I'm Doubling Down on MELI. Here's Why: MercadoLibre, Inc. ($MELI) Deep Dive

MercadoLibre Investment Thesis: why MELI remains an unstoppable force in LatAm...

Hi, Investor 👋

I’m Jimmy, and welcome to this week’s edition of our newsletter. Today, we’re diving into MercadoLibre ($MELI) – a deep dive into its ecosystem, from e-commerce dominance to fintech innovation, and why it’s a compelling long-term investment thesis.

Hope you enjoy the analysis! Don’t forget to share with friends and fellow investors.

In case you missed it, here are some recent insights:

I'm Buying Uber. Here's Why: Uber Technologies, Inc. ($UBER) Deep Dive

How to Define the Total Addressable Market (TAM): Uber's Case Study

Subscribe now and never miss a single report:

📦 Sector Overview:

Latin America’s e-commerce market stands out as one of the most compelling growth opportunities worldwide, fueled by low penetration rates and increasing digital adoption across the region.

In 2024, the market is projected to generate an estimated GMV of $194bn, with e-commerce accounting for just 12.3% of total retail sales - significantly below the global average of 19.7%.

Looking ahead, the growth outlook remains strong. The LatAm e-commerce market is expected to grow consistently over the coming years, with a forecasted CAGR of 8.50% from 2024 to 2028.

By 2028, the region’s GMV is anticipated to reach $269.8bn, driven by factors such as rising internet penetration, greater smartphone adoption, and continuous improvements in logistics infrastructure. These dynamics position Latin America as a key region for e-commerce growth in the medium to long term.

📖 MercadoLibre’s History:

MercadoLibre’s story began in 1999 in Buenos Aires, driven by a bold vision: to empower individuals across Latin America to buy and sell products online. Founded by Marcos Galperin and a team of entrepreneurs, including Brazilian Stelleo Tolda, the company set out to revolutionize commerce in a region full of potential.

Inspired by eBay, MercadoLibre launched as an online auction site for used goods. Within months, it expanded to Brazil, Mexico, and Paraguay. By 2000, operations had reached four more countries: Ecuador, Chile, Venezuela, and Colombia, supported by a $46 million investment from leading financial groups.

In 2001, eBay acquired a 19.5% stake, recognizing MercadoLibre’s potential. However, the company retained its independence, repurchasing eBay’s shares in 2016 for $925 million. Listed on NASDAQ in 2007, it became the first Argentine startup to surpass $10 billion in market capitalization by 2017, earning a place in the NASDAQ 100.

MercadoLibre’s milestones are a testament to its growth. In 2017, it sold over 1 million items in a single day. By 2020, it gained 5 million new customers and set a record of 1.4 million orders delivered in just one day. Today, MercadoLibre is a symbol of innovation and resilience, transforming Latin American commerce and becoming a global e-commerce leader.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

👔 Corporate Governance:

MercadoLibre has grown steadily since its IPO in 2007, supported by two follow-on offerings, the latest in November 2021 at $1,550 per share. The largest shareholders are Baillie Gifford & Co (12.2%), Capital Group (6%), and the trust of founder Marcos Galperin (7.6%).

In 2019, PayPal invested $750 million for a 3% stake, marking a key strategic partnership. The company’s growth has been predominantly organic, with its largest acquisition being DeRemate.com for $40 million, alongside smaller acquisitions aimed at acquiring talent.

💼 Business Model:

MercadoLibre ($MELI) is the largest online commerce ecosystem in Latin America, boasting a presence in 18 countries, including major markets like Brazil, Mexico, and Argentina.

Since its founding in 1999, the company has achieved remarkable growth, becoming a cornerstone of digital commerce and financial technology in a region with over 650 million people.

Over the last decade, MELI has nearly organically multiplied its revenues by 30x in US dollar terms, cementing its position as a leader in the fast-growing LatAm market.

