StoneCo ($STNE) Investment Thesis: Rebuilding Trust and Growing Stronger

Why StoneCo. ($STNE) is a unique investment opportunity in Brazil’s evolving merchant economy...

Hi, Investor 👋

I’m Jimmy, and welcome to this week’s edition of our newsletter. Today, we’re taking a closer look at StoneCo ($STNE) – exploring its journey from a disruptive payments company to a full-fledged financial ecosystem, and why it presents an attractive opportunity for long-term investors.

Hope you enjoy the deep dive! Feel free to share it with friends and fellow investors.

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

Our deep dive is divided into ten sections:

Sector Overview

StoneCo’s ($STNE) History:

Corporate Governance

Business Model

Competitive Advantages

Distribution Model

Linx Acquisition

Unit Economics

Valuation

Main Risks and Investment Thesis

StoneCo started as one of the biggest success stories in Brazil and Latin America's fintech world.

It grew fast and won the market’s attention.

But over time, ambition turned into overreach…

Since its peak in 2021, Stone’s stock has dropped by more than 85%, showing how fast a rising star can fall.

However, many changes have been made since then - from board and management reshuffles to a complete shift in the business model.

Now trading at just 8.5x 2026 P/E, StoneCo might be one of the biggest opportunities in the market today. Let me tell you why…

📖 Sector Overview:

Brazil is one of the largest and fastest-growing markets for digital payments. With a nominal GDP of R$11.7 trillion and private consumption expenditures (PCE) of R$7.5 trillion in 2024, the country offers major opportunities for financial services companies.

The acquiring industry has expanded rapidly, fueled by greater card adoption and higher risk appetite from banks…

Total card volumes grew 10.9% in 2024, reaching R$4.2 trillion. Even during recessions, the payments sector has consistently outpaced GDP growth.

A key accelerator has been Pix, Brazil’s instant payment system launched in 2020. Initially driven by peer-to-peer transfers, Pix is now widely used by merchants due to its lower cost and instant settlement.

By the end of 2024, there were over 171 million Pix keys registered, supporting financial inclusion and reducing cash usage.

I. Understanding the Acquiring Model:

Acquirers in Brazil generate revenue mainly through:

Merchant Discount Rates (MDRs) on transaction volumes,

POS rental and service fees,

Interest income from receivables anticipation.

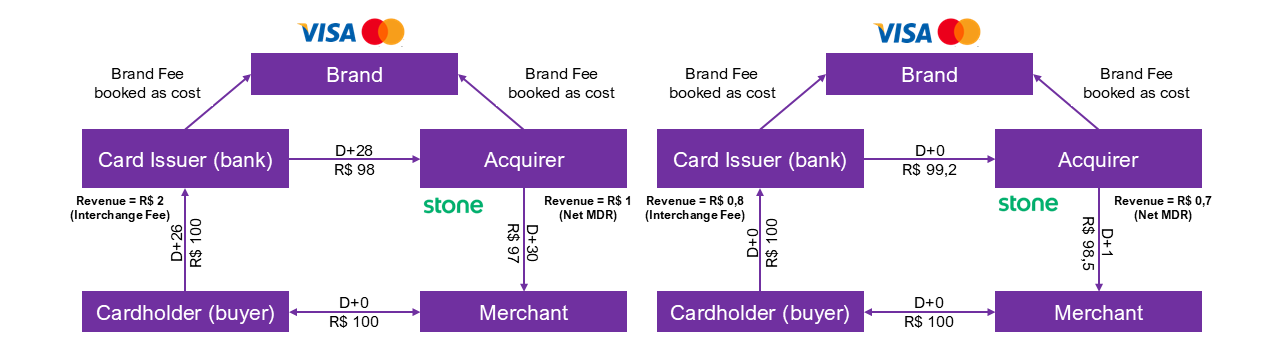

The payment cycle involves cardholders paying issuing banks, which pay acquirers net of interchange fees (typically 55–60% of gross MDRs).

Net MDRs average 1% for credit cards and 0.7% for debit cards.

