Nubank (NU): Redefining Banking in Latin America - A High-Growth Investment Opportunity

Investment thesis: leveraging technology, customer primacy, and operational efficiency to disrupt traditional banking 📬

Hi, Investor,

I’m Jimmy, and welcome to another deep dive from our newsletter, where we explore investments and stocks weekly with thoughtful reflections and analyses.

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

Executive Summary

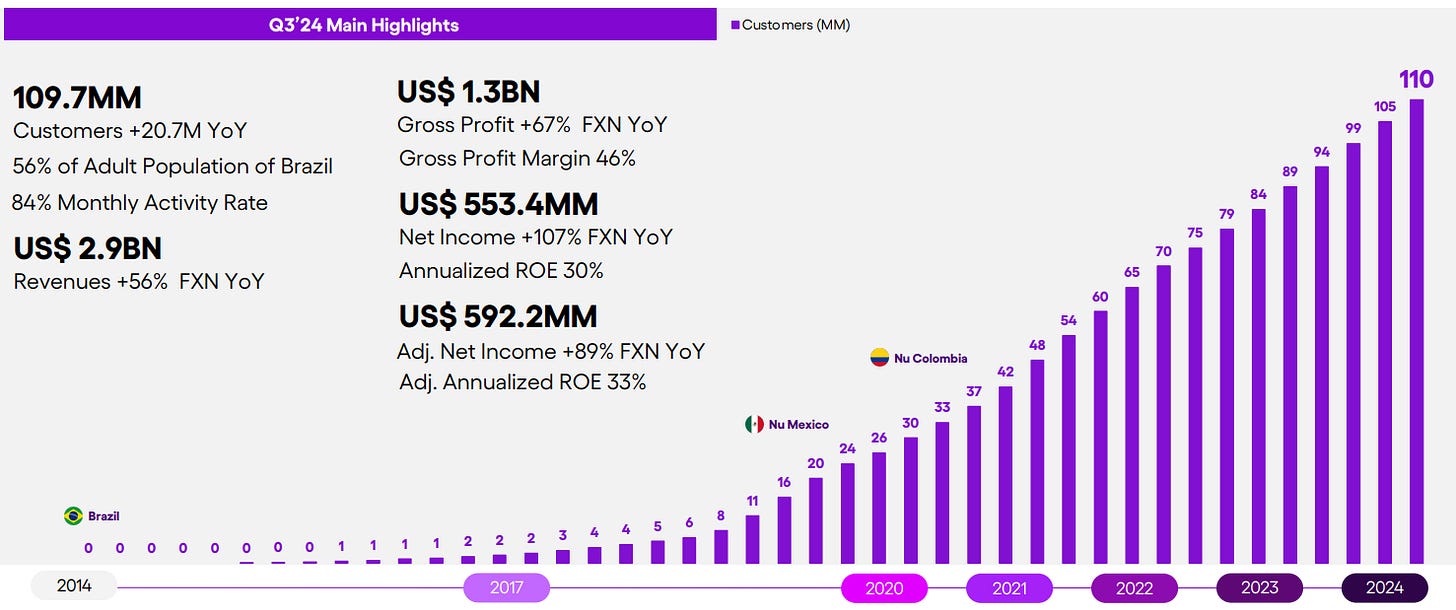

NuBank (NASDAQ: NU), a pioneer in digital banking, has rapidly become one of Latin America’s most valuable fintech companies by challenging the status quo of traditional banking. Its mission to “fight complexity and empower people” has redefined customer experience through technology and a hyper-focused, low-cost operating model.

In 2024, NuBank achieved remarkable financial and operational milestones, including an annualized ROE of 30%, profitability across its business units, and significant market share gains in a region historically dominated by traditional banks. As NuBank continues to scale, its flywheel effect—a virtuous cycle of customer acquisition, data-driven personalization, and cross-selling—is accelerating growth, reinforcing its position as a formidable competitor in the global financial services ecosystem.