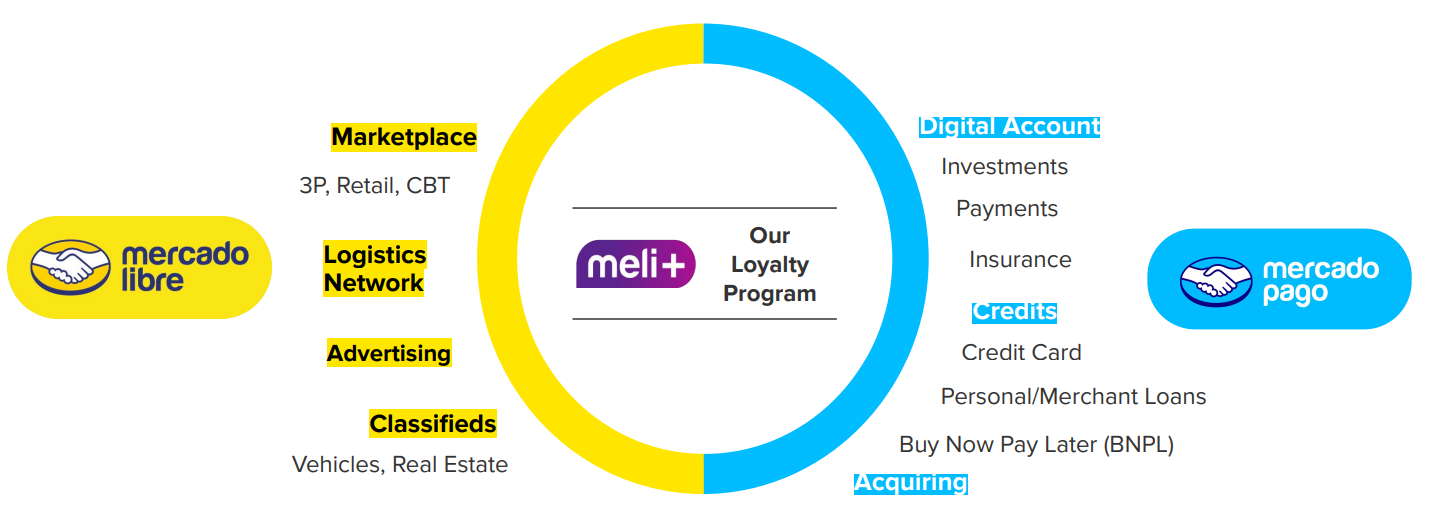

MercadoLibre operates through two primary business segments, both of which generate significant synergies:

E-commerce: where MELI first began its operations, contributes 57% of total revenues, with third-party (3P) sales, including advertising, making up the lion's share at 46%, and first-party (1P) sales accounting for 10%;

Fintech: initially conceived as a value-added service to its marketplace, has grown into a standalone powerhouse, representing 43% of total revenues (with payments contributing 26% and credit 17%).

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

🛒 MercadoLibre’s Ecosystem:

Beyond these revenue drivers, MercadoLibre has built a strong and versatile ecosystem of six interconnected services, which work in harmony to (i) create a seamless user experience and (ii) effectively address the specific needs of buyers, sellers, and businesses across the region:

MercadoLibre Marketplace;

Mercado Pago;

Mercado Envios;

Mercado Ads;

Mercado Libre Classifieds;

Mercado Shops.

I. MercadoLibre Marketplace:

The Mercado Libre Marketplace is a fully-automated, user-friendly platform accessible via website and mobile app - making it one of the most popular e-commerce destinations in Latin America. It enables individuals, merchants, and MercadoLibre itself (through 1P sales) to list and sell a vast range of products digitally, catering to millions of users across the region.

The Marketplace features a broad assortment of categories, including consumer electronics, apparel, beauty products, home goods, automotive accessories, toys, books, entertainment, and consumer packaged goods. In 2023, the platform recorded over 1.1 billion transactions, reflecting its immense scale and importance.

