Quick Pitch #1: LVMH and its Monopoly-Like Assets

LVMH's Investment Thesis: the Crown Jewel of the luxury goods industry...

Hi, Investor 👋

I’m Jimmy, and welcome to another free edition 🔓 of our newsletter. Today, we’re diving into one of the most iconic companies in the world of luxury: LVMH, the global leader that has redefined elegance and exclusivity.

Enjoy the insights! And if it resonates, don’t forget to share it with friends and fellow investors.

In case you missed it, here are some recent insights:

I'm Buying Uber. Here's Why: Uber Technologies, Inc. ($UBER) Deep Dive

NVIDIA (NVDA) Stock Analysis: A Deep Dive Into Its Future Growth Potential and Market Dominance

How to Define the Total Addressable Market (TAM): Uber's Case Study

Upgrade to paid now and never miss a single report:

1. Industry Overview: The Resilient Allure of Luxury Goods

The luxury goods industry stands as one of the most dynamic and resilient sectors globally, characterized by its ability to consistently outperform broader markets. Luxury companies operate in a high-margin environment, driven by exclusivity, exceptional craftsmanship, and heritage-rich branding.

Over the last five years (2017–2022), the luxury segment delivered a 100.6% total shareholder return, far outpacing the premium (51.7%) and mass-market segments (5.1%). Even amidst macroeconomic headwinds, luxury goods EBIT margins rose to 17.1% in 2022, showcasing the sector's robust profitability.

Key drivers include the expanding global middle class and a rising number of affluent consumers. Asia, particularly China, has emerged as a pivotal market, fueled by aspirational buyers seeking status-defining luxury products.

Millennials and Gen Z, now accounting for 63% of luxury spending, are reshaping the landscape with their preference for sustainability and experiential consumption. Consolidation among luxury giants, led by LVMH, has further solidified the dominance of a few key players in this lucrative space.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

2. LVMH’s History: Building an Empire of Elegance

LVMH (Louis Vuitton Moët Hennessy) was officially formed in 1987 through the merger of (i) Louis Vuitton, a luxury fashion house founded in 1854, and (ii) Moët Hennessy, a leading producer of champagne and cognac.

However, the company’s legacy stretches centuries, encompassing some of the world’s most storied brands. Louis Vuitton revolutionized travel with its durable, flat-topped trunks, while Moët & Chandon and Hennessy brought their rich heritages in fine champagne and cognac.