II. Opportunity and Competition:

Although digital payments account for over 90% of PCE, card penetration remains at only 32% of household consumption - much lower than the 45-50% seen in developed markets. Growth is expected to continue at 150-200 bps per year.

POS machine deployment reached 12.8 million units in 2020, a 22% year-over-year increase, but still shows room for expansion relative to Brazil’s large population.

The market has become highly competitive. Incumbents like Cielo, Rede (Itaú), and Getnet (Santander) still dominate, but fintech newcomers such as Stone and PagSeguro have gained significant ground, controlling around 34% of industry TPV by 2021.

While competition has pressured fees, the growing reliance of merchants on digital payments makes demand more resilient - a structural positive for the sector’s long-term outlook.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

📖 StoneCo’s ($STNE) History:

Stone Co. Ltd. (Stone) was founded in 2012 - by Andre Street and Eduardo Pontes - as a merchant acquirer

It reached operating levels in 2014, and subsequently received its MasterCard and Visa network licenses in late 2015 and early 2016, respectively.

In 2017, Stone became the first non-bank entity authorized by Brazil’s Central Bank to operate as a payment institution.

Since then, the company has grown both organically and through acquisitions, expanding its offerings beyond payments into software, banking, and credit solutions.

Over the years, Stone has made strategic investments and acquisitions, including:

Pagar.me (payment service provider, 2013),

Equals (data reconciliation, 2015),

Elavon (SMB and e-commerce payment platform, 2016),

Linx (retail management software, 2021).

Stone funded this expansion through various initiatives. Between 2017 and 2021, it raised over R$1 billion through FIDC (Fundo de Investimento em Direitos Creditórios) structures, including a R$400 million issuance in May 2021 to support its credit business.

The company also listed shares on NASDAQ in 2018 (ticker: $STNE) and issued US$500 million in bonds in 2021.

Over time, Stone’s evolution has been structured around what it calls the “Five Acts”:

Building a foundation by serving SMBs with differentiated payments solutions,

Expanding into the micro-merchant segment with Ton,

Developing a banking platform to deepen client relationships,

Moving upmarket and integrating financial services with software after acquiring Linx,

Deploying a restructured credit business to further monetize its ecosystem.

👔 Corporate Governance:

StoneCo has officially transitioned to a corporation model, and its founders are no longer controlling shareholders.

Although André Street and Eduardo Pontes retain minority stakes, their governance influence has significantly decreased following a corporate restructuring in 2022.

That year, Eduardo Pontes converted his Class B shares (entitled to 10 votes per share) into Class A shares, which have voting power 10 times lower.

This move effectively broke the founders’ controlling bloc, creating uncertainty in the market about the company's future governance structure.

In addition, in 2024, André Street stepped down from Stone’s board of directors and resigned from his position as Chairman (although he remains a shareholder with relevant voting power, his departure further marked Stone’s shift toward a fully institutional governance model).

As of March 31, 2025:

André Street beneficially owns 1.77% of Class A shares and 100% of Class B shares (representing 40.99% of total voting power).

Madrone Partners L.P. owns 9.95% of Class A shares and 5.98% of total voting power.

Entities affiliated with BlackRock own 12.53% of Class A shares and 7.53% of total voting power.

Class A shares represent 85.64% of total outstanding shares, while Class B shares account for 14.36%.

In 2023, Pedro Zinner was appointed CEO. With over 25 years of experience in strategy, finance, and risk management - including leadership roles at Vale, BG Group, and as CEO of Eneva - Zinner brings a track record of operational excellence.

His focus at Stone is to strengthen efficiency, deepen client relationships, and drive sustainable growth…

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe now and stay updated.

💼 Business Model:

StoneCo is a leading financial technology and software company focused on empowering Brazilian merchants, particularly Micro, Small, and Medium Businesses (MSMBs), to manage and grow their operations.

Through a comprehensive suite of financial services and integrated software solutions, Stone aims to deliver superior customer experiences, fair pricing, and operational simplicity.

Its business is structured around two core segments:

Financial Services; and

Software.

I. Financial Services:

At the heart of Stone's financial services offering is the ambition to become the primary financial operating system for merchants in Brazil.

