PayPal (PYPL): The Digital Payment Titan with Untapped Potential

Unlocking Long-Term Value in Digital Payments: Why PayPal’s Resilience and Growth Potential Make It a Compelling Buy

Introduction

As the world increasingly adopts digital financial transactions, PayPal Holdings, Inc. (NASDAQ: PYPL) remains at the forefront, providing secure, reliable solutions in this ever-evolving fintech ecosystem. Boasting over 400 million active users and strong brand recognition, PayPal has solidified its role in the global financial landscape. Yet, recent challenges have left investors questioning the company’s potential. Here’s a deeper look at the pillars of PayPal’s business and why it may present a compelling opportunity today.

1. Core Business Strengths

PayPal’s extensive user and merchant network is a powerful advantage that reinforces its market position. With thousands of merchants around the world, PayPal offers users a seamless payment experience, which, in turn, encourages more merchants to join the platform. This “network effect” has made PayPal one of the most widely accepted digital wallets globally. Additionally, PayPal’s margin profile—characterized by steady EBITDA margins—highlights its ability to generate profit while scaling.

This profitability allows PayPal to invest in new technologies and further embed itself within the fabric of digital payments. Unlike many fintech competitors, PayPal has managed to balance growth with profitability, positioning itself as a mature yet adaptable player in the digital finance space.

2. Growth Opportunities in Digital Payments

The digital payment market continues to expand rapidly, driven by factors like e-commerce growth, increased smartphone adoption, and a global shift toward cashless transactions. According to recent studies, digital payments still represent a small fraction of total global transactions, which underscores the potential market yet to be captured.

PayPal is well-placed to benefit from this trend, especially in areas like mobile payments, cross-border transactions, and innovations such as Buy Now, Pay Later (BNPL). BNPL has seen explosive adoption, and PayPal’s entrance into this space is a strategic move that allows it to serve a broader range of customers and merchants. As these trends unfold, PayPal’s established infrastructure and experience in the payments industry give it an advantage in navigating and capitalizing on the market’s growth.

3. Venmo’s Underutilized Potential

Venmo, PayPal’s popular peer-to-peer platform, has carved out a unique niche among younger, tech-savvy users. Its user-friendly app and social features have helped Venmo build a loyal customer base, making it one of the most widely recognized names in peer-to-peer payments in the U.S.

Venmo’s potential extends beyond P2P payments, as PayPal has gradually introduced monetizable features like Venmo-branded credit cards, business profiles for small merchants, and even cryptocurrency services. While monetization has been gradual, the potential remains significant. With continued innovation and targeted marketing, Venmo could evolve into a self-sustaining revenue stream that complements PayPal’s main business, appealing to new user segments and expanding PayPal’s reach in digital wallets.

4. Financial Resilience and Cash Flow Generation

PayPal’s robust cash flow is one of its strongest assets, especially in today’s uncertain macroeconomic environment. In the past year, PayPal generated over $5 billion in free cash flow, which it has used for strategic investments, product development, and selective acquisitions. This cash flow not only provides financial flexibility but also positions PayPal to consider shareholder-friendly moves such as stock buybacks and dividends.

Given the recent stock price pullback, buybacks could be a particularly appealing option, offering a way to create value for shareholders. In a rising interest rate environment, PayPal’s consistent cash flow generation acts as a buffer, adding a layer of financial stability that’s especially valuable for long-term investors.

5. Valuation and Market Sentiment

Despite its foundational role in digital payments, PayPal’s shares have seen a significant decline in recent years, driven by a combination of macroeconomic challenges and heightened competition. This pullback presents an intriguing valuation opportunity. With a current price-to-earnings ratio below historical averages, PayPal offers a potential entry point for investors with a long-term perspective.

Market sentiment has been impacted by concerns over BNPL margins, regulatory uncertainties, and slowing user growth, but PayPal’s financial fundamentals and market position remain strong. For investors able to look beyond short-term headwinds, PayPal’s valuation is increasingly attractive, especially given its market leadership and strong financial footing.

Key Risks to Consider

However, no investment is without risks. Competition in the digital payment space is fierce, with heavyweights like Block (Square), Apple Pay, and Google Pay aggressively vying for market share. These competitors are not only eroding market share but also applying downward pressure on transaction fees, which could impact PayPal’s profitability.

Additionally, the regulatory landscape around digital payments and BNPL services is evolving, and increased scrutiny could result in tighter controls that may limit PayPal’s growth potential. While PayPal’s global reach and established brand provide some level of insulation, its ability to adapt to these challenges will be critical in sustaining its competitive edge.

A Snapshot of Recent Financial Performance

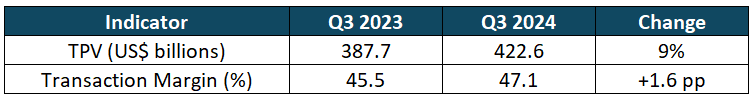

To illustrate PayPal’s financial results, let’s focus on two key indicators from the third quarter of 2024: Total Payment Volume (TPV) and Transaction Margin.

Total Payment Volume (TPV): TPV represents the total amount processed on PayPal’s platform within a specific period. In Q3 2024, PayPal reported a TPV of $422.6 billion, marking a 9% increase over the same period the previous year. Source: Barron’s

Transaction Margin: This metric reflects PayPal’s operational efficiency, calculated by subtracting transaction expenses from total revenue, then dividing by total revenue. PayPal achieved a transaction margin of 47.1% in Q3 2024, showing improvement over prior quarters. Source: MarketWatch

Financial Indicator Chart:

These indicators underscore PayPal’s continued growth in payment volume and operational efficiency, reinforcing its strong position in the digital payments market.

Investment Thesis: Long-Term Value with Upside Potential

PayPal’s position as a leader in digital payments, supported by its consistent cash flow, valuable Venmo franchise, and growth opportunities in new markets, offers a solid foundation for long-term growth. While short-term volatility and competition might weigh on immediate performance, PayPal’s diversified offerings, financial resilience, and strategic growth initiatives make it a compelling investment for those seeking exposure to the digital payments sector. With its current valuation, PayPal presents an attractive entry point for investors who believe in the long-term trends driving the adoption of digital payments and fintech solutions.