The Irrationality of the American Investor: A Rising Concern

Unchecked optimism and it's potential consequences

Hi, Investor, 👋

I’m Jimmy, and welcome to another edition of our newsletter. This time, it’s not a deep dive, but rather a brief reflection on the financial markets — a chance to step back and explore some broader perspectives.

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

In recent months, U.S. financial markets have witnessed unprecedented levels of investor euphoria. Optimism among market participants has soared to heights rarely seen, raising concerns about the sustainability of current trends. While confidence and enthusiasm are essential drivers of market activity, excessive exuberance often signals a potential storm ahead.

The Current Landscape

Indicators such as the Conference Board’s sentiment index reveal that investors are expecting unprecedented returns over the next year. This showcases an extraordinary level of optimism, largely fueled by strong performances in sectors like technology and the growing enthusiasm surrounding artificial intelligence. However, much of this confidence appears speculative, with many overlooking potential risks and placing excessive value on anticipated growth.

Parallels with the Past

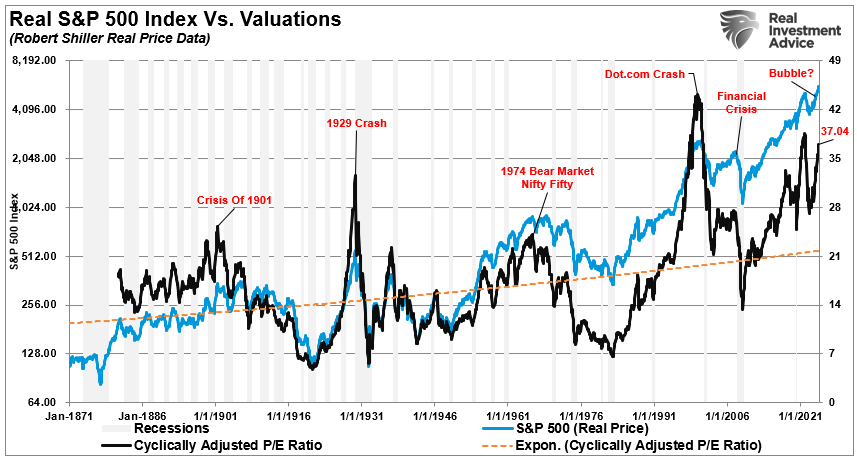

The term "irrational exuberance," famously coined by former Federal Reserve Chair Alan Greenspan in 1996, offers an insightful comparison. Greenspan’s warning came years before the dot-com bubble reached its peak, highlighting how markets can sustain upward momentum for prolonged periods despite underlying fragility. Today’s environment echoes that sentiment, as investors appear to dismiss traditional valuation measures, focusing instead on the seemingly boundless potential of key industries.

The dot-com era serves as a cautionary tale. During that time, the overvaluation of internet companies created a speculative bubble that eventually burst, leading to significant financial losses. The parallels with today’s optimism in tech and AI should not be ignored.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

The Risks of Overconfidence

When markets are driven by speculative sentiment rather than fundamental value, they become more susceptible to corrections. Minor adverse developments—be it a disappointing earnings report, interest rate hikes, or geopolitical tensions—can act as catalysts for sharp market downturns. In such cases, the fallout is often amplified by leveraged positions, forcing investors to sell assets at steep losses.

Furthermore, this irrational exuberance can distort capital allocation, funneling resources into overhyped sectors while neglecting areas of the economy with genuine long-term potential. Such misallocation can hinder broader economic growth and exacerbate the impact of eventual market corrections.

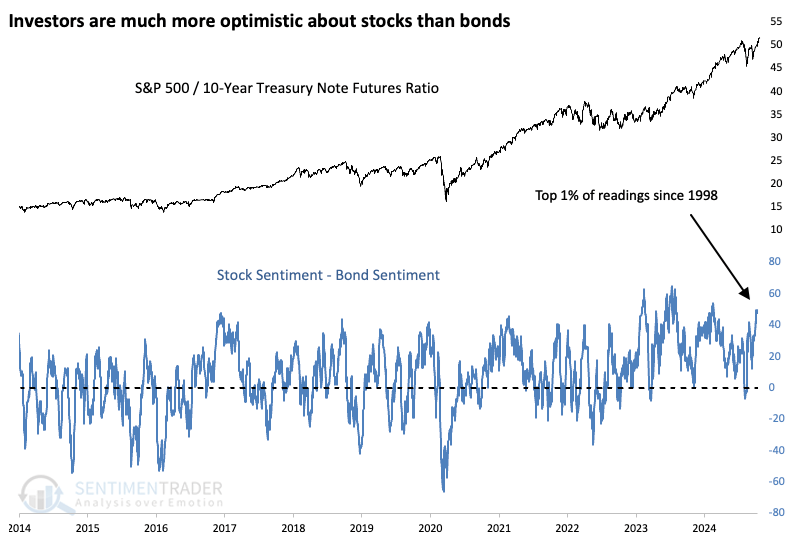

“As far as metrics go, it hardly matters which one we analyze. With a few exceptions, most indicators point to widespread optimism about stock performance in the coming months. In the fixed-income market, however, the story is different. After a brief respite from pessimism a few months ago, bond investors have returned to a negative stance.”

— Sentiment Trader

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

Caution Amid the Euphoria

To safeguard against these risks, investors should adopt a more balanced and disciplined approach. Diversification, for instance, can help mitigate exposure to speculative bubbles. Reallocating portfolios toward defensive sectors and maintaining liquidity are prudent steps in times of heightened market euphoria. Additionally, reducing reliance on leverage minimizes the likelihood of forced liquidations during market downturns.

“Markets can remain irrational longer than you can remain solvent.”

– John Maynard Keynes

Awareness of the psychological factors at play—such as herd mentality and fear of missing out (FOMO)—is also crucial. By staying grounded in fundamental analysis and resisting the temptation to chase unsustainable gains, investors can better navigate uncertain waters.

Conclusion

While optimism is a necessary ingredient for market growth, unchecked euphoria can lead to irrational decision-making and significant financial consequences. The current sentiment among U.S. investors is a double-edged sword, capable of sustaining market momentum in the short term but potentially setting the stage for painful corrections. By prioritizing caution and sound investment principles, market participants can better prepare for the challenges that lie ahead.

As history has shown, the line between rational confidence and irrational exuberance is perilously thin.

Thank you for reading! If you found this analysis valuable, share it with others who might benefit. Spread the insights and let’s grow the conversation together!