I'm Buying Uber. Here's Why: Uber Technologies, Inc. ($UBER) Deep Dive

Driving the future: why Uber is a compelling bet on mobility and delivery transformation

Hi, Investor 👋

I’m Jimmy, and welcome to another free edition 🔓 of our newsletter. Today, we’re presenting a deep dive into Uber ($UBER) – a complete investment thesis on a company that’s transforming mobility and delivery. From its dominant platform to its focus on profitability, we’ll cover why Uber remains a compelling long-term play.

Hope you enjoy it! And if you do, please share it with your friends.

In case you missed it, here are some recent insights:

Nubank (NU) Stock Analysis: Redefining Banking in Latin America - A High-Growth Investment Opportunity

NVIDIA (NVDA) Stock Analysis: A Deep Dive Into Its Future Growth Potential and Market Dominance

What If I Were a Portfolio Manager? #2 Stellar Capital Management

Subscribe now and never miss a single report:

🚘 Sector Overview:

The ride-hailing and online food delivery sectors have become essential components of the global economy, driven by advancements in technology and shifting consumer preferences.

Ride-hailing services, which utilize private vehicles and digital platforms, have disrupted traditional transportation by offering affordable, convenient, and scalable solutions. Similarly, the online food delivery market has transformed how consumers access groceries and meals, integrating e-commerce efficiency with lifestyle convenience.

The ride-hailing market is projected to grow by over 40% between 2023 and 2028, reaching $216 billion by 2028. Major players like Uber, DiDi, and Lyft dominate the industry, leveraging technology to enhance user experience and optimize operations.

Meanwhile, the online food delivery market is expected to see even greater growth, with revenues climbing from over $1 trillion in 2023 to $1.85 trillion by 2029. This expansion is fueled by the rise of grocery delivery, which accounted for $630 billion in 2023, alongside meal delivery services at $390 billion.

By the way, if you’d like to dive deeper into this topic, I recently wrote an article about the dualities in calculating Uber's TAM: How to Define the Total Addressable Market.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

📖 Uber’s History:

Uber’s journey began in Paris in 2008 when Travis Kalanick and Garrett Camp, attending the LeWeb tech conference, struggled to find a cab one winter night. Inspired, they envisioned a timeshare limo service ordered via an app. After returning to San Francisco, Camp purchased the domain UberCab.com, and along with Kalanick, Oscar Salazar, and Conrad Whelan, developed the concept further.

In 2010’s, UberCab was launched, resonating with tech-savvy professionals, but soon receives a cease-and-desist order from the San Francisco Municipal Transportation Agency.

A key issue was the use of “Cab” in its name, implying it was a taxi service. In response, the company rebrands as Uber, symbolizing its ambition to be a technology platform, not a traditional transportation service.

Uber’s Evolution (2015–2023)

2015: Launches Uber Eats, diversifying into food delivery. TAM gets even bigger.

2019: Goes public on the NYSE with a market capitalization of $75.5 billion.

2021: Expands Uber Eats amid the COVID-19 pandemic, pivoting successfully as food delivery demand surges.

2023: Celebrates 15 years with over 130 million monthly active users, cementing its position as a global leader in mobility and delivery.

👔 Corporate Governance

In 2025, Uber is supported by a diverse group of major institutional and individual shareholders. SB Cayman 2 Ltd, linked to SoftBank, remains the largest single shareholder with a 19.35% stake in the company.

Notable institutional investors include Vanguard Group (8.39%), BlackRock Inc. (7.02%), and Morgan Stanley (4.66%). The Public Investment Fund of Saudi Arabia, which has been a key backer since 2016, holds 3.47% of Uber's shares. Additionally, Garrett Camp, Uber's co-founder, retains a 3.20% ownership in the company.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

💼 Business Model

Uber Technologies, Inc. (UBER) operates a technology platform leveraging a massive network, advanced technology, and operational expertise to facilitate seamless movement of people and goods.

It powers three interconnected verticals: Mobility, Delivery, and Freight, across approximately 70 countries, addressing fragmented markets in North America, Latin America, Europe, the Middle East, Africa, and parts of Asia.

