The Next LatAm's 10-Bagger. VTEX ($VTEX) Deep Dive

Building the foundations of enterprise e-commerce for global growth...

Hi, Investor 👋

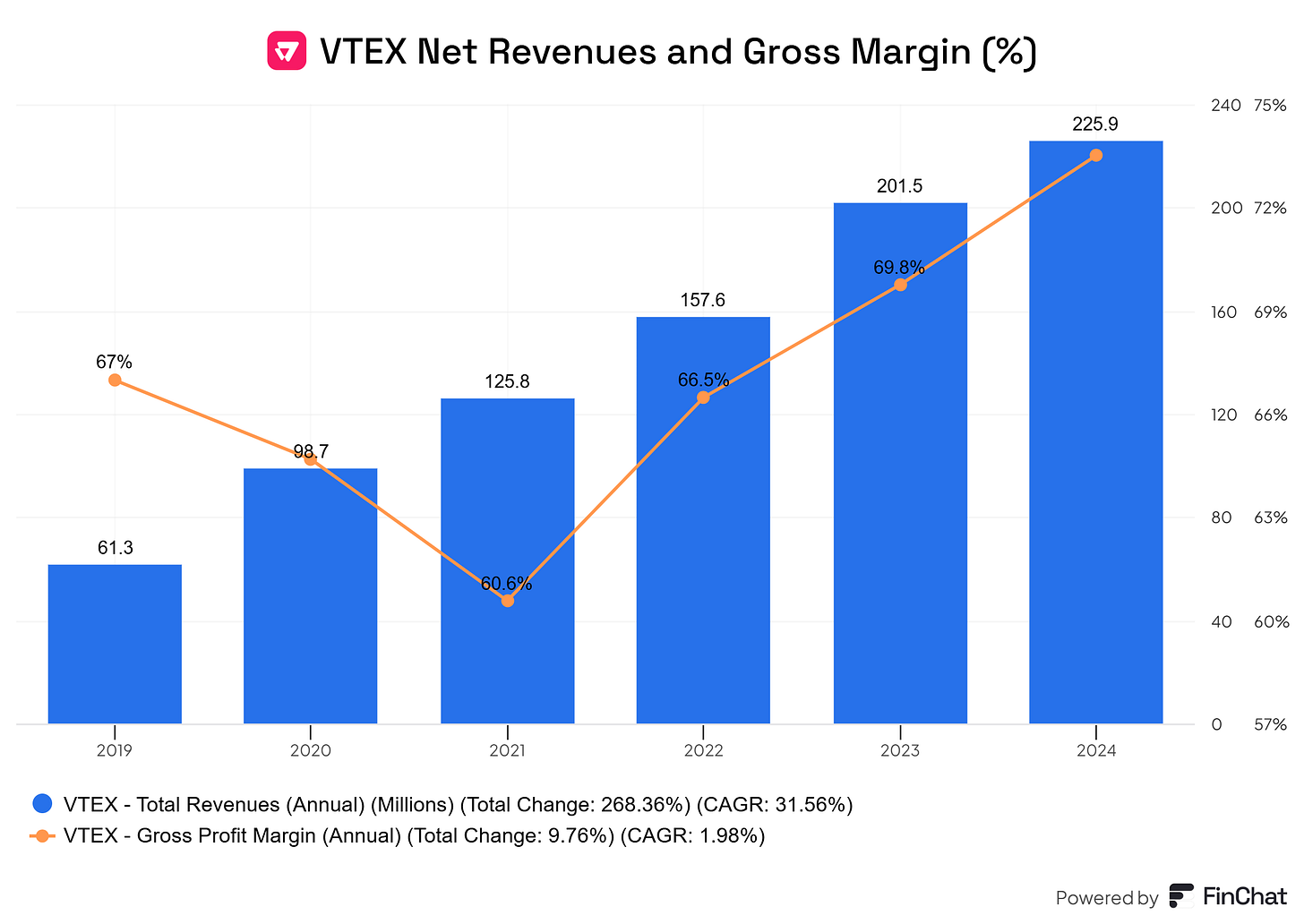

Hi, I’m Jimmy, and welcome to another edition of our newsletter! Today, we’re diving deep into VTEX ($VTEX) – a fast-growing ecommerce platform that’s changing the way businesses sell online. We’ll explore why it’s a company worth keeping an eye on for the long haul, especially as ecommerce continues to thrive worldwide.

