8 Lessons I Learned from Terry Smith

Everything I learned from reading Investing for Growth by Terry Smith

Hi, Investor! 👋🏼

Some books stay with you long after you close the last page.

For me, Investing for Growth by Terry Smith is one of them.

It’s not a dense manual filled with equations. It’s a collection of clear, practical lessons.

Simple to read. Surprisingly powerful to apply.

Terry Smith has become one of the great exponents of value and quality investing.

His philosophy is easy to describe but hard to replicate:

buy high-quality companies;

avoid overpaying; and

let compounding do the rest.

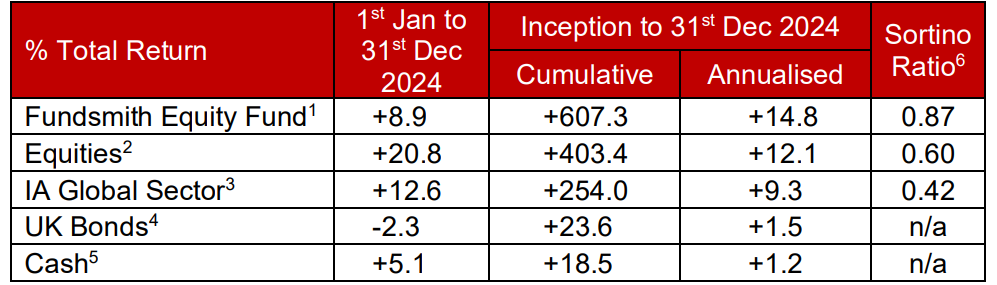

Since 2010, his Fundsmith Equity fund has compounded at more than 15% per year.

That track record places him in the very top tier of global investors.

Some people even call him “the modern Warren Buffett.” Maybe that’s an exaggeration - after all, there’s only one Buffett.

Still, the comparison says a lot about the respect Smith commands.

What struck me most is how universal his approach is.

You don’t need to be on Wall Street to follow it.

You don’t even need a Bloomberg terminal.

A retail investor with patience and discipline can use the same principles in their own portfolio.

Here are the eight lessons I took from Terry Smith - lessons that changed the way I invest.

Welcome to Jimmy’s Journal - your one-stop shop for becoming a better investor. 🧠

Written by a former equity analyst, for investors who seek high-quality businesses.

Subscribe now and start compounding.

In case you missed it, here are some recent insights:

1. Good Companies Beat Cheap Ones:

“It is better to buy a good company at a fair price than a fair company at a good price.” — Terry Smith

Cheap stocks seduce investors. The low P/E looks like a bargain.

The story sounds like “recovery.”

But the reality is brutal: most bad businesses stay bad.

They destroy value year after year, regardless of the price you pay. To make money, you need perfect timing - buying right before a turnaround and selling before the next collapse.

Almost no one can do this consistently.

Great companies, however, don’t require heroics. They compound value because their economics are outstanding - high returns, pricing power, recurring revenue.

Even if you pay a fair price (not the lowest), time is on your side.

The intrinsic value keeps expanding, and the market eventually follows.

Example: Fundsmith bought L’Oréal back in 2011. It has rarely looked “cheap.” But its brand power, ability to raise prices, and global footprint have created shareholder value for decades. Investors who avoided it waiting for a bargain missed the real compounding story.

2. Quality is ROCE, Not Hype:

“The most important measure of a company’s quality is its return on capital employed.” — Terry Smith

Growth in earnings per share (EPS) is not enough.

EPS can rise because of buybacks, cost-cutting, or accounting maneuvers.

That doesn’t mean the company is creating long-term value.

Smith’s compass is Return on Capital Employed (ROCE):

If a company consistently earns 20%+ on capital, it’s not just making money - it’s making money efficiently. That efficiency is the real sign of a moat.

High ROCE businesses tend to have durable competitive advantages:

Pricing power;

Strong brands;

Network effects; and/or

Scale.

They can reinvest profits at those high rates, creating a self-reinforcing cycle of wealth.

Example: Microsoft ($MSFT) fits this mold perfectly. Decades of high ROCE, unmatched margins and fortress cash flow.

Its business model reinvests profitably in cloud, software and AI, widening the moat every year.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

3. Cash is King:

“Companies don’t pay dividends out of earnings. They pay them out of cash.” — Terry Smith

Accounting numbers can lie. Free Cash Flow (FCF) tells the truth.

We’ve covered this in detail over the past few months. Click here to read the full article.

A company that generates steady FCF has options:

Reinvest in growth;

Pay dividends;

Reduce debt; or

Buy back stock.

A company with weak cash generation has no flexibility.

Smith insists on businesses with strong cash conversion. Profits that never show up as cash are red flags. They usually hide aggressive accounting or weak working capital.

Cash-rich businesses are resilient in crises. They can self-fund growth without relying on debt or markets. Cash-poor ones stumble at the first downturn.

Example: Nestlé is a classic Smith holding. Its products are simple, predictable, and cash generative.

That steady flow of cash funds innovation, marketing and dividends - reinforcing its leadership across decades.

