How to Read a Cash Flow Statement Like a Pro Investor

Learn to read a cash flow statement like a pro in just 8 minutes...

Hi, Investor 👋

I’m Jimmy, and welcome to another edition of our newsletter. Today, we’re breaking down the Cash Flow Statement - the clearest way to tell if a business is generating real cash or just accounting profits.

Let’s jump in - and as always, feel free to share this with other investors.

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

Let me start with a quick story…

Once, my finance professor asked a tough question:

“If you had access to all three financial statements but had to give one up, which one would it be - and why?”

A) Balance Sheet

B) Income Statement (P&L)

C) Cash Flow Statement (CFS)

The answer is at the end of this article…

Today, we’ll unpack how to read a Cash Flow Statement like a pro.

If the income statement shows performance and the balance sheet shows position, the cash flow statement reveals reality.

1. What Is the Cash Flow Statement?

The Cash Flow Statement (CFS) tells you how cash moves in and out of a business over a specific period.

It’s broken into three sections:

Operating Activities

Investing Activities

Financing Activities

Together, they answer one critical question:

Is this company generating real cash, or just paper profits?

Here’s an example to help you get used to it…

Don’t worry - it’s WAY simpler than it looks.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

2. Cash from Operating Activities:

That’s the real pulse of a business…

This section adjusts net income from the income statement by removing non-cash items (like depreciation) and accounting for changes in working capital.

Key Components:

Net Income: starting point, but often filled with accruals and estimates.

Depreciation & Amortization: non-cash expenses added back.

Changes in Working Capital: variations in receivables, payables, and inventory.

Why It Matters:

This is where you find out if profits are actually turning into cash.

A company can report earnings and still be burning cash due to poor collections or bloated inventory.

Red Flags to Watch:

Operating cash flow consistently lower than net income.

Growing net income but shrinking cash flow.

2.1. EBITDA vs. Operating Cash Flow: What’s the Difference?

Many investors confuse EBITDA with cash flow from operations, but they’re not the same thing…

Let’s break it down:

Key Distinctions:

EBITDA is accrual-based: it reflects accounting profit before non-cash charges and financing decisions - useful for comparability but not actual cash.

OCF is cash-based: it tells you how much real cash the business generates from its daily operations.

Investor Insight:

If a company highlights its EBITDA in presentations but hides its operating cash flow, dig deeper.

A company might post a $50M EBITDA but show only $15M in operating cash flow because receivables ballooned or payables shrank - it hasn’t collected the cash yet.

Cash is king - and OCF is the crown.

2.2. Understanding “Changes in Working Capital”:

When analyzing cash flow from operations, one of the most important (and misunderstood) adjustments is changes in working capital.

Working Capital = Current Assets – Current Liabilities (excluding cash and debt)

In practice, we look at how receivables, inventory, and payables are changing - because they affect how much cash is tied up (or freed up) in the day-to-day operation of the business.

Let’s break it down with a real-world example…

Imagine you're a retailer… 🛒

In Year 1, you carry $300 million in inventory.

You pay suppliers in 30 days (accounts payable).

You collect from customers in 60 days (accounts receivable).

Now fast forward to Year 2:

Your inventory grows to $400 million.

Your payment and collection terms remain the same.

What does this mean for your cash flow from operations?

2.2.1. Inventory Increased (+$100 million):

Inventory is a current asset, and when it increases, it uses cash. You’re buying more stock, but haven’t sold it yet.

This is a negative change in working capital:

You tied up $100 million more in stock.

Your cash flow goes down by $100M.

2.2.2. Accounts Payable Stayed the Same:

If your payment terms with suppliers remain unchanged, there’s no increase in accounts payable to offset the higher inventory. You didn’t delay payments to preserve cash.

Net effect on cash: neutral

No extra help from payables.

Notice that your cash outflow could’ve been lower if the payment terms had extended from 30 to 45 days (or something like that)…

2.2.3. Accounts Receivable Still 60 Days:

If your collection period stays at 60 days - and sales increased along with inventory - your receivables probably increased too.

Let’s say it went from $200 million to $260 million.