Hope you enjoy it! And if you do, don’t forget to share it with your friends.

In case you missed it, here are some recent insights:

I'm Buying Uber. Here's Why: Uber Technologies, Inc. ($UBER) Deep Dive

NVIDIA (NVDA) Stock Analysis: A Deep Dive Into Its Future Growth Potential and Market Dominance

How to Define the Total Addressable Market (TAM): Uber's Case Study

Subscribe now and never miss a single report:

📖 VTEX’s History

Founded in 2000 by Geraldo Thomaz and Mariano Gomide, VTEX began as "Vitrine Textil," a marketplace for the textile industry. With initial investments from connections at Banco Icatu, the duo faced the bursting of the internet bubble, leading them to pivot to freelance web development projects to stay afloat.

Despite significant challenges—including living on minimal income and frequent doubts about their future—they gained expertise in ecommerce by developing websites on a per-hour basis.

The breakthrough came in 2007 when VTEX won a high-stakes bid to develop Walmart’s Brazilian website, defeating better-known competitors despite overwhelming odds. This pivotal project marked the transition of VTEX into a serious ecommerce platform provider.

VTEX’s Evolution (2011–2024)

2011: Merged with WX7, adding expertise and reaching 100 clients. Secured investment from Naspers, fueling platform modernization and regional expansion.

2013: Began international expansion, starting with Argentina.

2015: Naspers exited. Riverwood acquired its stake, providing further growth capital.

2019: Raised USD 140 million in Series C funding from Softbank, Gávea, and Constellation to drive platform improvements and expansion.

2020: Completed a USD 225 million Series D pre-IPO round led by Tiger Global and Lone Pine, valuing the company at USD 1.7 billion.

2021: Went public with an IPO, raising capital to support global growth and cement its position as a leader in enterprise ecommerce platforms.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

👔 Corporate Governance

VTEX’s share structure reflects a dual-class model designed to balance founder control with broad investor participation:

Class A shares, totaling 75.5 million, hold 1 vote per share.

Class B shares, numbering 115.9 million, carry 10 votes each.

This results in a total of 191.4 million shares and a consolidated voting power of 1.23 billion votes.

SoftBank emerges as VTEX’s largest economic stakeholder with 20% ownership, while founders Geraldo Thomaz and Mariano Gomide retain significant influence, commanding 58% of voting power and 38% economic ownership. Riverwood Capital follows with an 11% voting stake and 7% economic interest, and Dynamo, another key player, holds a 13% economic stake but only 2% of voting power.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

📦 Sector Overview:

The global ecommerce market is set to grow from $5.8 trillion in 2023 to $8 trillion by 2027, driven by increasing internet access, smartphone adoption, and shifting consumer behavior. Improved payment technologies and logistics are also accelerating global ecommerce adoption.

In Latin America, the $145 billion ecommerce market in 2023 offers strong growth potential due to rising digital literacy and financial inclusion. Emerging markets like Mexico and Colombia are expected to lead this expansion as infrastructure improves and digital retail channels grow.

VTEX has a GMV of $18.2 billion, and considering that Brazil represents 50% of its revenue, the company’s GMV in the country is estimated at $9.1 billion. This positions VTEX with approximately 35% market share in Brazil’s enterprise ecommerce segment (excluding SMBs and marketplaces).

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

💼 Business Model:

VTEX is the leading enterprise ecommerce platform provider in Latin America, empowering businesses to execute their digital commerce strategies seamlessly.

“VTEX is where commerce happens. Our platform is designed to be the Operating System for the commerce ecosystem, enabling brands to orchestrate their complex network of consumers, business partners, suppliers, and fulfillment providers” - Geraldo Thomaz, VTEX’s co-CEO (2021)

Its platform facilitates the creation of online stores, enables integration and management of orders across multiple channels, and supports the establishment of marketplaces for third-party vendors.

