How to Define the Total Addressable Market (TAM): Uber's Case Study

Exploring how Uber’s innovation redefined market boundaries and expanded the concept of TAM

Hi, Investor 👋🏻

I’m Jimmy, and welcome to another edition of our newsletter. One of the key lessons for investors comes from the concept of redefining markets—a principle exemplified by Uber’s approach to Total Addressable Market (TAM).

In this edition, we’ll delve into how understanding and expanding TAM can uncover untapped potential, using insights from Uber’s transformative journey. By revisiting this case study, we’ll explore how innovation and strategic pivots redefine market boundaries and unlock new investment opportunities.

If you enjoy the content, don't forget to click like and share. It helps us a lot!

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

In the world of investing and entrepreneurship, defining the Total Addressable Market (TAM) is both essential and incredibly complex.

Few examples illustrate this better than the famous debate between Aswath Damodaran and Bill Gurley over Uber’s valuation. Their differing perspectives on TAM and market potential not only reveal the challenges of market sizing but also underscore the transformative power of innovation.

The Uber Debate: Numbers vs. Narrative

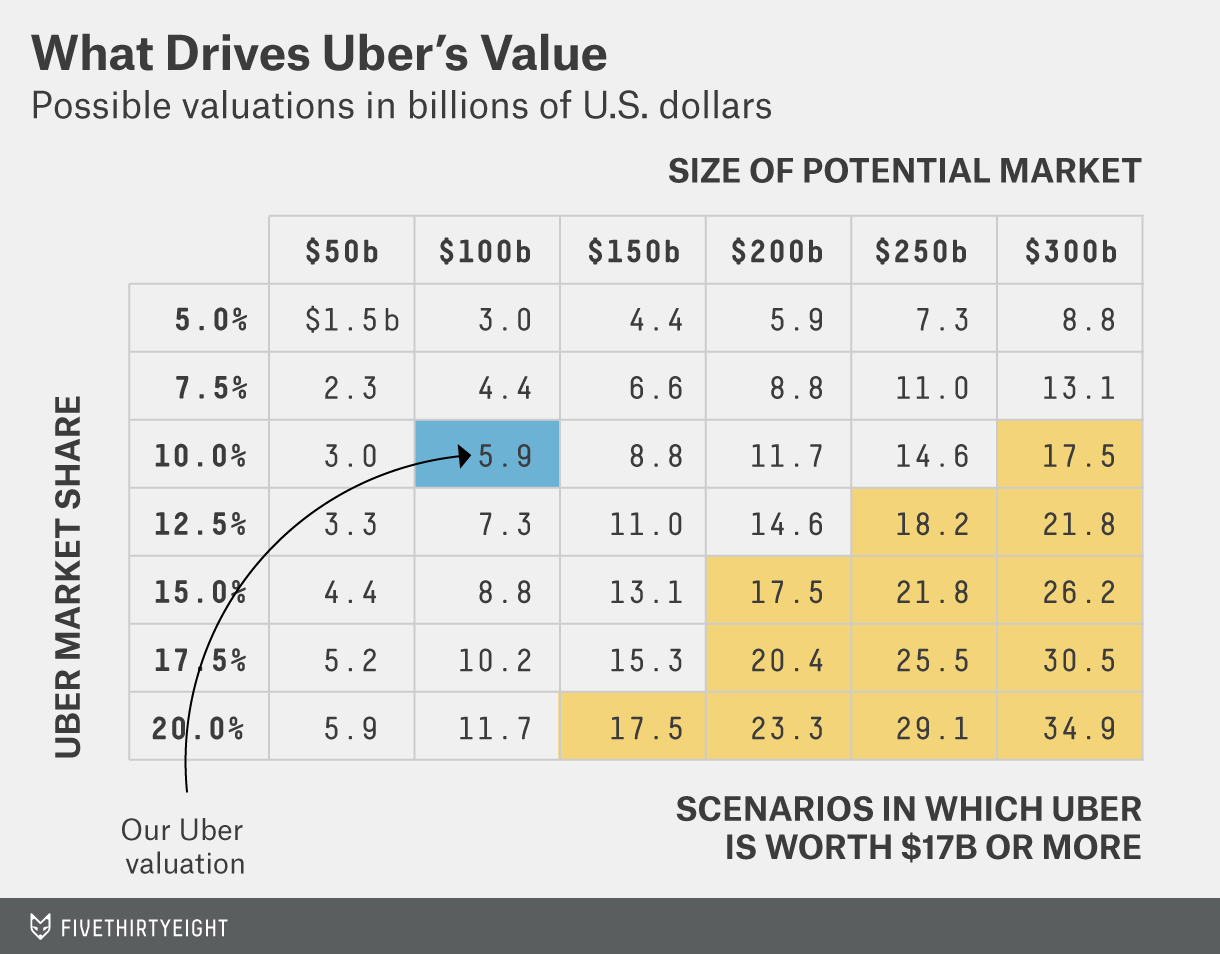

In 2014, NYU professor Aswath Damodaran published an article valuing Uber at $5.9 billion, far below its $17 billion valuation at the time. Damodaran’s analysis assumed that Uber’s TAM was limited to the global taxi and limousine market, estimated at $100 billion. His calculations further assumed that Uber could capture a maximum of 10% of this market, leading to a valuation that adhered to traditional financial modeling.

