How to Find 10-Baggers: Lessons from Peter Lynch

Finding 10-Baggers: Key Investment Insights from Peter Lynch

Hi, Investor 👋

I’m Jimmy, and I’m excited to bring you another free edition 🔓 of our newsletter! Today, we’re diving into some timeless wisdom from Peter Lynch, one of the most successful investors of all time.

Specifically, we’ll explore his insights on identifying "10-baggers"—stocks that multiply tenfold in value—and how you can apply these principles to your own investing journey. Let’s get started!

In case you missed it, here are some recent insights:

How to Define the Total Addressable Market (TAM): Uber's Case Study

NVIDIA (NVDA) Stock Analysis: A Deep Dive Into Its Future Growth Potential and Market Dominance

Subscribe now and never miss a single report:

If you've ever dreamed of extraordinary stock market returns, you've probably heard the term “10-bagger.” Coined by legendary investor Peter Lynch, a 10-bagger refers to an investment that grows to 10 times its initial value.

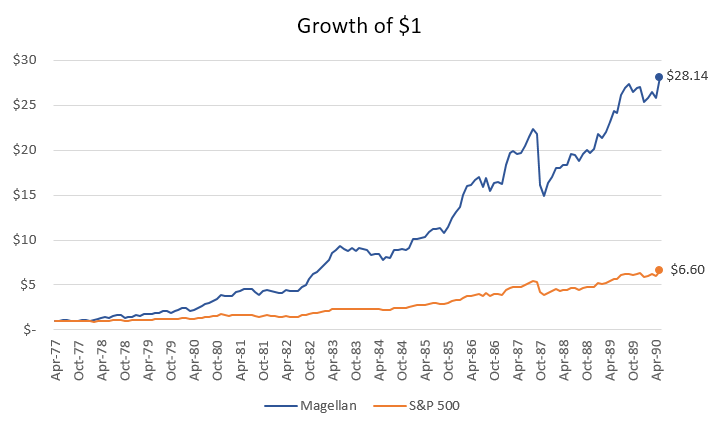

Lynch’s remarkable tenure managing the Fidelity Magellan Fund from 1977 to 1990 cemented his status as one of the greatest investors of all time. With an average annual return of 29.2%, Lynch transformed the fund into the largest mutual fund in the world.

His methodology, built on simplicity, diligence, and individual insight, provides timeless lessons for any investor.

This article unpacks Lynch’s core principles, combining actionable steps with real-world examples to illustrate how his strategy works in practice.

Lynch’s Investment Philosophy

Peter Lynch’s approach revolves around four key principles:

Diversify Strategically: Lynch embraced holding a large number of positions, often exceeding 1,000, to spread risk and maximize opportunities. He believed diversification increased the odds of finding multiple winners, where the gains from successful investments far outweighed the losses from weaker ones.

Invest in What You Know: Start with companies you encounter daily. Use your familiarity as a spark to identify potential opportunities, but always follow up with research to validate your insights.

Research Thoroughly: Observations are just the beginning. Dive deep into financials, market position, and management quality to confirm the company's potential for sustainable growth.

Growth at a Reasonable Price (GARP): Look for companies with strong growth potential that are undervalued by the market. Balance optimism with disciplined valuation analysis to make informed decisions (PEG Ratio can be your friend).

These principles work together to uncover high-growth opportunities in overlooked or underappreciated markets.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

1. Diversification: Lynch’s Contrarian Approach

Most successful value investors advocate for concentrated portfolios—a few big positions that allow them to focus on their best ideas (including Jimmy's Journal). Charlie Munger even coined the term "Diworsification" to criticize over-diversification, arguing that spreading investments too thin can dilute performance.

Peter Lynch, however, took a different approach. He was known for what some might call "excessive" diversification. Early in his tenure at Fidelity, his boss urged him to reduce the fund's positions from 40 to 25. Instead, Lynch expanded them to 60. At the peak of his career, he managed over 1,400 positions in the Magellan Fund.

This wasn’t a safety strategy—it was a by-product of his relentless pursuit of opportunities. Lynch believed that if a company had strong fundamentals and reasonable growth potential, it was worth adding to his portfolio. While some of his picks inevitably underperformed, the sheer number of investments ensured that the winners vastly outpaced the losers. For every one company that failed, five or six others delivered solid returns.

