Dempster Mills: The First Company Buffett Ever Ran (and Almost Bankrupted)

Back to the days when Buffett hunted for cigar butts and orchestrated a massive turnaround...

“We are presently (1962) involved in the control of Dempster Mill Manufacturing Company of Beatrice, Nebraska. Our first stock was purchased as a generally undervalued security five years ago. A block later became available, and I went on the Board about four years ago. In August 1961, we obtained majority control, which is indicative of the fact that many of our operations are not exactly of the ‘overnight’ variety.”

That’s how Warren Buffett announced to his partners that he was taking over the management of Dempster Mills, a windmill and farm equipment maker in Beatrice, Nebraska.

At that time, Warren Buffett was not yet the Oracle of Omaha. He was just a young, ambitious investor, deeply rooted in the teachings of his mentor, Benjamin Graham.

Back then, Buffett’s strategy revolved around buying stocks that looked cheap on paper—companies trading below their book value, regardless of their business quality. And that’s exactly what brought him to Dempster Mill Manufacturing Co..

He kept writing...

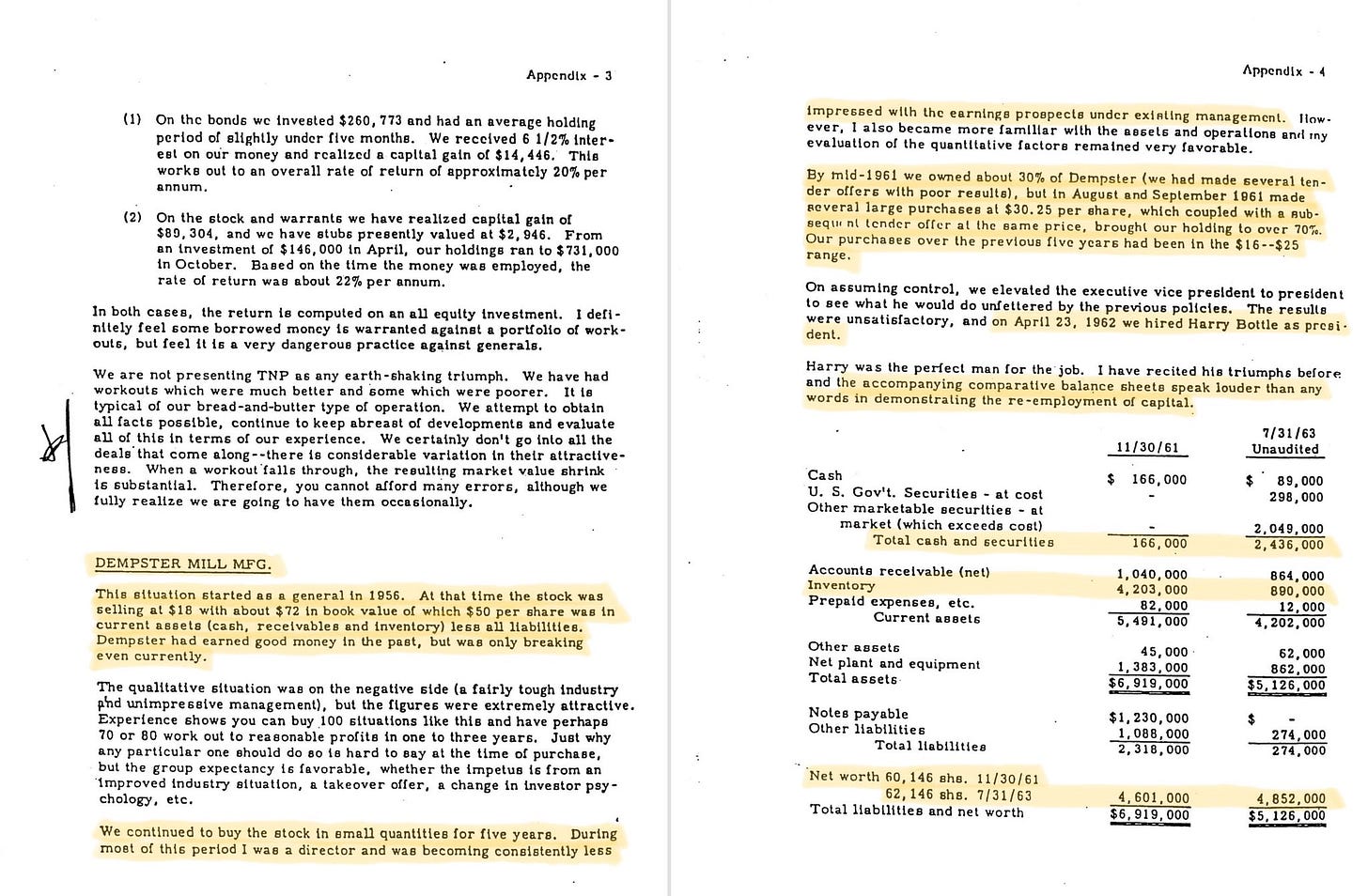

“[…] Dempster is a manufacturer of farm implements and water systems with sales in 1961 of about $9 million. Operations have produced only nominal profits in relation to invested capital during recent years. This reflected a poor management situation, along with a fairly tough industry situation. Presently, consolidated net worth (book value) is about $4.5 million, or $75 per share, consolidated working capital about $50 per share, and at yearend we valued our interest at $35 per share. While I claim no oracular vision in a matter such as this, I feel this is a fair valuation to both new and old partners. Certainly, if even moderate earning power can be restored, a higher valuation will be justified, and even if it cannot, Dempster should work out at a higher figure. Our controlling interest was acquired at an average price of about $28, and this holding currently represents 21% of partnership net assets based on the $35 value.”

