NVIDIA ($NVDA) Stock Analysis: A Deep Dive Into Its Future Growth Potential and Market Dominance

📬 Discover why NVIDIA is positioned as a leader in AI, data centers, and GPUs, and what it means for long-term investors

Hi, Investor 👋

I’m Jimmy, and welcome to another edition of our newsletter. Today, we’re diving deep into the business model, financial performance, and future potential of NVIDIA ($NVDA) – a trailblazing company that has redefined the technology landscape. From powering the latest advancements in AI and machine learning to dominating the GPU market for gaming and data centers, NVIDIA stands as one of the most innovative and influential players in today’s market.

In case you missed it, here are some recent insights:

What if I were a Portfolio Manager? Stellar Capital Management 🛰️

Netflix (NFLX): When the Market Overreacts, Opportunity Knocks

Nubank (NU): Redefining Banking in Latin America - A High-Growth Investment Opportunity

Subscribe now and never miss a single report:

Industry Overview

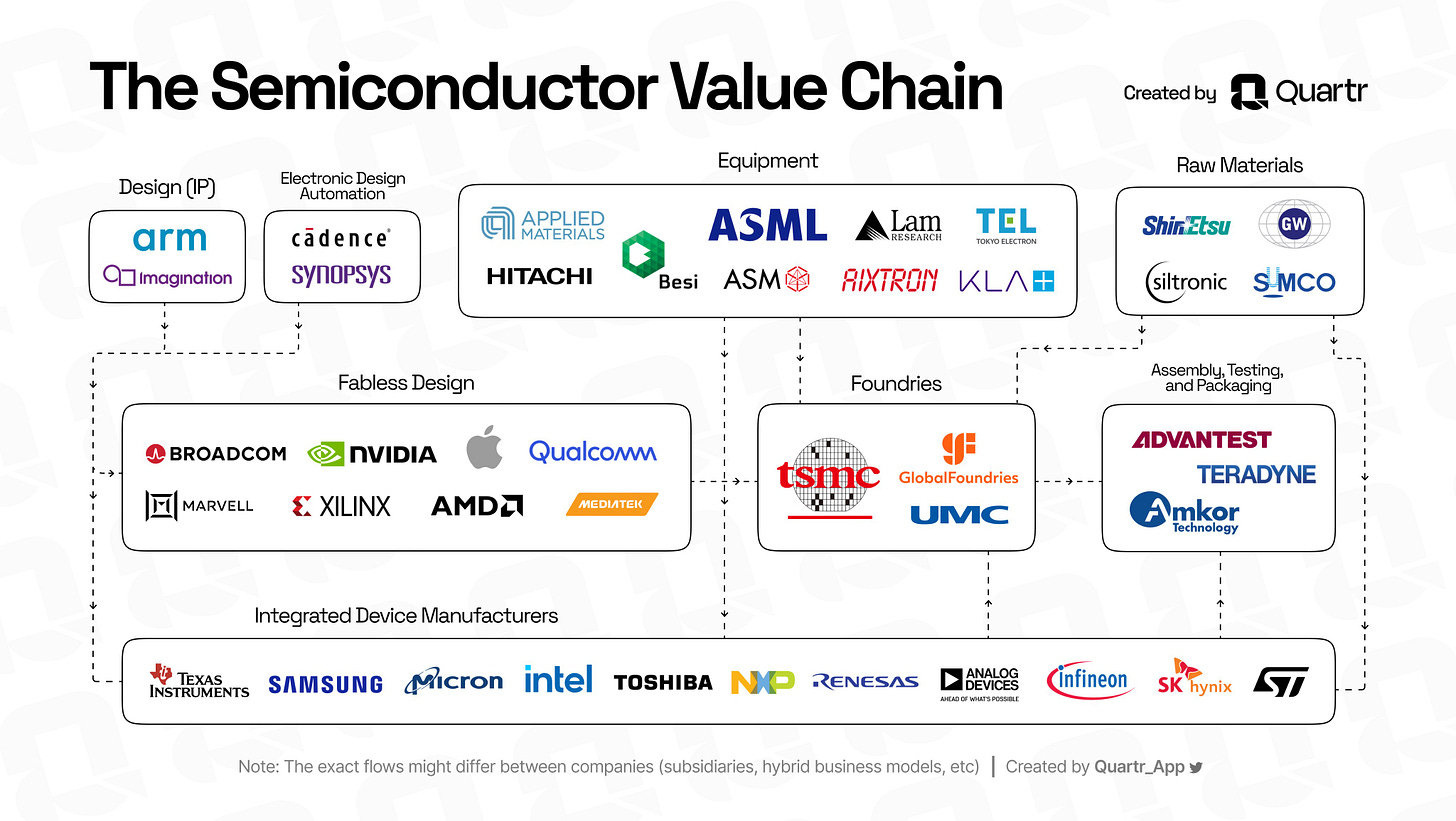

The semiconductor industry is a highly intricate and interconnected ecosystem, where different companies specialize in various stages of chip design, production, and deployment.