The company boasts a diverse portfolio of over 2,600 clients and 3,500 active online stores spread across 43 countries. Having started its international expansion in 2013 within Latin America, VTEX has since ventured into the US and Europe, broadening its global footprint.

Over the last twelve months, clients using the VTEX platform have generated an impressive USD 18.2 billion in GMV.

Its client base includes renowned global brands such as Sony, Nike, Unilever, Samsung, and Nestlé, reflecting VTEX's ability to serve top-tier enterprises across a variety of industries.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

📊 How Does VTEX Make Money?

Fixed Subscription Fees:

Clients are charged an upfront fixed fee based on the duration of their contracts, typically ranging from one to five years. This fee, recognized over the contract's lifetime, provides VTEX with a stable and predictable revenue base.

Contract terms are flexible, allowing clients to choose a risk allocation strategy that aligns with their GMV expectations. New or smaller clients often opt for a lower fixed fee with a higher take-rate, while established clients with predictable GMV may select a higher fixed fee and lower take-rate.

Tiered Pricing Model: VTEX’s pricing tiers cater to various client sizes, with annual fees ranging from USD 6,000 (for smaller clients with lower GMV) to USD 300,000 (for top-tier clients). Larger clients benefit from lower take-rates due to their higher transaction volumes.

Inflation-Adjusted Fees: Prices are adjusted annually for inflation, ensuring consistent value realization for VTEX without compromising competitiveness.

Take-Rate on GMV:

Approximately 2/3 of VTEX’s revenue comes from take-rates applied to clients’ GMV. This structure ensures VTEX’s interests align with those of its clients, as its revenue scales with the success of its customers.

The take-rate varies by client size, product segment, and transaction characteristics, with an average of 0.9% in the last three years.

High-Ticket Items: For segments like home appliances, where average transaction values are higher, VTEX adjusts take-rates downward to reflect lower marginal costs, ensuring competitive pricing while maintaining profitability.

GMV-Based Upscaling: As clients grow their GMV and move into higher bands, they transition to plans with higher fixed fees and lower take-rates, balancing risk and reward for both VTEX and the client.

Professional Services:

VTEX also generates revenue through professional services, accounting for approximately 5% of total revenue. These services include consulting and implementation support for complex clients, ensuring a frictionless onboarding process.

While this revenue stream operates at a negative gross margin—due to VTEX subsidizing these services—it ultimately boosts long-term subscription revenue by facilitating seamless adoption and reducing churn.

Scalability and Alignment:

VTEX’s business model is inherently scalable. For example:

In Q3 2024, VTEX reported USD 56mn in gross revenue, of which USD 53,9mn came from subscriptions (split between fixed fees and take-rate revenue).

With an average of 0.9%-1,2% applied to USD 4.4bn in GMV, VTEX generated approximately USD 39,6mn in take-rate revenue during 3Q24.

The remaining USD 14.3mn came from fixed fees, equating to an average monthly subscription of USD 1,360 per store.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

🎯 Value Proposition:

Flexibility for Client Needs:

VTEX’s pricing structure accommodates various client strategies:

A new ecommerce entrant with uncertain GMV can choose a plan with a lower fixed fee and higher take-rate, minimizing upfront risk.

An enterprise-level client with a strong ecommerce presence can negotiate a higher fixed fee with a lower take-rate, optimizing long-term costs.

"All-You-Can-Eat" Platform Access:

The company offers a comprehensive ecommerce platform without charging separately for individual modules or features. This "all-you-can-eat" model provides clients with access to all functionalities, from CMS and OMS to CRM and analytics.

When new features are introduced—either through in-house development or acquisitions—clients do not incur additional costs. Instead, VTEX benefits indirectly by increasing GMV and its share of take-rate revenue.

Built-In Client Retention:

VTEX’s integrated model ensures that clients remain on the platform for the long term. Its refusal to customize the core platform reinforces scalability and agility, while its low-code, API-first approach allows clients to tailor specific functionalities without disrupting the system.