He bought a company for $28 that he thought was worth $75. Just counting cash, receivables, and inventory, it was already worth $50.

It's the classic “cigar butt”, a concept coined by Benjamin Graham for companies trading well below their fair value.

And as Warren himself wrote in future letters, this was the cornerstone of his investment philosophy at that time:

“Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good results. The better sales will be the frosting on the cake.”

Here, we can already see the early glimpse of the margin of safety concept...

Don’t Miss Out! Make sure you're subscribed to receive our future posts!

1. Too Good To Be True?

As we all know, a company only trades significantly below its intrinsic value for a reason (Dempster was trading at 0.25 price-to-book when Warren started buying)…

Dempster Mills was in shambles: (i) sales had flatlined, (ii) inventory overflowed, and (iii) cash was running out. Warren Buffett, who had recently taken control, faced resistance from management, who ignored his suggestions.

As the banks threatened to seize inventory and shut the company down, Buffett turned to Charlie Munger for help.

Warren already knew that, at that time, there was only one way to save the company: take control and step into management himself.

2. Dempster’s Turnaround:

Munger introduced him to Harry Bottle, a tough operator known for reviving struggling businesses - “the doctor of sick companies”, as he likes to call himself.

Bottle immediately got to work and implemented several initiatives to pull the company out of bankruptcy.

As Warren said later…

“Hiring Harry may have been the most important management decision I ever made. Dempster was in big trouble under two previous managers and the banks were treating us as a potential bankrupt.”

