How to Spot the Next 100-Bagger Before Anyone Else (+Checklist to Find Your Own)

A practical framework to identify long-term compounders before they go mainstream

Hi, Investor 👋

I’m Jimmy, and welcome to another edition of the newsletter. Today we’re diving into one of the rarest - and most powerful - phenomena in the market: the 100-bagger.

You’ll learn what sets these companies apart, why most investors miss them, and how to build the right habits to catch one early (+ a proprietary checklist to help you find your own 📝).

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

Turning $10,000 into $1 million sounds like a fantasy.

But history says otherwise…

Between 1962 and 2014, over 365 U.S. stocks returned 100x or more - not through speculation or luck, but by compounding at 20%+ annually for decades.

In 100-Baggers, Chris Mayer studied these rare winners and found they weren’t anomalies.

They shared repeatable traits: high returns on capital, reinvestment opportunities, and aligned leadership.

But here’s the twist:

Most investors who found a 100-bagger almost sold it too early.

In today’s letter, I’ll break down the traits that define a 100-bagger, why most investors never hold them long enough, and how to use a practical checklist to spot the next one before everyone else.

Let’s start with the real engine behind long-term compounding…

1. High ROIC:

The most consistent trait among 100-baggers is a high and sustainable return on invested capital.

ROIC = NOPAT / Invested Capital

(Net Operating Profit After Tax over equity + interest-bearing debt)

This metric tells you how efficiently a business turns capital into profit. A company with 20% ROIC reinvests each dollar at a 20% return - a massive compounding advantage.

For context, the average S&P 500 company earns closer to 7-10%.

High ROIC doesn’t appear out of nowhere…

It’s usually the result of durable competitive advantages: pricing power, high gross margins, customer stickiness, or structural scale.

Think of it like this:

High margins suggest strong pricing power

Low capital intensity leads to greater free cash flow

Sustained ROIC means the moat is holding

But ROIC is just the engine. You still need fuel - which brings us to reinvestment.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

2. Reinvestment Rate:

High ROIC only matters if the business can reinvest at those same attractive rates.

Many good companies generate lots of cash - and then return it to shareholders. That’s fine, but it limits long-term compounding.

A 100-bagger needs internal reinvestment opportunities (!!!)

That means the business must still be in an active growth phase - with room to scale, launch new products, or expand into adjacent markets - all while keeping ROIC high.

This framework becomes easier to understand when you visualize where a company is in its life cycle:

In the early and high-growth phases (Bar Mitzvah → Scaling Up), businesses reinvest heavily: expanding production, entering new markets, and testing product lines. It’s in these stages that high ROIC + high reinvestment potential produce the exponential compounding we’re looking for.

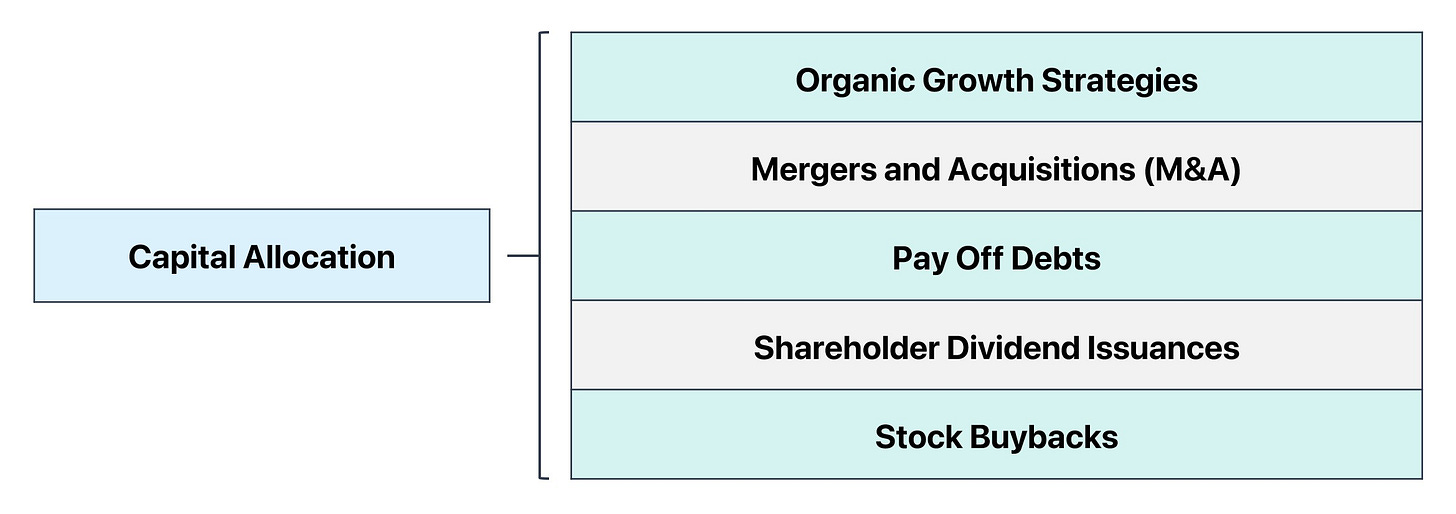

As companies mature, reinvestment opportunities tend to dry up. That’s when you start seeing share buybacks, dividends, and debt-fueled M&A - not because those are bad strategies, but because the internal growth engine is fading.