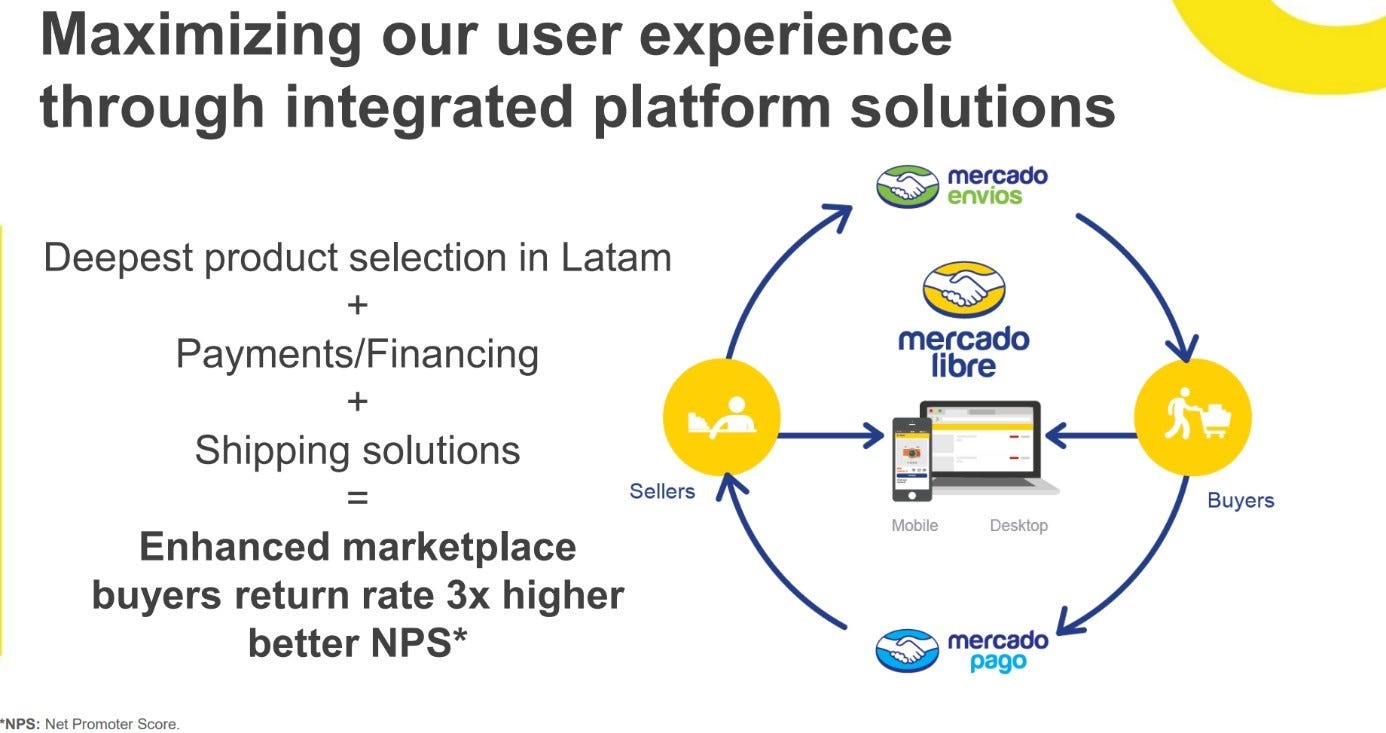

With more than 10 million active sellers and over 150 million unique buyers annually, the Marketplace thrives on strong network effects. Sellers benefit from the platform’s robust ecosystem, including Mercado Pago for payment processing and Mercado Envios for logistics, while buyers enjoy a seamless and reliable shopping experience.

That’s MercadoLibre’s Flywheel…

The MercadoLibre Marketplace generates the majority of its revenue through a final value fee charged to sellers when their items are sold. Additional revenue streams come from sales made in installments and from buyers using the platform’s shipping services.

The final value fees vary depending on the listing type selected by the seller, offering different levels of visibility and benefits:

Free Listings: as part of a "freemium" strategy, non-professional sellers can list a limited number of items annually at no cost. These listings receive the lowest visibility, appearing below others in search results, and do not include benefits like free installments.

Classic Listings: for a standard fee, sellers gain moderate exposure, with their listings displayed above free options but below premium ones.

Premium Listings: sellers who opt for premium listings pay a higher fee in exchange for maximum exposure.

This tiered structure not only enhances the seller’s ability to reach their target audience but also provides flexibility for businesses of all sizes to participate on the platform. By aligning fees with listing benefits, MercadoLibre has created a scalable and effective monetization model that supports its expansive ecosystem.

II. Mercado Pago:

Mercado Pago was created to simplify payments on MercadoLibre’s marketplace, addressing trust issues in transactions. Integrated at no extra cost to sellers, it quickly achieved 100% adoption and is mandatory in some countries, ensuring a secure and seamless process…

Its installment payment system is vital in Latin America, allowing buyers to pay in installments either with interest or through zero-interest options when sellers opt for premium listings. This flexibility drives sales and enhances affordability.

Now a standalone business, Mercado Pago contributes 43% of MercadoLibre’s total revenues. It extends beyond the marketplace, supporting point-of-sale systems (POS), QR code payments, and other digital solutions, becoming a leader in LatAm fintech.

By transferring credit risk to issuing banks, Mercado Pago has minimized financial exposure while boosting financial inclusion. It remains central to MercadoLibre’s growth and ecosystem.

Here is a diagram to illustrate how it works…

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

III. Mercado Envios:

MercadoLibre’s logistics services, under Mercado Envios, offer three distinct models to cater to sellers and buyers.

Drop-Shipping: This traditional strategy relies on sellers managing logistics independently. After a sale, sellers send products to a local carrier's distribution center for delivery. While simple, this model involves longer delivery times and higher risks, making it less appealing to users.

Cross-Docking: In this approach, sellers send items to MercadoLibre’s sortation centers immediately after a sale. Products are quickly processed and shipped directly to buyers, significantly reducing delivery times. Cross-docking has grown rapidly in Brazil, covering 50% of shipments.

Fulfillment: Sellers send inventory to MercadoLibre’s warehouses in advance, where products are stored, packaged, and shipped by MELI. This ensures faster delivery and enhances customer satisfaction. Sellers using fulfillment experience 2.5x higher sales, as their products gain marketplace prominence. Fulfillment leads in Mexico, with over two-thirds of shipments, and is expanding in Brazil - covering 45% of shipments.

These tailored logistics solutions drive efficiency, improve user experience, and strengthen MercadoLibre’s ecosystem across Latin America.

In 2023, approximately 80% of shipments were delivered within 48 hours, with around 56% arriving on the same or the next day. Moreover, at the 2023 MELI Experience event, it was revealed that the fulfillment network in Brazil now reaches 90% of the population with one-day deliveries.