That’s an extra $60 million you haven’t received in cash yet.

2.2.4. Summary: What Happened to Cash Flow?

So, even if your EBITDA grew, your operating cash flow could be much lower - or even negative - just because your working capital increased.

Enjoying the content? Encourage me to keep creating more like this. Buy me a coffee!

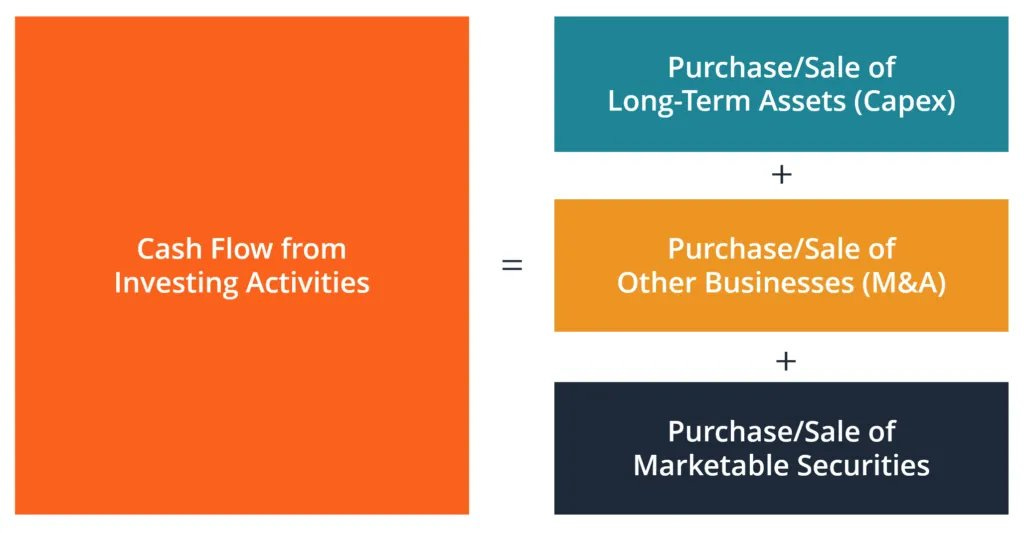

3. Cash from Investing Activities:

Growth or cash burn?

This section reflects investments in the business - buying/selling assets, acquisitions, or selling securities.

Key Components:

CAPEX (Capital Expenditures): money spent on buildings, equipment, or technology.

Acquisitions: cash used to buy other businesses.

Investment Sales: cash inflows from selling financial assets or subsidiaries.

Why It Matters:

Negative cash flow from investing is not always bad - it could mean the company is investing for future growth.

But you need to ask: are these investments paying off?

4. Cash from Financing Activities:

Who’s getting paid?

This section shows how a company raises and returns capital to shareholders and lenders.

Key Components:

Issuance or Repayment of Debt

Issuance or Repurchase of Shares

Dividends Paid

Why It Matters:

You’ll see if a company is taking on debt to survive, buying back shares as a signal of confidence, or distributing steady dividends.

Watch for:

Rising debt paired with weak operating cash flow - a red flag.

Share buybacks while operating cash is tight - risky capital allocation.

Consistent dividend payouts backed by cash (not debt) - a healthy sign.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

5. Putting It All Together: Free Cash Flow

The true power of the DFC comes when you calculate Free Cash Flow (FCF):

FCF = Cash from Operating Activities – Capital Expenditures

FCF tells you how much cash a company has left after reinvesting in the business.

This is what’s available to pay down debt, distribute dividends, buy back shares, or sit on the balance sheet.

Why is FCF so important?

Because it’s unmanipulated (well, almost)... It doesn’t rely on accounting tricks. It’s the cold, hard cash.

A company can distort its free cash flow for a few months or quarters, but not for long.

As Warren Buffett would say,

"You only find out who’s swimming naked when the tide goes out."

That’s pretty much the idea.

6. Direct vs. Indirect Method:

Cash flow from operating activities can be reported using two methods: direct and indirect.

The difference lies in how cash flow is calculated and presented.

