Long Before Berkshire: Lessons from a Young Warren Buffett

The early hustles that shaped a legend...

Hi, Investor 👋

I’m Jimmy, and welcome to this week’s edition of our newsletter. Today, we’re looking at the early days of Warren Buffett - long before Berkshire, when he was just a kid obsessed with making money.

From small hustles to big lessons, his childhood shaped the investing principles he still follows today. Let’s dive in!

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

"When Warren was a little boy collecting bottle caps, flinging papers day after day ... if you had asked him if he wanted to be the richest man on earth, he would have said, Yes." - Alice Schroeder

It’s easy to look at Warren Buffett today - one of the richest men in the world, the face of Berkshire Hathaway - and forget that he was once just a kid with an insatiable hunger to figure out how money worked.

Long before billion-dollar deals and annual shareholder letters, there was an eleven-year-old boy flipping through the pages of One Thousand Ways to Make $1,000.

That book wasn’t just an interesting read; it was a spark. Buffett had already spent his childhood finding creative ways to make a buck, but this was different.

It showed him that wealth wasn’t just something you stumbled into - it was something you built, step by step.

The idea of compounding, reinvesting, and scaling small ventures into something bigger wasn’t just a theory to him. It was a game plan.

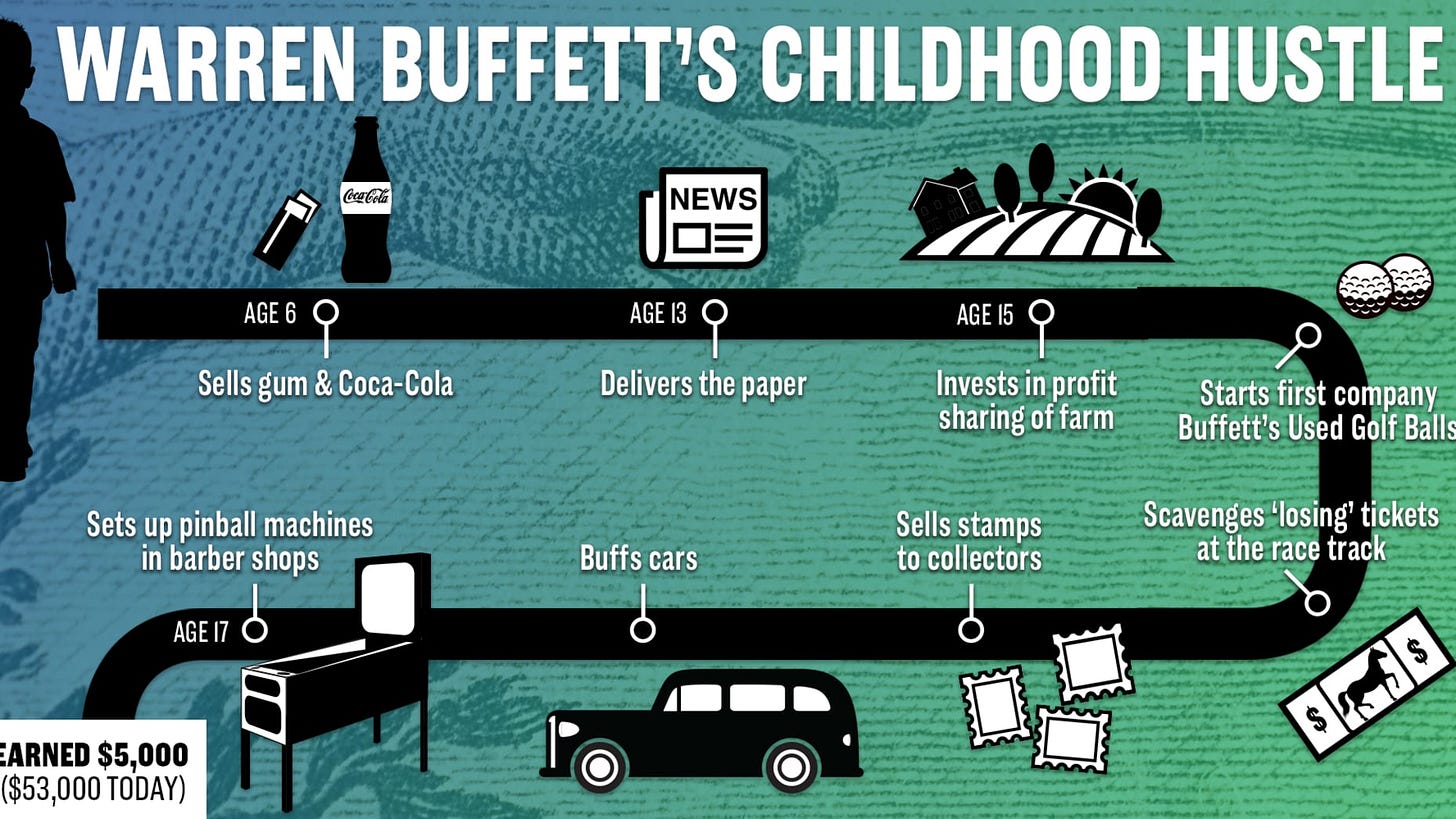

Early Hustles: A Boy Obsessed with Making Money

Buffett’s obsession with earning money started long before he read One Thousand Ways to Make $1000. At six years old, he was already selling packs of gum door to door.