In terms of infrastructure, MercadoLibre operates a robust logistics network in Brazil, including 10 fulfillment centers, 22 cross-docking stations, 105 service centers, approximately 4,500 pickup/drop-off locations, and a receiving center, along with an unspecified number of sorting centers. The company also utilizes seven airplanes, soon expanding to nine, and a fleet of around 4,200 trucks.

IV. Mercado Ads:

“We are also building one of the largest Retail Media platforms in the region, which leverages our extensive first-party data to offer advertisers unique audience targeting capabilities […]”

That’s how MercadoLibre’s management defined its advertising segment.

Since 2009, MercadoLibre has provided sellers and large advertisers with the opportunity to display ads and promote their businesses on its web pages. This approach helps enhance the visibility of specific listings by featuring them as sponsored at the top of search results.

More recently, the company has shifted its focus towards the Display Ad product and has been improving the seller interface to better manage, measure, and optimize ad campaigns.

In 2019, Mercado Ads' revenue was just $79MM, and four years later it reached $705MM – growing at an impressive CAGR of 72.8%. Today, it holds over 5% of the advertising market share in LatAm…

Mercado Libre’s Display Ads use a CPM model, focusing on brand awareness and exposure rather than clicks. Advertisers can purchase ads through Direct or Programmatic methods, targeting either all visitors (for launches, promotions, or product highlights) or specific audiences throughout their purchase journey.

Costs depend on placement and format, with the Home Slider, the top spot on Mercado Libre’s homepage, offering the highest visibility.

The platform leverages extensive user data - such as search behavior, purchase history, and payment preferences - to optimize targeting. Through machine learning, Mercado Libre categorizes users into over 140 segments, divided into three key groups:

Demographics: segments users by age and purchasing power, based on frequency, ticket size, and product types.

Purchase Mindset: identifies users “In Market” (actively browsing product pages within 30 days) and the categories they’re most likely to purchase.

Interests and Affinity: focuses on shopping habits, lifestyle preferences, and vendor interactions.

This detailed segmentation allows advertisers to display tailored ads to specific users at key moments in their buying journey.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

💳 Credit Operations:

Credit granting is key to MercadoLibre’s growth, enabling sellers to scale and buyers to access products. It fuels e-commerce, boosts transaction volumes, and deepens user engagement across its ecosystem.

MELI’s credit portfolio grew rapidly in 3Q24, reaching $6.1 billion (+22% q/q). Consumer credit leads ($2.5 billion), followed by credit cards ($2.3 billion) and loans to marketplace sellers ($1.6 billion). Over half of consumer credit is buy-now-pay-later, mainly within MercadoLibre’s platform.

Notably, the average loan duration is just 3 months, far shorter than the 24-36 months typical for traditional banks. Credit origination in 3Q24 even surpassed the portfolio size, reflecting high turnover.

MELI’s portfolio resembles Nubank’s, with a strong consumer focus and a fast-paced, agile credit model integrated into its marketplace ecosystem.

Over 20% of active sellers on MercadoLibre’s platform now have some form of credit, up from just 10% a year ago. MELI's Fintech Monthly Active Users (MAU) has surpassed 56 million, representing a 35% year-over-year growth.

The Net Interest Margin After Losses (as a percentage of the average portfolio) stands at 24.2% (vs. 37.4% in Q3 2023). Meanwhile, the 90+ NPL rate decreased from 20.3% to 17.9%, with NPL formation (15-90d) remaining stable.

PS: MercadoLibre records its credit operations as follows:

Credit Revenues: Included in fintech revenues, covering loan interest and interchange fees from credit cards.

Funding Costs: Recorded under cost of service, including interest from securitization funds and CDs (added in 2Q23).

Provisions: Booked under selling expenses, mainly tied to Mercado Crédito, as bad debts from marketplace fees have largely disappeared due to universal use of Mercado Pago.

📊 Market Share Analysis:

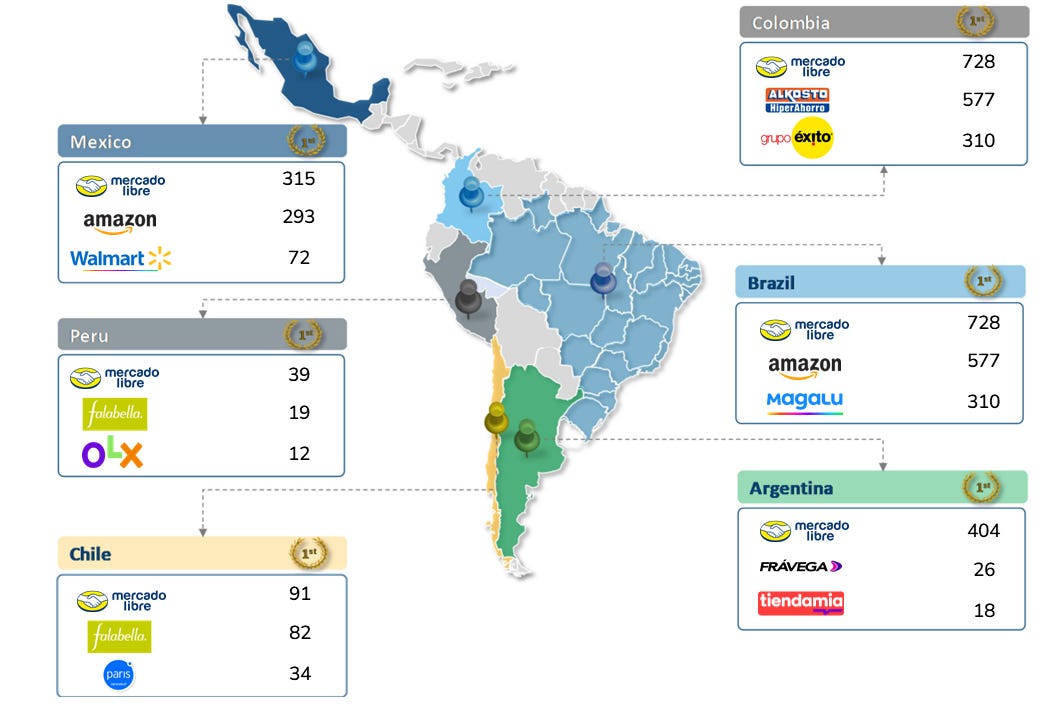

MercadoLibre stands as the undisputed leader in e-commerce across Latin America, operating in 18 countries with a consolidated regional market share of approximately 25%.

Its dominance is particularly evident in Argentina, where it commands an impressive 55% share, followed by substantial leadership positions in Brazil (36%) and Mexico (27%).

In other countries, we estimate a market share of just 8%, although we have less confidence in these figures.

As we can see, Brazil is the most representative country – so let’s dive a little deeper into it...

In Brazil, for instance, MELI is the most exposed player to 3P sales, which account for nearly 97% of its transactions. Meanwhile, its main peers, such as Magalu and Casas Bahia, operate around the 30% range. In other words, MELI operates without fixed assets tied up in inventory.

Moreover, the company has been expanding its leadership in recent years, capitalizing on the financial fragility of some local competitors, as shown below:

When analyzing click metrics, we also see MercadoLibre as a leader in its respective regions.

Competition with Amazon is more intense in Mexico, given its proximity to the U.S. border. In Brazil, Amazon has closed the gap in terms of clicks but still lacks a GMV of comparable scale.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

🏰 Competitive Moats:

Competition is what can kill any business, no matter how good it is. Below is a brief analysis of the competitive advantages we can identify in MercadoLibre:

I. Integrated Ecosystem:

One of MELI's standout strengths is its seamlessly integrated ecosystem across all business lines. By combining e-commerce, payments (Mercado Pago), logistics (Mercado Envios), and even credit services, the company maximizes its share of wallet, driving profitability from each individual customer (higher lifetime value). Its diversified revenue streams, particularly between Mercado Pago and Envios, create stability and resilience.

II. Network Effect:

As the leading e-commerce platform in Latin America, MercadoLibre benefits from a strong network effect. A growing base of buyers attracts more sellers, which in turn attracts even more buyers, creating a virtuous cycle that solidifies its market dominance.

III. First-Mover Advantage:

Being an early entrant in the region, MercadoLibre has established itself as the market leader in key countries like Brazil, Mexico, and Argentina. Its early mover status has allowed it to capture significant market share, making it a trusted and dominant player in Latin America.

IV. Proprietary Logistics:

Mercado Envios, MELI's proprietary logistics arm, is a game changer. It enables faster deliveries, greater reliability, and reduced dependency on third-party carriers - key advantages in a region with complex logistics challenges.

V. Data and Machine Learning:

Leveraging extensive consumer data and advanced machine learning, MELI has a deep understanding of its audience. This enables personalized experiences, smarter credit underwriting, and optimized operations, further reinforcing its competitive moat.

Together, these advantages create significant barriers to entry and position MercadoLibre as not just a leader but an innovator in e-commerce and fintech in Latin America.

💹 Unit Economics | Revenues and Costs:

Analyzing MercadoLibre's Unit Economics can be complex, as it involves multiple business lines and simultaneous moving parts...

I. Revenues:

E-commerce (Marketplace Revenue):

Monthly Orders per User (MOU): MercadoLibre continues to see increasing engagement, with MOU steadily rising as users rely more on the platform for their shopping needs. Higher MOU indicates strong user activity and retention, which drives overall platform growth.