“It is better to specialize in what you do best and trade for the rest, rather than trying to do everything yourself.” - David Ricardo (1772-1823)

The value chain includes the following key segments:

Design (IP) and Electronic Design Automation (EDA):

Companies like Arm and Imagination create the intellectual property (IP) that forms the foundation of semiconductor chips.

Cadence and Synopsys provide software tools for designing, simulating, and testing semiconductor components, enabling accurate chip design.

Fabless Design:

Fabless companies like NVIDIA, AMD, Qualcomm, and Broadcom design chips but do not manufacture them. NVIDIA plays a crucial role here, focusing on GPUs and AI accelerators, which are vital for gaming, data centers, and AI workloads.

These companies rely on foundries to fabricate their designs.

Foundries:

Manufacturers like TSMC, GlobalFoundries, and UMC handle the physical fabrication of chips. NVIDIA, for example, partners heavily with TSMC for its high-performance GPUs.

Equipment Providers:

Companies such as ASML, Applied Materials, and Lam Research supply the advanced machinery and tools required for semiconductor manufacturing, including lithography and etching.

Raw Materials:

Suppliers like Shin-Etsu and Siltronic provide essential materials such as silicon wafers, which are the foundation of semiconductor fabrication.

Assembly, Testing, and Packaging:

Firms such as Advantest and Amkor Technology handle the final steps, ensuring chips are functional and packaged for use.

Integrated Device Manufacturers (IDMs):

Companies like Intel, Samsung, and Micron manage both design and manufacturing, integrating multiple stages of the value chain.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

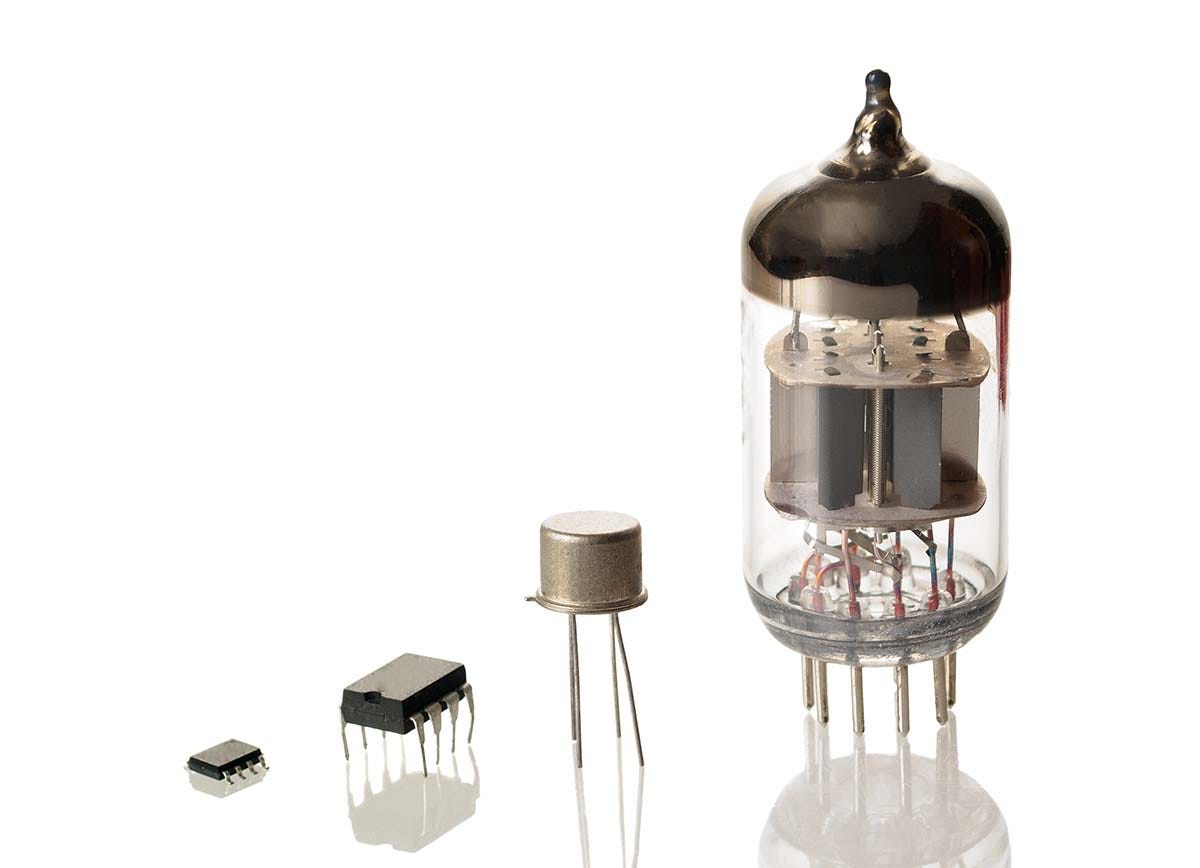

The Evolution of Semiconductors: From Vacuum Tubes to GPUs

The evolution of semiconductors is a remarkable story of innovation, starting with the invention of vacuum tubes and culminating in the sophisticated graphics processing units (GPUs) that power today’s digital landscape. Tracing this journey helps illustrate the critical role NVIDIA plays in the semiconductor ecosystem.