#1 in mobility (~25% market share worldwide and ~70% in the US) and #2 in delivery markets. Local leadership, global scale.

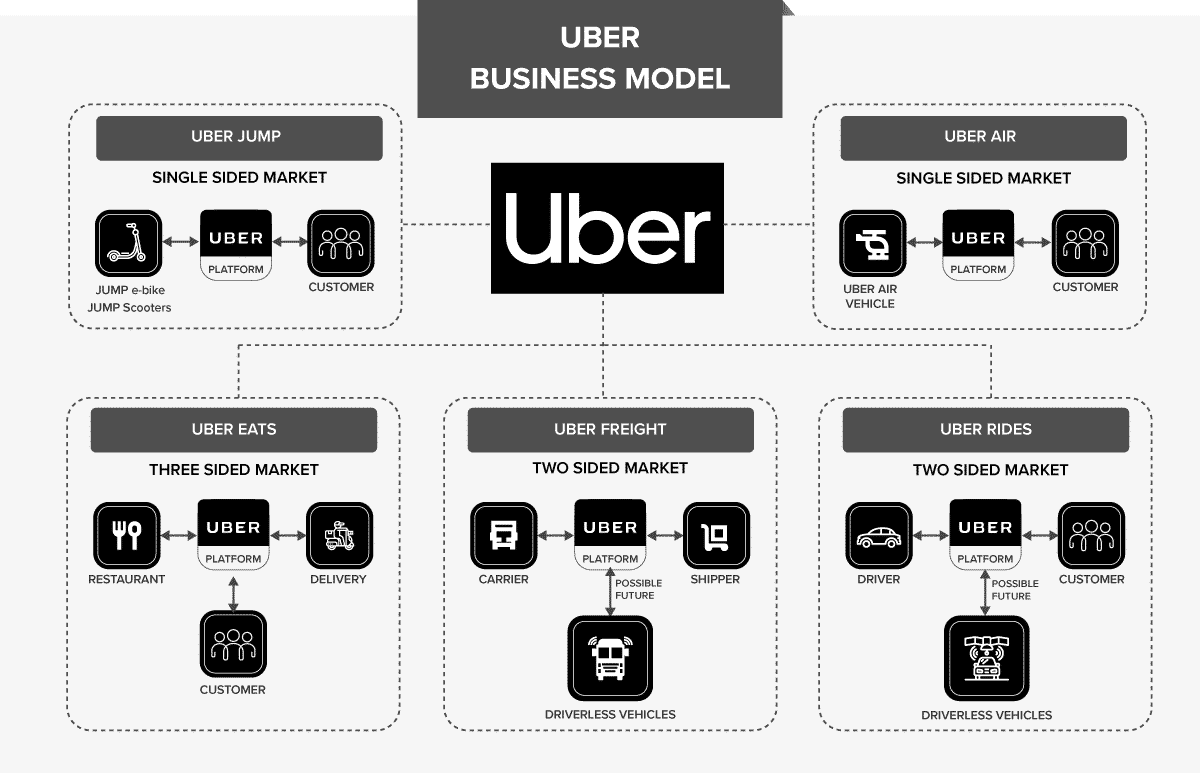

Uber has become a major force in transportation and is leveraging its platform to disrupt other markets. Its two-sided platform connects drivers with customers seeking rides via its app, creating efficient interactions between supply and demand. In Mobility, it matches drivers with riders, while in Delivery (a three-sided market), it connects restaurants, couriers, and consumers.

Uber’s model balances supply-side (drivers, merchants, carriers) and demand-side (riders, eaters, shippers), resembling platforms like Airbnb and Amazon. Focused on matching—one of four platform types (collaboration, orchestration, creation, matching)—it simplifies connections and transactions.

Its foundation lies in advanced technology, like Google Maps API for user-driver matching and a dynamic pricing system adjusting rates based on demand. These innovations enable Uber to scale efficiently into new markets and solidify its leadership in platform-driven business models.

📊 Revenue Lines:

Mobility

Uber’s Mobility offering connects consumers with a diverse range of transportation options, including ridesharing, car rentals, micromobility, and public transit.