History

Founded in 2013 in São Paulo by David Vélez, NuBank started as a credit card issuer targeting Brazil’s unbanked and underbanked population. By eliminating fees, introducing transparent pricing, and leveraging mobile-first technology, NuBank rapidly gained a loyal customer base.

"I was shocked by the bureaucracy, the long lines, the poor service, and the high fees."

— David Vélez, co-founder and CEO of Nubank

Over the years, the company expanded into a full-stack digital bank, offering products such as personal loans, savings accounts, and investments. Its IPO in December 2021 marked a turning point, granting NuBank access to capital markets to fuel growth across Latin America.

NuBank now operates in Brazil, Mexico, and Colombia, serving over 109 million customers. Its journey from a disruptor to a dominant player in one of the world’s most competitive banking landscapes underscores its ability to execute and innovate.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

Sector Overview: David vs. Goliath

The Latin American financial services landscape has long been dominated by a few large, incumbent banks operating under a “Goliath” model characterized by high fees, low competition, and limited customer-centricity. These traditional institutions, built on outdated infrastructure, are ill-equipped to meet the needs of a rapidly evolving, digitally connected population. High operating costs from sprawling branch networks and legacy systems have made it difficult for these banks to innovate, resulting in a persistent lack of access and high costs for consumers.

At the same time, approximately 50% of the Latin American population remains unbanked or underbanked, a stark contrast to more developed markets. This presents a significant opportunity for disruption, especially among younger, tech-savvy consumers who expect intuitive digital experiences. NuBank emerged in this context as a challenger that redefined what banking could mean in the region.

Its “David” strategy began by tackling two primary pain points: accessibility and affordability. Where incumbents charged exorbitant fees for basic services, NuBank offered no-fee accounts and transparent credit products. By eliminating the need for physical branches, it could pass on these cost savings to customers while providing a seamless, mobile-first experience. The rise of smartphones and growing internet penetration further amplified NuBank’s reach, enabling it to rapidly scale across socioeconomic classes and geographies.

The shift toward open banking regulation in Brazil has also catalyzed innovation, giving players like NuBank an edge in leveraging customer data to offer tailored financial solutions. Additionally, younger demographics in the region are highly receptive to digital financial services, accelerating NuBank’s ability to gain market share. In this David vs. Goliath battle, the Goliaths have been slow to respond, constrained by their dependence on traditional business models and outdated technology stacks. NuBank’s agility, coupled with its ability to execute at scale, has made it not just a disruptor but a dominant force in the sector.

"Nubank appears to be the best-positioned among digital banks in terms of technology, strategy, capital, and deposits."

— Alfredo Setubal, CEO of Itaúsa

Business Model: the low cost provider

NuBank’s business model is grounded in simplicity, scalability, and an unwavering commitment to customer empowerment. From its inception, NuBank has adopted a low-cost, digital-first approach, enabling it to deliver financial services at a fraction of the cost incurred by traditional banks. This cost efficiency is not merely a result of eliminating physical branches; rather, it stems from a purpose-built system that leverages data, technology, and behavioral insights to optimize every aspect of the banking experience.

Being a low-cost provider gives NuBank a distinct advantage, particularly in a region where many traditional banks struggle to serve lower-income populations effectively. Legacy banks operate with significant overhead, including expansive branch networks and outdated IT systems, which makes them inefficient and unable to cater to underserved demographics without incurring high costs. NuBank’s lean operating model, built entirely in the cloud, bypasses these inefficiencies, enabling it to offer no-fee accounts, low-cost credit products, and accessible financial services that resonate with millions of customers who previously lacked adequate options.

In its latest quarterly results, the company reported an efficiency ratio of 31.4%, significantly lower than the average of traditional banks. Moreover, NuBank reported a low Customer Acquisition Cost (CAC), estimated at approximately $5.00 per customer during 2021, with only around 20% of that amount allocated to paid marketing efforts. This cost-effective acquisition strategy is further amplified by a high Customer Lifetime Value (LTV), resulting in an LTV/CAC ratio that can exceed 30x.

