MercadoLibre & Nubank: Earnings Review 4Q24

Breaking down the numbers: growth, challenges, and what’s next...

Hi, Investor 👋

I’m Jimmy, and welcome to another edition of our newsletter. We’re diving into the Q4 2024 earnings analysis of two of LatAm’s top companies: MercadoLibre ($MELI) and Nubank ($NU).

Enjoy the deep dive, and don’t forget to share your thoughts with fellow investors!

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

MercadoLibre and Nubank are two of the biggest gems in Latin America and are on many investors' watchlists.

I decided to share my Q4 2024 take in a post format.

Let’s start with $MELI...

MercadoLibre ($MELI):

I. Strong Growth and Earnings Beat

MercadoLibre delivered a robust Q4, with consolidated GMV growing +56% y/y on an FX-neutral basis.

While GMV growth was slightly below BBG consensus, the company’s operating performance shone through: EBIT came in 26% above expectations and net profit surged by 46%. Key regional drivers were Brazil and Mexico, with GMV up +32% and +28% y/y, respectively.

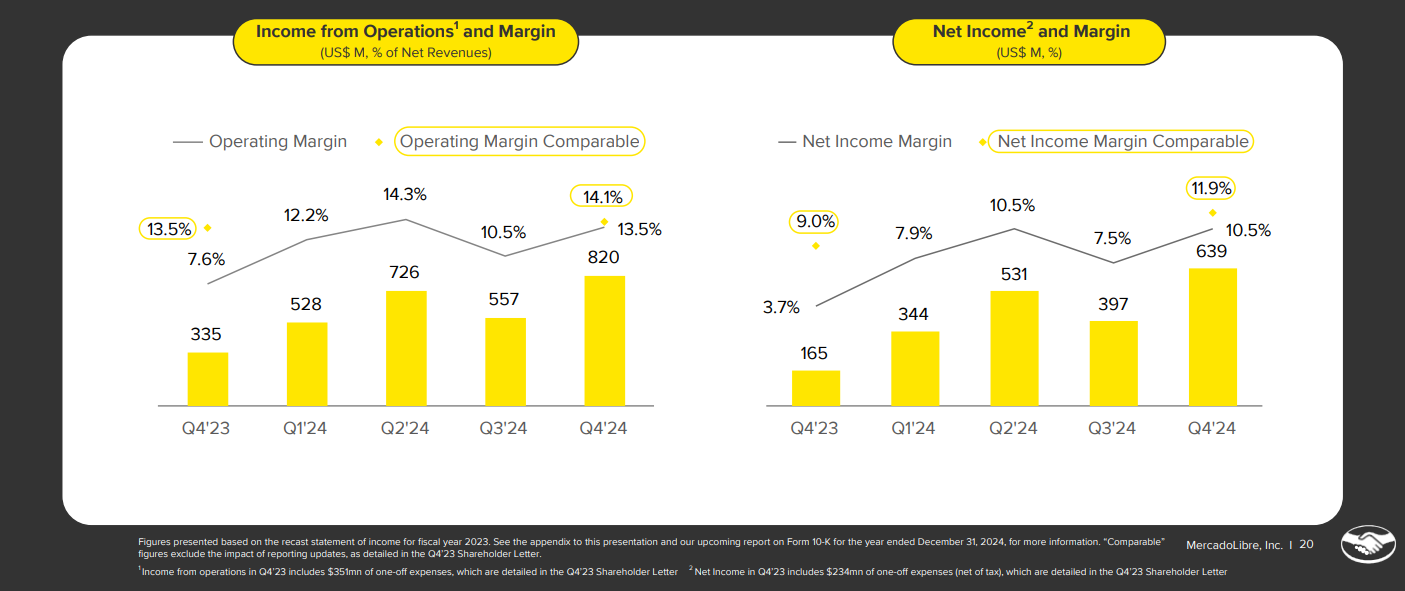

II. Operational Efficiency Boosts Margins

Despite higher upfront provisions from increased investments in its credit business, operational improvements more than offset these pressures.

Effective cost management in logistics, efficient collections, and strong operating leverage resulted in a comparable EBIT margin of 14.1% and a net margin of 11.9% (+290bps y/y). A lower tax burden and reduced FX losses in Argentina further supported the bottom line.

III. Ecosystem Expansion and Digital Innovation

MercadoLibre’s diversified business model continued to evolve. The 3P ecommerce segment saw an improved take rate at 20.8%, while advertising revenues grew by 41% y/y.

