📈 Jimmy's Trade Alert #2 | Taking Profits After an +81% Run-Up

Rebalancing the portfolio and reassessing risk-reward going forward...

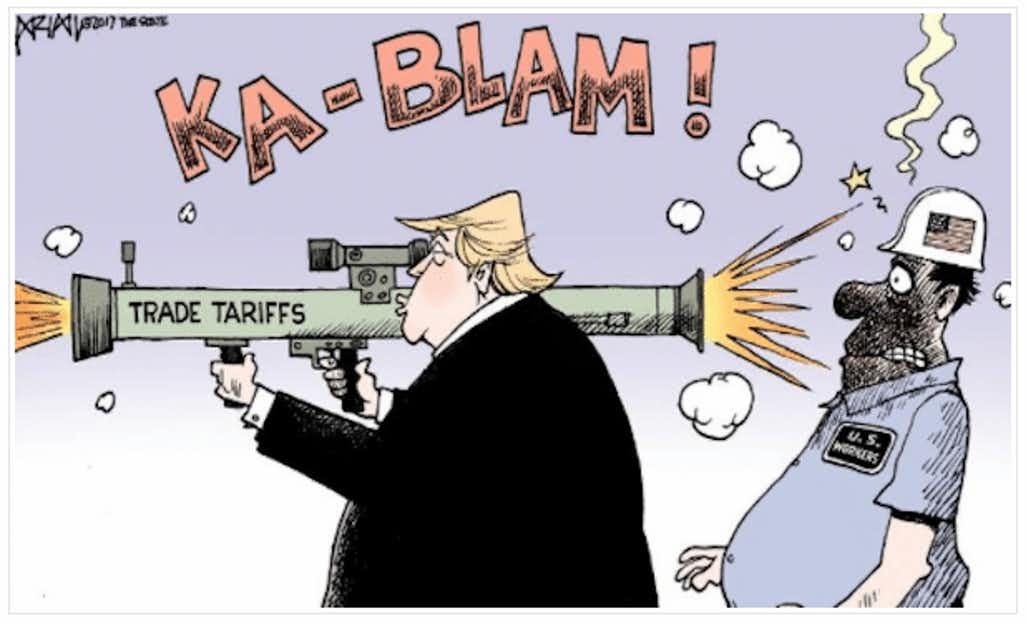

Economic Embargo:

Yes. Economic embargo.

That was the best way to describe the trade relationship between the world’s two largest economies - until now.

Over the past few months, we saw an unprecedented escalation in tariffs…

From 20% to over 145% - effectively making business between the two countries nearly impossible.

The consequences of these actions would be almost linear:

GDP had already begun to show signs of weakness - with a -0.3% drop in Q1 2025.

Inflation would start to rise (with even the risk of shortages in some products),

Interest rates wouldn’t come down in the upcoming Fed meetings,

And the economy would likely slip into a recession...

Thankfully, Trump chose not to follow through on what was shaping up to be a kamikaze strategy.

To be fair, his diagnosis might not be entirely wrong - but the methods were detached from reality. And it would’ve backfired. No doubt.

The 90-day pause announced yesterday brought relief to the markets, with equities jumping more than +3%.

Enjoying the content? Encourage me to keep creating more like this. Buy me a coffee!

New Trades:

In that context, we used the rally as an opportunity to lock in some profits - while also initiating small positions in a few names that had long been on our radar (why not?).

We exited one of the oldest positions in our portfolio - up more than 81% since inception. A blue chip with relatively low volatility and stable fundamentals.

The IRR on this investment was an impressive 28.6% per year.

It was a forgotten stock. A pure value investing play - quiet, under the radar, but fundamentally solid.

With these changes, our portfolio now consists of 8 core holdings. They are:

Keep reading with a 7-day free trial

Subscribe to Jimmy's Journal to keep reading this post and get 7 days of free access to the full post archives.