Netflix: When the Market Overreacts, Opportunity Knocks

How Netflix turned panic into profit, proving that market overreactions are the perfect time to invest

Hi, Investor 👋

I’m Jimmy, and welcome to another edition of our newsletter. Today, let’s step back from the daily market updates and take a closer look at Netflix’s recent earnings report. It’s a perfect case study in resilience, innovation, and how market overreactions can create incredible investment opportunities.

In case you missed it, here are some recent insights:

The Irrationality of the American Investor: A Rising Concern

Distant Reflections: The Real Economy and the Mirror of the Financial Market

Subscribe now and never miss a single report:

In the ever-changing world of streaming entertainment, Netflix (NASDAQ: NFLX) has solidified its place as an industry titan. What makes this story even more compelling is how it highlights a crucial investment lesson: market overreactions can cloud long-term fundamentals, creating opportunities for those who stay the course.

Market Overreaction: The Netflix Crash of 2022

Let’s rewind to 2022. Netflix experienced its first subscriber loss in over a decade, sparking widespread panic among investors. The narrative was dire: new competitors like Disney+ and HBO Max were poised to overtake the streaming pioneer, and headlines proclaimed Netflix’s fall from grace. Its stock nosedived nearly 70%, driven by fears of subscriber stagnation and increasing competition.

The headlines at the time were full of doom and gloom:

"Netflix's Days as the Streaming King Are Numbered" and "Disney+ Poised to Overtake Netflix in Global Subscriptions."

But hindsight reveals just how much the market overreacted. What many saw as the beginning of Netflix’s decline was, in reality, a momentary stumble. The company remained fundamentally strong, with a vast library of content, global brand equity, and a history of adapting to challenges. Those who looked beyond the pessimism and held onto their shares have since been richly rewarded.

Fast-forward to 2024, and Netflix has proven the doubters wrong. Its stock has skyrocketed, posting a 380% gain from its 2022 low. This resurgence serves as a case study in resilience and highlights how moments of panic often create incredible investment opportunities.