A hallmark of NuBank’s credit strategy is its measured, customer-first approach. Instead of relying on traditional metrics that often exclude low-income or underbanked populations, NuBank uses advanced data analytics to responsibly assess creditworthiness. By offering initial lines of credit at manageable levels, NuBank builds trust while minimizing risk. Over time, it deepens relationships with customers by expanding their access to credit as they demonstrate financial responsibility. This thoughtful growth strategy not only strengthens portfolio quality but also fosters customer loyalty. That’s the low and grow!

NuBank’s revenue streams are interconnected, driven by credit card interchange fees, interest income from loans, and cross-selling of complementary services such as investments (NuInvest) and digital accounts (NuConta). By leveraging granular data points—from transaction patterns to app engagement—NuBank can create highly personalized offerings that increase customer engagement and stickiness. These data-driven insights allow NuBank to maintain high operational efficiency and optimize profitability even as it scales.

Another pillar of NuBank’s model is its flywheel effect:

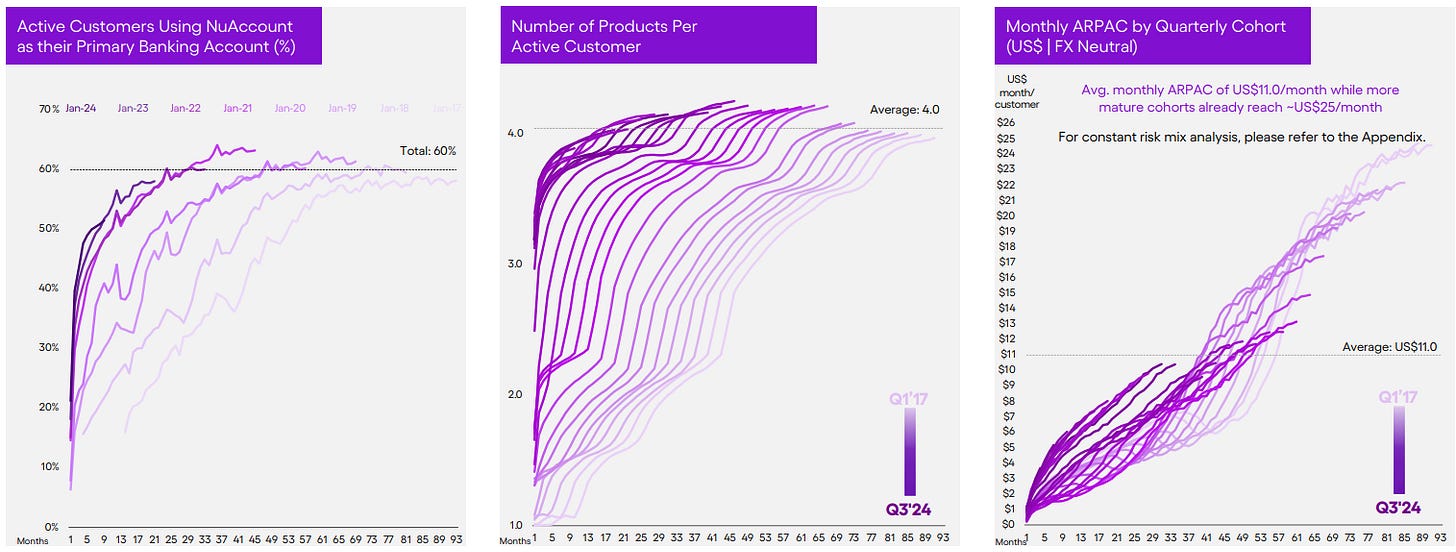

Low-cost customer acquisition, driven by organic growth and word-of-mouth referrals, feeds into a cycle of deeper engagement and product adoption. As customers use more services, NuBank gathers richer data, enhancing its ability to personalize offerings and cross-sell.

