Go Big or Go Home: Lessons from Soros and Druckenmiller

The high-stakes trade that brought down the pound and made financial history...

“I’ve learned many things from George Soros, but perhaps the most significant is that it’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong.” - Stanley Druckenmiller

George Soros is widely known for his bold move in 1992 that earned him the nickname "the man who broke the Bank of England." He made an astonishing $1 billion by betting against the British pound during its devaluation.

While Soros became the face of this daring gamble, it was actually Stanley Druckenmiller, his portfolio manager at the time (often referred to as Soros's alter ego), who played a key role in pulling it off. It’s a fascinating story, full of complexities that are often overlooked.

This edition is divided into 6 main sections:

Historical Context

A Spark of Conviction

Finding Asymmetry

The Perfect Storm

The Day the Pound Fell

Lessons from Legends

1. Historical Context:

Let’s set the stage. It was 1992, and Britain was part of the European Exchange Rate Mechanism (ERM) - a system designed to stabilize exchange rates by pegging currencies to the German mark.

But there was a problem: Germany, fresh off its reunification, was fighting inflation by raising interest rates, while Britain’s economy was in a deep recession and desperately needed lower rates.

This mismatch created a fragile system that Soros and Druckenmiller saw as an opportunity.

Don’t Miss Out! Make sure you're subscribed to receive our future posts!

2. A Spark of Conviction:

“What’s most interesting about the breaking of the pound,” said Scott Bessent, head of Soros’s London office at the time, “was the combination of Druckenmiller’s gamesmanship—Stan really understands risk/reward—and George’s ability to size trades.”

The idea to short the pound came from Druckenmiller, but Soros’s role was crucial. He pushed Druckenmiller to go all-in. “Make no mistake about it,” Bessent continued:

“Shorting the pound was Druckenmiller’s idea. Soros’s contribution was pushing him to take a gigantic position.” - Scott Bessent

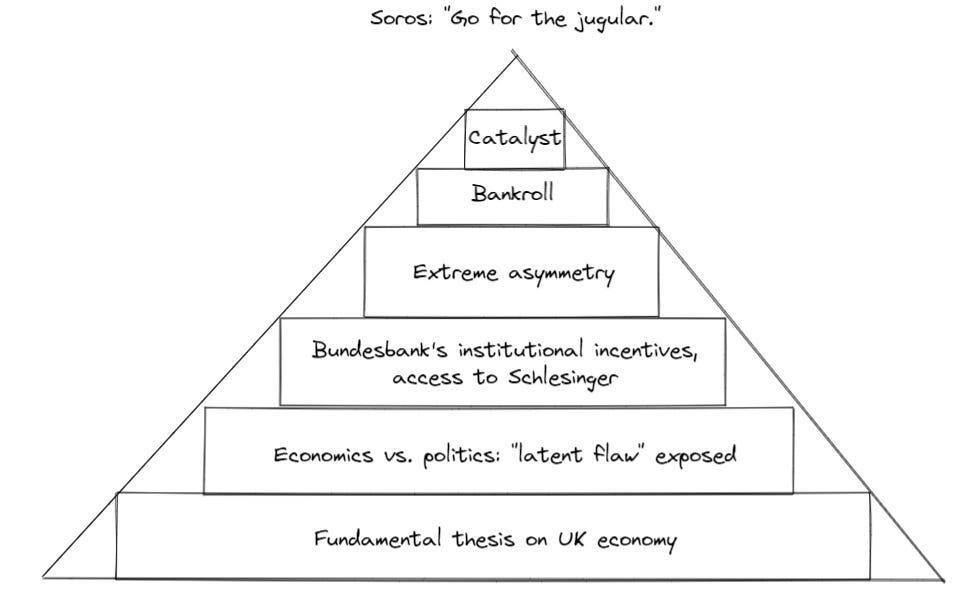

This confidence wasn’t blind. The team’s conviction came from months of research. Bessent recalled analyzing the UK housing market and noting that 90% of mortgages were tied to overnight rates, making the economy incredibly vulnerable to rising costs. “We’d been thinking about it for a while. We did a lot of bottom-up research,” he said.