Dominating the Streaming Landscape

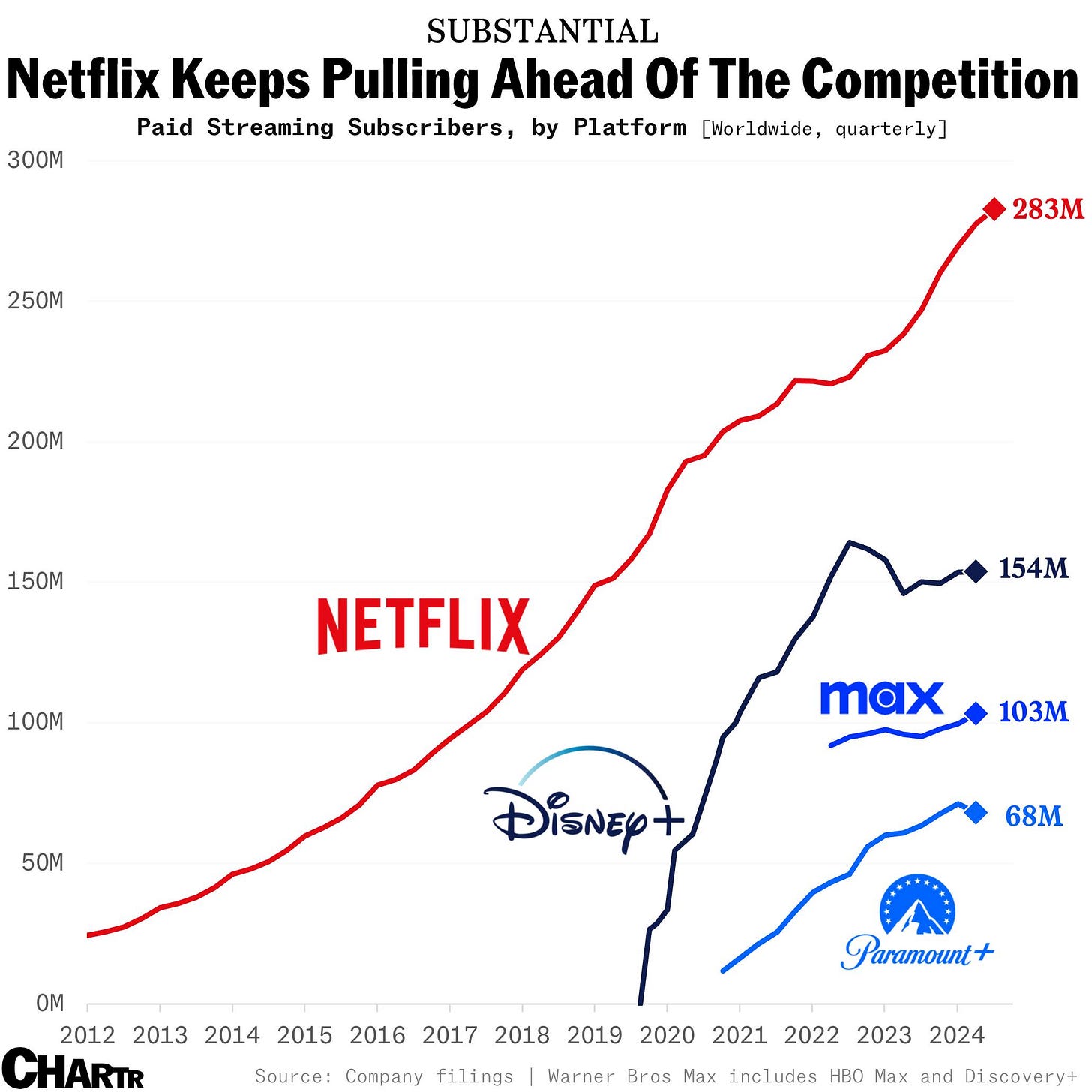

The numbers tell the story of Netflix’s dominance. Today, Netflix boasts a staggering 283 million global subscribers, leaving competitors like Disney+ (154M), HBO Max (103M), and Paramount+ (68M) in the dust. The chart below illustrates Netflix’s unparalleled growth trajectory compared to its peers.

While competitors have struggled with profitability and churn, Netflix has not only maintained its lead but also continued to innovate. Its introduction of an ad-supported tier and a crackdown on password sharing have been transformative, driving subscriber growth and bolstering its profitability.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

Financial Strength: A Closer Look

Netflix’s recent earnings report highlights just how strong the company has become. Profits surged by 41% year-over-year, driven by smart strategic pivots. The introduction of new revenue streams, like an ad-supported tier, and measures like cracking down on password sharing have not only boosted revenue but also expanded its reach to cost-conscious consumers.