Vacuum tubes, introduced in the early 20th century, were the first devices capable of amplifying electrical signals. These devices were essential for early radios, televisions, and computers, but they were far from ideal due to their large size, fragility, and high energy consumption. These challenges prompted the search for smaller and more efficient alternatives, ultimately giving rise to semiconductors.

The turning point came in 1947 when John Bardeen, Walter Brattain, and William Shockley at Bell Labs invented the transistor. This revolutionary component replaced vacuum tubes by offering a smaller, more durable, and energy-efficient solution. The invention of the transistor paved the way for integrated circuits (ICs), which brought multiple transistors and other electronic components together on a single silicon chip, enabling significant advancements in electronics.

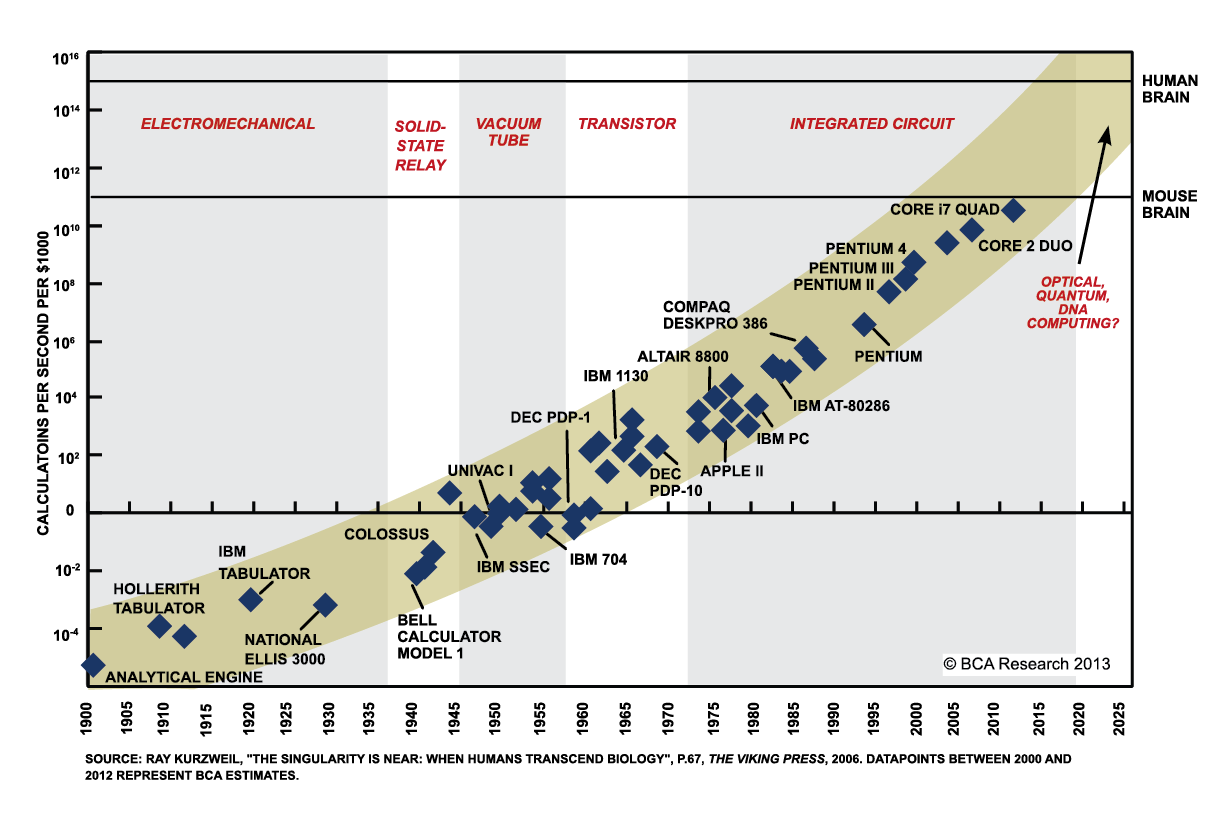

In the 1970s, the invention of the microprocessor, or central processing unit (CPU), transformed the semiconductor industry yet again. By packing thousands of transistors onto a single chip, microprocessors enabled complex computations and drove the rapid expansion of the personal computer market. This innovation laid the foundation for the development of countless modern electronic devices.