The platform’s scale and marketplace data provide a competitive edge, enabling faster innovation and higher service reliability. For consumers, this translates to enhanced experiences across various vehicle types, while drivers benefit from increased earning opportunities and consistent demand. That’s Uber’s Flywheel.

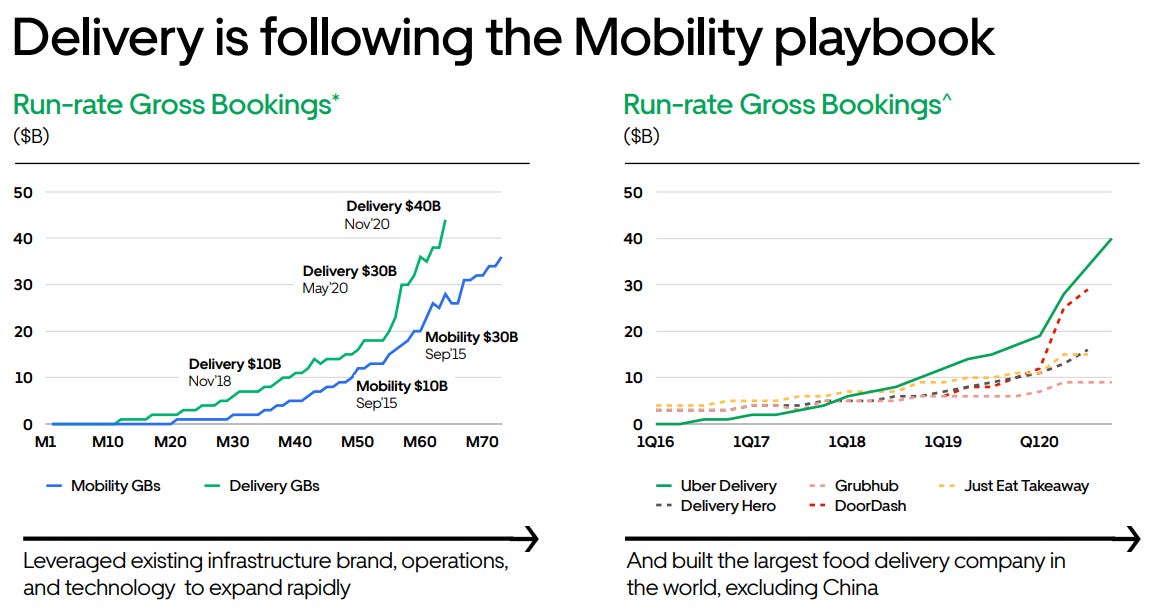

Delivery

Uber’s Delivery offering, anchored by Uber Eats, connects consumers with local commerce, encompassing restaurants, groceries, alcohol, convenience items, and retail goods.

The Delivery segment expands consumer engagement with the Uber platform, enhances merchant reach, and provides drivers with increased earning opportunities. Additionally, products like Uber Direct (white-label delivery) and in-app advertising unlock new revenue streams while reinforcing platform synergies.

Freight

Uber Freight revolutionizes the logistics industry by providing a digital marketplace that connects Shippers with Carriers.

This segment leverages Uber’s brand, technology, and operational excellence to enhance transparency, pricing, and operational control for businesses. Focused on North America and Europe, Freight offers an end-to-end solution for Shippers and Carriers, enabling real-time booking, pricing, and shipment tracking.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

🎯 Value Proposition: How Uber Works

Uber operates as a car-for-hire service, connecting riders with drivers via a smartphone app. Riders request rides by setting their pickup location in the app, which matches them with nearby drivers. Payments are processed seamlessly through the app, making the experience cashless and convenient.

The platform integrates smartphone technologies like GPS for navigation, accelerometers for safety monitoring, and payment gateways for transactions. Uber’s value lies in its ease of use, underpinned by advanced technology that ensures efficient ride-matching, secure payments, and a user-friendly experience.

