Inter&Co (INTR): the future of digital banking in Brazil

📬 Investment thesis: unveiling the potential of one of the largest fintechs in the country and its impact on the digital banking landscape

Introduction:

Inter (NASDAQ: INTR) is one of the largest fintechs in Brazil, with a customer base exceeding 30MM by 2023. Alongside Nubank and other digital players, the orange bank has been revolutionizing a sector historically dominated by only five institutions, employing a digital approach focused on user experience (UX) and customer satisfaction.

History:

Founded in 1994, Inter&Co began its operations under the name Intermedium Financeira, providing personal loans for individuals (PF) and working capital for SMEs. From 1995 to 2007, the institution experienced growth in the state of Minas Gerais, with a strong focus on real estate credit (reflecting the founders' DNA, who also control MRV, one of Brazil's largest real estate developers and owner of Resia in the US).

Subsequently, they obtained authorization to operate as a multiple bank, establishing Inter DTVM and entering the insurance brokerage business until, in 2015, they introduced the 100% digital checking account.

The Banco Inter brand officially emerged in 2017, a year before being listed on B3 under the ticker BIDI11 (raising R$ 722 million in the IPO, with 70% in primary offerings). In 2019, one of their most famous products, Inter Shop, was launched.

In 2022, with a steep rise in stock prices in previous years (+500% between 2019 and 2021), the management concluded its corporate reorganization, migrating Inter&Co's shares to NASDAQ (ticker INTR). As a result, the controlling group was able to utilize supervoting stocks and currently holds 30% of the economic value and 80% of the votes. Softbank, another significant investor, holds a 16% economic stake and approximately 5% of the votes.

Business Model

"As we began our journey as a digital bank, we were drawn to a market that we believed was ready for disruption due to a lack of focus on what truly matters: the customer. Therefore, we positioned Inter at the 'INTERsection' of technology and banking, combining the agility and innovation of a fintech with the credibility and expertise of a traditional bank."

Inter’s value proposition revolves around three main pillars. They are:

Zero fees for a checking account and basic transactions - which is already a radical change compared to the model of traditional banks that used to charge maintenance fees for a checking account, card issuance, among others;

Easy-to-use UX (mobile app, internet banking);

A full-service platform to centralize the customer's “primacy” and strengthen cross-selling. According to the management itself, the intention is that a loyal customer does not need to use any other application to meet their daily needs; the Inter SuperApp would already be sufficient;

Cost Structure

With robust investments in technology and a lean cost structure, Inter positions itself as the low-cost provider in the industry. The institution does not have any physical branches to serve its customers, giving it unparalleled scalability compared to incumbents. Just for comparison, Itaú and Bradesco, the largest private banks in the country, each have approximately 100,000 employees (and a customer base of around 80 million individuals and businesses). Inter has 30 million customers with only 3,500 employees - and we expect that its growth will result in marginal expansion in headcount.

Cost of Funding

Another very interesting advantage of the bank is its low funding cost (approximately 65% of the CDI, Brazil's basic interest rate), driven by the perception of a 'transactional' brand. The free services offered from the beginning have attracted interest from customers who keep their funds idle in their checking accounts, without remuneration, with the goal of using this capital for future needs—whether it be transferring P2P capital, making online purchases, purchasing insurance, investing, among other uses.

In this regard, Inter holds approximately 7% market share in PIX in Brazil—the Central Bank's instant payment method. Credit penetration is still low, with only around 1.5% participation. The end result is that Inter can charge lower credit fees for its customers, creating a virtuous circle that reinforces itself: powered by technology and with a low funding cost, the bank can offer a better user experience (UX) and attract more customers, generating more data and knowledge. This information will be used to enhance internal credit models, offer more products, and scale operations.

Fee-free really means “no fees”?

As Inter does not charge any maintenance fees, it needs to monetize its customers through cross-selling, keeping them engaged. In other words, to extract the maximum value (ARPAC: avg. revenue per active client), the bank must guide its customers through a journey that starts with the creation of the bank account, goes through routine transactions and purchases in Inter Shop, and eventually leads to credit origination.

Currently, secondary business units represent approximately 30% of the bank's total revenue (vs. 70% from credit concessions) and also help minimize the volatility of the Brazilian credit cycle.

If this content is helpful, don't forget to subscribe to receive the latest updates.

