How to Invest in Your 20's, 30's, and 40's

Asset Allocation: what to prioritize in your 20's, 30's, and 40's to secure your financial future...

Hi, Investor 👋

I’m Jimmy, and welcome to another edition of our newsletter. Today, we’re breaking down how to invest in your 20s, 30s, and 40s - because smart investing isn’t about timing the market, it’s about understanding your stage of life.

Let’s jump in - and as always, feel free to share this with other investors.

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

"Someone is sitting in the shade today because someone planted a tree a long time ago." — Warren Buffett

Imagine three friends sitting at a café…

One is 24, just started her first job.

The second is 35, juggling career and kids.

The third is 43, trying to make up for “lost time.”

They all ask the same question:

“Am I investing the right way for my age?”

The answer? It depends.

Because your 20s, 30s, and 40s are vastly different financial seasons - each with its own priorities, constraints, and opportunities.

Let’s walk through them. Asset allocation is the name of the game.

20’s: Time Is Your Superpower

Most people underestimate how powerful their 20s can be for investing.

Sure, the income is lower, and it feels like you “don’t have much to invest.”

But here’s the magic: you have something far more valuable - time.

Let’s compare two investors:

Emma starts investing $300/month at age 22 and stops at 32.

Total invested: $36,000.

Lucas starts at 32 and invests the same $300/month until 62.

Total invested: $108,000.

Assuming an annual return of 8%:

Emma ends up with $612,108 at age 62.

Lucas ends up with $475,681 - even though he invested 3x more.

This is the magic of compounding. The earlier you start, the less you need to do.

3 Investing Principles for Your 20’s:

Invest automatically. Even if it’s just $50/month. It builds the habit.

Prioritize a Roth IRA or equivalent. You’re likely in a low tax bracket now - future you will thank you.

Take calculated risks. You’re young, and time is on your side - this is the moment to lean into riskier assets like equities, while you can still ride out the volatility.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

30’s: Balance, Not Perfection

Your 30s are often a decade of transitions:

Marriage,

Kids,

Home purchases,

Career changes.

Financial complexity increases - and so do your responsibilities.

This is the time to build a financial system that runs in the background.

It’s no longer about “just investing.” It’s about aligning your investments with your real life.

Common goals in your 30s:

Saving for a down payment

Funding retirement and education (maybe both)

Creating an emergency fund that can handle surprises

According to Vanguard, the average 35-year-old has about $60,000 in retirement savings - but most should aim closer to 1x their annual salary by that point.

3 Investing Strategies for Your 30’s:

Max out your 401(k) match (if offered). It’s free money. Don’t leave it on the table.

Start a taxable brokerage account. This gives you flexibility outside of retirement constraints.

Revisit your asset allocation. A typical target: 80% stocks, 20% bonds — but adjust for your risk tolerance and goals.

And most importantly: automate it.

Set rules so you don’t need willpower every month.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

40’s: It’s Not Too Late

By your 40s, the pressure often builds.

You may look at your retirement account and feel behind. Maybe you prioritized your kids.

Maybe life just got in the way…

Here’s the good news: you still have time - but it’s time to act decisively.

The average American in their 40s has saved around $93,000 for retirement, according to the Federal Reserve. But most financial advisors suggest having around 3x your salary by age 45…

3 Things to Focus on in Your 40’s:

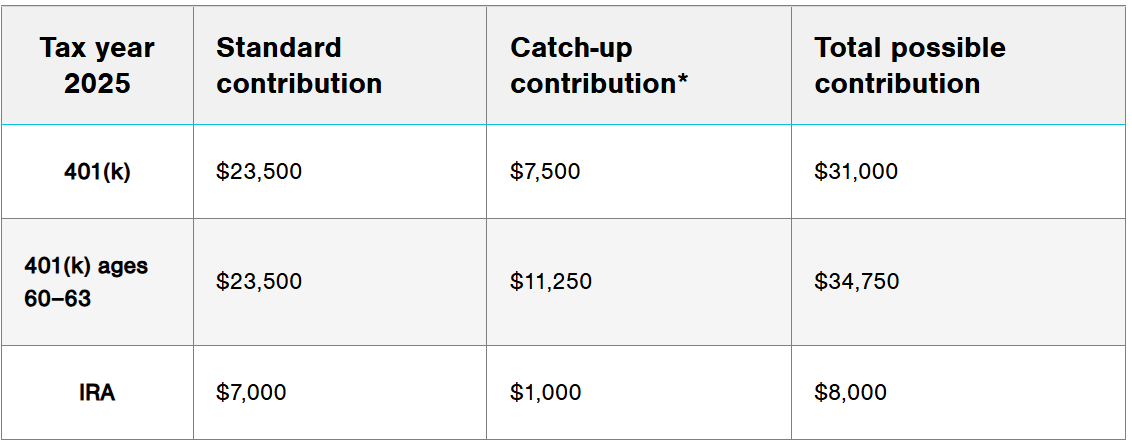

Catch-up contributions. After age 50, you can invest more in retirement accounts - but start planning now.

Increase contribution rates. Even going from 10% to 15% of your income can make a big difference.

Avoid lifestyle creep. As your income grows, don’t let expenses balloon. Invest the raise.

And consider talking to a fiduciary financial planner. A second opinion can bring clarity and help you align your money with your future.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

So… What’s the “Right” Way to Invest?

Here’s a secret:

There’s no perfect strategy - just the right one for your stage of life.

In your 20s, the key is to start. Even if it’s small.

In your 30s, it’s about building a system that supports your life.

In your 40s, it’s time to double down, course-correct, and build momentum.

What matters more than your stock picks is your consistency.

As Ramit Sethi says:

“You don’t need to be an expert. You just need a plan that works for your life - and the discipline to follow it.”

Final Word:

Wherever you are right now - it’s not too early and it’s not too late.

Start where you are.

Use what you have.

And most importantly: stay in the game.

Until next time,

Jimmy

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.

How to invest in your 90's.

Not sure I understood the tip for x times the 60,000 for retirement. Is it ten times?