Top-10 Dividends Stocks to Watch in 2025

📬 High quality and high dividends: the best stocks to profit from dividend distribution next year

Hi, Investor 👋

I’m Jimmy, and welcome to another edition of our newsletter. As we step into 2025, I’ve been diving deep into dividend stocks that not only provide stable income but also show promising long-term growth. Below, I’ve compiled my top 10 picks with detailed insights into why they’re worth your attention.

In case you missed it, here are some recent insights:

NVIDIA (NVDA) Stock Analysis: A Deep Dive Into Its Future Growth Potential and Market Dominance

What if I were a Portfolio Manager? Stellar Capital Management 🛰️

Nubank (NU): Redefining Banking in Latin America - A High-Growth Investment Opportunity

Subscribe now and never miss a single report:

10. Realty Income (O)

Business Model:

Realty Income owns and leases commercial properties to tenants in essential industries like grocery, drugstores, and convenience. Its long-term leases ensure predictable cash flow, and it passes much of this income to shareholders through monthly dividends.

Why is Realty Income interesting?

Monthly Payouts: Known as "The Monthly Dividend Company," it offers consistent income.

Dividend Growth: Realty Income has increased its dividend for 32 consecutive years, a rare feat among REITs.

Undervalued Asset: Despite growing revenue post-pandemic, its stock price remains below pre-pandemic levels, making it an attractive buy.

Valuation:

Current Yield: 5.5% (5-year average: 4.3%)

9. Pfizer (PFE)

Business Model:

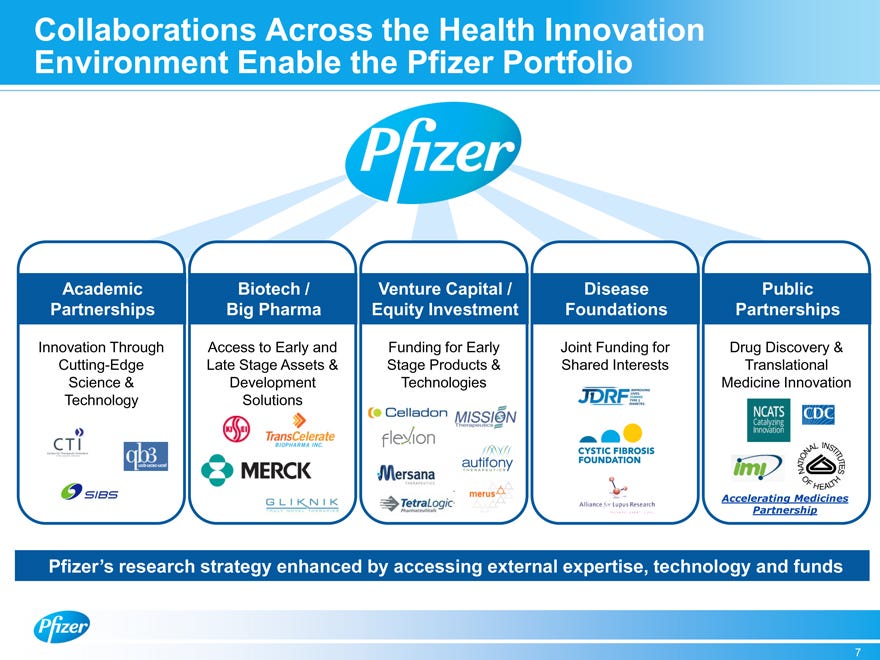

Pfizer generates revenue by developing and selling pharmaceuticals and vaccines, including well-known treatments like Lipitor and the COVID-19 vaccine. Its pipeline of innovative drugs ensures a steady flow of new products.

Why is Pfizer interesting?

Healthcare Demand: Pharmaceuticals are a necessity, offering resilience during economic fluctuations.

Dividend Stability: A history of steady payouts, with a current yield of 4.5%.

Pipeline Potential: Investments in oncology and immunology support long-term growth.

Valuation:

Current Yield: 4.5% (5-year average: 3.7%)

Future Upside: With strong R&D efforts, Pfizer is well-positioned for growth in a critical industry.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

8. CME Group (CME)

Business Model:

CME operates a platform where futures, options, and other derivatives are traded. The more trades conducted, the more fees CME earns. Its business model thrives on market activity, irrespective of whether the market is bullish or bearish.

Why is CME Group interesting?

Cash Flow Machine: Exchanges like CME generate substantial cash flow with minimal capital expenses.

Dividend Structure: CME offers both regular and variable dividends, rewarding shareholders based on performance.

Growth Trend: Increasing use of financial derivatives ensures a growing market for CME’s services.

Valuation:

Current Yield: 4.4% (historical average: 3.6%)

7. Altria Group (MO)

Business Model:

Altria generates revenue through its portfolio of tobacco products, including Marlboro cigarettes and smokeless tobacco. It also has stakes in the cannabis and alcohol industries, diversifying its income streams.

Why is Altria interesting?

Strong Yield: With a yield above 8.5%, Altria is one of the highest dividend payers in the market.