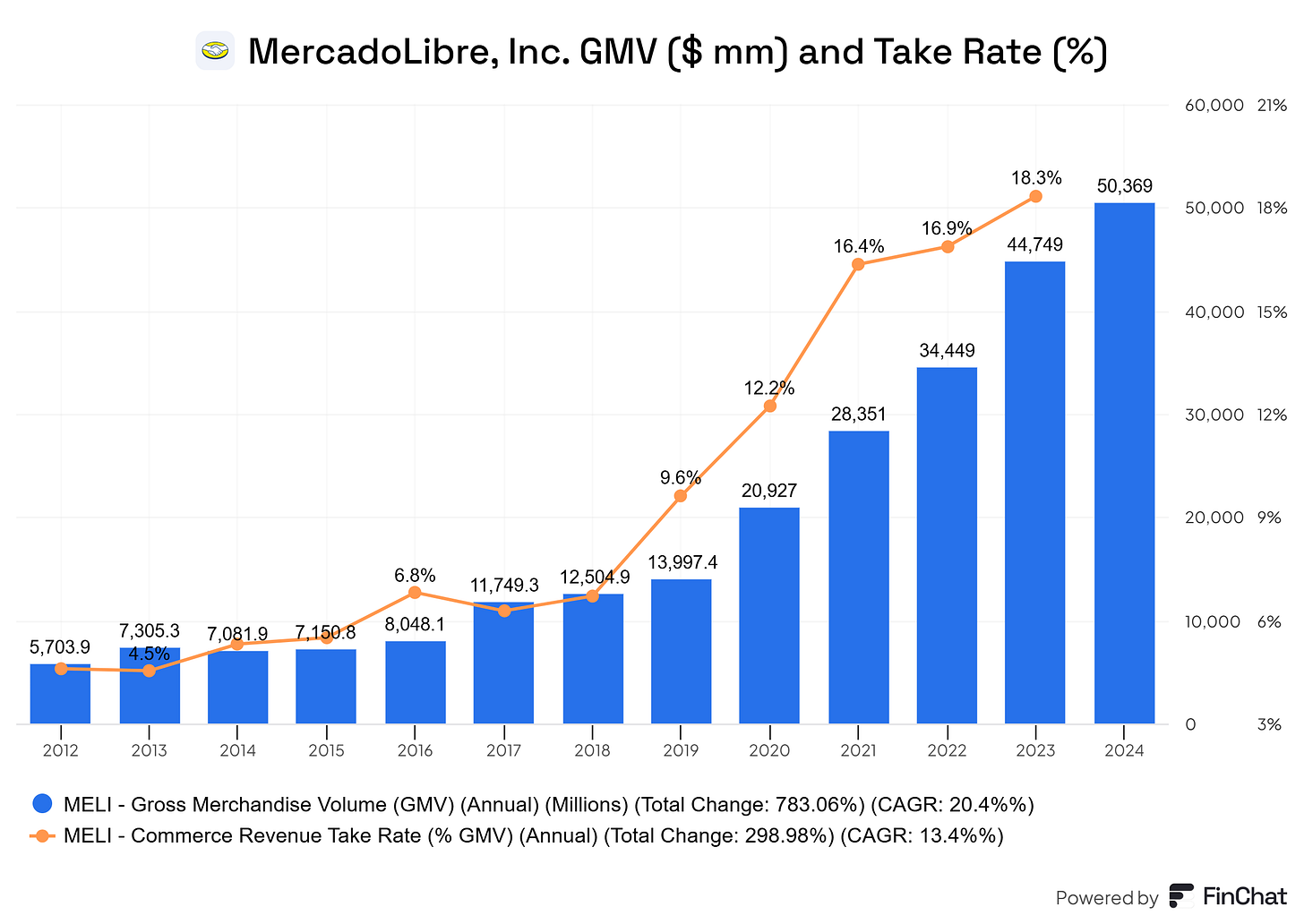

Gross Merchandise Volume (GMV): Increased MOU and user engagement directly translate to higher GMV. In 2024, MercadoLibre’s GMV surpassed $50 billion, reflecting robust growth in transaction volumes.

Take Rate: MercadoLibre has consistently improved its take rate through value-added services like advertising and logistics, as well as increased seller competition. Currently, the company retains 18% of the GMV transacted on the platform.

Fintech (MercadoPago Revenue):

Total Payment Volume (TPV): MercadoPago processed over $140 billion in TPV in 2024. Off-platform payments, including QR codes and peer-to-peer transactions, are particularly popular in key markets like Brazil and Mexico.

Take Rate: MercadoPago’s take rate has remained stable (~4%), supported by its leadership in digital payments and growing adoption of its fintech services.

Credit Operations:

Revenue is generated through interest on loans provided to consumers and small businesses, supported by advanced credit scoring and user data.

Advertising:

Sellers pay for advertising to increase their product visibility, creating a high-margin revenue stream for MercadoLibre. EBIT Margin around 70%…

II. Cost Structure:

While MercadoLibre does not disclose a detailed breakdown of costs, key components can be estimated:

Logistics (~15% of revenues): Logistics has become the largest cost, driven by the expansion of managed logistics services. Part of this cost is netted from revenues rather than expensed directly.

