Monthly Portfolio Update #3

January 2025: Stellar Capital Management – a lot of trades and a new company...

Hi, Investor 👋

I’m Jimmy, and welcome to the third edition of the Stellar Capital Management newsletter series! Through our fictional investment fund, I share high-conviction ideas to challenge conventional thinking.

In this edition, we’ll break down January 2025’s performance, key insights and trades from the month, and a new stock we recently added to the portfolio. Let’s dive in!

In case you missed it, here are some recent insights:

I'm Buying Uber. Here's Why: Uber Technologies, Inc. ($UBER) Deep Dive

I'm Doubling Down on MELI. Here's Why: MercadoLibre, Inc. ($MELI) Deep Dive

Subscribe now and never miss a single report:

Monthly Introduction:

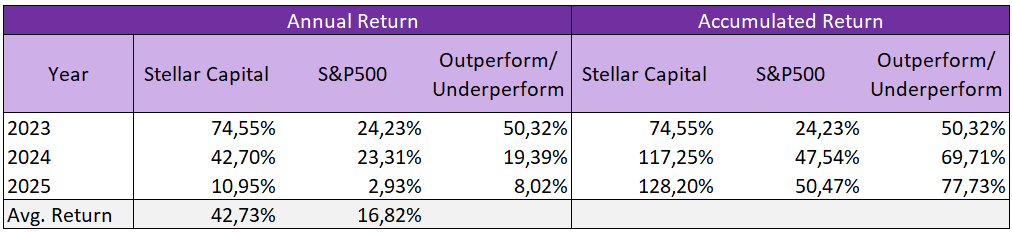

January was an excellent month for our portfolio - far exceeding our expectations. We delivered a +10,95% return, significantly outperforming the S&P 500’s +2,93%, a remarkable outperformance of 8,02%.

It's our best start to the year since 2023, when I began investing independently (without the traditional constraints that the SEC imposes on an equity analyst).

Our core holdings played a major role in this strong start to the year, largely driven by earnings season, which reinforced our investment theses across the board. We’ll dive into that shortly.

But first, I want to touch on January’s key theme: DeepSeek and the potential commoditization of AI...

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

DeepSeek and Market Distortions:

The recent launch of DeepSeek-V3 and R1 has fueled discussions on AI's future, especially as LLMs continue to commoditize. While these models showcase impressive hardware optimization and cost efficiencies - reportedly 20x cheaper than leading alternatives - they still lag in complex applications requiring creativity, adaptability, and sustained coherence.

DeepSeek’s multi-token prediction (MTP) and FP8 precision training optimize cost and hardware usage, making them efficient for logic-heavy tasks like code review and translations. However, benchmarks like AidanBench reveal limitations in generating diverse responses and maintaining contextual depth, which are crucial for AI copilots and chatbots:

Additionally, while DeepSeek emphasizes cost reductions, these numbers overlook key variables, such as R&D expenses and infrastructure overhead. Training V3 and R1 still required thousands of NVIDIA H800 chips, signaling a much higher cost base than initially suggested.

Their ability to run on less advanced NVIDIA chips (A800, H800) raises questions about future AI infrastructure demand. Despite this, our analysis suggests these models won't disrupt existing AI trajectories in a meaningful way - at least not yet.

The AI race remains focused on Agentic AI and more sophisticated reasoning models. However, DeepSeek’s cost-cutting advancements could pressure incumbents like OpenAI, Google, and Anthropic to innovate further.

Most importantly, DeepSeek’s emergence created a great buying opportunity in select companies - and we seized one of them.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

Portfolio Overview:

As you already know, our portfolio is intentionally concentrated - reflecting our belief that generating alpha in a highly competitive market stems from focusing on a select group of high-conviction companies.

It's hard for a company to earn a spot in this portfolio - typically, a new position comes at the expense of another. This time, that wasn’t the case.

During the month, we increased our positions in:

Keep reading with a 7-day free trial

Subscribe to Jimmy's Journal to keep reading this post and get 7 days of free access to the full post archives.