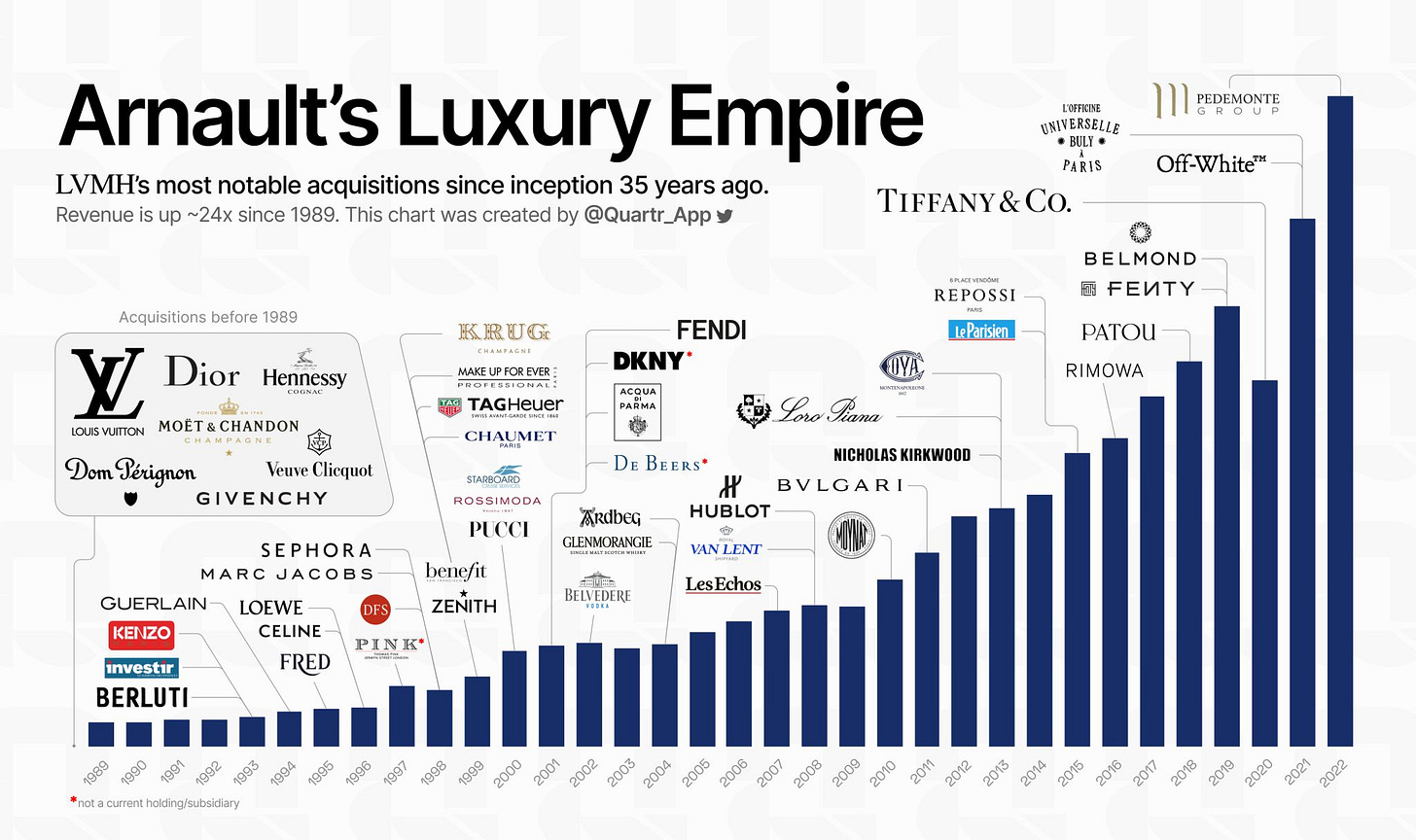

Under the leadership of Bernard Arnault, who joined as chairman and CEO in 1989, LVMH expanded into a global powerhouse. Today, the conglomerate oversees 75 “Maisons,” operates over 5,500 stores, and employs more than 175,000 people worldwide.

Iconic acquisitions such as Christian Dior, Bulgari, and Tiffany & Co. have added to its prestige and financial strength, with the company consistently outperforming its peers in profitability and growth. Monopoly-Like Assets.

Buy me a coffee and enjoy exclusive insights and premium analyses delivered straight to your inbox!

3. Bernard Arnault: A "Founder’s Mindset" at Scale

Bernard Arnault, the architect of LVMH’s modern success, embodies a Founder’s Mindset—a relentless focus on growth, innovation, and long-term value creation. Arnault sees LVMH not merely as a corporation but as a steward of cultural heritage, charged with preserving and elevating its brands.

Arnault has been instrumental in transformative acquisitions like Tiffany & Co., Bulgari, and Christian Dior. He ensures that each Maison maintains its distinct identity while benefiting from the scale and expertise of the broader LVMH network.

Arnault’s strategic vision has also driven digital transformation and sustainability initiatives, keeping LVMH at the forefront of industry innovation.

In his words,

“When you run a luxury business, you are not just selling products; you are selling timeless excellence.” - Bernard Arnault

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

4. Business Model: Diversification and Excellence

LVMH operates across five key segments: (i) fashion and leather goods, (ii) perfumes and cosmetics, (iii) watches and jewelry, (iv) wines and spirits, and (v) selective retailing.

This diversification reduces risk and ensures steady growth even during economic downturns. Each segment is anchored by world-class brands:

Fashion and Leather Goods: the crown jewel of LVMH, this segment includes Louis Vuitton and Christian Dior. Louis Vuitton operates entirely through fully owned stores, ensuring pristine brand control and premium pricing power.

Watches and Jewelry: with Bulgari and the recently acquired Tiffany & Co., LVMH is well-positioned in this high-growth, high-margin market.

Perfumes and Cosmetics: iconic brands like Christian Dior and Guerlain, combined with innovative ventures like Fenty Beauty, give LVMH a strong foothold in this competitive sector.

Wines and Spirits: dominated by Moët & Chandon, Dom Pérignon, and Hennessy, this segment benefits from LVMH’s leadership in premium champagne and cognac markets.

