Monthly Portfolio Update #5 | Building a Tariff-Proof Portfolio

March 2025: noise turning into signals...

Hi, Investor 👋

I’m Jimmy, and welcome to the fifth edition of the Stellar Capital Management newsletter series! Through our fictional investment fund, I share high-conviction ideas to challenge conventional thinking.

In this edition, we’ll break down March 2025’s performance, highlight the most relevant insights, and walk through the trades that shaped our positioning going into Q2. Let’s dive in!

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

Monthly Introduction:

March was a tough month for risk assets - just like the second half of February.

Narratives around tariffs, recession, and trade wars started gaining serious traction in the markets.

What initially felt like noise has increasingly turned into signals. And signals, especially when your portfolio isn’t positioned for the moment, often require action.

That’s exactly what we did.

March marked one of the biggest strategy shifts in my track record. We added three highly defensive stocks throughout the month, reduced exposure to growth, and took advantage of still-elevated valuations to raise cash.

The changes we made throughout the month saved us over 7,0 p.p in performance.

We’ll talk more about that in a bit...

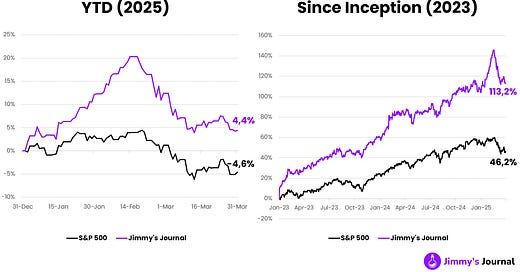

For the month, our portfolio declined by -7.16%, compared to -5.75% for the S&P 500.

Year-to-date, we’re still up +4.36%, while the S&P 500 is down -4.59%.

Since inception, we’ve accumulated a gain of +113.18%, versus +46.16% for the S&P 500.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

Tariffs Everywhere: No More Noise, Just Reality

March was defined less by data and more by policy, as sweeping new tariffs reshaped the economic landscape.

A 10% baseline rate on most imports, with additional surcharges tied to trade deficits, pushed the effective tariff rate above 20% - levels unseen in decades.

Markets took notice:

Equities slid, led by trade-sensitive sectors, and

Business sentiment fell sharply.

Growth forecasts were revised down, while inflation expectations nudged higher. Core goods prices began rising even before most tariffs took effect, suggesting front-running. Import costs rose across categories, and the risk of supply chain disruptions is growing.

Despite this, the Fed held rates steady and signaled caution. While projections still show cuts starting mid-year, more members are now penciling in fewer moves. Chair Powell called the inflation impact of tariffs “transitory,” but acknowledged the high degree of uncertainty.

Consumer data offered a mixed picture. Jobless claims remain stable, but sentiment worsened. Restaurant sales have weakened notably, while retail control group spending surprised to the upside. Overall, Q1 consumption is tracking around 0.5 - 1.0%.

Manufacturing lost momentum. February industrial production held up, but March surveys - especially the Empire State and Philly Fed - signaled concern, with capex plans falling. In housing, activity remains firm, though builder sentiment dipped on rising cost concerns.

With tariffs now in effect and retaliatory measures expected, uncertainty has become the defining theme. The question for Q2 is no longer whether the economy slows, but how much and how fast.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

Portfolio Overview:

As you already know, our portfolio is intentionally concentrated - reflecting our belief that generating alpha in a highly competitive market stems from focusing on a select group of high-conviction companies.

As we highlighted in our last Monthly Portfolio Update, the environment was starting to demand real changes - and we acted accordingly…

Keep reading with a 7-day free trial

Subscribe to Jimmy's Journal to keep reading this post and get 7 days of free access to the full post archives.