Bill Gurley, a seasoned venture capitalist and Uber board member, challenged this view. He argued that Damodaran’s assumptions were fundamentally flawed because they failed to account for the transformative nature of Uber’s business model.

Gurley posited that Uber wasn’t merely disrupting the taxi market—it was creating an entirely new one, expanding its TAM far beyond traditional boundaries.

At that moment, he even referenced a tweet by Aaron Levie (co-founder and CEO of the enterprise cloud company Box).

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

Why Damodaran’s Approach Fell Short

Damodaran’s model was precise but missed the bigger picture. By anchoring Uber’s TAM to historical data, he failed to account for two critical factors:

1. Innovation as a Market Multiplier

Gurley highlighted how Uber redefined the car-for-hire experience, transforming it into something fundamentally new. Innovations like real-time tracking, cashless payments, and dual rating systems didn’t just improve existing services—they created entirely new use cases:

Suburban Ridesharing: Uber made it viable to access on-demand transportation in less urban areas where taxis were scarce.

Rental Car Replacement: For business travelers, Uber offered a hassle-free alternative, eliminating the need for parking, insurance, and rental lines.

Social Outings: Uber enabled safer transportation for nights out, addressing concerns like drinking and driving.

Family and Accessibility: Parents trusted Uber to transport children, while older adults found it a convenient alternative to driving.

Mass Transit Integration: UberX served as a supplement to public transportation, providing last-mile solutions and bridging gaps in transit schedules.

These innovations didn’t just capture existing demand—they expanded the market by creating new consumer behaviors and expectations.

2. The Power of Network Effects

Uber’s network effects created a flywheel of growth:

Shorter Pick-Up Times: As more users and drivers joined, wait times dropped, making the service more reliable.

Broader Geographic Coverage: Uber extended its reach from urban centers to suburbs, increasing its potential user base.

Increased Utilization: Higher driver utilization allowed Uber to lower prices, further expanding its TAM.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

The Game Changer: Uber as a Car-Ownership Alternative

One of the most transformative aspects of Uber’s innovation is its potential to disrupt not just the taxi market but also the multi-trillion-dollar car ownership market. By addressing the high costs and inefficiencies of owning a personal vehicle, Uber positioned itself as a viable alternative, particularly for urban residents.

As Bill Gurley stated,

“Uber’s potential market is far different from the previous for-hire market precisely because the numerous improvements over the traditional model lead to a greatly enhanced TAM. Now we consider Uber-like services as a car ownership alternative. This trend is just beginning, but because of the points highlighted herein, we believe this to be a real opportunity. For our model, we assume that Uber-like services will encroach on a mere 2.5%-12.5% of this market. This represents a potential opportunity of $150-$750 billion depending on how aggressively one believes these services can succeed as a car alternative.”

This vision was not merely theoretical. The average annual cost of car ownership in the U.S. is estimated at $9,000, encompassing expenses like insurance, maintenance, parking, and fuel. Even capturing a small fraction of this $6 trillion global market represented an enormous opportunity. For families, this might mean reducing their car fleet, dropping from two vehicles to one—or even eliminating ownership altogether in urban areas where Uber’s reliability and affordability made this practical.

By expanding beyond the traditional car-for-hire market and into car ownership replacement, Uber demonstrated how innovation could radically reshape the TAM and redefine what was possible for the transportation industry.

Adjacent Markets: The Role of UberEats

Uber’s TAM expanded even further with its foray into food delivery via UberEats. Today, UberEats contributes over 30% of the company’s revenue, tapping into a global food delivery market valued at over $1,2 trillion. This strategic pivot demonstrates how innovation can unlock entirely new revenue streams, further redefining a company’s TAM.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

Lessons from the Debate

The clash between Damodaran and Gurley is a masterclass in understanding TAM and the limitations of traditional financial models:

1. Assumptions Drive Outcomes

Damodaran’s reliance on historical data led to conservative assumptions about Uber’s potential. Gurley, by contrast, recognized that innovation could fundamentally reshape consumer behavior and market dynamics.

2. Precision vs. Accuracy

Financial models often produce precise results, but their accuracy depends on the quality of the assumptions they’re based on. As Gurley pointed out, seemingly minor changes in assumptions can lead to dramatically different conclusions.

3. Thinking Beyond Existing Markets

Uber’s success illustrates the importance of imagining how a product or service can create new markets rather than merely competing in existing ones. Entrepreneurs and investors must ask:

How does this innovation change consumer behavior?

What new use cases could it unlock?

How might network effects amplify its impact?

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

The Bigger Picture: Innovation Redefines TAM

Uber’s story teaches us that TAM isn’t static—it evolves with innovation and strategic pivots. A decade after the debate between Aswath Damodaran and Bill Gurley, the outcome offers a nuanced perspective on who was more accurate.

Today, Uber generates $41 billion in annual revenue and holds a market valuation of $180 billion. At first glance, it seems that Gurley’s vision prevailed. However, much of Uber’s current valuation stems from its entry into an entirely new market: food delivery through UberEats.

The numbers tell the story:

The global ride-hailing market is valued at $180 billion.

The food delivery and grocery market, by contrast, exceeds $1,2 trillion.

UberEats now contributes over 30% of Uber’s total revenue, despite being available in limited regions. This strategic diversification significantly expanded Uber’s TAM and boosted its valuation. Without this pivot, and had Uber remained focused solely on ride-hailing and car ownership alternatives, Damodaran’s lower valuation estimates would likely have been closer to reality.

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.