Selective Retailing: through Sephora and DFS, LVMH extends its reach to beauty retail and travel retail, leveraging its exclusive access to in-house and partner brands.

Enjoying the content? Upgrade to our paid subscription for exclusive insights and premium analyses delivered straight to your inbox!

5. Competitive Advantages:

Scale:

LVMH’s competitive edge lies in its ability to combine the exclusivity of luxury with the efficiency of scale. Fully integrated supply chains, in-house manufacturing, and direct-to-consumer distribution allow LVMH to maintain control over quality and pricing while optimizing costs.

Brand Equity:

The company’s brand equity is unparalleled. Louis Vuitton, for instance, is a global icon with over 100 years of history, and its products are never discounted, reinforcing their desirability and premium status. Meanwhile, the acquisition of Tiffany & Co. has revitalized the American jeweler through fresh collections, store refurbishments, and a renewed focus on exclusivity.

LV has increased the price of its LV Speedy bag by 5% yearly over more than 40 years. That’s brand equity.

Innovation:

LVMH also excels in innovation, with initiatives ranging from digital marketing to sustainability. Its Sephora division, for example, has leveraged data analytics and exclusive partnerships to enhance customer experiences, setting a benchmark for luxury retail.

Enjoying the content? Upgrade to our paid subscription for exclusive insights and premium analyses delivered straight to your inbox!

6. Stock -30% since 2023: what are the investors’ concerns?

LVMH’s stock is now down approximately 30% from its April 2023 ATH. Recent updates, particularly the Q3 2024 trading results, underscore why investor sentiment has soured.

In Q3, LVMH reported a 3% decline in organic sales, underperforming expectations and marking a slowdown from Q2’s 1% growth. The fashion and leather goods (F&LG) division, a key profit driver, fell by 5%—its first significant drop since 2009—largely due to a sharper-than-expected decline in Chinese consumer demand.

Previously growing at mid-to-high single digits, Chinese mainlander spend is now down mid-single digits, according to management.

Other regions also showed muted performance, with Japan’s growth decelerating sharply from 57% in Q2 to 20% in Q3. LVMH’s CFO described the current environment as more “demand-driven than supply-driven,” reflecting fatigue in pricing strategies and a maturing luxury market after a decade of strong growth.

While segments like wines and spirits (W&S) and perfumes and cosmetics (P&C) remained stable, they also showed signs of softer demand, and a turnaround at Tiffany & Co. helped offset declines in watches and jewelry.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

7. Valuation and Future Prospects:

The declining sales and tougher backdrop have prompted analysts to revise their forecasts. For 2024 and beyond, EBIT estimates have been reduced by 8%, reflecting ongoing deleverage in LVMH’s divisions.

The company’s profitability is further pressured by elevated investment levels from prior years, limiting its ability to absorb declining sales through cost reductions.

LVMH currently trades at 23x P/E on 2025E earnings estimates, above the sector average of 19.6x.

According to Bloomberg consensus projections, the company is expected to deliver approximately £86 billion in revenue for 2025E, indicating modest growth compared to 2024. Margins are anticipated to remain under pressure, with EBIT forecasted at £21 billion, translating to a ~24% margin—down from 26.5% in FY2023.

Buy me a coffee and enjoy exclusive insights and premium analyses delivered straight to your inbox!

8. LVMH’s Investment Thesis:

Despite these headwinds, LVMH’s long-term prospects remain compelling. The company’s diversified portfolio, market leadership, and strong brand equity position it to navigate cyclical downturns effectively.

Unmatched Brand Power: LVMH leads global luxury with brands like Louis Vuitton, Dior, and Sephora. Its vertical integration ensures control, pricing power, and high margins, maintaining its edge despite short-term challenges.

Founder’s Mindset: Bernard Arnault’s leadership combines heritage preservation with innovation. Strategic acquisitions, like Tiffany & Co., and disciplined execution ensure LVMH’s resilience and adaptability.

Long-Term Growth Potential: while demand in key markets like China has softened, rising global affluence and expansion in underpenetrated regions position LVMH for sustained growth.

Attractive Valuation: trading at 23x P/E on 2025E earnings, LVMH offers modest growth to £86 billion in revenue and ~24% EBIT margins, creating a solid entry point for a premium leader.

In the words of Coco Chanel,

“Fashion changes, but style endures.”

The same can be said for LVMH, making it an unparalleled investment opportunity in the luxury goods space.

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.

Agree