During this period, Moore’s Law, proposed by Intel co-founder Gordon Moore, became a guiding principle for the semiconductor industry. Moore predicted that the number of transistors on a chip would roughly double every two years, leading to exponential improvements in performance and reductions in cost. This observation not only drove the industry’s relentless pace of innovation but also set expectations for the capabilities of modern processors, including CPUs and GPUs.

As technology progressed, the rise of graphical applications brought new challenges, as CPUs struggled to meet the growing demands for processing visual data. This led to the creation of the graphics processing unit (GPU), a specialized chip designed to handle the intensive computational requirements of rendering complex images and animations. GPUs became a game-changer, enabling more efficient visual processing and powering advancements in fields ranging from gaming to artificial intelligence.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

The History of NVIDIA ($NVDA):

Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, NVIDIA Corporation has played a pivotal role in the GPU industry. The company revolutionized graphics processing with the introduction of the world's first GPU, the GeForce 256, in 1999.

Over the years, NVIDIA has expanded its influence beyond gaming, entering industries such as artificial intelligence, data centers, and autonomous vehicles.

📟 1990’s:

NVIDIA began as a graphics chip company, releasing its first product, the NV1, in 1995, and later the GeForce 256, the first GPU with hardware transform and lighting. In 1999, it went public on NASDAQ ($NVDA).

🗄️ 2000’s:

The company grew its presence in PC gaming, launching the first GPU for notebooks and becoming Microsoft’s partner for the Xbox. NVIDIA also acquired 3dfx and entered the motherboard chipset market.

🔎 2006:

NVIDIA introduced CUDA, enabling general-purpose parallel computing, which opened new opportunities in AI and scientific research.

🖥️ 2007-2010s:

The launch of Tesla GPUs marked NVIDIA’s entry into high-performance computing (HPC) and data centers, while Apple adopted NVIDIA GPUs for MacBooks.

🧠 2010’s:

NVIDIA became a leader in AI and deep learning, introducing Tensor Cores with the Volta architecture to accelerate deep-learning workloads.

🌐 2010’s-Present:

NVIDIA expanded into new markets like automotive, robotics, and edge computing with platforms such as NVIDIA DRIVE and Jetson. Its data-center-focused architectures, like Pascal, Turing, and Ampere, solidified its leadership in AI and HPC.

Today, NVIDIA is a dominant force in GPU technology, excelling in AI, data centers, and autonomous systems, driven by continuous innovation and market expansion.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

NVIDIA’s Business Overview

Key Executives:

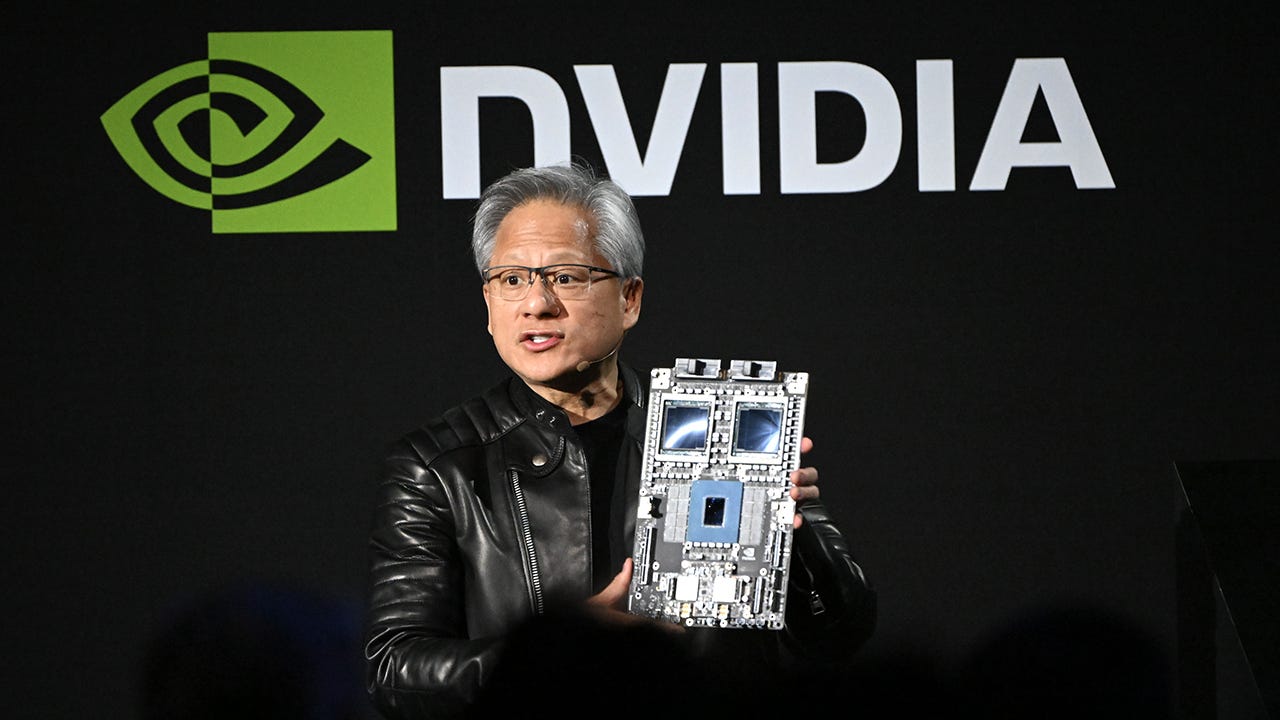

NVIDIA's success is deeply tied to the vision and expertise of its leadership team, led by Jensen Huang, the company’s co-founder and CEO. Huang has been at the helm since NVIDIA’s inception in 1993, steering it from a graphics hardware startup to a global leader in AI, gaming, and data center technology.

Known for his innovative vision and hands-on approach, Huang has consistently positioned NVIDIA at the forefront of technological breakthroughs, including advancements in GPUs, AI, and autonomous systems.

Supporting Huang is Colette Kress, NVIDIA's Executive Vice President and Chief Financial Officer, who oversees the company’s financial strategy and operations. Kress joined NVIDIA in 2013, bringing decades of experience from leading roles at Microsoft and Cisco.

Another key leader is Jeff Fisher, Senior Vice President of the GeForce business. Fisher plays a pivotal role in maintaining NVIDIA’s dominance in the gaming and consumer GPU markets, driving innovation in products like the GeForce RTX series.

Finally, Debora Shoquist, Executive Vice President of Operations, oversees the company’s global supply chain and manufacturing.

Revenue Streams:

NVIDIA’s revenue streams are divided into five major markets: Data Center (85%), Gaming (9%), Professional Visualization (3%), Automotive (2%), and OEM & Others (1%). These markets are categorized into two operating segments: Compute & Networking and Graphics.

1. Compute & Networking Segment

This segment powers cutting-edge computing solutions for industries like AI, autonomous driving, and robotics. It includes:

Data Center Solutions: Accelerated computing platforms with GPUs, DPUs, and CPUs, supported by the CUDA programming model and an extensive suite of software and tools.

Automotive: AI Cockpits, autonomous driving systems, and electric vehicle computing platforms.

Robotics & Edge Computing: Jetson embedded platforms for robotics and other applications.

Software: NVIDIA AI Enterprise for AI applications and other specialized software.

Crypto Mining: Cryptocurrency Mining Processors (CMP).

2. Graphics Segment

Focused on gaming, professional visualization, and virtual computing, this segment includes:

Gaming: GeForce GPUs for PCs and laptops, GeForce NOW for cloud gaming, and game console development.

Professional Visualization: NVIDIA RTX GPUs for enterprise, virtual GPU (vGPU) software for cloud-based computing, and Omniverse Enterprise for 3D and metaverse applications.

Automotive Infotainment: Solutions for in-car entertainment systems.

Key Revenue Drivers

Data Center

NVIDIA’s Data Center business leads its revenue, driven by demand for GPUs in AI, data analytics, and high-performance computing. Recent innovations include the Hopper-based GPU (H100), featuring a Transformer Engine designed for AI model training, and the Grace CPU, tailored for AI and HPC needs.

Due to the AI boom, data centers have been responsible for nearly 100% of the company's recent revenue growth. In 2022, this segment accounted for ~42% of NVIDIA's net revenue, totaling $3.7 billion. Today, it represents an astonishing ~85% of the company’s revenue, reaching $30.7 billion as of Q3 FY24.

Gaming

Gaming remains a vital revenue pillar for the company, although it is far less significant than in the past. NVIDIA offers GeForce RTX GPUs and innovative solutions like the GeForce RTX 40 Series, powered by the Ada Lovelace architecture, which boosts gaming performance by up to 4x compared to previous generations.

Professional Visualization

This market caters to industries like design, manufacturing, and content creation. Solutions like NVIDIA Omniverse enable collaboration in virtual environments, with applications ranging from architectural walkthroughs to surgical training.

Automotive

NVIDIA’s Automotive division focuses on AI systems for autonomous vehicles and infotainment platforms. The DRIVE Hyperion platform provides end-to-end solutions for self-driving systems, leveraging NVIDIA GPUs for deep learning and control systems.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

Contrary to what many might think, NVIDIA does not manufacture its own chips. Instead, its expertise lies in designing and developing the intelligence behind its processors, including the architectures and software that make its products so advanced.