COGS (~10%): Includes costs from 1P sales and mPOS machines. Although 1P sales were scaled down recently, the segment is expected to ramp up due to improved profitability.

Billing and Collections (~10%): Includes credit/debit card processing fees, closely tied to TPV. This cost as a percentage of TPV has declined due to growth in non-card TPV and merchant acquirer licenses in select countries.

Taxes (~8%): Covers taxes on revenues in Brazil, Argentina, and Colombia. These are stable and treated as a cost of service, rather than a deduction from gross revenues.

Customer Support (~6%): Refers to in-house customer support and hosting costs. These have decreased since a peak between 2015-2018, reflecting greater operational efficiency.

Other (~3%): Includes financing costs for credit operations. Financing for credit card prepayment is treated as a deduction from revenues rather than an expense.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

🔮 What About the Future?

On August 2, Marcos Galperin, president of MercadoLibre, posted on X (formerly Twitter): “Había que hacerlo… y lo hicimos” (“It had to be done... and we did it”). The post celebrated MercadoLibre becoming Latin America’s most valuable company, surpassing giants like Vale and Petrobras.

With roots in a Buenos Aires garage, the company now thrives as a leader in e-commerce and fintech innovation.

The future for MercadoLibre is promising but far from easy. The Brazilian market - its largest and most important - is growing a lot, but is set to become increasingly competitive. Asian platforms like Shopee and Shein are expanding aggressively, offering low prices and attracting cost-sensitive consumers.

Additionally, the growth of local players and partnerships among competitors adds pressure. To maintain its leadership, MercadoLibre must continue innovating and strengthening its ecosystem across e-commerce, fintech, and logistics.

Expanding to other Latin American countries will be crucial for MercadoLibre’s growth. The recovery of Argentina’s economy and the region’s overall development could become key allies in the coming years (currency depreciation significantly impacted results over 2023 - 2024).

Logistical hurdles due to infrastructure gaps, complex tax regulations across borders, and currency volatility, all of which will require strategic solutions to navigate effectively…

🇦🇷 Blue Chip Swap and ARS Risks:

Since the second half of 2019, Argentina's government has imposed strict exchange controls, limiting the ability of companies and individuals to exchange Argentine Pesos (ARS) for foreign currencies and transfer funds abroad.

Access to the official exchange market requires Central Bank approval, which may be denied depending on circumstances.

To navigate these restrictions, businesses, including MercadoLibre, rely on the Blue Chip Swap Rate. This mechanism involves purchasing U.S. dollar-denominated securities (like shares or sovereign debt) with ARS in Argentina and subsequently selling those securities for U.S. dollars locally or abroad.

This process allows companies to access dollars while bypassing official market restrictions.

I. The Exchange Spread: Official vs. Blue Chip Swap:

The Blue Chip Swap Rate often diverges significantly from the official ARS/USD exchange rate, creating an exchange spread. This gap reflects the peso's devaluation risk.

December 31, 2023: The spread between the Blue Chip Swap Rate and the official rate was 20.4%.

September 30, 2024: The spread widened to 28.2%, underscoring increasing currency pressure.

This growing spread highlights the peso's weakening value and the challenges companies face in managing currency exposure.

II. Additional Tax Burdens:

Argentina has also introduced taxes on foreign currency transactions.

On July 24, 2023, Decree No. 377/2023 imposed taxes on foreign services, transportation, and imported goods at rates up to 25%.

These taxes directly impact companies like MercadoLibre, raising costs for imported goods and services crucial to operations.

By September 2, 2024, Decree No. 777/2024 reduced some tax rates to 7.5%, but the cumulative impact of these measures adds to the complexity of operating in Argentina.

III. Implications for MercadoLibre:

MercadoLibre mitigates ARS risks by converting excess cash at the Blue Chip Swap Rate instead of the official rate, reducing the impact of peso devaluation on its financials. However, its exposure remains significant:

As of 1H23, 43% of MercadoLibre’s EBIT was exposed to ARS. This includes outsourced costs from Argentina to other subsidiaries, increasing sensitivity to currency fluctuations.

While the Blue Chip Swap provides an essential tool to access dollars, persistent devaluation risks, regulatory changes, and tax burdens continue to pressure MercadoLibre's margins and growth. Its ability to navigate these challenges is crucial to maintaining its leadership position in the region.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

📈 Valuation:

I. Financials:

Unlike most other Latin American tech companies, MercadoLibre has consistently operated in the financial green, maintaining steady profitability over time, with the exception of the 2018-2020 period.

From 2014 to today, MercadoLibre’s net revenue skyrocketed from $560 million to $18.4 billion, reflecting an impressive CAGR of 43% annually. During this growth, margins temporarily tightened as the company shifted its profile by expanding into transactional and credit services through MercadoPago.

While these moves compressed margins in the short term, they fundamentally strengthened the business model, adding resilience and creating a more diversified and sustainable ecosystem.