4. Most Stocks Fail: Outperformance is Concentrated

“It’s better to own a few great companies you really understand than dozens you barely know.” — Terry Smith

Diversification has its limits.

Owning 15-20 stocks already gives you plenty of protection against single-company risk.

Beyond that, you often dilute returns and end up holding mediocre businesses just for the sake of being “diversified.”

Smith argues that true outperformance comes from concentration in outstanding companies.

A handful of compounders can drive the majority of your portfolio’s long-term results.

The danger of over-diversifying is that it pushes you toward “diworsification”. Filling the portfolio with average names that drag down performance and blur conviction.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe now and stay updated.

5. Do Nothing (Most Of The Time):

“The hardest thing in investing is to do nothing.” — Terry Smith

Most investors can’t resist fiddling with their portfolios.

Markets go up, they buy more.

Markets go down, they panic-sell.

The result: they underperform the very funds they invest in.

Smith takes the opposite view.

He buys quality businesses and then largely does nothing.

Fundsmith’s annual turnover is below 5%.

By avoiding constant dealing, he avoids frictional costs, emotional mistakes and missed compounding.

Doing nothing is not laziness - it’s discipline. It requires conviction in the businesses you own and patience to let time do its work.

Example: Fundsmith has held Microsoft ($MSFT) since inception. No trading around, no market timing. Just letting a great business grow into a bigger position naturally.

Reflection: What’s the stock you’ve held the longest? And how many years has it been in your portfolio?

6. Costs Compound Against You:

“The industry’s favorite way of making money is to churn your money.” — Terry Smith

Every time you trade, someone else takes a cut - brokers, market makers, funds.

Over decades, these costs compound against you.

Smith is ruthless about minimizing costs. His low turnover not only avoids hidden fees but also maximizes the money left to compound for shareholders.

For retail investors, the lesson is clear:

Cut out layers of intermediaries.

Don’t trade too much.

And don’t pay high fees for closet index funds that underperform anyway.

Even small differences in cost add up dramatically over 20+ years. A 1% fee can devour a third of your wealth over a lifetime.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

7. Forget Macro Forecasts:

“The only function of economic forecasting is to make astrology look respectable.” — Terry Smith

Markets obsess over GDP forecasts, rate cuts, elections.

Smith ignores it all.

Because even if you could predict the macro perfectly, you’d still need to predict how markets will react - an impossible second step.

Instead, he focuses on what you can know (know knowns): the quality of the business and the price you’re paying.

That’s within your control. The rest is noise.

Example: During Brexit, many fund managers obsessed over political outcomes. Smith stayed focused on companies like Unilever and Diageo.

Both global brands barely noticed UK politics - and went on compounding as usual.

8. Keep It Simple:

“If you can’t understand what it does, don’t invest in it.” — Terry Smith

Complexity is a cover for risk.

If you need a 100-page deck to understand a business, you probably shouldn’t own it.

Smith prefers boring companies with predictable demand and clear economics: consumer staples, software, healthcare leaders.

Simple businesses make forecasting easier, reduce surprises and increase conviction.

Example: PepsiCo ($PEP) sells snacks and drinks. Boring? Yes. But global distribution, brand loyalty and pricing power make it a compounding machine.

Simplicity is often the strongest moat.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe now and stay updated.

Final Thoughts:

Two decades of Terry Smith’s writing and results show something clear: he never chased fads. He pursued clarity and discipline.

Investing, for him, is not about forecasts or clever tricks.

It’s about sticking to principles that work:

Buy quality companies.

Measure returns by ROCE, not hype.

Trust cash, not accounting illusions.

Concentrate on the best, not the most.

Be patient - most of the time, do nothing.

Keep costs down.

Ignore macro noise.

Stay simple.

“If you can’t understand it, don’t invest in it.” — Terry Smith

The rest is distraction.

I hope you enjoyed the read.

Which of Terry Smith’s lessons do you find most powerful?

Share it with a friend who might like it too.

And if any part of this article sparked a reflection in your mind, please click the like button. That way, I can see which content is truly useful and keep improving.

Cheers,

Jimmy

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.

Great recap. What I like about Smith’s lens is how it bridges growth and dividends — high ROCE businesses compound, but that same efficiency also funds durable payouts. Quality drives both.

I love Smith's mantra: buy quality, don't overpay; do nothing.

The "don't overpay" is, I feel, the most important - don't wait for a bargain, quality rarely comes cheap. But equally, don't pay any price - quality companies can be susceptible to hype and you can pay too much and then not see capital gains as the hype fades and multiples compress. Know what you are willing to pay and stick to it.

Much as I love Smith, I do think his shareholders deserve a better explanation for under-performance over the last few years than just "because we don't own NVDA." NVDA isn't the only reason the S&P index has gone up, and actually, some of the European indices are / were wiping the floor with America earlier this year.

His decision to drop Diageo when he did looks inspired in hindsight, although he held on to Brown Forman, a position he has since exited (along with PepsiCo). It's been a rough few years, but his track record is still excellent.