Business Units:

1. Banking and Spending

A fully digital account that allows customers to pay bills, spend online and offline, transfer money, etc.; 6.4 million credit and debit cards (~14% penetration); 69% of customers with a primary banking relationship. Interchange and credit as sources of revenue;

2. Credit

Credit solutions that allow customers to finance their ambitions; Real Estate, SMEs (receivables anticipation), Payroll, Credit Card, Rural. R$ 26 million in gross portfolio;

3. Inter Shop & Commerce Plus

Commerce solutions for customers to purchase goods efficiently and an expanding set of on-demand services to meet customers' daily activities.

GMV of R$ 4 billion, 1 million SKUs, and 900 merchants. Cashback for retention, and revenue comes from the take rate charged to sellers.

4. Inter Insurance

Insurance brokerage services that allow customers to protect all assets and important aspects of their lives. Wiz holds a 40% stake in the Inter Seguros operation and has exclusivity at the counter until 2069.

There are 1.3 million active customers and over 20 products, including home, life, lender, and vehicle insurance, among others. Inter does not assume the insurance risk and only distributes products from major international insurers, such as Sompo and Liberty Seguros. Active contracts have earn-out clauses to be executed over time if certain metrics are met, totaling over R$ 500 million;

5. Inter Invest

An open market for investment products that empowers customers to invest. 2.8 million active customers (11.7% penetration of total customers) and Assets Under Custody (AuC) of 67 billion;

6. Global Account

Solutions for Brazilian customers traveling abroad and residents in the United States. This is the former USEND, acquired in 2021 by the bank.

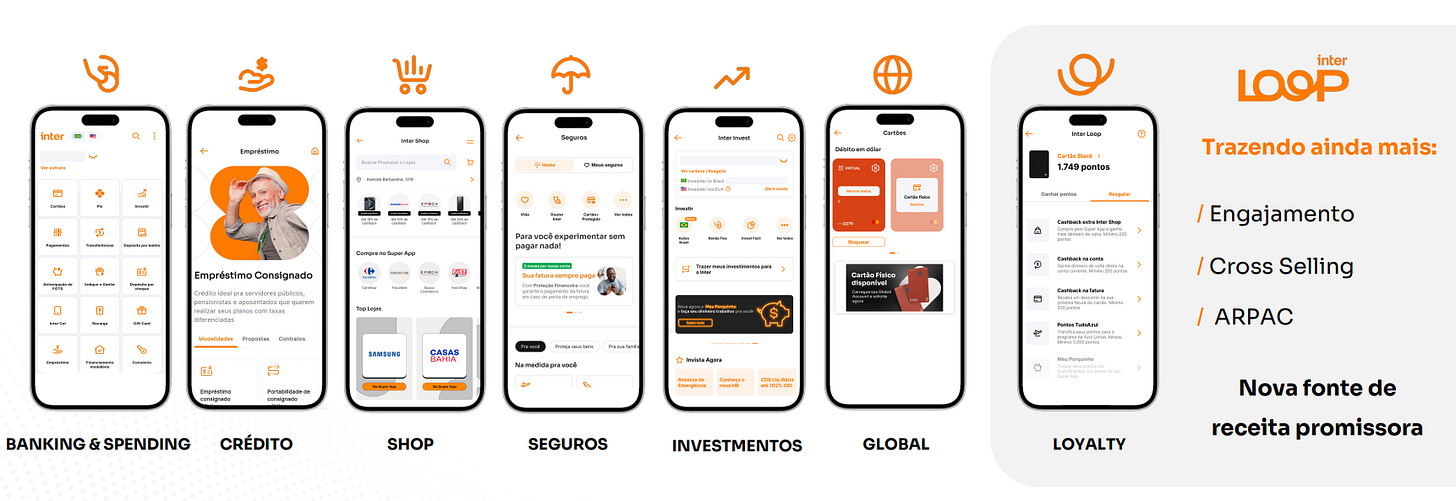

7. Loyalty Inter Loop

InterLoop is the latest product from Inter, designed to bridge the gap left by traditional loyalty programs of incumbent banks. With it, customers accumulate points that can be exchanged for future rewards, such as cashback, travel miles, etc;

Investment Thesis

For a long time, Inter was more focused on launching products and adding more customers—a side effect of the low-interest-rate environment we experienced until 2021. Since then, the market has demanded results, and it was impossible for the bank to readjust its course so quickly. As a result, stocks plummeted more than 80% from their peak.

Cost Discipline

In order to make the operation more profitable, Inter held back on expanding headcount, renegotiated contracts with suppliers and prioritized the repricing of its products. With revenue still growing and costs stable, operational leverage became quite evident, and the efficiency ratio (SG&A divided by net revenue) dropped from 88% to 50% between 2Q21 and 3Q23.

