying the cheapest stock, but buying something whose future cash flows, adjusted for risk, are worth far more than the price paid.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

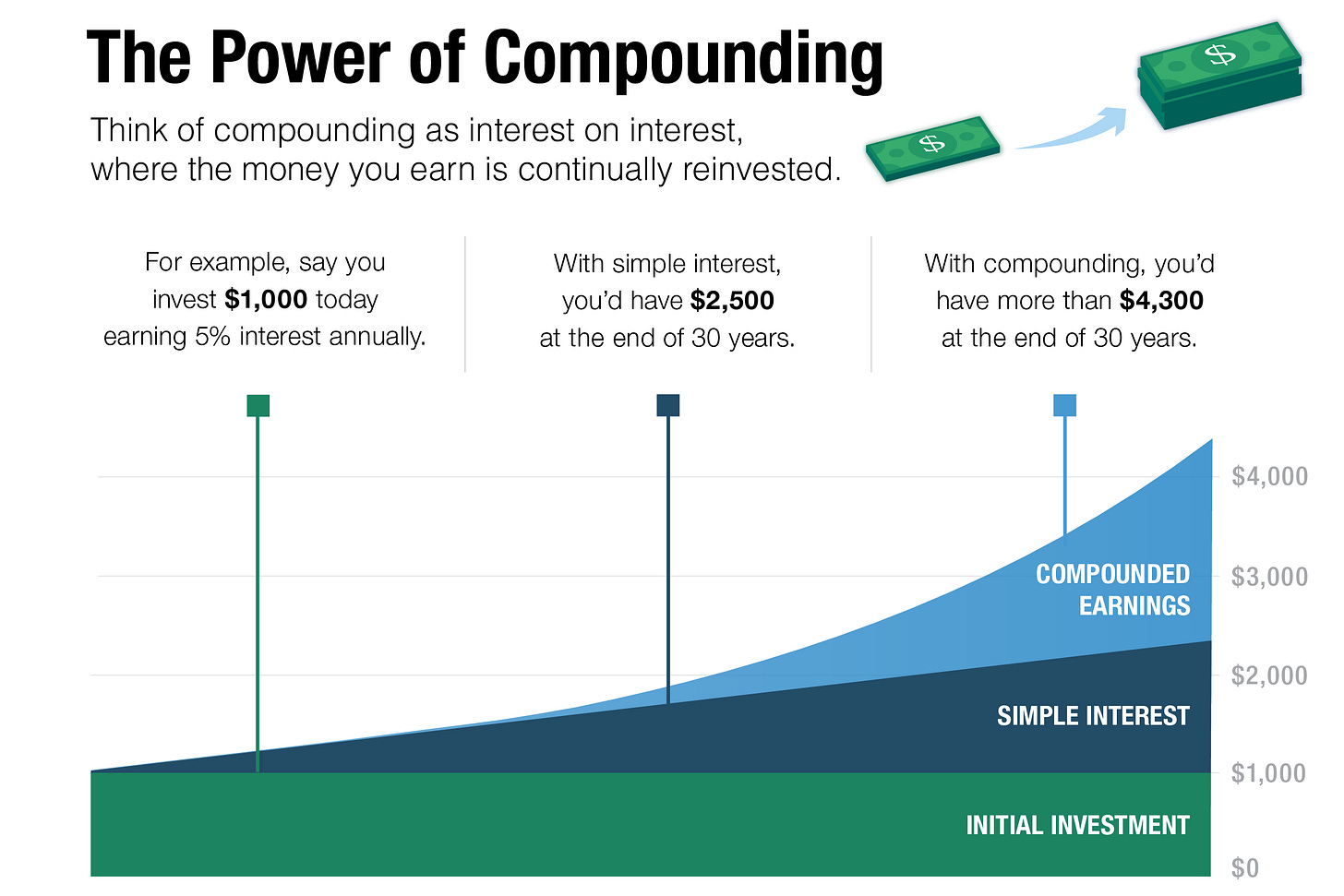

2. Time and Compounding Are the Greatest Allies:

"Our favorite holding period is forever."

— Berkshire Hathaway Letter to Shareholders (1988)

Compounding is mathematically simple but psychologically difficult.

Buffett’s letters show that the key is keeping the process going for decades without unnecessary interruptions.