♟️ Competitive Advantages:

Massive Network Scale

Uber’s vast network comprises tens of millions of Drivers, consumers, Merchants, Shippers, and Carriers, operating in over 10,000 cities worldwide. This scale creates a self-reinforcing ecosystem where every interaction contributes to smarter operations through data aggregation and network intelligence. The reach and liquidity of Uber’s network enable rapid scalability and a seamless user experience, setting it apart from competitors.

Network Effect: The platform grows more valuable as it attracts more users, increasing engagement and operational efficiency.

Global Presence: Uber’s operations span diverse regions, ensuring broad market reach and adaptability to local nuances.

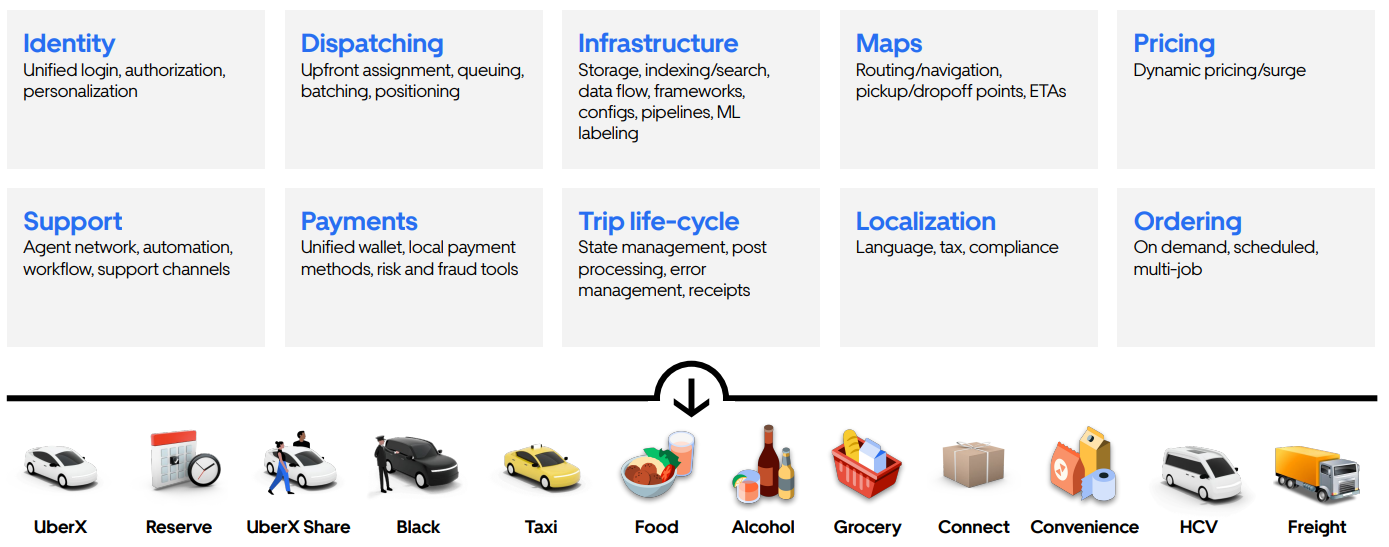

Proprietary Technology Leadership

Uber’s cutting-edge marketplace technologies, including demand prediction, dispatching, pricing, and payment systems, provide unmatched efficiency in launching and managing services.

These proprietary tools allow Uber to innovate faster and maintain a competitive edge in Mobility, Delivery, and Freight. More data, more capabilities.

Core Differentiator: The integration of marketplace, routing, and payment systems fosters seamless scalability and adaptability across offerings.

Future-Ready: Continuous investment in technology ensures Uber stays ahead in leveraging AI and data analytics for improved operations.

Operational Excellence

Uber’s regional teams possess deep market-specific knowledge, enabling rapid product launches and sustained growth. This localized expertise strengthens relationships with regulators, supports platform users, and drives efficient market entry.

On-the-Ground Expertise: Regional operations enhance the platform’s ability to scale while addressing specific regulatory and consumer needs.

Resilient Expansion: Uber’s ability to balance global standardization with local adaptation supports sustained growth in diverse markets.