What to look for:

Large or expanding Total Addressable Market (TAM)

Low capital intensity, high operating leverage

Optionality to launch adjacent products, services, or geographies

A classic case: MercadoLibre ($MELI) > It started as a basic e-commerce platform and gradually expanded into payments, logistics, credit, advertising - each reinvestment building on the last.

This is what sets great companies apart: they find ways to keep compounding without relying on debt or dilution.

In simple terms: ROIC gives you the speed. Reinvestment gives you the distance.

And when you sustain both for 10+ years? That’s when the math becomes exponential…

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

3. High-Quality Management:

Mayer found again and again that founder-led businesses had a major edge. Not just because they were innovative - but because they were aligned.

When insiders own significant stakes, they tend to think in decades, not quarters. They avoid the pressure to over-optimize short-term KPIs. They reinvest more thoughtfully and resist destructive acquisitions.

You can usually spot great capital allocators by their language and incentives:

Do they speak like operators or asset managers?

Do they discuss long-term value per share - or just revenue beats?

Are they buying back stock below intrinsic value - or issuing it at any price?

In short: the CEO is your capital allocator. And if you’re going to sit with a business for 15-20 years, you’d better trust the person steering the ship.

The “Twin Engines” of 100-Bagger Performance:

Most big winners share a second-layer pattern: they grow earnings per share and get rewarded with a higher multiple.

It’s not just fundamentals improving - it’s the market slowly waking up to them.

Let’s say a company grows earnings 10x over a decade. If it starts trading at 10x earnings and ends at 25x, that’s not a 10-bagger. That’s a 25-bagger. And if it happens again? You’re looking at triple digits.

Mayer calls this the “twin engines” of compounding:

Earnings growth (powered by ROIC and reinvestment)

Multiple expansion (powered by narrative and market recognition)

The problem is that most investors don’t hold long enough to benefit from both…

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

Time: Why Most People Miss Out

Even when investors find a 100-bagger, most don’t hold it long enough to benefit.

Apple. NVIDIA. MercadoLibre.

All 100-baggers - but none got there in a straight line.

Each endured deep drawdowns. Each tested conviction.

Chris Mayer shares the story of a man who bought Apple in the 1980s. He held through multiple 70% crashes. He nearly sold. But he didn’t. That one choice turned into a 200-bagger.

That’s the uncomfortable truth: compounding takes time - and patience.

25% per year → 100x in 20 years

18% per year → 100x in 28 years

10% per year → 100x in 48 years

Most people give up long before that.

If you want exponential returns, you have to endure: the boredom, the volatility, the doubt.

But here’s your advantage:

You can wait. Wall Street can’t.

The Coffee Can Portfolio:

Coined by Robert Kirby, the “Coffee Can Portfolio” is simple:

“Buy a handful of high-quality companies, put them in a metaphorical can, and forget about them for a decade.”

You don’t trim winners. You don’t panic on earnings misses. You don’t get distracted.

The power of this strategy is psychological. It removes the temptation to overtrade, overthink, and under-hold. It gives compounding the uninterrupted timeline it needs.

Most people want 100-bagger outcomes - but behave like traders.

This approach flips that mindset. It forces you to be an owner, not a speculator.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

