How to Read a 10-K Like Warren Buffett

Learn to spot what really matters inside any annual report...

Hi, Investor 👋

I’m Jimmy, and welcome to another edition of our newsletter. This week, we’re taking a break from earnings and diving into something even more foundational: how to read a 10-K like Warren Buffett.

While most investors find 10-Ks boring, Buffett sees them as a goldmine - and today, you’ll learn to read them like he does.

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

Most people look at a company’s 10-K and feel overwhelmed.

Dense. Boring. Intimidating.

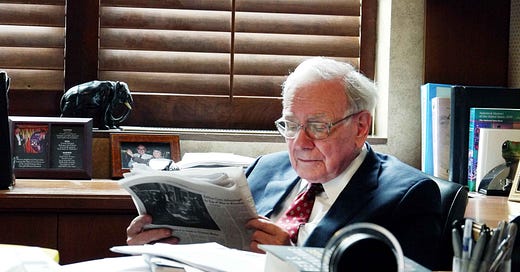

But not Warren Buffett…

To him, each annual report is a window into how a business really works - its strategy, its risks, its soul.

He doesn’t rush through them. He reads every page. Carefully…

Someone once asked Buffett how to become smarter - how to truly understand businesses and make better decisions.

He didn’t mention mentors, MBAs, or magic formulas.

Instead, he lifted a stack of papers and said:

“Read 500 pages like this every day. That’s how knowledge builds up. Like compound interest.”

Simple. But powerful.

Because Buffett understands something most people miss: knowledge isn’t built in leaps. It’s built in layers - slowly, quietly, one page at a time.

And that’s exactly how he reads a 10-K. Not looking for a quick tip. Not chasing a headline. But patiently absorbing how a business is built, where its strengths lie, and what could bring it down.

Today, we’ll walk through how to read a 10-K like Warren Buffett.

Not with formulas or shortcuts - but with curiosity, clarity, and the kind of mindset that turns pages into insight.

1. Start with the Business, Not the Balance Sheet:

Buffett’s approach is simple: understand the business before the financials.

So before you dive into Item 8 (Financial Statements), start with Item 1: Business Overview.

This is where the company tells you what it does in plain English.

Ask yourself:

What exactly does this company sell?

Who are its customers?

Who are its competitors?

How does it make money?

Buffett looks for companies with simple, understandable models.

He famously said,

“Never invest in a business you cannot understand.”

If a 10-K makes your head spin in the first few pages, maybe it’s not for you.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

2. Jump to the Risks (Really):

Go to Item 1A: Risk Factors.

Why?

Because companies are legally required to disclose what could go wrong. Buffett loves this section - not because he’s pessimistic, but because he wants to know what could kill the business.

Look for:

Revenue concentration (one big customer?)

Dependency on external pricing (like oil or interest rates)

Regulatory risks (especially in healthcare, finance, or energy)

Buffett isn’t scared off by risk - he just wants to understand it.

Risk you understand is called uncertainty.

Risk you don’t understand is called foolishness.

3. Read the Letter to Shareholders (If Available):

Not technically part of the 10-K, but often included in the annual report, this is a goldmine.

Buffett’s own letters are legendary. But when reading others, he looks for:

Honest reflection on the year

Clear explanation of strategy

Management that admits mistakes

If a CEO can’t explain what happened in simple, sincere language, that’s a red flag.

Enjoying the content? Encourage me to keep creating more like this. Buy me a coffee!

4. Management’s Discussion and Analysis (MD&A):

This is Item 7 - and it’s one of Buffett’s favorite sections.

Here’s where management tells you:

What happened last year

Why it happened

And what they expect next

Buffett reads MD&A like a detective reads a witness statement. He’s looking for consistency, credibility, and candor.

Ask yourself:

Are they owning their numbers?

Are they focused on long-term value or short-term noise?

Are explanations data-driven - or just PR fluff?

5. Now, Dig into the Numbers:

Once you understand the business and the narrative, it’s time for the financials.

Buffett has never publicly revealed his true order of preference, but if I had to guess, it would be:

Income Statement

Balance Sheet

Cash Flow Statement

Speaking of which, we’ve already covered how to read and interpret each of the three financial statements here in the newsletter. Here’s the link to the latest article:

But he doesn’t look at just one year. He always looks at trends. Three years minimum, five if possible.

What is he looking for?

High and stable gross margins (suggest pricing power)

Consistent return on equity (ROE) (suggests effective capital use)

Low capital requirements (more free cash to reinvest or return)

Buffett loves businesses that generate high returns on capital without needing to constantly reinvest more.

It’s why he loves insurance, brands, and software…

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

6. Read the Footnotes (Yes, All of Them!!!)

This is where the truth hides…

Footnotes are where accounting quirks, litigation risks, lease obligations, and non-GAAP adjustments live.

Buffett reads them because he wants to understand what’s behind the numbers. It’s like the difference between looking at someone’s résumé and talking to their old boss.

If you skip the footnotes, you might miss:

Hidden debt (like leases or off-balance sheet items)

Aggressive revenue recognition

Contingent liabilities

Think of footnotes as the fine print of capitalism - and Buffett is always reading the fine print.

7. Watch for Red Flags:

Buffett doesn’t use formulas to find red flags - he uses common sense:

Revenue up, but cash flow down?

Consistent GAAP profits, but constant adjustments?

Frequent stock buybacks while taking on more debt?

Remember: good businesses throw off cash. Great businesses don’t need to brag about it.

Buffett once said,

“Accounting is the beginning of understanding, not the end.”

Always follow up the math with the why.

Personal tip: when reading any company’s 10-K, hit Ctrl + F and search for the following keywords: (i) adjusted, (ii) non-recurring, (iii) unexpected, (iv) pro forma, (v) core earnings, (vi) normalized, (vii) excluding.

These terms often signal that management is telling a slightly different version of reality. That’s where some of the most revealing details tend to hide.

Oh, and I also can’t stand words like ‘transformational’, ‘synergies’, ‘ecosystem’, ‘accelerated growth’, and so on. Be skeptical when these buzzwords show up - they often try to impress, not to inform.

Enjoying the content? Encourage me to keep creating more like this. Buy me a coffee!

8. Tie It All Together:

By the end of the 10-K, Buffett isn’t looking for a “yes” or “no.” He’s building a mental model of the business.

He asks:

Do I understand how this business makes money?

Is it likely to keep making money 10 years from now?

Does management act like owners or operators?

Would I want to own the whole company?

If the answer to all of those is “yes,” it goes on the watchlist.

9. Final Thought:

Why most investors never read 10-Ks?

Let’s be honest - most people never even open a 10-K.

Too long. Too boring. Too complex.

But that’s exactly why reading them is such an edge.

Buffett built a $100B empire not on speed, but on patience. He reads hundreds of 10-Ks every year - not because he has to, but because that’s how you find truth others overlook.

As he put it:

“The more you know about the business, the less risk you face.”

So the next time someone hands you a tip about a “hot stock,” do what Buffett would do.

Smile.

Then go read the 10-K. 😁

Thanks for reading this far.

Until next time,

Jimmy

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.

The question to ask yourself is if there is a better way to invest that beats WB and that does not involve reading a 10-K? :0)

Inside Buffett’s Latest Portfolio Changes - Warren Buffett’s Final Year: 1 New Buy, 2 Exits, 6 Cuts, and 7 Increases

https://ffus.substack.com/p/warren-buffetts-successor-secret