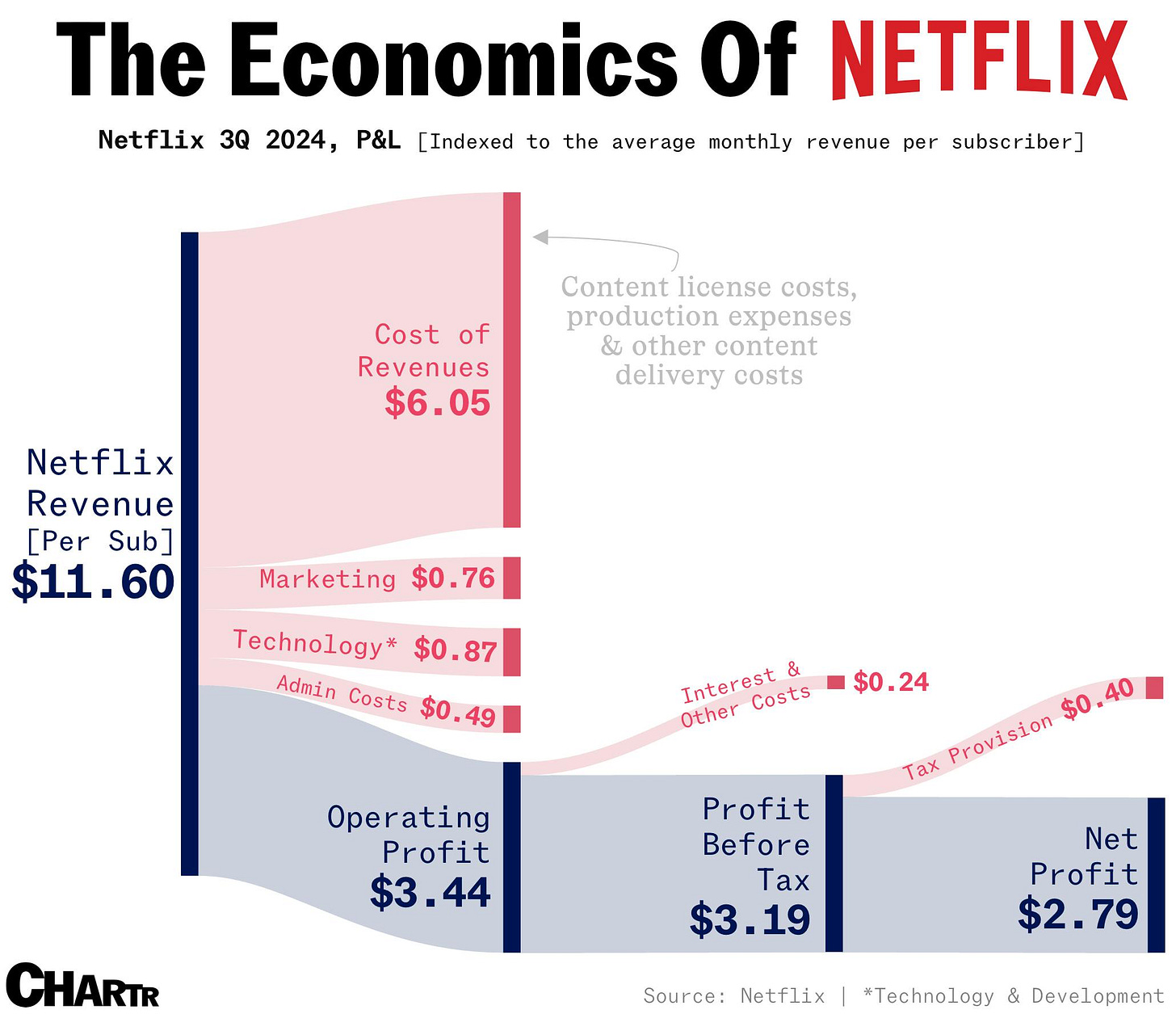

What’s more, Netflix is now more profitable than ever on a per-subscriber basis. As illustrated in the chart below, the company generates $3.44 in operating profit for every $11.60 in revenue per subscriber. This remarkable profitability is a testament to Netflix’s efficient cost management and ability to maximize value.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

The Flywheel Effect

Netflix’s success is no accident—it’s the result of a carefully engineered business model. The company often references its flywheel effect, a virtuous cycle where increased profitability enables reinvestment into high-quality content. This, in turn, attracts more subscribers and enhances engagement, further fueling growth and profitability. Today, this flywheel is spinning faster than ever, driving Netflix’s continued dominance.