Lynch’s diversification strategy underscores a key lesson: you don’t need to win on every stock. With a disciplined approach to identifying growth opportunities, a well-diversified portfolio can yield extraordinary results over time.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

2. Invest in What You Know

Lynch famously believed that individual investors hold a unique advantage: the ability to notice trends in their everyday lives. However, he warned against blind enthusiasm. Just because you love a product or store doesn’t mean you should buy the stock. Instead, use that familiarity as a starting point for research.

His own disclaimer states:

"Peter Lynch doesn't advise you to buy stock in your favorite store just because you like shopping there, nor should you buy stock in a manufacturer because it makes your favorite product or a restaurant because you enjoy the food. Liking a store, a product, or a restaurant is a good reason to get interested in a company and put it on your research list, but it's not enough reason to own the stock! Never invest in a company before you've done the homework on the company's earnings prospects, financial condition, competitive position, expansion plans, etc." - Peter Lynch (1989)

Take Dunkin’ Donuts, for example. Lynch frequented its stores (he loved their coffee) and observed long lines and loyal customers. Curious, he delved into the company’s financials and discovered strong earnings growth, scalability, and room for expansion. Convinced of its potential, he invested heavily, and the stock soared as the business expanded.

Similarly, Hanes caught Lynch’s attention because of its consistent sales of affordable, high-quality products (his wife alerted him to the L’eggs craze). After researching the company’s brand strength, management, and growth potential, he made another winning investment.

Key Takeaway: Pay attention to the businesses you encounter, but never skip the homework. Look at earnings, competition, and scalability before making a decision.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

3. Research Thoroughly: Amateurs can be Pros?

Observations spark interest, but research drives decisions. Lynch emphasized:

Financials: Look for growing revenues, manageable debt, and strong cash flow.

Market Position: Is the company a leader in its niche or does it have a competitive advantage?

Management: Assess the leadership’s track record and vision.

Lynch’s thoroughness ensured his investments were grounded in data, not just intuition.

“Pep Boys, Seven Oaks, Chart House, Telecredit, Cooper Tire–now I was beginning to see that some of my favorite stocks did have something in common. These were companies with strong balance sheets and favorable prospects but most portfolio managers wouldn’t dare buy them. As I’ve mentioned before, a portfolio manager who cares about job security tends to gravitate toward acceptable holdings such as IBM, and to avoid offbeat enterprises like Seven Oaks, the aforementioned servicer with a plant in Mexico.” - Peter Lynch (1978)

Curiously, Peter Lynch had a particular fondness for “boring names” and “boring sectors”. Individual investors can also benefit from this and even outperform professional investors, as he himself points out…

Boring names: In his view, companies with plain, simple names often hold great potential. A prime example is Bob Evans Farms Inc. (BOBE), known for its restaurant chain in the US. Such companies are frequently overlooked simply because their names fail to grab attention.

Boring activities: Similarly, companies engaged in mundane, straightforward activities often fly under the radar of most investors. Despite having strong business models or growing profits, these businesses are typically noticed only when they achieve standout results or become trendy.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

4. Focus on Simplicity

Lynch’s mantra, “Never invest in an idea you can’t illustrate with a crayon,” underscores the importance of simplicity. Complex business models are harder to evaluate and often carry hidden risks.

Take Dunkin’ Donuts again. Its business model—selling coffee and donuts through franchises—was easy to grasp. This clarity allowed Lynch to assess its scalability and profitability effectively.

Writing down your investment thesis can also help. For instance:

Why this company? Growing demand for eco-friendly products.

Competitive advantage? Unique supply chain innovation.

Financials? Consistent revenue growth.

This exercise keeps you grounded, especially during market turbulence.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

5. The Value of Niche Markets

One of Lynch’s greatest insights was recognizing the power of niche markets. A company operating in a less competitive space often outperforms peers in overcrowded industries.

"The experts said that this exciting industry would grow at 52 percent a year–and they were right, it did. But with thirty or thirty-five rival companies scrambling on the action, there were no profits." - Peter Lynch (1989)

For example:

Philip Morris thrived despite being in a declining tobacco market because it dominated its niche.