This platform enables clients to accept payments, manage cash flow, access working capital, and conduct banking activities seamlessly through an integrated, user-friendly experience.

Stone operates differentiated go-to-market strategies across customer segments:

Micro-Merchants (clients with monthly TPV < R$15,000) are served predominantly through Ton, Stone’s highly digitalized, low-cost solution that focuses on ease of use, self-onboarding, and efficient unit economics.

Small and Medium Businesses (SMBs) (monthly TPV between R$15,000 and R$2 million) are catered through Stone's flagship brand, offering a bundled approach that combines payment solutions, banking services, and, where needed, more sophisticated integrations with vertical-specific software.

Key Accounts and Larger Clients are addressed opportunistically, offering tailored solutions with a strong emphasis on profitability and operational efficiency rather than volume maximization.

Stone’s financial services offering encompasses:

Payments: Merchants can accept a wide variety of payment methods, including credit and debit cards, Pix, and boletos, through physical and digital channels. The company has also invested in innovations like TapTon (tap-to-phone technology) to enable smartphone-based acceptance.

Prepayment Solutions: Recognizing the cash flow needs of Brazilian businesses, Stone offers prepayment of receivables, providing liquidity by advancing funds against future card sales (in my opinion, one of the best businesses in the world. It requires low capital expenditure, carries low credit risk, and generates healthy spreads).

Digital Banking: StoneBank, the company's digital banking arm, offers business accounts fully integrated with the merchant's payments ecosystem, enabling seamless receivables management, bill payment, Pix transfers, and tax payments - all within a low-friction digital environment.

Credit: Stone extends working capital loans to its clients, with repayment linked to the merchant’s transactional volumes, aligning incentives and reducing delinquency risk (credit decisions are powered by proprietary risk models that combine real-time data from payment flows with external datasets).

II. Software Solutions:

In 2021, Stone significantly expanded its capabilities with the acquisition of Linx, positioning itself as a leading provider of retail software in Brazil.

Stone’s software business is strategically focused on deepening client relationships by embedding itself into merchants’ daily workflows across key verticals, such as:

Retail

Gas Stations

Food Services

Drugstores

Software offerings include Point-of-Sale (POS) systems, Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), Omnichannel Order Management Systems (OMS), and fiscal compliance tools.

These solutions are designed to integrate seamlessly with Stone’s financial services, enhancing operational efficiency and enabling merchants to sell more across multiple channels.

Software is managed through three strategic fronts:

Strategic Verticals: Integration of software and financial services in high-priority industries.

Enterprise Solutions: POS and ERP tailored for large clients, with omnichannel support.

Other Verticals: POS and ERP solutions for additional segments where full integration opportunities are less immediate.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

🏰 Competitive Advantages:

1. First-Mover Advantage:

Stone was the first company to successfully target SMBs in Brazil with a profitable model.

Today, it covers over 99% of Brazil’s GDP and operates across all 5,570 cities, supported by more than 600 Stone Hubs and over 500 strategic partners, with millions of digital accesses per month.

2. Proprietary Technology:

Stone's fully digital, cloud-native platform allows rapid deployment of new features without disruptions, low marginal transaction costs, and scalable operations.

From 1Q23 to 4Q24, Stone reduced logistics cost per client by 13%, expanded its client base by 50%, and lowered client support costs by 38%, while maintaining an 88% CSAT.

3. Integrated Financial and Software Solutions:

By combining financial services with software, Stone offers a complete solution that simplifies merchants’ operations.

In 4Q24, TPV from its software client base reached R$7.0 billion, growing 20.4% year-over-year, at a pace 1.5x faster than MSMB TPV.