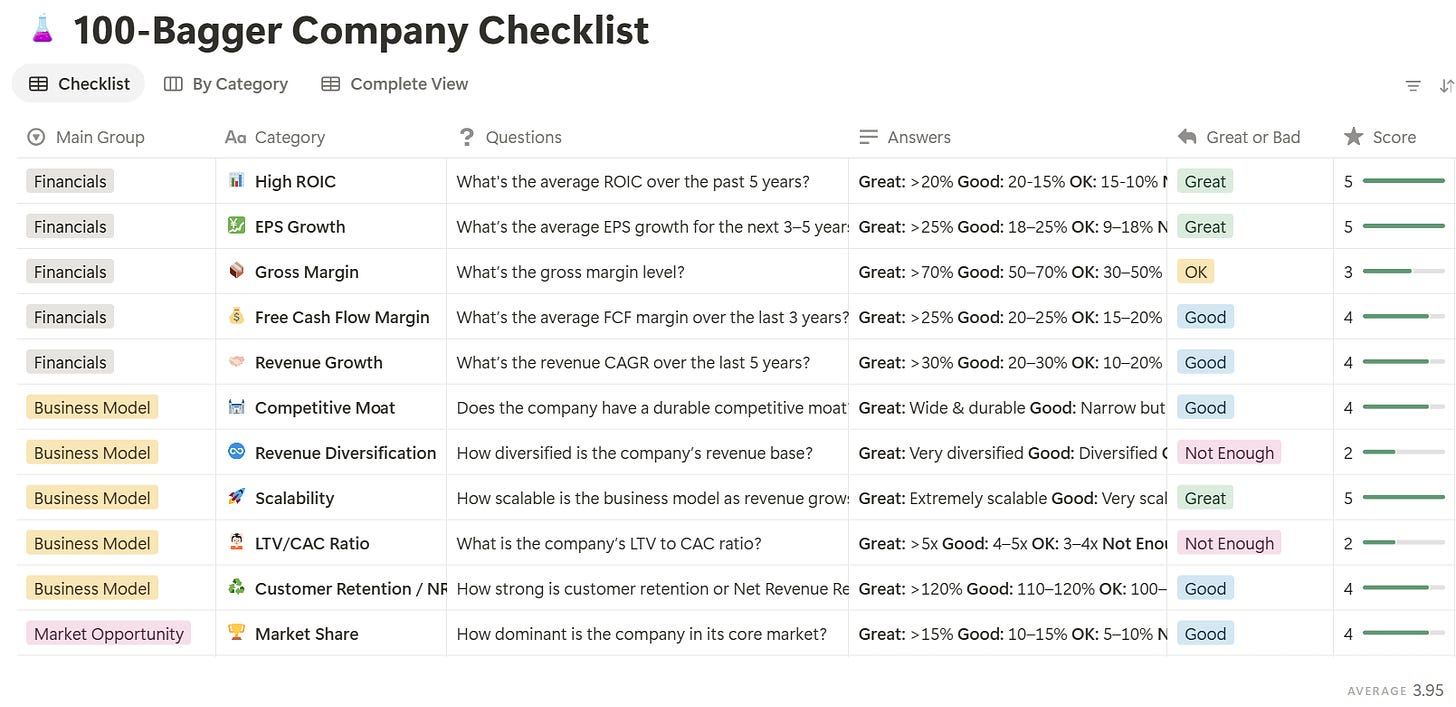

100-Bagger Checklist:

High ROIC, strong reinvestment opportunities, and founder-led culture are foundational characteristics of potential 100-baggers - but they often manifest in multiple layers.

When building a real-world checklist, we can go beyond the core traits and consider a broader set of signals - financial, strategic, and behavioral.

Each one adds a different perspective on the company's ability to compound value over time…

Here are a few key markers to keep in mind:

High EPS Growth (>20% annually):

One of the most visible consequences of high ROIC paired with reinvestment. If earnings are compounding at 20%+, the intrinsic value is growing rapidly - whether the market notices or not.

High Gross Margin (>50%):

Gross margin is a proxy for pricing power and control over the production chain. Companies with gross margins above 50% often operate with product or brand differentiation that’s hard to replicate.

High Free Cash Flow (with low leverage):

Earnings and margins mean little if the business burns cash or relies too heavily on debt. The best compounders generate surplus cash consistently - and don’t owe it all to banks.

Aligned Incentives (Management + Shareholders):

Skin in the game matters. Look for insider ownership, performance-based comp packages, and shareholder-friendly capital allocation. Founder-led is ideal - but not strictly required.

Low Analyst Coverage:

Neglect is often an opportunity. When a business has solid fundamentals but isn’t widely followed, the re-rating potential is far greater - especially if the story starts to shift.

Small Market Share Relative to TAM:

You want companies early in their growth curve, not at saturation. The lower the penetration, the longer the runway for reinvestment and compounding.

Discount to Historical Averages:

Valuation still matters. A great business bought at half its historical multiple offers a built-in margin of safety - and sets the stage for multiple expansion.

💡 How strong is your stock idea?

Many questions can be asked to identify potential 100-baggers.

But some patterns show up again and again - and the best companies tend to score well across the same key dimensions.

We built a proprietary 100-Bagger Checklist on Notion to help paid subscribers evaluate any business through the lens of long-term compounding.

This includes:

20+ questions tied to profitability, growth, and competitive edge

Pre-set answers with a scoring system from 1 to 5

Automatic total score at the end

Clean, visual format - built in Notion

Based on 100-Baggers by Chris Mayer + our own investing criteria

If you're serious about finding long-term winners, start here.

Available exclusively for paid members - just $89.99/year (or $7.50/month).

Closing Notes:

The next 100-bagger is out there.

It won’t look flashy.

It might even go unnoticed for years.

But if it can earn high returns on capital, reinvest internally, and be led by disciplined operators - you don’t need perfect timing. You just need time.

And the discipline to let compounding do its work.

Thanks for reading this far.

I appreciate your time and curiosity.

Cheers

Jimmy

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.

Only very disciplined few can do it. Humans are not wired for that due to many emotional tugs