Here’s what Harry did:

I. Increased Prices:

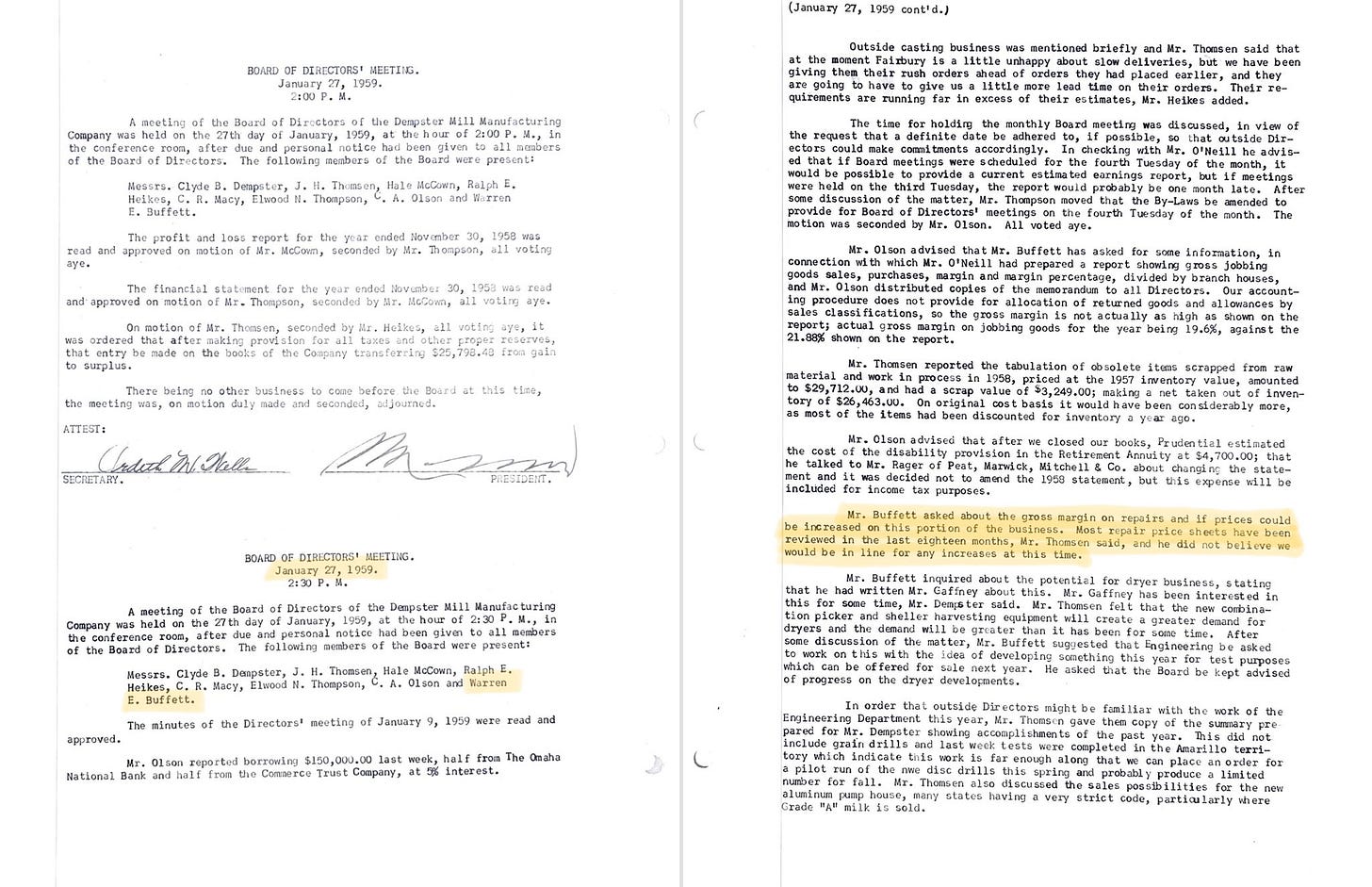

Buffett recognized that Dempster could charge significantly more for replacement parts without facing much resistance.

Harry agreed and adjusted the pricing as follows:

Fully proprietary parts: increased by up to 500%.

Semi-proprietary parts: raised by 200% to 300%.

Non-proprietary parts: increased by up to 100%.

As he said later…

“[…] Adjusted prices of repair parts, thereby producing an estimated $200,000 additional profit with virtually no loss of volume.”