This creates a win-win scenario where VTEX benefits as its clients grow, and clients benefit from VTEX’s continuous platform enhancements.

In 2021, 82% of revenue came from clients who had been with VTEX for over a year, while 49% came from clients added in the previous three years.

The company's churn has been in the low single digits over the past few years.

Long-term relationships, sustained growth.

“Deliver a connected, comprehensive, and extensible platform for the ecommerce operation of our customers, with a low total cost of ownership and agility, allowing them to grow profitably.” - VTEX’s Earnings Release, 2024.

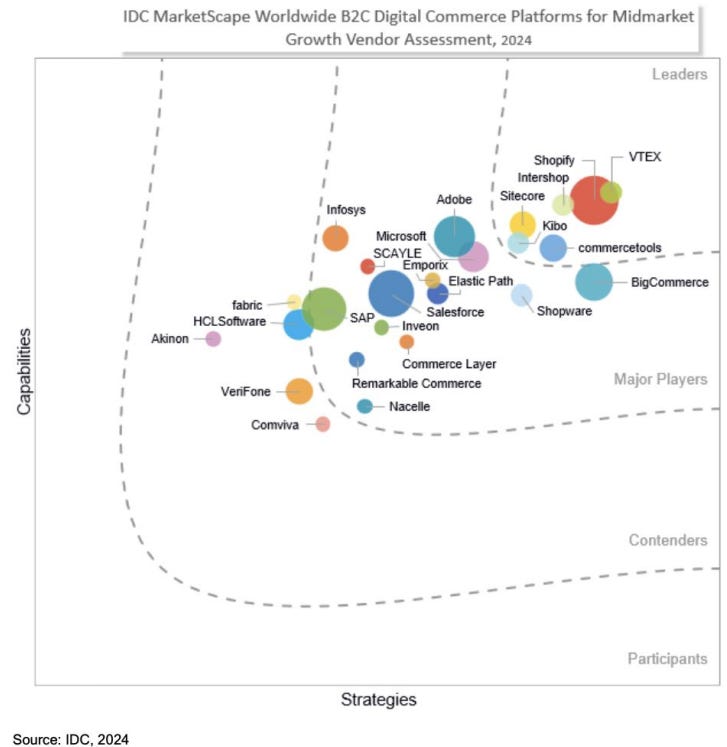

Still in this regard, this IDC MarketScape chart highlights VTEX as a leader in B2C digital commerce platforms for midmarket growth. Positioned with strong capabilities and strategies, VTEX stands out among competitors like Shopify and commercetools…

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

🥊 Competitive Advantages:

VTEX stands out in the e-commerce platform market through its speed, seamless integration, and future-proof architecture. In a competitive landscape dominated by players like Shopify Plus, Magento, and Salesforce Commerce Cloud, VTEX differentiates itself by enabling businesses to launch faster, operate more efficiently, and scale with confidence.

Speed to Market:

VTEX’s implementation is significantly faster than competitors, often taking six months or less. Its extensive out-of-the-box features allow clients to avoid the heavy reliance on third-party integrations that platforms like Magento or Shopify require, enabling quicker go-to-market strategies.

Collaborative and Scalable Architecture:

It’s multi-tenant model ensures all clients benefit simultaneously from platform updates, keeping them competitive without additional development costs. This agility, coupled with lower total cost of ownership compared to Magento or SAP, makes VTEX a preferred choice for enterprises aiming to scale efficiently.

Integrated Capabilities:

Unlike competitors that demand multiple vendors for OMS, marketplaces, and omnichannel operations, VTEX offers a unified solution. For instance, clients can route orders between online and offline stores or even become a marketplace themselves—capabilities that are costly and time-intensive to achieve on other platforms.

Beyond its already discussed strengths, VTEX further distinguishes itself with a thriving ecosystem, featuring 6,000+ VTEX IO extensions, 1,000+ SIs and ISVs, and integrations with 330+ marketplaces, 180+ payment solutions, and 90+ logistics providers.