The physical production of these chips is outsourced to specialized semiconductor manufacturers, such as TSMC (Taiwan Semiconductor Manufacturing Company), a global leader in the industry and the primary producer of NVIDIA’s chips.

This approach allows NVIDIA to focus on innovation and technology while relying on its partners to handle the complexities of large-scale manufacturing.

NVIDIA’s Main Products

Here’s an overview of NVIDIA’s key product categories:

GeForce GPUs:

NVIDIA's GeForce GPUs are designed for gaming and consumer applications, delivering high-performance graphics tailored to gamers. These GPUs include cutting-edge technologies like real-time ray tracing and DLSS (Deep Learning Super Sampling) for immersive gaming experiences. The current lineup, based on the Ampere architecture, features GPUs such as the RTX 3090, RTX 3080, and RTX 3070.

Quadro and NVIDIA RTX GPUs:

Targeted at professionals in industries like media, entertainment, architecture, and engineering, Quadro and NVIDIA RTX GPUs deliver advanced graphics capabilities, reliability, and certified drivers optimized for professional applications. These GPUs are widely used in design, content creation, and scientific visualization.

Tesla and A100 GPUs:

Built for data centers, high-performance computing (HPC), and AI workloads, Tesla and A100 GPUs provide exceptional performance and efficiency for tasks such as deep-learning training, financial modeling, and scientific simulations. The latest A100 GPU, based on the Ampere architecture, includes third-generation Tensor Cores, Multi-Instance GPU (MIG) technology, and up to 80 GB of high-bandwidth memory (HBM2e).

H100 Tensor Core GPU:

Based on NVIDIA's Hopper architecture, the H100 GPU introduces a Transformer Engine designed to significantly accelerate AI model training. Hopper Tensor Cores utilize mixed FP8 and FP16 precisions for faster computations and offer up to three times the floating-point operations per second (FLOPS) for various precisions compared to previous generations. This GPU is optimized for high-performance computing (HPC) and AI workloads, offering a massive leap in speed and efficiency.

Competitive Advantages

In the fast-paced world of technology, few companies have managed to maintain such a commanding lead as NVIDIA.