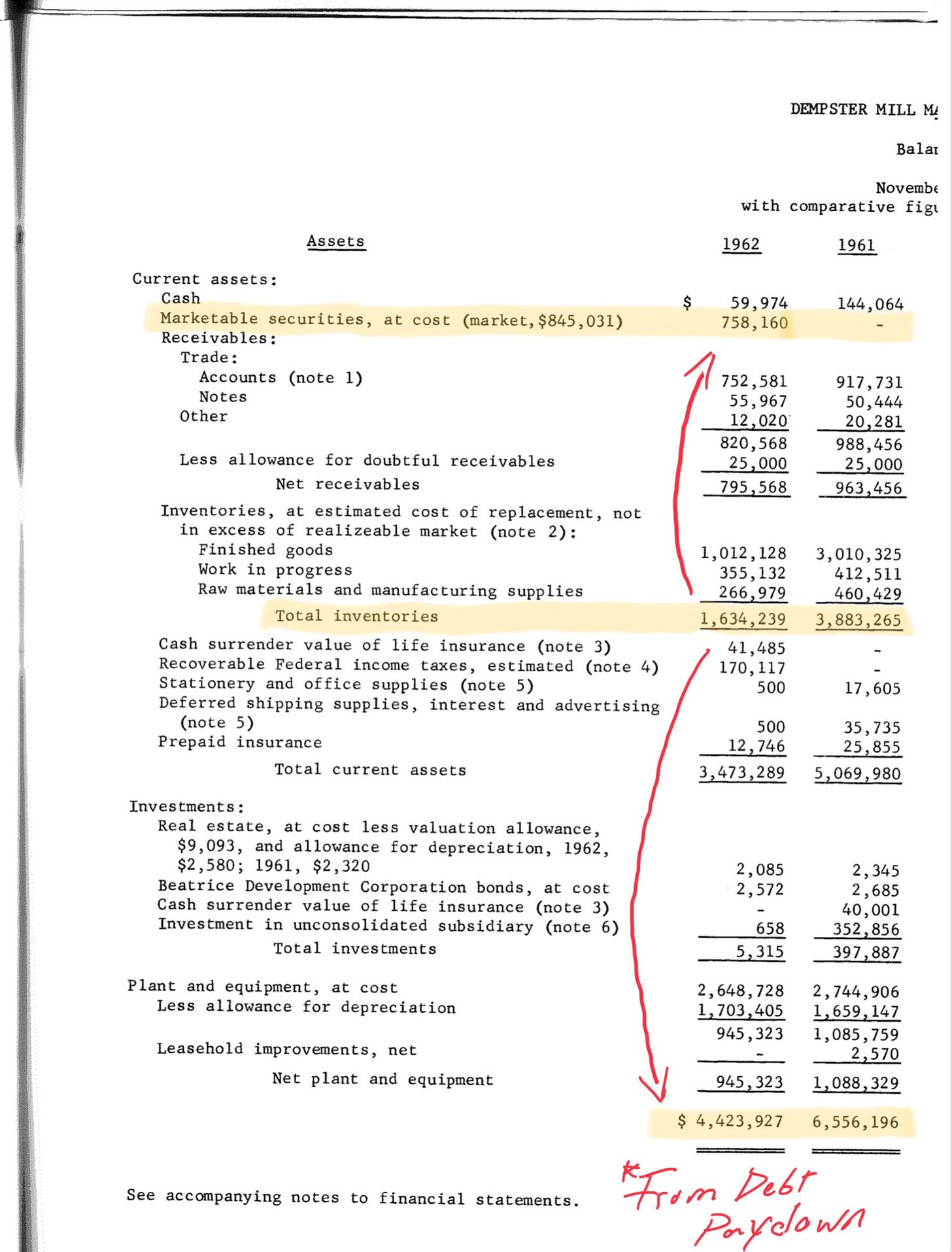

II. Reduced Inventories:

Dempster was turning over its inventory twice a year while operating with only 30 days of trade credit. This created a heavy reliance on debt or equity investment compared to its sales volume.