Integrated Product Ecosystem

The introduction of the “Super App” and membership programs like Uber One unify Uber’s offerings into a seamless user experience. These initiatives deepen customer engagement, reduce friction, and foster cross-platform utilization. In Q4 2023, Uber exited the year with 19 million members across its Uber One, Eats Pass, and Rides Pass programs.

Customer Stickiness: Cross-platform memberships incentivize users to explore and utilize multiple services, driving higher average engagement.

Convenience Focus: Streamlined access to rides, delivery, and groceries enhances customer satisfaction and loyalty.

Advertising as a Growth Engine

Uber’s advertising division, launched in 2022, unlocks a new revenue stream by connecting merchants and brands with Uber’s extensive network. Offerings like Uber Journey Ads provide engaging touchpoints throughout the user experience, enabling targeted and impactful campaigns. By Q4 2023, active advertising merchants surpassed 550,000, highlighting the rapid adoption of this model.

Monetization of Engagement: Uber’s data-driven advertising platform allows brands to connect with consumers at pivotal moments in their journey.

Scale Advantage: The platform’s vast network ensures unparalleled reach and precision for advertisers.

Synergistic Platform Dynamics

Uber’s ability to integrate Mobility, Delivery, and Freight on a single platform enhances user acquisition and engagement. For instance, 60% of first-time Delivery users in Q4 2023 were new to the Uber platform, and users engaging with both Mobility and Delivery averaged 10.5 trips per month, compared to 5.0 for single-service users.

These synergies amplify network effects, creating a compounding advantage over competitors.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

🔮 Perspectives:

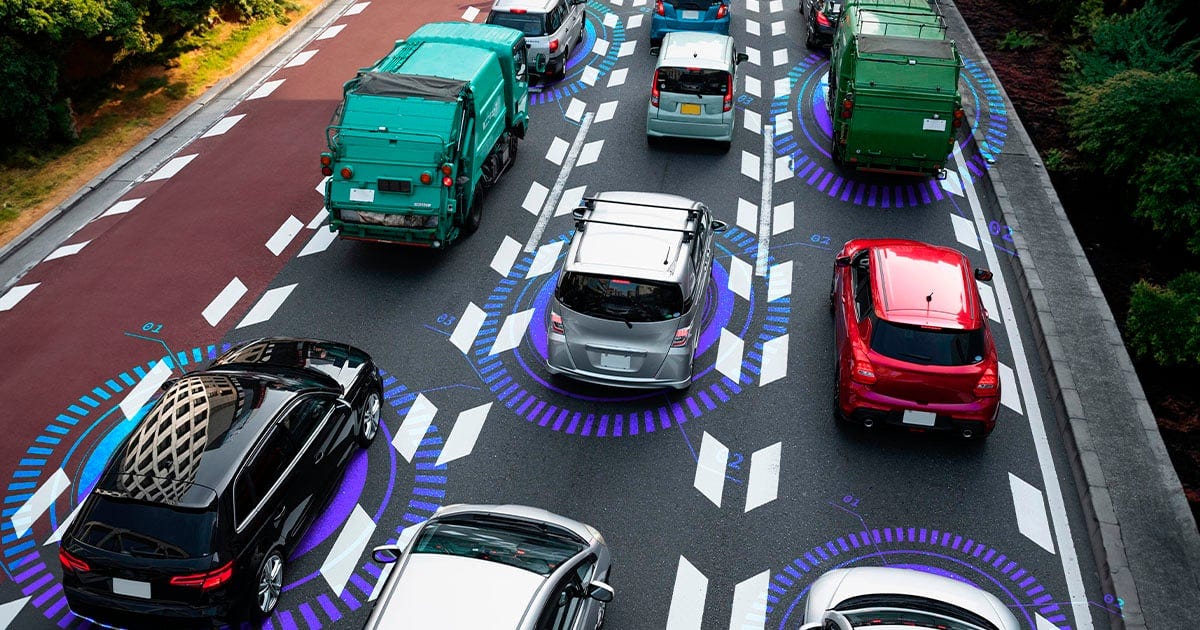

The ride-hailing and delivery sectors are poised for significant growth, supported by a vast total addressable market (TAM). According to Goldman Sachs’ Future of Mobility report, mobility is expected to transform more in the next decade than at any point since the invention of the automobile, creating opportunities for innovation and expansion.