Netflix’s Market Value Surges

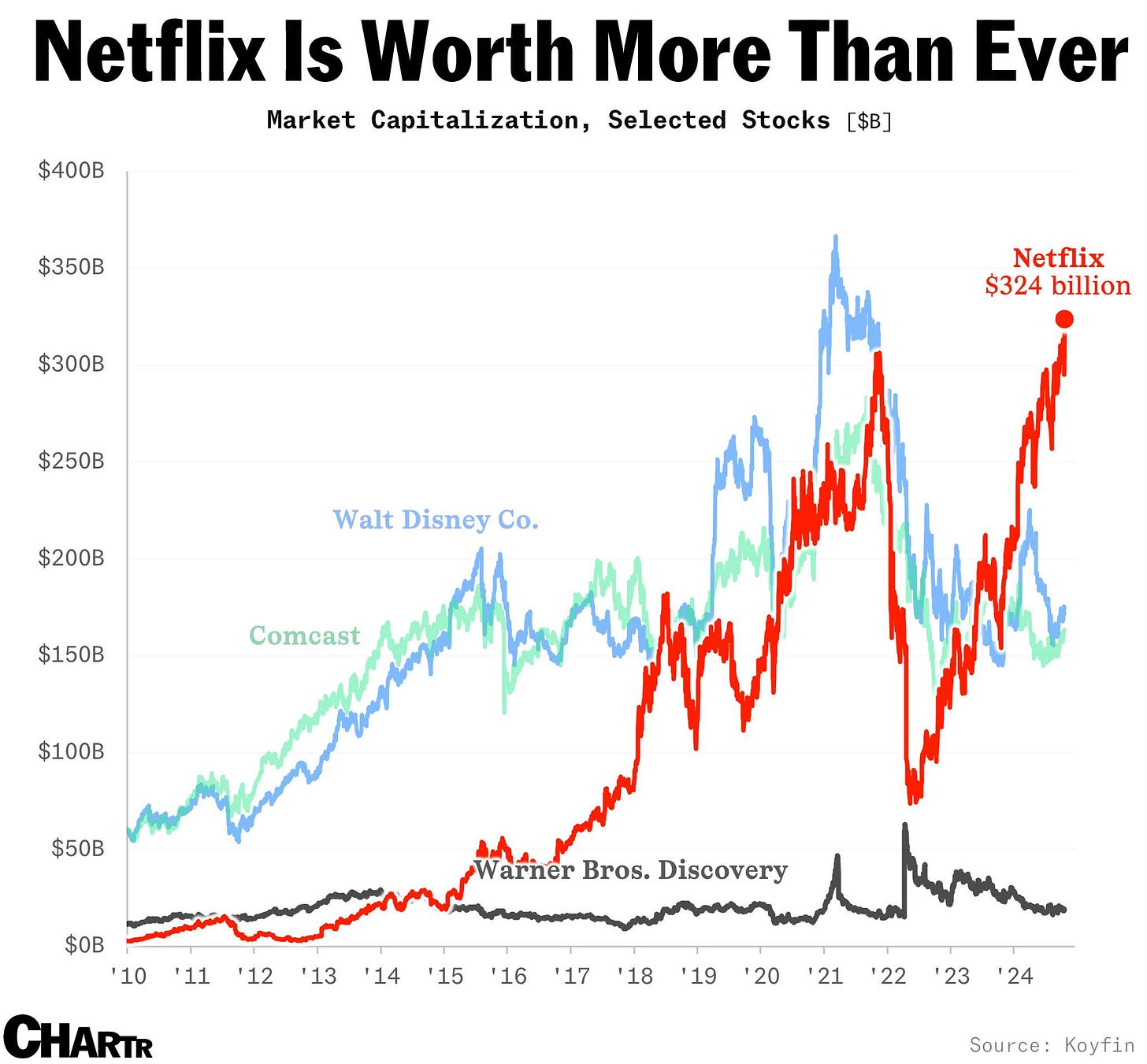

Netflix’s leadership isn’t just reflected in subscriber numbers—it’s evident in its valuation. Today, Netflix’s market capitalization stands at $324 billion, its highest ever. For comparison, Walt Disney Co., a formidable rival, trails far behind at $154 billion.

This incredible growth in market value underscores Netflix’s strategic excellence. By consistently outperforming competitors, the company has secured its position as a dominant force in global entertainment, earning the confidence of investors worldwide.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

Lessons for Investors

Netflix’s story offers a timeless lesson: short-term narratives can obscure long-term fundamentals. Back in 2022, the market was consumed by fears of competition and subscriber losses. What was overlooked? Netflix’s massive content library, global reach, and proven ability to adapt.

For savvy investors, moments like these are golden opportunities. Netflix’s recovery and subsequent rise highlight the value of patience and the importance of focusing on a company’s core strengths rather than getting swept up in market panic.

“Be fearful when others are greedy, and greedy when others are fearful.”

- Warren Buffett

Netflix’s ability to lead the streaming industry while innovating and expanding into new markets, like live sports, makes it clear that the company’s best days are still ahead. While competitors grapple with challenges, Netflix continues to set the pace, proving that it isn’t just a streaming company—it’s an entertainment empire.

For investors and industry watchers alike, Netflix serves as a reminder that resilience, innovation, and strategic foresight are the ultimate keys to success.

Thank you for reading! If you found this analysis valuable, share it with others who might benefit. Spread the insights and let’s grow the conversation together!

Final Thoughts

If you’re intrigued by Netflix’s incredible journey and the principles that have driven its success, I highly recommend reading No Rules Rules: Netflix and the Culture of Reinvention by Reed Hastings, Netflix’s co-founder and former CEO. The book provides an insider’s perspective on the innovative culture and unconventional strategies that have propelled Netflix to the forefront of the entertainment industry.

You can grab your copy here: [Buy on Amazon]

It’s a must-read for anyone interested in leadership, innovation, or simply understanding how Netflix became the streaming giant it is today.

Until next time,

Jimmy