Bottle took the inventory from over $4 million (much of it slow moving) to under $1 million, reducing carrying costs and obsolescence risks tremendously…

By reducing the company’s reliance on inventory, Buffett was able to:

Improve the return on invested capital (ROIC).

Free up cash for other opportunities (Buffett still loves this concept to this day - it’s very similar to the insurance business model: cash upfront, invest the float in other assets).

A funny incident illustrates Harry Bottle’s no-nonsense approach. At one point, he had a white line painted on the wall of Dempster’s warehouse, ten feet above the floor. He warned management that if inventory ever piled higher than that line, everyone in the warehouse - except the shipping department - would be fired.

Over time, as things improved, Bottle kept lowering the line, forcing the team to manage inventory more efficiently.

III. Cut Costs:

In every good turnaround, cutting unnecessary costs is a key component.

Harry Bottle tackled this head-on and implemented the following changes:

Reduced administration and selling expenses from $150,000 to $75,000 per month.

Lowered factory overhead costs from $6 to $4.50 per direct labor hour.

Shut down five unprofitable branches, keeping the three that were performing well and replacing the others with more efficient distributors.

Resolved operational issues at an auxiliary factory in Columbus, Nebraska.

Eliminated jobbed product lines that tied up significant capital without generating profits, freeing up cash for more productive investments, like securities.

3. The Next Steps:

The turnaround was executed brilliantly - Buffett’s strategy paired with Bottle’s execution. With the actions taken, Dempster Mills was able to:

Eliminate all debt.

Boost ROIC from 0% to 10%.

Allocate $750,000 into securities investments.

Harry Bottle letter about Dempster's turnaround:

Enjoying the content so far? Why not subscribe?

4. It’s Time To Sell:

The turnaround was challenging, and Buffett experienced firsthand what it meant to manage a company. With brilliant minds by his side, he successfully saved Dempster from bankruptcy.

The result? Two years after taking control, Buffett sold Dempster’s operating business at book value.

Combined with the remaining cash and securities, the investment generated a 3x return for BPL - Buffett’s partnership at that time, long before the days of Berkshire Hathaway.

As Warren said…

“If Dempster had gone down, my life and fortunes would have been a lot different.”

A very curious fact, as mentioned in The Snowball, is that the sale of Dempster Mills was far from smooth. When Buffett announced that the company would be sold, “Beatrice [the city] went berserk at the thought of another new owner that might impose layoffs or a plant closing on its biggest and virtually only employer.”

“The people of Beatrice pulled out the pitchforks. Buffett was stunned. He had saved a dying company—didn’t they see that? Without his intervention, Dempster would have gone under. Yet he hadn’t anticipated the intensity of the backlash or the personal vitriol directed at him.” - Alice Schroeder

5. Key Lessons:

Margin of Safety Matters:

Buffett’s purchase of Dempster at a significant discount to intrinsic value provided a cushion that allowed the investment to succeed, even amidst turmoil.The Right Management is Crucial:

Harry Bottle’s decisive actions demonstrated the importance of strong, effective leadership in turning around a failing business.Turnarounds Require Tough Decisions:

Dempster’s revival showed that successful turnarounds demand bold and often unpopular choices, from cutting costs to rethinking operations.

Join us in the Jimmy's Journal chat and connect with a growing community of investors:

If you’d like to learn more about our approach, check out our investment philosophy here:

And if you’d like to learn more about the companies we invest in, take a look at our latest deep dive:

Thank you so much for reading this far. If you found value in these ideas, consider sharing Jimmy’s Journal with other like-minded investors.

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.

A very interesting read into how to save a company using actionable tips! That’s good! Keep doing it! This amount of text is just right. Fast to read, yet thorough