This virtuous cycle not only reduces churn but also compounds customer lifetime value, reinforcing NuBank’s competitive position in the market.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

Competitive Advantages: it’s all about primacy

In addition to being the low-cost provider in the industry, NuBank holds an unparalleled advantage in Brazil: primacy. As the primary financial institution for millions of customers, NuBank seamlessly integrates into their daily lives, managing salary deposits, transactions, and savings. This trusted role grants NuBank a profound understanding of its customers’ financial behaviors, allowing for precise credit assessments and the delivery of highly personalized financial solutions.

This primacy cultivates exceptional customer loyalty. Those who rely on NuBank as their main bank naturally deepen their engagement, adopting a broader range of its offerings (share of wallet). This not only expands NuBank’s share of their financial lives but also solidifies its position as an indispensable partner, elevating the banking experience and driving sustainable long-term growth.

Some argue that primacy significantly reduces delinquency rates. Even with a riskier credit portfolio, NuBank manages to achieve lower NPLs than the industry average for comparable risk levels—demonstrating its ability to extract maximum value from its customers while delivering immense value in return.

After all, no one wants to lose their relationship with "Roxinho," as the beloved purple card is affectionately known.

NuBank’s position as the primary bank for a large and growing customer base provides it with a significant low-cost funding advantage. By becoming the go-to financial institution for millions of Latin Americans, NuBank benefits from direct access to customer deposits, which serve as a stable and cost-effective source of funding for its lending operations.

In traditional banking, funding costs are often driven by the need to attract deposits through high-interest savings accounts or reliance on wholesale borrowing. These methods not only increase expenses but also expose banks to market volatility. NuBank, however, has cultivated deep trust and engagement with its customers, who use the platform not only for credit cards and transactions but also as their main account for receiving salaries and managing savings. This primacy results in a steady inflow of low-cost deposits.

Customers have developed a strong relationship with "Caixinhas," term deposits designed to help with personal financial organization. Clients have the option to allocate their funds to one of the pre-designed boxes or simply leave the money in their checking account.

Another cornerstone of its competitive advantage is its data-driven credit model. NuBank leverages an extensive array of data points—ranging from transaction history to app usage patterns—to responsibly extend credit to populations often excluded by traditional banks. This innovative approach enables NuBank to manage risk effectively while expanding its customer base, especially in regions where formal credit histories are uncommon.

Furthermore, NuBank benefits from a network effect. As more customers join the platform, NuBank gathers richer data, allowing it to refine its offerings and attract even more users. This feedback loop strengthens customer loyalty and reduces acquisition costs, solidifying its position as the leading digital bank in Latin America.

The Duality: Bank or Tech Company?

NuBank operates at the intersection of traditional banking and cutting-edge technology, a duality that defines its identity and strategic positioning. On the one hand, it is subject to the regulatory constraints and capital requirements of a bank, such as Basel III compliance, which governs its risk management and balance sheet structure. On the other hand, NuBank’s DNA is that of a technology company, driven by innovation, data, and scalability. This duality presents both opportunities and challenges as NuBank balances growth with prudence.

Banking Discipline: Basel III and Capital Constraints

As a licensed financial institution, NuBank must adhere to stringent banking regulations, including the Basel III framework, which dictates the minimum capital adequacy ratio to ensure financial stability. NuBank’s capital adequacy ratio, consistently above regulatory thresholds, reflects its prudent approach to managing risk. However, this banking discipline also imposes limitations on how fast the company can grow its credit portfolio, as expanding lending requires proportional increases in capital to maintain compliance.

While NuBank’s rapid growth might tempt comparisons to tech companies with minimal constraints, its banking arm is inherently tied to its ability to manage risk, particularly in credit markets. For example, NuBank must carefully balance the growth of its loan book against its non-performing loan (NPL) ratios and cost of risk, ensuring that profitability is not sacrificed for the sake of aggressive expansion.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

Technology Mindset: Scalability and Innovation

Simultaneously, NuBank operates like a tech company, leveraging its low-cost, cloud-native infrastructure to scale without the physical and financial burdens of traditional banks. Unlike incumbents whose growth is constrained by the need for branch networks and extensive staffing, NuBank’s scalability is virtually limitless, driven by its digital platform. This allows the company to focus resources on product innovation, user acquisition, and customer experience rather than on maintaining a costly physical footprint.