Inter Loop itself is one of the major examples of this change. The bank was able to implement 'raspa contas' (sweep accounts), offering low returns on sight deposits of its clients in exchange for a higher return on the Central Bank's reserve requirement. Customer returns are given in points, which remain stagnant until the customer decides to use them. This practice is already quite common among all banks, and the net result is quite positive as it promotes an expansion of the Net Interest Margin (NIM).

Repricing

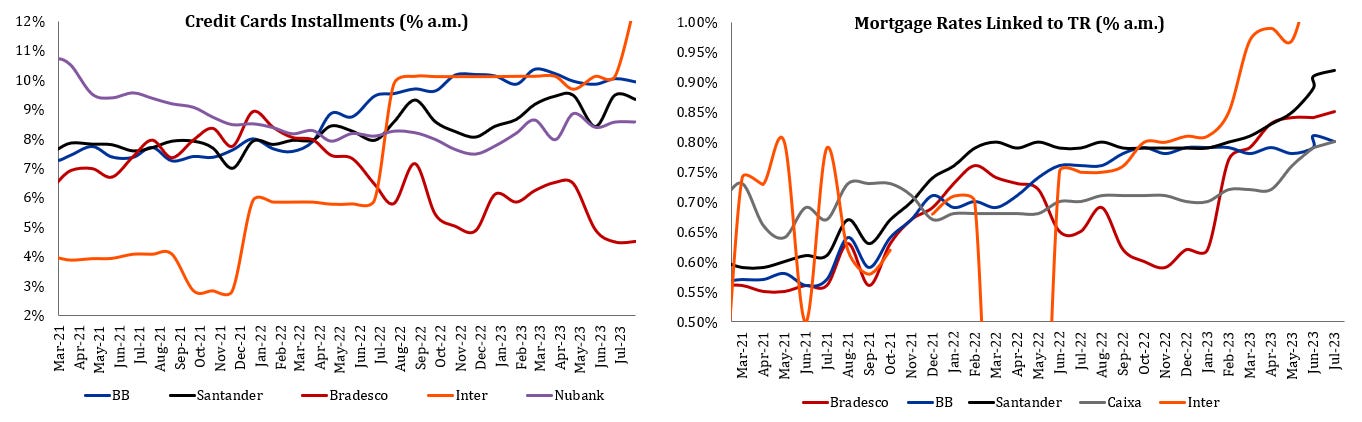

On the repricing side, we see a sharp change: until 2022, the bank charged the lowest rates in the market across almost all lines. Since then, executives have adjusted their internal models, structured the treasury/ALM, and started originating credit with lines more consistent with the market and with hedging. This, combined with the country's interest rate decline cycle, is expected to promote an expansion of NIM in the coming quarters.

It is important to emphasize that the average term of a bank portfolio varies from 18 to 24 months, depending on each case. Therefore, we should still see an expansion of NIM due to the longer duration of consigned and real estate portfolios.

The bank has also been originating a lot in credit lines with good yield and collateralized, which were not as prevalent in the past, such as (i) home-equity and (ii) anticipation of FGTS withdrawals.

Favorable Credit Cycle

Finally, we still have a more favorable credit cycle for Brazil. Data released by the Central Bank indicates that the peak of delinquency for major credit lines for individuals was in May 2023. The downward trajectory of the Selic also helps to reduce household debt service and correlates with NPL levels. The 15-90 NPL, for example, already shows significant relief, which we expect will also extend to the 90-day NPL.

As a result, the bank may be able to reduce its provision levels, especially in the credit card segment – which has been its major issue, with an ~18% cost of risk and responsible for ~88% of the bank's NPL. Credit cards represent 30% of the total portfolio, an amount of R$ 7 billion.

If you found this content valuable, share it with your friends and spread the knowledge.

Final Considerations

Hence, we witness a bank strategically repricing its credit portfolio, crafting a more compelling mix with strategic hedges, showcasing robust cost discipline, all within a propitious delinquency cycle.

However, the risks are still significant. The income brackets that Inter primarily serves fall predominantly within classes B to D—making them susceptible to Brazil's interest rate and inflation cycles. Any hiccup could interrupt this trajectory of declining PDD.

Another significant risk is execution risk. The management must be able to reprice the portfolio without prejudicing origination, fine-tuning credit models and reducing delinquency. Cost structure should remain lean, and Inter must maintain its innovation capability, which has been one of the main draws for current customers. That’s not a simple mission.