Its leadership in collaborative commerce is evident, with 40%+ of GMV driven by these transactions and 80%+ of GMV generated by customers using collaborative integrations.

Additionally, there’s a thriving developer community with 28,500+ active users and 630+ daily third-party deploys, ensuring continuous innovation and scalability for its clients.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

💹 Unit Economics:

New clients are at the heart of VTEX’s growth story. In 2021, for example, a remarkable 51% of the platform's revenue was generated by customers acquired within the past three years.

This underscores just how critical it is to grasp VTEX’s unit economics in order to truly understand its long-term potential.

At the core of this evaluation lies the LTV/CAC ratio (Lifetime Value to Customer Acquisition Cost), a powerful measure of efficiency. This metric captures the return on investment from acquiring new customers—essentially serving as the ROIC of customer acquisition and a testament to the sustainability of VTEX's growth model.

In the following exercise, we will calculate the LTV/CAC ratio for VTEX's new customers using updated data and assumptions.

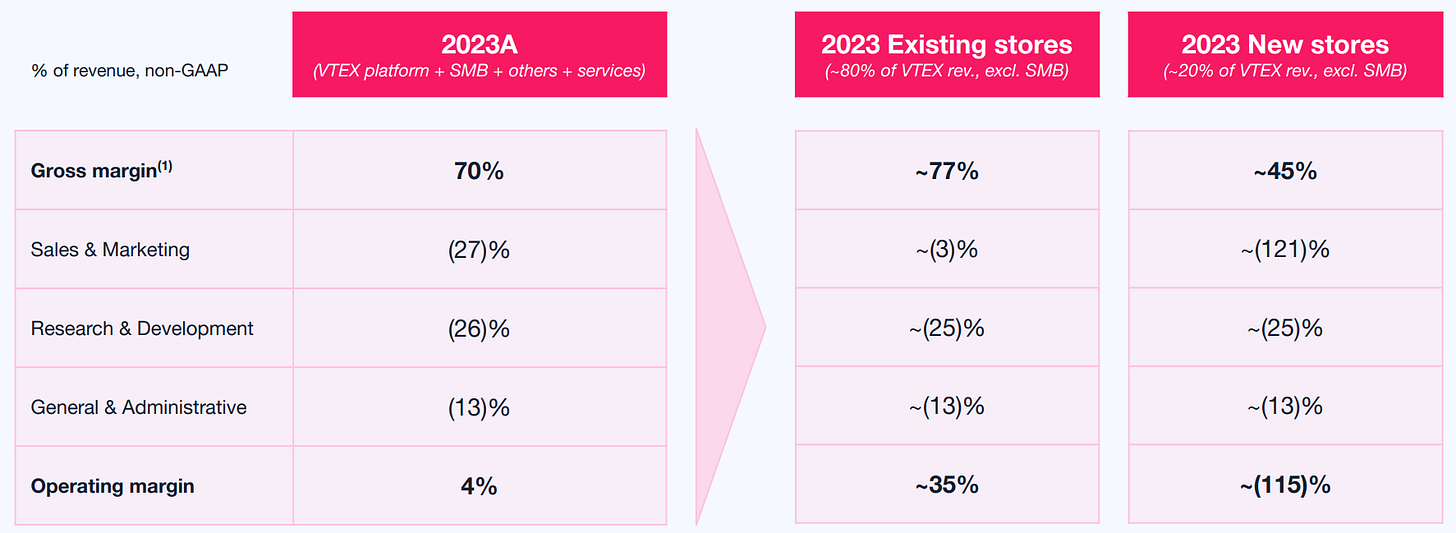

Revenue and Gross Margin

Total Revenue in the Last 12 Months (LTM): USD 210 million.

Subscription Revenue (96% of Total Revenue): USD 201.6 million.

Revenue from New Customers (21% of Subscription Revenue): USD 42.34 million.

Gross Margin for New Customers: 45%.

Gross Profit from New Customers: USD 19.05 million (USD 42.34 million × 45%).

Lifetime Value (LTV)

Assuming an annual churn rate of 5% (20-year lifetime), the LTV is calculated as:

LTV: USD 381 million (USD 19.05 million × 20 years).