Short-term challenges, however, remain significant. The ride-hailing sector faces hurdles such as competition, regulation, rising labor costs, and macroeconomic pressures. Inflation and higher living costs may also lead consumers to view services like Uber and Lyft as luxuries rather than everyday necessities.

“The way people get around is poised to change more in the next decade than any time since the invention of the automobile […]. While we see new mobility as a massive long-term opportunity, the path to reaching it is far from a straight line. We see the long-term leadership in the space as far from settled”. - Goldman Sachs

To sustain demand, companies must shift their offerings from being perceived as conveniences to essential utilities. This transformation is critical to ensuring affordability and long-term user engagement in a competitive environment.

In the long term, technology developments like autonomous vehicles and AI could redefine the industry. For delivery services, rising consumer demand for convenience and improvements in logistics will drive growth. Success will depend on addressing current challenges while building scalable, indispensable solutions.

💹 Unit Economics | Revenues and Cost:

In the ride-hailing and delivery markets, scale makes all the difference, especially when it comes to user experience and pricing power.

Uber’s ride-hailing services, with a 25% global market share, offer an average wait time of just 5 minutes. On the delivery side, Uber Eats has grown its network to over 800,000 partner restaurants in 11,000 cities worldwide, with an average delivery time of around 30 minutes.

These factors play a key role in customer choice, reinforcing the network effect:

Better services attract more customers (with a lower CAC), which brings in more drivers and couriers, improving the UX and driving higher profits and margins.

Revenue Drivers:

MAPCs (Monthly Active Platform Consumers) measure the number of unique users who complete a ride or receive an Uber Eats delivery at least once per month, averaged over each month in the quarter.

Trips, on the other hand, represent the total number of completed rides and deliveries during a given period.

Uber expects Trips to outpace MAPC growth as the company focuses on enhancing user engagement and increasing trip frequency (25,8% and 17,9% CAGR, respectively).

Gross Bookings Growth Drivers:

Uber’s gross bookings are expected to grow through four main strategies:

Increasing penetration in existing ride-hailing (currently, ~50% of users take only 1-2 trips per month) and online food delivery markets.

Geographical expansion, tapping into new regions with untapped demand.

Acquiring new users via its New Mobility offerings, such as micromobility and car rentals.

Reducing churn by leveraging loyalty programs and rewards to retain users and encourage repeat usage.

We expect the take rate to remain stable over time, around 25%.

Cost Drivers:

Insurance Costs: Uber combines third-party insurance and self-insurance mechanisms to manage risks such as auto liability, physical damage, and workers’ compensation. Insurance costs are significant, especially in North America, but are expected to decrease as the company grows internationally and scales less insurance-intensive businesses.

Payment Processing: Payment fees are another major cost, with most transactions processed via credit cards.

Hosting Fees: Uber relies on third-party cloud services and data centers. As the company scales, it aims to optimize cloud usage and negotiate more favorable deals to lower hosting costs.

Operations & Support: These expenses include employee compensation for city operations, driver support, and customer service.

Sales & Marketing: This includes employee compensation, advertising, promotions, and customer discounts. Historically one of Uber’s largest expenses, these costs are expected to decrease as the company focuses on profitability and leverages existing customer acquisition efforts.

Research & Development: R&D covers platform improvements and technology development, such as autonomous driving projects.

Overall, we believe Uber is well-positioned to maintain its leadership in these segments and achieve over $180 billion in gross bookings by 2025. On the margin side, we expect Uber to benefit from scaling insurance and payment costs, supported by increased efficiency across its OPEX.

The company projects a long-term adj. EBITDA margin of 25% (vs. ~10% today).

Now, let's dive into the company's numbers, projections, and target price...