This technology-first approach also enables NuBank to achieve extraordinary operational efficiencies. For instance, its cost-to-income ratio is significantly lower than that of legacy banks, allowing it to reinvest savings into growth initiatives, such as AI-driven product development and market expansion. In this regard, NuBank mirrors the growth dynamics of a technology company, characterized by exponential scaling once the platform achieves critical mass.

The Growth Dilemma: A Balancing Act

The duality between being a bank and a tech company also creates a growth dilemma. As a bank, NuBank must maintain a conservative approach to risk, particularly in credit issuance, to ensure long-term sustainability. However, as a tech company with a high-growth ethos, there is pressure to expand rapidly, capture market share, and justify its valuation. This creates a constant balancing act between responsible lending and aggressive customer acquisition.

For instance, NuBank’s loan portfolio growth is inherently tied to its capital structure. To maintain regulatory compliance, NuBank may face limits on how quickly it can grow its credit offerings, especially in high-risk segments like unsecured personal loans. On the flip side, NuBank’s technology-driven risk management systems and deep data analytics allow it to mitigate these risks by optimizing credit issuance and reducing default rates.

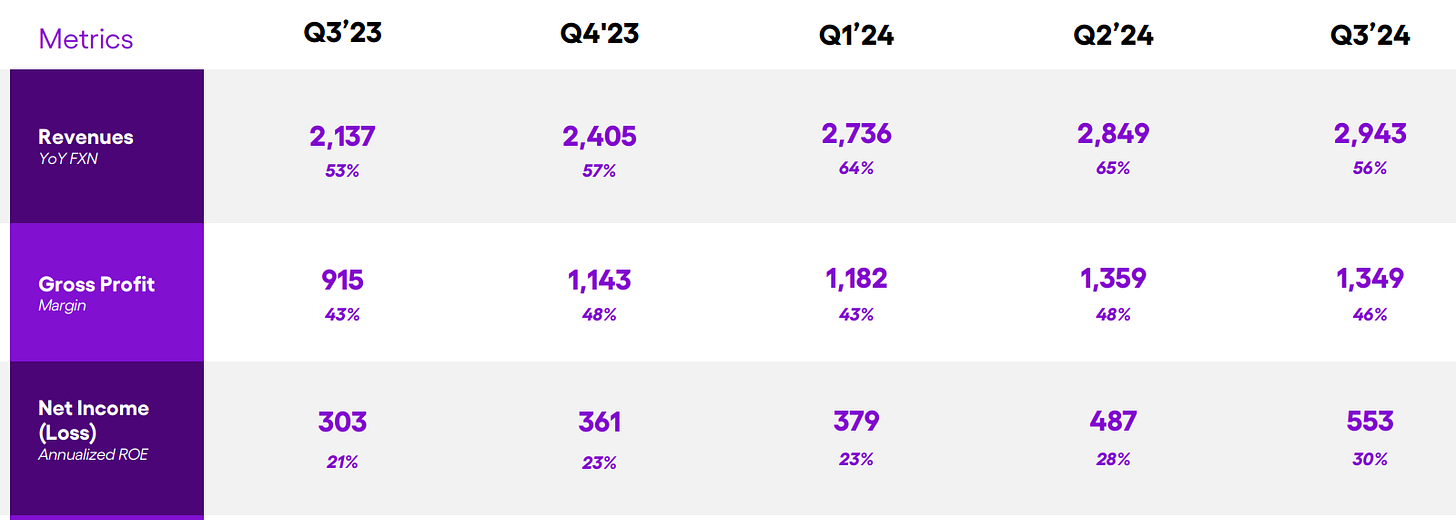

Another facet of this duality is the challenge of maintaining high return on equity (ROE) in a heavily regulated industry. Traditional banks often face declining ROE due to rising capital requirements, but NuBank’s low-cost structure and efficient use of technology allow it to sustain profitability even as it scales. In 2024, for instance, NuBank achieved an annualized ROE of 30%, far outperforming its incumbent peers.