Debt has never been a concern for MercadoLibre. The company has operated with net cash for most of its history, maintaining a ND/EBITDA average of -0.5x. This financial stability has provided the flexibility to reinvest in growth initiatives without compromising its balance sheet…

It’s also important to note that, with these results, we’re looking at an ROE of nearly 50% – which is truly impressive…

II. Multiples:

With a market cap of $93bn, MELI is trading at 65x trailing P/E and 42x 2025E P/E. The 5-year PEG ratio, according to Bloomberg consensus, stands at 1.1.

These are the lowest valuation multiples in the past five years for the company, significantly below its historical average.

EPS is now at 28/share, a 47% growth compared to last year…

III. Main Estimates and Target Price:

MercadoLibre ($MELI) is projected to achieve steady growth with a slight market share gain over time. EBIT margin is expected to improve as scale efficiencies become evident and the advertising business contributes more to results.

Credit and 1P sales will also support margin expansion, reaching 15% by 2029E. This reflects a combination of strong execution and strategic monetization opportunities.

Our DCF model points to a December 2025 target price of $2,200, underpinned by a 10.2% WACC in nominal USD terms and a 5.6% real growth rate in perpetuity.

With a structural ROE of 40%, the company benefits from limited dividend payouts and abundant opportunities for capital reinvestment, reinforcing its long-term value creation potential.

Our sensitivity matrix suggests potential returns ranging from -6.5% to +78%, depending on variations in growth rates and cost of capital.

We see significant value in the company’s business, driven by complementary revenue streams. E-commerce is the primary value generator, accounting for an estimated 70% of the projected value, followed by payments and credit.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

⚠️ Main Risks:

Here are the main risks that could impact MercadoLibre’s growth and profitability:

Competition in Brazil & Mexico: Amazon's expansion could erode MELI’s market share if it fails to sustain its logistics and pricing advantages.

Currency Depreciation: the Brazilian real and Argentine peso remain volatile, impacting MELI’s USD-reported financials and consumer demand.

Credit Risk & NPLs: Mercado Pago’s lending growth increases exposure to rising non-performing loans, especially in economic downturns.

High Interest Rates: prolonged tight monetary policy in key markets could weaken consumer spending and slow e-commerce and fintech adoption.

Before we continue...

Thank you for being a valued reader of Jimmy's Journal — your support inspires and empowers me to continue this journey.

If you enjoy Jimmy's Journal, it would mean the world to me if you invited friends to subscribe and read with us. If you refer friends, you will receive benefits that give you special access to Jimmy's Journal.

📢 How to participate:

1. Share Jimmy's Journal. When you use the referral link below, or the “Share” button on any post, you'll get credit for any new subscribers. Simply send the link in a text, email, or share it on social media with friends.

2. Earn benefits. When more friends use your referral link to subscribe (free or paid), you’ll receive special benefits.

Get a 1 month comp for 5 referrals

Get a 3 month comp for 10 referrals

Get a 6 month comp for 15 referrals

To learn more, check out Substack’s FAQ.

Thank you for helping get the word out about Jimmy's Journal!

💡 Investment Thesis:

Our MercadoLibre ($MELI) investment thesis is built on four key pillars:

I. Market leader in Latin America:

MercadoLibre dominates Latin America's e-commerce and fintech space, holding a 25% regional market share and leading in Argentina (55%), Brazil (36%), and Mexico (27%). With e-commerce penetration still at just 12.3% of total retail sales, the $269.8B addressable market is set to grow at an 8.5% CAGR through 2028, fueled by rising digital adoption, smartphone penetration, and logistics improvements.

II. Integrated ecosystem driving monetization:

MELI’s business spans e-commerce, fintech (Mercado Pago), logistics (Mercado Envios), credit (Mercado Crédito), advertising (Mercado Ads), and more. This ecosystem enables cross-selling, enhances customer stickiness, and maximizes LTV while keeping CAC low, leading to strong monetization and profitability.

III. Strong competitive moats defending profitability:

MELI's strong network effects, proprietary logistics, and integrated payments create high barriers to entry, making it tough for new competitors to challenge its dominance. Players like Amazon, Shopee, and Shein lack its infrastructure and ecosystem synergies.

IV. Financial performance & attractive valuation:

MercadoLibre has a consistent track record of profitability, with revenue growing at a 43% CAGR since 2014 and an ROE near 50%. Despite this growth, MELI trades at just 30x P/E 2026E, a bargain given its projected earnings expansion and high reinvestment returns.

With robust competitive advantages, continuous innovation, and a high-growth region, MercadoLibre ($MELI) stands out as a compelling investment opportunity. With our recent purchases, it now accounts for 25% of our portfolio.

Hope you enjoyed the content.

See you next time!

Jimmy

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.

What do you think about their fintech business?

A comprehensive read! What do you think about their GTM in Spain? Living here, I've heard so much about them from my Argentinian friends but have not seen a single store. Is there a policy barrier or is it just a company strategy to not have expansion in Spain or Europe?