Additionally, MercadoEnvios’ fulfillment operations grew 44% y/y, delivering over 500 million items in Q4. On the fintech front, the monthly active users reached 61.2 million (+34% y/y), bolstering transaction volumes and further integrating the company’s digital ecosystem.

IV. Robust Credit Business and Portfolio Shifts

The credit portfolio experienced significant expansion, growing 74% y/y to US$6 billion. A strategic shift was evident as credit card penetration increased from 32% in 4Q23 to 40% in 4Q24.

Although higher upfront provisions added pressure, improvements in collections, favorable seasonality, and better risk model performance helped stabilize the portfolio, with credit revenue rising +41% y/y to account for 17% of consolidated revenue.

V. A Promising Outlook for a Top Pick

Overall, the Q4 results reflect the maturation of MercadoLibre’s ecosystem - balancing solid growth with enhanced operational efficiency and strategic investments in credit and logistics.

Despite trading at elevated multiples, the company’s healthy profitability and promising credit expansion reaffirm its status as a top pick for investors in LatAm.

In case you missed it, here’s our deep dive on MercadoLibre ($MELI):

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

Nubank ($NU):

I. Slower Top-Line Recovery and NIM Pressure

NuBank reported Q4 2024 GAAP net income of US$553mn (28.9% ROE), in line with market consensus. The top line showed signs of recovery after a slowdown in Q3, though this was partially driven by seasonal factors.

However, Net Interest Margin (NIM) fell more than expected, impacted by FX depreciation, a shift toward secured lending, and higher funding costs in Mexico and NU’s deposits. The combination of these factors led to a 9% drop in the stock price in after-hours trading.

II. Strong Deposit Expansion and Client Growth

The neobank continued expanding its customer base, closing Q4 with 114mn clients (+22% y/y), including 3mn SMEs (+36% y/y). Net additions in Mexico remained stable at 1.1mn, reaching 10mn clients, while growth in Colombia slowed slightly to 500k new clients, totaling 2.5mn.

In Brazil, client growth decelerated slightly, adding 3mn new accounts, reaching 102mn. Monthly active credit card users rose to 40mn (+5.5% q/q), and PIX financing users increased to 15.5mn (+8% q/q). Deposits grew 16% sequentially and +55% y/y to US$28.9bn, with Brazil, Mexico, and Colombia all contributing.

III. Loan Portfolio Accelerates

NuBank’s loan portfolio reached US$20.7bn (+13% q/q; +45% y/y, FX-neutral), with the interest-earning portion now representing 54% of total loans (+75% y/y, FX-neutral). Growth was mainly driven by personal and SME loans, with origination reaching R$18.4bn (+16% q/q).

Within that, R$2.8bn came from secured personal loans, R$1.6bn from new SME loans, and R$14bn from unsecured personal loans. The credit card book grew +9% q/q to US$14.6bn, representing 70.5% of the total loan book, though its share declined 2.5p.p. sequentially.

IV. Improved Asset Quality and Stable Risk Metrics

Despite the continued expansion of the loan portfolio, asset quality metrics showed improvement across all key indicators. The >90-day NPL ratio in Brazil dropped 20bps q/q to 7%, while early-stage NPLs declined 30bps q/q.

Meanwhile, the coverage ratio for >90-day NPLs improved by 3.1p.p. sequentially, reaching 215%. The credit card Stage 3 loan ratio fell 30bps q/q to 9.5%, while coverage for Stage 3 personal loans rose 3p.p. to 69%. However, PIX Financing remained stagnant, with management stating that penetration is unlikely to increase meaningfully in the next 1-2 quarters.

V. Strategic Outlook

In his closing remarks, CEO David Vélez outlined NuBank’s "Three-Act Strategy", focusing on: (i) building the largest and most loved retail banking franchise in LatAm, (ii) expanding beyond financial services, and (iii) evolving into a global AI-driven digital bank.

Despite strong execution and ongoing international expansion, expectations for growth may be overly optimistic given the current lending mix and market conditions. While NuBank remains well-positioned for long-term upside, market consensus holds a neutral stance on the stock due to valuation concerns.

In case you missed it, here’s our deep dive on Nubank ($NU):

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

What did you think of MercadoLibre and Nubank's results? Do you hold any of them in your portfolio?

Drop your thoughts in the comments.

Until next time.

Cheers,

Jimmy

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.