Customer Acquisition Cost (CAC)

For the CAC calculation, we take into account the full Sales & Marketing expenses reported by the company in 2023, totaling USD 58 million. Given that a platform typically takes 6 to 9 months to go live, we align the LTV from 2024 with the CAC from 2023.

This approach reflects the reality that investments made in one year drive the revenue growth realized in the next, capturing the true cost of acquiring and onboarding new clients.

Sales and Marketing Expenses (2023): USD 58 million.

LTV/CAC Ratio

LTV/CAC: 6.57x (USD 381 million ÷ USD 58 million).

This 6.57x LTV/CAC ratio highlights VTEX's impressive ability to efficiently acquire and retain new customers.

With a strong gross margin of 45% for new clients and their substantial impact on subscription revenue, VTEX demonstrates not only financial strength but also the potential to sustain meaningful, long-term growth.

Do you want access to this LTV/CAC calculation table? Comment “table” below, and I'll send it to you right away.

Now, let's dive deep into the valuation…

📈 Valuation:

As you all know, valuing high-growth technology companies is quite challenging. Below, we present an exercise to determine a feasible range for the target price based on projections of GMV, revenue and exit multiples.

Projections for the e-commerce market by eMarketer indicate a total market size of $8 trillion by 2027E, representing a compound annual growth rate (CAGR) of approximately 12.5%.

We believe VTEX has room to gain market share in the industry, with a compound annual growth rate (CAGR) of 16.2% over the years, reaching a total GMV of $35 billion by 2028E.

Margin improvements are expected to come primarily from the EBITDA line, driven by the expansion of services and deeper penetration with existing customers. We project the company to achieve a 25% EBITDA margin by 2028E.

Assuming an exit P/E multiple of 30x in 2028E—reasonable given the company's growth rate, low capital requirements, and profitability—we arrive at a market cap of $2.3 billion (or a target price of $12.5/share). This implies a 110% upside by then, or an annualized return of 21%.

In the sensitivity matrix, with multiples ranging from 25x to 35x and net margins between 13% and 23%, we estimate a target price range of $7.5/share to $18.7/share.

At current multiples, VTEX is trading at 18x P/E 2027E and an EV/Sales of 2.7x—considerably below its main peers, such as Shopify ($SHOP).

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

⚠️ Main Risks:

Here are the key risks we identify for the VTEX investment case:

Technological Adaptation: As a software company, VTEX must keep up with technological changes and market trends. Failure to do so could weaken its competitive position.

International Expansion: Expansion into markets like the US and UK may fail. Persisting in these markets despite setbacks could be costly.

Currency Risk: Only 9% of revenues in 2021 came from hard currencies, and FX devaluation has eroded growth in USD over time. A deviation from stable FX assumptions could impact investor returns in USD.

Service Reliability: VTEX offers mission-critical solutions. Any interruptions (e.g., cyberattacks or security breaches) could damage its reputation and lead to client losses.

Competition: A tougher competitive environment could hurt revenue growth and margins.

Valuation Sensitivity: As a long-duration stock, VTEX’s valuation is highly sensitive to discount rate changes. Terminal EBITDA margin assumptions also significantly impact the target price.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

💡 Investment Thesis:

VTEX represents a compelling investment opportunity in the rapidly growing global e-commerce market. With a (i) strong foothold in Latin America, (ii) innovative technology, and a (iii) scalable business model, the company is well-positioned to capture market share and sustain long-term growth.

Its impressive LTV/CAC ratio, growing GMV, and ability to deepen customer relationships highlight its operational efficiency and potential for margin expansion.

While risks such as technological adaptation, international expansion, and currency exposure exist, VTEX's ability to deliver mission-critical solutions and navigate competitive pressures reinforces its resilience.

Assuming steady execution, VTEX’s projected growth and improving profitability could generate significant shareholder value, offering an attractive upside for long-term investors.

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.

Great to read, Jimmy! Thanks for sharing.

Great report! Thanks for sharing, Jimmy.