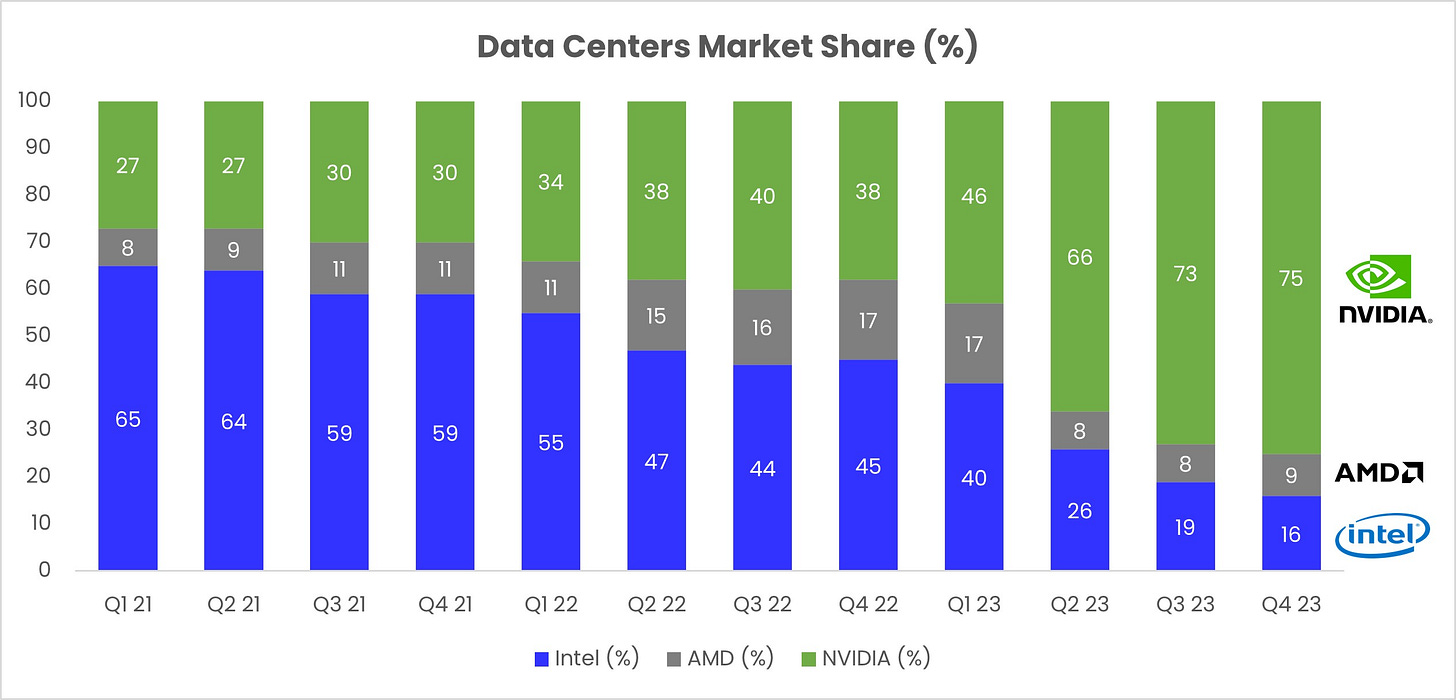

NVIDIA leads the market for discrete GPUs, holding a dominant share of 70%-80%, with AMD and Intel capturing the remaining 20%-30%, primarily in the gaming sector. NVIDIA has several key advantages that set it apart from other semiconductor giants, helping the company maintain its position at the forefront of the GPU and AI industries.

Let's dive into what makes this company a true powerhouse:

Cutting-Edge Graphics Technology: At the core of NVIDIA’s unparalleled success is its mastery of GPU (Graphics Processing Unit) technology. NVIDIA’s GPUs, such as the RTX series, have revolutionized gaming with real-time ray tracing and AI-driven features, offering unmatched visual fidelity and performance. Beyond gaming, these GPUs are indispensable for professionals in fields like 3D rendering, video editing, and scientific visualization, making NVIDIA the gold standard for high-performance computing.

Pioneering AI and Deep Learning: NVIDIA has positioned itself as a cornerstone of the AI revolution. Its GPUs are integral to breakthroughs in artificial intelligence and machine learning, powering cutting-edge innovations in autonomous vehicles, natural language processing, and advanced robotics. Central to this dominance is NVIDIA’s CUDA platform, which provides developers with tools to optimize and accelerate their AI models, reinforcing NVIDIA’s leadership in both AI hardware and software.

Dominance in Data Centers: While many associate NVIDIA with gaming, its data center business has become even more transformative. NVIDIA GPUs, like the A100 Tensor Core, are now a critical infrastructure component for cloud computing and big data. These GPUs enable rapid data processing, simulation, and analytics for applications spanning scientific research, enterprise solutions, and more. This prowess ensures NVIDIA remains the top choice for cloud service providers and enterprises requiring peak computational power.

Strategic Expansion Through Acquisitions: NVIDIA’s strategic acquisitions, such as Mellanox Technologies, illustrate its vision to extend beyond traditional GPU markets. By integrating networking and high-performance computing technologies, NVIDIA has expanded its influence into adjacent markets, from interconnect solutions to AI-driven data centers. These moves not only diversify its offerings but also position NVIDIA as an indispensable player in future computing ecosystems.

Building an Ecosystem and Brand Loyalty: NVIDIA has cultivated a thriving ecosystem that fosters deep customer loyalty. Through its software platforms like NVIDIA Studio and GeForce Experience, as well as its cutting-edge hardware solutions, the company ensures seamless integration and performance for gamers, creators, and researchers alike. This interconnected ecosystem creates a strong competitive moat, making it difficult for competitors to attract users away from NVIDIA’s platform.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

CUDA: Powering Parallel Computing with NVIDIA GPUs

CUDA (Compute Unified Device Architecture) is a powerful parallel-computing platform developed by NVIDIA that allows developers to tap into the full potential of NVIDIA GPUs. It’s designed to speed up computing tasks by offloading intensive computations from the CPU to the GPU, offering a significant performance boost for many applications.

Rather than being its own programming language, CUDA works as an extension to familiar languages like C, C++, and Fortran. This means developers can use their existing skills to write parallel code for GPUs, which is made easier with the set of APIs, libraries, and tools CUDA provides.

In CUDA, code is divided into two parts: host code (which runs on the CPU) and device code (which runs on the GPU). The device code uses special CUDA keywords to manage parallel processing and memory access, which are essential for making the most of GPU power.

A key component of CUDA is its compiler, called nvcc (NVIDIA CUDA Compiler). The nvcc compiler takes CUDA code, splits it into host and device parts, and compiles them separately. The host code is compiled with a standard C/C++ compiler, while the device code is compiled into an intermediate format (PTX) or directly into GPU machine code. This flexibility allows the GPU to optimize and further compile the code during runtime for maximum performance.

CUDA is a game-changer for fields like AI, scientific computing, and data processing, as it empowers developers to create more efficient and faster applications by leveraging the immense parallel processing power of NVIDIA’s GPUs.

Competitors to CUDA in GPU Programming:

ROCm (Radeon Open Compute):

Developed by AMD, ROCm is an open-source platform for GPU computing on AMD GPUs. It includes libraries like MIOpen and rocBLAS, similar to CUDA’s, and supports the HIP programming model, making it easier to port CUDA code to AMD GPUs.OpenCL (Open Computing Language):

OpenCL is an open standard for parallel programming across various processors, supporting GPUs from multiple vendors, including NVIDIA, AMD, and Intel. It uses a C-based language and requires more manual optimizations compared to CUDA.