Xerox, despite operating in a booming tech sector, struggled due to intense competition.

Lynch taught that a mediocre company in the right niche could outperform a great company in a crowded market.

"Philip Morris has found its niche. Negative-growth industries do not attract flocks of competition." - Peter Lynch (1989)

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

6. Growth at a Reasonable Price (GARP)

Fast-Growers: The Land of Explosive Returns

Peter Lynch had a profound admiration for fast-growing companies, often describing them as the most exciting and rewarding investments in the stock market. These companies, typically smaller and more aggressive, grow at an annual rate of 20–30% or more, making them the prime candidates for achieving 10-, 40-, or even 200-bagger returns.

The magic lies in the power of exponential growth. Lynch emphasized how sustained growth rates can lead to staggering returns:

10% annual growth: 160% gain over a decade

20% annual growth: 520% gain over a decade

30% annual growth: 1,280% gain over a decade

40% annual growth: 2,800% gain over a decade

In today’s world, driven by the digitization of industries and globalization, such growth rates are more attainable than ever. The key challenge, as Lynch pointed out, is determining when to sell and how much to pay for this kind of growth. This underscores the importance of pairing optimism about growth potential with disciplined valuation analysis.

For Lynch, the appeal of fast-growers lay not only in their potential for explosive returns but also in their ability to capture and sustain market share in rapidly expanding industries.

PEG Ratio: A Key to Growth at a Reasonable Price

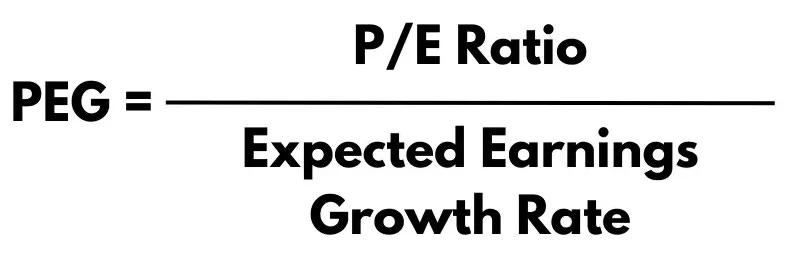

One of Lynch’s most celebrated tools for blending growth and value investing is the PEG ratio, which evaluates a stock’s price relative to its earnings growth rate.

Unlike the traditional P/E ratio, the PEG ratio incorporates growth potential, offering a more nuanced view of valuation:

PEG = 1: The stock is fairly valued relative to its growth rate.

PEG < 1: The stock may be undervalued, presenting a potential opportunity.

PEG > 2: The stock might be overpriced.

For example, a company with a P/E ratio of 20 and an earnings growth rate of 25% would have a PEG ratio of 0.8, signaling that it might be undervalued relative to its growth potential.

The PEG ratio isn’t just about numbers—it’s a framework that combines quantitative analysis with qualitative factors like management quality, industry trends, and competitive positioning. This makes it a cornerstone of Lynch’s Growth at a Reasonable Price (GARP) strategy, allowing investors to strike a balance between optimism about a company’s future and a realistic assessment of its current valuation.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

7. Discipline and Patience: The Hallmarks of Success

Finding 10-baggers takes time, discipline, and patience. Lynch held investments for years, allowing their full potential to materialize.

Ignore the Noise: Focus on your thesis, not daily market fluctuations.

Trust the Process: Great investments often require time to bear fruit.

Two of Lynch’s standout successes—Dunkin’ Donuts and La Quinta Inns—illustrate this patience. Both had simple models, niche focus, and scalable operations, but their value unfolded over time.

You have to get in early. And you have to hold onto the investment.

8. Start Simple, Stay Focused

Peter Lynch’s legacy offers a clear roadmap for investors. By observing the world around you, conducting diligent research, and maintaining a disciplined approach, you can uncover transformative opportunities.

In Lynch’s words: “The person that turns over the most rocks wins the game.” Start small, stay curious, and never underestimate the power of simple observations combined with solid research. Your first (or next) 10-bagger could be right in front of you.

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.

Interesting. Peter Lynch invested more like a venture capitalist than a traditional value investor.

I read One Up on Wall Street at university and it is one of the most influential books in my investment thinking.