6.1. Direct Method:

Reports actual cash inflows and outflows - such as cash received from customers and cash paid to suppliers.

It’s straightforward but requires detailed records of cash transactions.

Example:

Cash received from customers: $1.2M

Cash paid to suppliers: $700K

Cash paid for salaries: $200K

(=) Net cash from operations: $300K

6.2. Indirect Method:

Starts with net income and adjusts for non-cash items (e.g., depreciation) and changes in working capital.

This is the most commonly used method in financial reports.

Example:

Net income: $200K

Depreciation: +$50K

Increase in receivables: –$30K

Increase in payables: +$80K

(=) Net cash from operations: $300K

Summary:

Direct = actual cash movement.

Indirect = accounting adjustments to net income.

Both methods lead to the same result, but the path differs.

Enjoying the content? Encourage me to keep creating more like this. Buy me a coffee!

7. Key Ratios to Analyze a Cash Flow Statement Like a Pro:

Cash flow ratios give you a clearer view of financial health than earnings alone…

Here are the most useful ones:

7.1. Cash Flow Ratios:

Operating Cash Flow Margin = OCF / Revenue

Measures how efficiently a company turns sales into cash.

Free Cash Flow Yield = FCF / Market Cap

Shows return to shareholders in cash terms; useful for valuation.

7.2. Coverage Ratios:

Cash Interest Coverage = OCF / Interest Expense

Assesses ability to cover interest payments with cash, not earnings.

Cash Debt Coverage = OCF / Total Debt

Indicates how long it would take to repay all debt using operating cash flow.

7.3. Cash Conversion Efficiency:

Cash Conversion Ratio = OCF / Net Income

Measures the quality of earnings - how much profit turned into cash.

Use these ratios to compare companies in the same sector and test the sustainability of their operations.

8. Red Flags in the Cash Flow Statement:

The CFS can reveal deeper operational and financial problems that the income statement may mask.

Watch for:

OCF consistently below net income: poor earnings quality.

Negative free cash flow over multiple years: unsustainable if not backed by high growth.

Rising debt financing despite weak OCF: may indicate cash shortfalls.

Large swings in working capital: potential volatility or accounting manipulation.

Heavy reliance on financing to support operations: red flag for liquidity stress.

Reading between the lines of the CFS helps you spot companies that look profitable but may be burning cash behind the scenes.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

9. Conclusion: Think Like a Pro Investor

You can’t spend accounting profits - only cash pays the bills.

The cash flow statement gives you a clear view of financial health:

How money is made;

How it’s spent; and

Whether the company is running on solid ground or borrowed time.

No matter how strong the story sounds, if the cash isn’t flowing, the business isn’t growing.

Remember: Revenue is vanity. Profit is sanity. Cash is reality.

And for those who made it to the end - here’s the answer to this edition’s opening question…

“If you had access to all three financial statements but had to give one up, which one would it be — and why?”

If you fully understood what we covered - especially sections 6.1 and 6.2 - you already know the correct answer is:

C) Cash Flow Statement

Why?

Because you can reconstruct much of the cash flow statement using only the income statement (P&L) and the balance sheet.

For example:

Operating cash flow can be estimated by starting with net income, then adjusting for depreciation (from the income statement) and changes in working capital (from the balance sheet).

Investing cash flow can be inferred from changes in fixed assets (on the balance sheet) and depreciation expenses (from the income statement).

Financing cash flow can also be derived - changes in debt levels are reflected on the balance sheet and interest expenses are found in the income statement. Dividends paid can be estimated by looking at the change in retained earnings plus the net income for the period.

In other words, while the cash flow statement is incredibly valuable, it’s the most reconstructable of the three - if you know where to look.

Leave a comment, share your thoughts, or give it a like - your feedback helps shape future editions.

Until next time,

Jimmy

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.

Great work on this. Pls consider adding a discussion on deducting stock-based compensation (SBC) from operating cashflow; it's an expense and should be accounted for. This will help bring attention to the companies which dilute their shareholders each year-perhaps understandable and acceptable for young and growing companies, but less so for mature companies (e.g. INTU, CRM, ORCL).

Very well done, Jimmy. Merci.