That requires three key elements:

Businesses that grow with high ROIC.

Discipline not to sell during short-term volatility.

Conservative risk management to avoid permanent capital loss.

Example: Berkshire’s Coca-Cola stake, bought in the late 1980s, cost around $1.3 billion. Today, annual dividends alone exceed $700 million - more than 50% of the original cost every year. The position is still worth over $25 billion.

Buffett reminds us that “time in the market” beats “timing the market” because compounding needs years to show exponential results.

Selling too early or chasing quick trades kills the snowball effect.

Compounding = (return rate) × (time invested) × (reinvestment rate).

Break any of these three, and the effect dies.

Enjoying the content so far?

Don’t stop here - unlock the full experience with Jimmy’s Journal Premium:

Monthly Portfolio Updates with performance insights

Exclusive deep-dives into top-quality businesses

Portfolio Tracker to monitor allocations and results

Premium tools & frameworks

This is your first step to becoming a better investor.

And right now, we’re giving you a limited-time offer - 20% OFF (!!!) until tomorrow. 🎁

That’s just a fraction of what it’s really worth. Don’t miss it.

3. The Circle of Competence: Invest Where You Understand

"What counts is not the size of the circle of competence, but how well you define it."

— Berkshire Hathaway Letter to Shareholders (1996)

Buffett never tried to invest in every sector.

His focus is on businesses he understands deeply, which means knowing:

The revenue engine - why customers pay

Cost structure and margin drivers

The main risks and how they might play out

Reinvestment rate and sustainable growth potential

Investing outside your circle means working with incomplete information - and unpriced risk.

Example: For years, Buffett avoided technology stocks. Not because they were bad, but because he didn’t understand their pace of innovation or entry barriers.

He only invested in Apple when he saw it as a consumer company with a closed ecosystem, strong brand, and extreme customer loyalty.

Your circle of competence isn’t fixed, but expanding it requires deep study, historical analysis, and qualitative understanding. Outside it, probabilities work against you.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

4. Reputation is a Non-Negotiable Asset:

"It takes 20 years to build a reputation and five minutes to ruin it."

— Berkshire Hathaway Letter to Shareholders (1991)

Reputation is intangible capital, but it has real economic value:

Customers pay more for trusted brands.

Partners and suppliers offer better terms.

Regulators grant more flexibility.

Buffett’s letters make it clear: one unethical decision can destroy decades of trust.

Example: In the early 1990s, Salomon Brothers was caught manipulating Treasury auctions. Buffett stepped in as interim chairman to restore credibility.

The episode cost time, money, and energy - and could have destroyed the firm entirely.

Buffett’s simple test:

“If you’d be uneasy seeing it on the front page of the paper tomorrow, don’t do it.”

Strong reputation lowers cost of capital, increases customer loyalty, and strengthens resilience during crises.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

5. Simplicity is a Competitive Advantage:

"I don’t need a computer to know I’m right about a simple business."

— Berkshire Hathaway Letter to Shareholders (2007)

Buffett prefers companies with predictable models, clear economics, and visible moats.

This applies to both investing and management: complexity is fertile ground for errors and bad decisions.

Simple businesses typically have:

Predictable cash flows.

Stable cost structures.

Durable moats such as brand, distribution, or network effects.

Low dependence on constant innovation to survive.

Example: Burlington Northern Santa Fe (BNSF), acquired in 2010, is predictable: rail transportation with high physical and regulatory barriers, stable demand, and consistent returns. It’s hard to replicate and easy to understand.

Simplicity increases visibility into future returns, reduces forecasting errors, and minimizes the chance of negative surprises.

Key Lessons to Remember:

Half a century of Berkshire letters shows that Buffett and Munger never sought instant genius - they sought lasting consistency.

Investing, for them, is a game of probabilities, and the odds improve when you:

Buy quality businesses.

Pay a fair price.

Hold for decades.

Protect your reputation.

Keep things simple.

"If you’re an investor with a 20-year horizon, your biggest enemy is yourself."

— Warren Buffett

The rest is noise.

I hope you enjoyed the read.

What do you think is Warren Buffett’s most important lesson?

Share it with a friend who might like it too.

Cheers,

Jimmy

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.

Very good writing Jimmy

Great post Jimmy!