Jensen Huang, CEO of NVIDIA, often discusses the company’s pivotal role in shaping the future of AI, data centers, and graphics technology. He highlights NVIDIA’s leadership in driving AI advancements and how its GPUs power industries from gaming to autonomous vehicles. Huang also talks about the strategic vision for leveraging cutting-edge technology to stay ahead in an increasingly competitive market.

For more insights, you can watch the interview directly here:

Valuation

1. Total Addressable Market (TAM):

The global data center market is worth approximately $92.9 billion in 2024, fueled by growing demand for cloud computing, big data analytics, and artificial intelligence (AI).

According to Straits Research, this market is set to expand at an impressive compound annual growth rate (CAGR) of 18.8% from 2024 to 2032, potentially reaching nearly $400 billion by the end of the forecast period. Key drivers of this growth include surging internet traffic, the rollout of 5G networks, and the rapid adoption of AI-powered technologies across industries.

AMD’s projections are even more optimistic, forecasting that the data center market could reach $400 billion as early as 2027, with a staggering CAGR of 34.5%. This contrasts with the more conservative outlook from MarketsandMarkets, which estimates the market will grow to $311 billion by 2029, driven by a 19.8% CAGR. While AMD’s forecast represents an aggressive growth scenario, both projections underscore a common theme: the data center market is poised for robust expansion, reaffirming its pivotal role in enabling the ongoing digital transformation.

2. Competitive Dynamics and Market Share

NVIDIA’s early entry into the AI GPU market has proven transformative, providing the company with a significant head start over competitors like AMD and Intel. By establishing itself early, NVIDIA was able to build a strong foundation, shaping the industry and securing a leadership position that continues to expand. As of Q1 2024, the company commands an impressive 88% share of the GPU market, up from 80% a year earlier—a clear testament to its ability to outpace the competition and maintain its edge in a rapidly evolving landscape.

If NVIDIA maintains its current market share—not just in GPUs, but in the broader data center space—it could generate annual revenues of up to $300 billion by 2029. This projection assumes that NVIDIA continues to lead in providing the computational power required for AI, big data analytics, and other high-performance workloads that are critical to modern data centers.

The other segments are important mainly due to the synergies in development with the GPU/data center business. However, they represent a small portion of the total, and we expect modest CAGRs for the coming years. In our view, the big trend to watch will continue to be the data centers—despite all the innovations happening in gaming and automotive.

3. Main Assumptions

Fueled primarily by the growth of its data center business, NVIDIA’s net margin is projected to climb to approximately 35% by 2029. With an anticipated net revenue of $340 billion across all segments, this translates to an estimated net profit of $119 billion.

Historically, NVIDIA’s stock has traded at an average price-to-earnings (P/E) multiple of 35x over the past 15 years. While the company’s recent acceleration in growth and improved margins might justify a higher multiple, adopting such a projection comes with risks. Factors like the rising cost of capital, potential market competition, margin pressures, and a likely moderation in growth rates by 2029 make a more conservative approach prudent.

Applying the long-term average P/E multiple of 35x yields a valuation of $4.2 billion ($170 per share). This represents a notable 20.4% upside compared to the current market valuation of $3.4 billion ($140 per share).

Our sensitivity matrix tests several combined scenarios between net margin and P/E multiple for 2029. The net margin ranges from 30% to 40% - quite feasible in my opinion. The P/E multiple, on the other hand, also varies, but between a maximum of 45x and a minimum of 25x. In these scenarios, the best-case outcome would result in a stock price of $250 per share, representing a +77% upside, while the worst-case scenario would be $104, reflecting a -26% downside.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

Conclusions

Nvidia’s competitive advantages are undeniable. With its dominant position in the GPU market, leadership in AI, and stronghold in data centers, the company has cemented its role as a central player in the future of technology. Its business model is robust, with diversified revenue streams spanning gaming, professional visualization, AI, and data centers, all while fostering brand loyalty through an expansive ecosystem.

While the projected 20% upside based on a 35x P/E multiple might seem modest, it still represents an attractive return for a company that is not only solid but also completely dominant in its segment. The growth rates Nvidia is experiencing, particularly in AI and data centers, make it a compelling choice for investors seeking exposure to high-growth industries. Despite the potential for increased competition and margin pressures, Nvidia's entrenched position and forward-looking strategy provide a solid foundation for continued success.

“It’s better to buy a wonderful company at a fair price than a fair company at a wonderful price.” - Warren Buffett

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.

My fair value estimate is close. 37 P/E (20 years average) x 3.93 NTM EPS = 145.