But it wasn’t just research that gave them the edge. Soros’s ability to read people and situations was unmatched. At a speech in Basel, Bundesbank President Helmut Schlesinger hinted at cracks in the ERM. Soros caught the nuance, called Druckenmiller, and said, “Short more lira.”

3. Finding Asymmetry:

This trade wasn’t just about making a bet; it was about finding a trade where the risk was small, and the potential reward was enormous. Robert Johnson, a trader Soros was recruiting, broke it down:

— “Sterling is liquid, so you can always exit losing positions. The most you could lose is half a percent or so,” Johnson explained.

— “What could you gain?” Druckenmiller asked.

— “Fifteen to twenty percent if it busts out,” Johnson replied.

— “How likely is that?”

— “On a three-month timeframe, about ninety percent.”

For Druckenmiller, it was a no-brainer. But Soros wasn’t satisfied with playing it safe. He argued:

“If the story is this good, why just nibble? Go for the jugular.” - George Soros

And that’s exactly what they did. Druckenmiller started shorting the pound aggressively. As he later put it,

“We realized that we could push the Bank of England against the trading band where they had to buy an unlimited amount of pounds from us.” - Stanley Druckenmiller

Enjoying the content so far? Why not subscribe?

4. The Perfect Storm:

September 1992. The Italian lira was the first to break out of the ERM, signaling to the world that the system was under immense strain. Then, Schlesinger made public comments hinting that more currencies could fall. That was all the confirmation the markets needed.

Druckenmiller walked into Soros’s office to propose gradually increasing their $1.5 billion short position. His response was immediate and decisive:

“That doesn’t make sense. If the news is accurate and there’s almost no downside, why not jump straight to $15 billion?” - George Soros

Druckenmiller later admitted that this push from Soros was what made the trade truly legendary.

“We probably got twice the profit I would have had without that snide comment he made about ‘Well, if you love it so much…’” - Stanley Druckenmiller

5. The Day the Pound Fell:

September 16, 1992—Black Wednesday. The Bank of England was under siege. It raised interest rates from 10% to 12%, then to 15%, desperately trying to defend the pound. But the market’s pressure was relentless. Traders knew the Bank couldn’t win.

By the end of the day, the British government capitulated. The pound was pulled from the ERM, and its value plummeted. Soros and Druckenmiller’s Quantum Fund made $1 billion in profit on the pound’s collapse alone, with additional gains from related trades. By the end of the year, the fund was up 69%.

6. Lessons from Legends:

Druckenmiller often says that great fortunes are built on concentrated bets, but he’s quick to caution against reckless imitation. “I can do all my fancy analysis,” he once said, “but one simple statement like that in terms of size… that’s genius.”

This wasn’t just a lucky trade. It was the result of meticulous research, unparalleled access to key players, and the courage to act decisively. Soros himself summarized it best:

“Every exchange rate regime is flawed. The tremendous injection of capital from West Germany into East Germany set up strong inflationary pressures. The high German interest rate policy was totally inappropriate to the conditions that prevailed in England.” - George Soros

Join us in the Jimmy's Journal chat and connect with a growing community of investors:

If you’d like to learn more about our approach, check out our investment philosophy here:

And if you’d like to learn more about the companies we invest in, take a look at our latest deep dive:

7. Conclusion:

The trade that broke the Bank of England wasn’t just about money; it was about understanding the forces shaping the world and having the conviction to act. Their story is a reminder of what’s possible when preparation meets opportunity and boldness.

PS: If you want to play the game of highly concentrated bets, you have to be able to recognize when it’s a special day. And you should learn how to build multiple layers of conviction.

As Druckenmiller said,

“There are things the little guys can do that the big guys can’t. But there are also things the big guys can do that the little guys can’t.” - Stanley Druckenmiller

This was one of those moments where being big made all the difference.

Thank you so much for reading this far. If you found value in these ideas, consider sharing Jimmy’s Journal with other like-minded investors.

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.

Epic writing Jimmy 🔮