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

📈 Valuation:

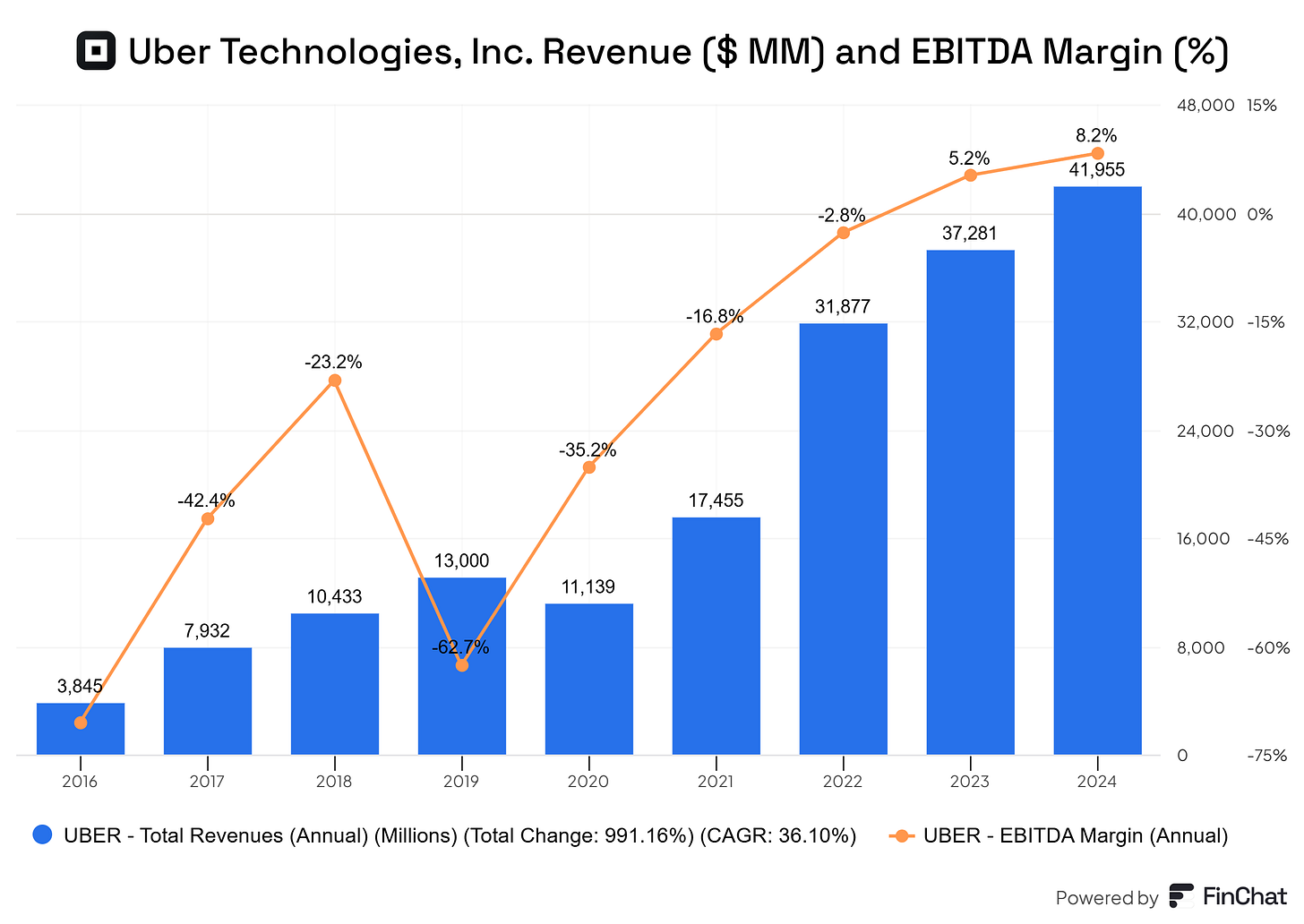

Historical Performance:

Historically, Uber has faced significant financial challenges. From its inception through much of its history, the company was synonymous with cash burn and recurring losses: Uber’s strategy revolved around subsidizing rides and expanding its market share, often at the expense of profitability.

Keep reading with a 7-day free trial

Subscribe to Jimmy's Journal to keep reading this post and get 7 days of free access to the full post archives.