Monthly Portfolio Update #7 | +37,05% CAGR Through High-Quality Investing

May 2025: what worked so far and key trades...

Hi, Investor 👋

I’m Jimmy, and welcome to the seventh edition of the Stellar Capital Management newsletter series! After a short holiday break, we’re back with the latest results from our portfolio so far in 2025.

We’ll dive into what’s been working, what we’re watching, and how we’re adapting to keep your capital positioned for long-term growth.

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

Monthly Introduction:

May felt like the rainbow after the stormy skies of the previous months.

Following a period of heightened volatility, risk assets staged a strong rebound: the S&P 500 rose +6.15%, while the NASDAQ soared +9.56% - marking one of the best months of the year for U.S. equities.

As the environment shifts, so does our strategy…

And that flexibility is showing in our results: year to date, we’ve consistently outperformed the market by a margin of 10 to 15 p.p. - all while staying true to our core principle: investing only in high-quality businesses.

In May 2025, our portfolio rose +5.25% - compared to +6.15% for the S&P 500 in the same period.

In 2025, we are up +13.63% versus +0.51% for the S&P 500 (+13.12 p.p. of alpha generation).

Since 2023, our cumulative performance stands at +132.12% versus +53.45% for the S&P 500 - an outperformance of over +78.67 percentage points.

In other words, we’re talking about a compound annual growth rate (CAGR) of +37.05% per year, compared to +20.03% for the S&P 500. An excellent return for the index - and an even better one for our own portfolio.

And we've done it by keeping things simple: no options, no leverage, no speculative small caps. Just high-quality businesses.

By the way, we made a few moves this month - and we’ll talk about them in just a bit...

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

“Wait and See”... But For How Long?

In May, focus shifted to fiscal policy, with Congress revisiting the long-delayed stimulus extension. A bipartisan framework began to take shape, but disagreements over tax credits and defense spending remain. Markets seem to have priced in a deal, though any unexpected delay could spark renewed volatility…

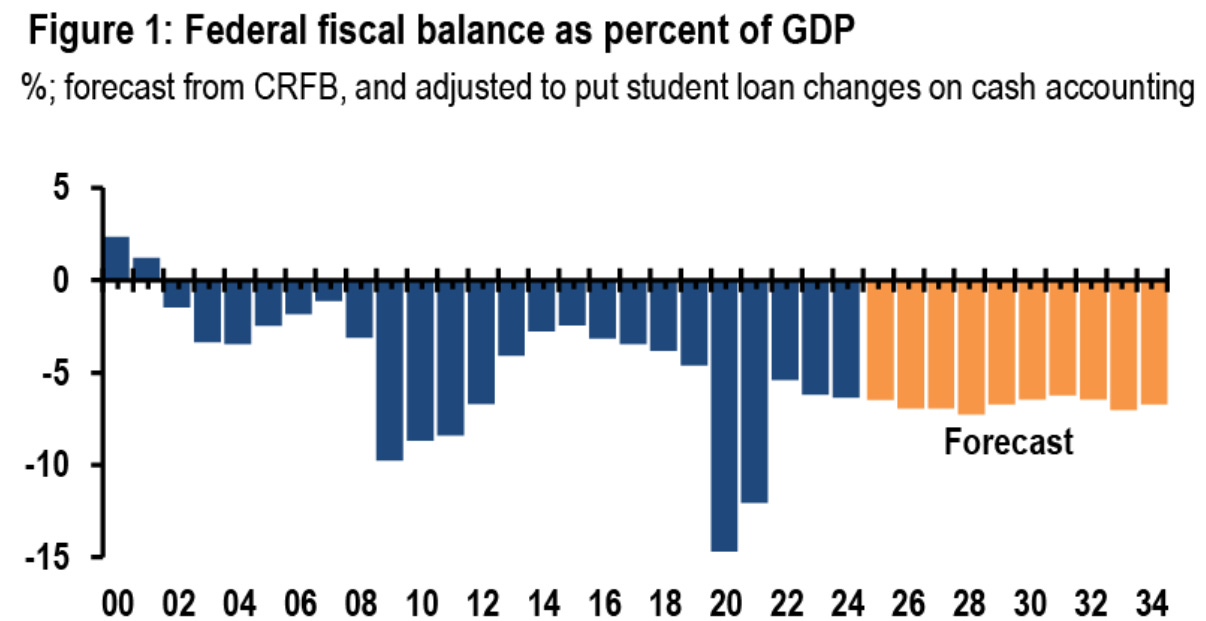

Notably, the House reconciliation bill is projected to add around $3 trillion to 10-year deficits - even before accounting for tariffs and interest expenses - raising fresh concerns over fiscal sustainability. For more details, click here.

The Fed held rates steady as internal divisions emerged over how long to maintain a restrictive stance. Inflation has eased slightly but remains above target, keeping a pivot off the table for now.

Fed funds futures now suggest just one rate cut in 2025, down from the three expected earlier in the year. It’s the classic “wait and see” - but the question remains: for how long?

Economic signals, in turn, were mixed. Durable goods orders fell more than forecast, dragged by aircraft and capital goods. Still, consumer spending - especially on services - remained strong. Core PCE rose +0.12% in April, reinforcing a slow but steady disinflation trend. A soft landing remains possible, though risks persist.

The labor market is showing signs of cooling, with rising jobless claims and the highest level of continuing claims since 2021. Still, job creation remains positive and wage growth is easing.

At the same time, business sentiment improved slightly in May, driven by services, while manufacturing stayed flat. Input costs rose again due to tariffs and supply issues, and companies remain cautious amid ongoing policy uncertainty.

Enjoying the content? Encourage me to keep creating more like this. Buy me a coffee!

Portfolio Overview:

As you already know, our portfolio is intentionally concentrated - reflecting our belief that generating alpha in a highly competitive market stems from focusing on a select group of high-conviction companies.

This strategy has worked not only for the portfolio as a whole, but also for each individual company we’ve selected.

Our focus is not - and never will be - the short term. That said, here’s a look at the acquisitions we’ve made over the past six months...

With the sales and acquisitions - including one new company added in May - here’s how our portfolio currently looks:

Keep reading with a 7-day free trial

Subscribe to Jimmy's Journal to keep reading this post and get 7 days of free access to the full post archives.