LTCM: How to Break the Financial System

The rise and fall of Long Term Capital Management: how overconfidence and leverage nearly brought down the financial system...

Hi, Investor 👋

Today, we’re diving into Long Term Capital Management (LTCM) - the hedge fund that thought it had “eliminated risk” but ended up nearly crashing the financial system in 1998.

How did a team of Nobel Prize winners get it so wrong? And what can we learn from their downfall?

Hope you enjoy the insights! Share with friends and fellow investors.

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

This edition will be divided into the following sections:

Introduction

The Rise of LTCM

A House of Cards

Royal Dutch Shell

The Fatal Flaws: "The Models Can’t Be This Wrong"

The Collapse: "The Market’s Broken"

Too Big to Fail

Key Lessons in Risk Management

The Legacy of LTCM

1. Introduction:

Few stories in financial history are as gripping as the rise and fall of Long-Term Capital Management (LTCM).

A hedge fund led by Nobel Prize-winning economists and Wall Street legends, LTCM promised to change the game with sophisticated models and massive leverage.

But in 1998, the fund imploded, nearly bringing the global financial system down with it.

The lessons from LTCM’s collapse remain essential for investors, traders, and risk managers. How did a fund packed with some of the smartest minds in finance go so disastrously wrong?

2. The Rise of LTCM:

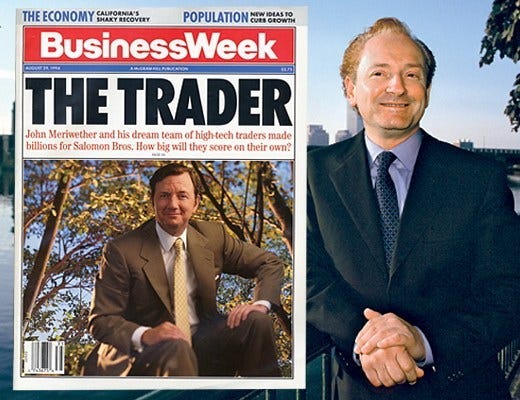

John Meriwether, the mastermind behind LTCM, had already built a reputation at Salomon Brothers, where he ran an immensely profitable bond-arbitrage group.

After leaving in the wake of a trading scandal, he gathered an elite team, including Myron Scholes and Robert Merton - who later won the Nobel Prize for their work on options pricing.

LTCM was built on an elegant idea: inefficiencies exist in financial markets, and with enough capital and the right models, those inefficiencies could be exploited.

The firm’s strategy relied on relative-value arbitrage, betting on small price differences in similar securities.

The key was using extreme leverage to magnify tiny returns into huge profits.

It worked - at first. From 1994 to 1997, LTCM delivered astonishing returns:

1994: +28%

1995: +59%

1996: +57%

1997: +25%

With success came arrogance. Investors lined up to get in. It all seemed unstoppable.

To magnify profits, LTCM borrowed heavily. Their equity of $5 billion supported an exposure of $1.25 trillion - a stunning 250:1 leverage.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

3. A House of Cards:

LTCM’s trades were complex but followed a simple idea: find two securities that should move together, go long on the cheap one, short the expensive one, and wait for the gap to close.

Fixed Income Arbitrage: Betting that old and new Treasury bonds would converge in price.

Equity Arbitrage: Exploiting pricing differences between different stock classes.

Volatility Arbitrage: Selling options and betting volatility would remain low.

Emerging Market Debt: Buying high-yielding sovereign debt, especially in Russia.

Meriwether and his team believed in their models.

“We’re not taking risks,” he insisted. “We’re eliminating them.”

But risk has a way of sneaking up on those who think they’ve conquered it.

4. Royal Dutch Shell:

One of LTCM’s most well-known trades involved Royal Dutch Shell. The company was formed by a merger between Royal Dutch Petroleum (Netherlands) and Shell Transport and Trading Ltd (UK). Despite being separate legal entities, they had a fixed earnings split of 60:40.

In theory, the share price of Royal Dutch should have been 1.5 times the price of Shell. But historical data showed persistent deviations. At times, Royal Dutch shares were overvalued relative to Shell by as much as 20%.

LTCM saw an opportunity. In mid-1997, Royal Dutch was trading at a 10% premium. The fund went short on Royal Dutch and long on Shell, expecting their prices to converge…

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

5. The Fatal Flaws: "The Models Can’t Be This Wrong"

LTCM’s downfall wasn’t a single bad trade - it was a system-wide failure. The fund’s models were based on historical trends, assuming markets would behave as they had in the past.

The problem? Markets don’t always play by the rules.

Overconfidence in Models: The fund’s risk assessments ignored extreme market moves. “The models can’t be this wrong,” Merton muttered as losses mounted.

Excessive Leverage: LTCM’s massive leverage - sometimes 25-to-1 - meant even small miscalculations led to enormous losses.

Liquidity Risk: Many of LTCM’s trades were in securities that couldn’t be easily sold in a crisis.

Counterparty Exposure: LTCM relied heavily on Wall Street banks, which quickly turned against them when trouble hit.

Then, in August 1998, disaster struck.

6. The Collapse: "The Market’s Broken"

On August 17, 1998, Russia defaulted on its debt. Global markets panicked. Credit spreads surged, and riskier assets plummeted.

LTCM was caught in the storm. The trades that were supposed to be low-risk turned into massive losses overnight. The fund lost 50% of its capital in weeks.

Instead of converging, the price gap between Royal Dutch and Shell, for example, widened…

Panic set in. Banks demanded more collateral. Traders at LTCM watched in disbelief. “The market’s broken,” one of them said as their positions crumbled.

By September, LTCM was on the brink of collapse. If LTCM went under, its highly interconnected trades could trigger a global financial crisis…

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

7. Too Big to Fail:

Realizing the systemic risk, the Federal Reserve Bank of New York stepped in. It orchestrated a $3.6 billion bailout with Wall Street’s biggest banks, ensuring an orderly unwind of LTCM’s trades.

Alan Greenspan later warned:

“Had the failure of LTCM triggered the seizing up of markets, substantial damage could have been inflicted on many market participants.”

LTCM was finished, but the financial system survived.

8. Key Lessons in Risk Management:

Leverage is a double-edged sword: LTCM’s downfall proved that while leverage amplifies profits, it also magnifies losses.

Markets can defy history: risk models based on historical trends don’t always capture real-world risks.

Liquidity matters more than you think: a trade is only as good as your ability to unwind it when needed.

Counterparty risk is real: if your funding depends on other institutions, their panic can become your downfall.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

9. The Legacy of LTCM:

After LTCM’s collapse, financial institutions revamped risk management practices. Regulators introduced stricter capital requirements. But the same excesses returned a decade later during the 2008 financial crisis, proving that financial memory is short.

John Meriwether later launched another hedge fund, but it never achieved LTCM’s early success.

As Warren Buffett famously put it:

“You only find out who is swimming naked when the tide goes out.”

For LTCM, the tide went out in 1998 - and the fund’s overconfidence was laid bare. The lessons from its failure remain just as relevant today.

If you want to learn more about the history of LTCM, consider reading When Genius Failed.

You can grab a copy here.

Thank you for reading this far.

Until next time.

Cheers,

Jimmy

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.