The Future: Banking Innovation with Tech Agility

NuBank’s ability to navigate this duality lies in its unique positioning: it is a bank with the agility and mindset of a tech company. As it continues to grow, NuBank can leverage its technology stack to unlock efficiencies that offset the limitations imposed by banking regulations. For example, its data-driven lending models enable precise risk segmentation, allowing it to optimize capital allocation while expanding its portfolio responsibly.

Additionally, NuBank’s commitment to financial inclusion and its focus on underbanked populations create a growth avenue that aligns with both its tech-driven mission and its banking obligations. By prioritizing low-income customers, NuBank is not only addressing a massive untapped market but also aligning its growth trajectory with its regulatory commitments.

In conclusion, the duality of NuBank as both a bank and a tech company is not a contradiction but a synergy. Its adherence to banking discipline ensures financial stability and responsible growth, while its technology-first approach drives innovation, scalability, and efficiency. Navigating this balance will be critical as NuBank continues to disrupt Latin America’s financial landscape and solidify its position as a leader in digital banking.

2024 so far: Nubank’s (NU) strong results

So far in 2024, NuBank has delivered strong financial results, highlighting consistent growth and its strengthened market position. In the first quarter, the company reported a net profit of $378.8 million, a 167% increase compared to the same period in the previous year. Revenue reached $2.7 billion, driven by an expanding customer base and increased user engagement.

The second quarter saw continued momentum, with NuBank achieving a net profit of $487 million, more than double the figure recorded the year prior. The average monthly revenue per active customer (ARPAC) rose to $11.2, reflecting effective cross-selling and up-selling strategies. The customer base grew to 104.5 million, solidifying NuBank’s position as one of the largest digital financial services platforms globally.

By the third quarter, NuBank had exceeded market expectations, posting a net profit of $553.4 million—a 107.3% increase compared to Q3 2023. Revenue reached $2.9 billion, reflecting a 56% year-over-year growth. The global customer base expanded to 110 million, with notable growth in key markets like Mexico and Colombia.

These results underscore the effectiveness of NuBank’s business model, which combines a low-cost structure with technological innovation and a strong focus on customer satisfaction. The company continues to expand its presence across Latin America, maintaining high customer retention and loyalty rates, which have fueled its positive financial performance throughout 2024.

Have a different take on NuBank's results? What are your expectations for 2025? Share your thoughts in the comments! I’d love to hear your perspective.

Navigating Growth: What to Expect in 2025?

In 2025, NuBank faces a dual challenge as it seeks to solidify its position as a regional leader in digital banking. The expansion into Mexico, while promising, presents a more complex environment compared to Brazil, with a different competitive landscape and a banking population less accustomed to digital-first solutions. Building trust, adapting its value proposition, and navigating regulatory hurdles will require significant investment and strategic focus.

Simultaneously, in Brazil, NuBank must work to climb the income pyramid, attracting higher-income customers who typically demand more sophisticated financial products and services. Balancing its low-cost, inclusive model while offering competitive features for this segment without diluting its core identity will be critical. These challenges will test NuBank’s ability to scale its innovative model while maintaining the operational efficiency and customer-centric approach that have driven its success so far.

Disclaimer:

The information provided on this platform is for informational purposes only and does not constitute financial advice or a recommendation to buy, sell, or hold any investment. The content presented reflects the opinions of the author and should not be interpreted as professional financial advice.

Investing involves risks, and individuals should conduct their own research and seek the advice of a qualified financial advisor before making any investment decisions. The author and the platform shall not be held responsible for any investment actions taken by the readers based on the information provided here. All opinions expressed are subject to change without notice.

Thank you for reading! If you enjoyed this analysis, don’t miss out on future insights and updates. Subscribe to the newsletter now and stay ahead with exclusive content delivered straight to your inbox.

Nice write up. Thanks, Jimmy. I'm still watching Nu. I should just add a starter position to refocus my brain on it. :)

What a great deep dive Jimmy! Thanks for the content