Defensive Sector: Tobacco demand is less affected by economic downturns.

Innovation: Investments in reduced-risk products and cannabis position it for long-term growth.

Valuation:

Current Yield: 8.7% (5-year average: 7.5%)

Risk-Reward Balance: Despite regulatory challenges, its cash flow stability and high yield make it attractive.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

6. Verizon Communications (VZ)

Business Model:

Verizon generates revenue through its expansive telecommunications network, providing wireless, internet, and entertainment services to millions of customers. Its mobile network is the largest in the U.S., and the company benefits from consistent subscription revenues.

Why is Verizon interesting?

Stable Cash Flow: Verizon’s services are essential, making its revenue streams steady even in challenging economic times.

High Yield: With a dividend yield currently exceeding 7%, it’s an income investor’s dream.

Market Leader: Its leadership in 5G technology ensures a competitive edge, especially as data consumption grows.

Valuation:

Yield Comparison: Current yield: 7.2% (5-year average: 4.5%)

Future Prospects: With its 5G investments and strong balance sheet, Verizon offers a mix of income and growth potential for patient investors.

5. Devon Energy (DVN)

Business Model:

Devon explores, develops, and produces oil and natural gas across U.S. basins like the Delaware and Eagle Ford. Its innovative “fixed-plus-variable” dividend model ties payouts to its quarterly earnings.

Why is Devon Energy interesting?

Dynamic Dividends: Its variable dividend allows investors to benefit directly from rising oil prices.

Operational Efficiency: Devon has some of the lowest production costs in the industry.

Positioned for Growth: With a strong presence in top U.S. basins, Devon is well-positioned for future energy demand.

Valuation:

Current Yield: 8.3% (variable component included)

Energy Exposure: Devon’s dividend model aligns investor returns with energy price cycles, offering high upside potential.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

4. PepsiCo (PEP)

Business Model:

PepsiCo earns revenue from its globally recognized food and beverage brands, including Pepsi, Gatorade, Lay’s, and Quaker. The company’s diversified portfolio and significant market presence ensure steady sales across economic cycles.

Why is PepsiCo interesting?

Dividend Growth: A Dividend Aristocrat with over 50 years of consecutive increases.

Strong Brands: Dominance in both snacks and beverages ensures stability.

Global Reach: Expansion in emerging markets fuels long-term growth.

Valuation:

Current Yield: 2.7% (5-year average: 2.8%)

Dependable Choice: Its strong cash flow and market leadership make it a cornerstone for dividend-focused portfolios.

3. JPMorgan Chase & Co. (JPM)

Business Model:

JPMorgan Chase is one of the largest and most diversified financial institutions in the world. It offers a range of services, including investment banking, asset management, consumer banking, and treasury services. The bank generates revenue through interest on loans, investment products, trading, and fees from its various financial services.

Why is JPMorgan interesting?

Consistent Dividend Growth: JPMorgan has a long history of increasing its dividend, demonstrating its ability to generate steady cash flow even in challenging times.

Strong Financials: With robust earnings and capital reserves, JPMorgan is positioned well for economic fluctuations, providing stability and growth potential for investors.

Well-Established Brand: As a leader in the financial industry, JPMorgan benefits from a global presence and diversified revenue streams, helping mitigate risks and provide consistent returns.

Valuation:

Current Yield: 2.06% (historical average: 2.2%)

P/E Ratio: Trailing 15x;

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

2. Procter & Gamble (PG)

Business Model:

P&G sells essential household and personal care products under iconic brands like Tide, Gillette, and Pampers. Its global reach ensures diversified income.

Why is P&G interesting?

Reliable Dividends: 67 years of consecutive increases highlight its financial resilience.

Defensive Play: Even in downturns, consumers prioritize essentials, benefiting P&G.

Global Leader: Strong brand recognition fuels steady cash flow.

Valuation:

Current Yield: 2.5% (historical average: 2.3%)

Safe Haven: Ideal for conservative investors seeking stability and moderate growth.

1. Domino’s Pizza (DPZ)

Business Model:

Domino’s profits from selling pizza through its massive global franchise network. With 99% of its stores franchised, it enjoys a high-margin, scalable business model. They are the world's leading pizza company, operating over 20,000 stores across more than 950 markets.

Why is Domino’s interesting?

Tech Innovator: Investments in delivery technology give it an edge in the competitive food industry.

Aggressive Buybacks: Since 2010, Domino’s has reduced its share count by over 40%, significantly boosting shareholder value.

Global Growth: With untapped potential in international markets, Domino’s is far from saturation.

Valuation:

Current Yield: 1.5% (historical average: 0.98%)

Growth Focused: With a P/E ratio of 28x and an anticipated annual return of 14%, Domino's offers an excellent balance of growth and dividend potential.

Final Thoughts

These stocks offer a mix of high yields, growth potential, and stability, catering to different investor needs. Whether you prefer the steady payouts of a REIT or the growth story of a tech-savvy pizza chain, there’s something here for everyone.

Which of these are you considering for your portfolio? Let me know!

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.