4. Strong Client Engagement:

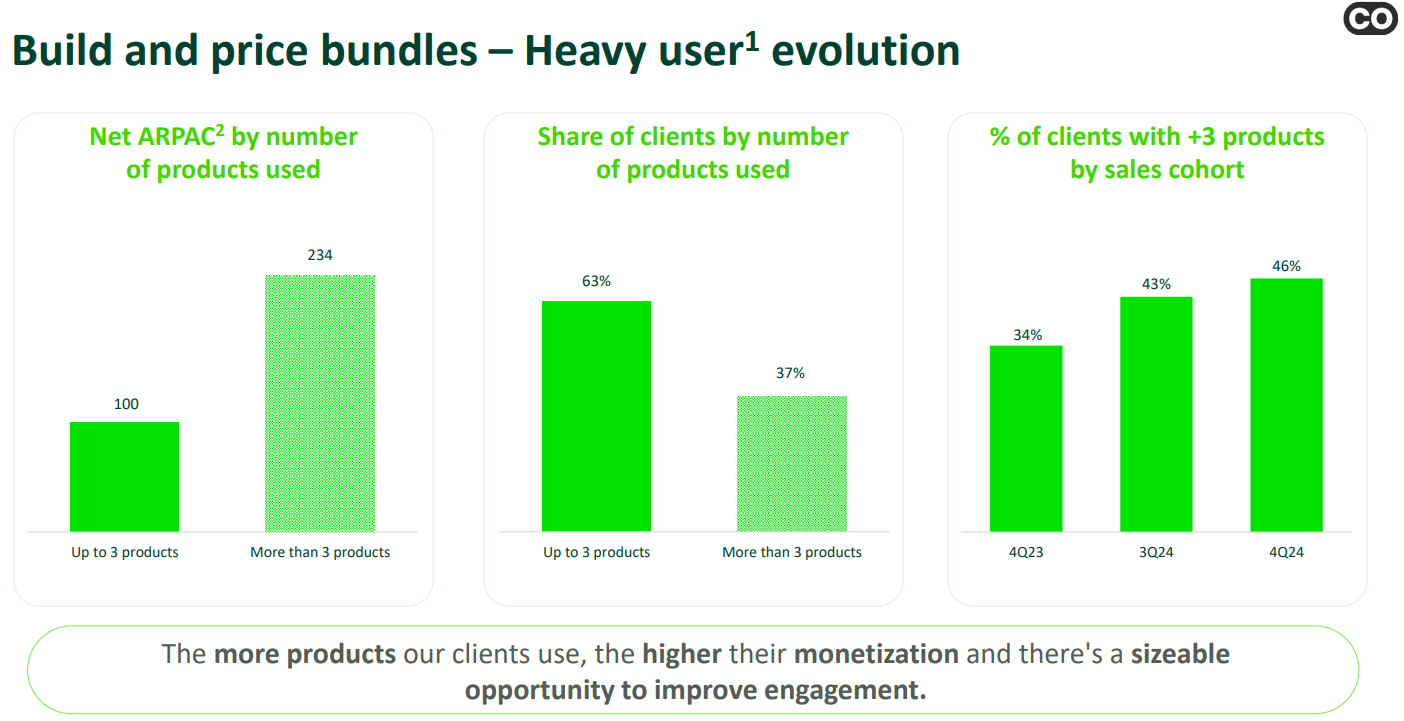

Clients using more than three Stone solutions generated over 2x more revenue than lighter users.

The share of new clients joining with more than three solutions grew from 17% in 1Q23 to 46% in 4Q24, demonstrating higher engagement and better monetization.

5. Protective Business Model and Strong LTV:

Stone’s vertically integrated model - controlling technology, distribution, and service - creates high barriers to replication, ensuring stronger client retention, higher upsell potential, and enhanced client lifetime value.

🚚 Distribution Model:

Stone's distribution model is a major source of competitive advantage and combines physical proximity with digital scalability:

Proximity Channels: Over 600 Stone Hubs (owned and franchised) across Brazil provide localized sales, onboarding, logistics, and support, particularly to SMBs.

Digital Channels: Self-onboarding through web and app, supported by inbound sales centers, mainly serve micro-merchants efficiently at scale.

Strategic Partners: Integration with independent software vendors (ISVs) and marketplaces, expanding Stone’s reach into new client bases through embedded finance models.

The Marco Polo sales platform underpins Stone’s distribution strategy, enabling real-time territory management, performance tracking, and client lifecycle management to maximize sales force productivity.