Not long after, he started flipping bottles of Coca-Cola, buying six-packs from his grandfather’s grocery store for a quarter and selling each bottle for a nickel - pocketing a 20% profit.

By the time he was ten, Buffett had graduated to bigger operations. He secured a newspaper delivery route for the Washington Post, waking up before dawn to distribute papers.

But simply delivering newspapers wasn’t enough - he found ways to maximize his earnings by selling calendars to his customers and collecting old magazines, which he repurposed as scrap paper for wartime efforts.

As pointed out by Alice Schroeder in the book The Snowball:

“He also sold calendars to his newspaper customers, and he developed another sideline too. He asked all his customers for their old magazines as scrap paper for the war effort. Then he would check the labels on the magazines to figure out when the subscriptions were expiring, using a code book he had gotten from Moore-Cottrell, the publishing powerhouse that had hired him as an agent to sell magazines. He made a card file of subscribers, and before their subscriptions expired, Warren would be knocking at their door, selling them a new magazine.”

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

The Budding Investor: First Stocks and the Power of Compounding

At eleven, Buffett took his first step into the stock market. With money he had saved, he bought three shares of Cities Service Preferred. When the stock dipped, he panicked but eventually sold at a small profit. However, he soon watched it soar even higher, teaching him a hard lesson in patience and long-term thinking.

By fifteen, Buffett had amassed enough savings to buy a 40-acre farm in Nebraska, which he leased out for passive income. He was already thinking like an investor, looking for assets that could generate consistent returns without requiring his direct involvement.

Around the same time, he discovered the power of reinvesting earnings - every dollar he made from newspapers, Coca-Cola sales, and magazine recycling was funneled into his next venture.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

Scaling Up: Golf Balls, Pinball Machines, and Business Expansion

As Buffett approached his late teens, his ventures became more sophisticated. He realized that instead of working for money, he could make money work for him.

The book One Thousand Ways to Make $1,000 introduced Buffett to the idea of compounding through coin-operated weighing machines.

"The weighing machine was easy to understand. I’d buy a weighing machine and use the profits to buy more weighing machines. Pretty soon, I’d have twenty weighing machines, and everybody would weigh themselves fifty times a day. I thought - that’s where the money is. The compounding of it - what could be better than that?" - The Snowball

One of his most notable ventures was reselling used golf balls. By July of one summer, he had sold 220 dozen golf balls, making $1,200 in profits.

He carefully tracked his earnings, meticulously recording every cent from his newspaper route, stock sales, and small businesses. By sixteen, he had saved an astounding $5,000 - an amount that would eventually seed every dollar he ever made.

At seventeen, Buffett and a friend pooled their money to buy a used pinball machine for $25 and placed it in a local barber shop. The idea was simple but effective - customers played while waiting for a haircut, and within weeks, the machine had generated enough profits to buy additional machines. Soon, they had a network of pinball machines in multiple barber shops.

A year later, they sold the business for $1,200, a sizable return for two teenage entrepreneurs.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

Discovering The Intelligent Investor:

Buffett’s relentless pursuit of financial knowledge eventually led him to The Intelligent Investor by Benjamin Graham. By this time, he had already read every book on investing in the Omaha Public Library, but Graham’s work was different. It provided a structured, analytical approach to investing - one that resonated deeply with Buffett.

He devoured its principles and decided he had to learn from Graham himself. This decision led him to enroll at Columbia Business School, where he studied directly under Graham, refining the investment philosophy that would define his career.

And the rest of the story, you already know...

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

The Takeaway: Lessons from Young Buffett

Buffett’s early years offer some of the most enduring principles for success:

Start early: he began investing and running businesses before he was a teenager.

Hustle relentlessly: from newspapers to pinball machines, Buffett was always looking for opportunities.

Learn obsessively: he read everything he could about finance and business, always seeking more knowledge.

Think long-term: even in his youth, he understood the power of compounding and patient investing.

Before Berkshire Hathaway, before billions of dollars, before becoming a household name, Warren Buffett was just a kid obsessed with making money and understanding how it worked. His story proves that success isn’t an accident - it’s built, one smart decision at a time.

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.