🛍️ Linx Acquisition:

In 2020, Stone made a bold move. After a heated battle with Totvs, it acquired Linx for R$6.7 billion, aiming to expand beyond payments into software.

But integration didn’t unfold as planned…

As Stone faced a wave of credit defaults in 2021, its focus shifted. The complex task of merging two companies was left on the back burner, only gaining real traction by late 2022.

Stone tried to unlock value by targeting key sectors - retail, pharmacies, food, and gas stations - but soon realized that full ownership of Linx wasn't essential for cross-selling.

Now, four years later, Stone is ready to move on. With the help of J.P. Morgan and Morgan Stanley, it’s exploring a sale.

Totvs has shown interest again, though at a lower price, and private equity funds like GIC and Advent are circling (likely somewhere around R$5 billion).

As Stone redefines its priorities and fights to regain market confidence, the sale of Linx could close a challenging chapter - and open new possibilities for both companies.

The sale of Linx is yet another sign that Stone is doubling down on its core business - becoming a complete platform for micro, small, and medium-sized businesses.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

💹 Unit Economics:

I. Revenue Drivers:

Stone’s ability to grow revenue and profitability depends on the interplay of a few critical operational KPIs:

Active Clients:

Stone defines active clients as those that generated revenue within a given period. Increasing the active client base through efficient acquisition channels - hubs, digital onboarding, and strategic partners - directly drives volume and revenue expansion.As a general rule, the higher the number of active clients, the greater the company’s TPV.

Total Payment Volume (TPV):

TPV measures the aggregate value of transactions processed across Stone’s platform. TPV growth is driven by increasing the number of merchants, expanding share of wallet, and capturing a greater share of consumer spending.Take Rate:

The take rate represents the average percentage fee Stone earns per unit of TPV. Managing take rates involves balancing pricing competitiveness with margin preservation, often influenced by client size, vertical, and product bundling strategies.In other words, with a TPV of R$128 billion in 4Q24, the take rate was approximately 2.5% for MSMBs (95% of TPV) and 1.49% for Key Accounts. Payment revenue reached R$3 billion.

Credit Penetration:

As Stone deepens relationships with merchants, it can increase credit adoption. A greater share of clients using Stone’s credit solutions leads to incremental revenue streams, with risk-adjusted returns improving as underwriting models mature (NPL > 90 days = 3,61% 4Q24).Subscription Revenues:

Growth in software subscription revenues contributes to greater revenue stability and margin expansion over time. Penetration of software solutions into Stone’s existing client base enhances lifetime value (LTV) and reduces churn.

II. Cost Structure:

Stone operates with a highly efficient cost structure that supports its strong profitability metrics.

The company’s business model is fundamentally asset-light, requiring relatively low capital expenditure and limited credit risk exposure, which enables it to sustain high gross margins (~70%) and robust EBIT margins (~40%) over time.

The company's cost base is primarily composed of the following elements:

Interchange Fees:

Payments made to card issuers and payment networks for processing transactions. These fees are typically passed through to clients but can impact margins depending on client mix and competitive dynamics (MDR less Stone’s take rate).Funding Costs:

Costs associated with prepayment of receivables and credit disbursements. As Stone advances funds to merchants, it incurs funding expenses that are offset by the discount revenues collected through prepayment services and loan interest.Transaction and Processing Costs:

Expenses related to running payment authorization, clearing, settlement, and reconciliation processes across Stone’s technology platforms. This includes cloud services, fraud prevention tools, and integration maintenance.Customer Support and Logistics:

Stone invests in its Green Angels logistics team and customer service operations to maintain its best-in-class service levels. These operational costs are necessary for merchant acquisition, retention, and satisfaction.R&D, Sales and Marketing:

Continuous investment in technology development, product innovation, and infrastructure upgrades to expand both financial services and software offerings.

Despite these expenses, Stone’s model is inherently scalable: most costs are either variable with clear efficiency levers or relatively fixed at scale, allowing the company to expand margins as volumes grow.

Now, let's dive into the valuation...

📊 Valuation:

I. Financials:

Keep reading with a 7-day free trial

Subscribe to Jimmy's Journal to keep reading this post and get 7 days of free access to the full post archives.