The Platform Playbook: Why They Dominate +32% of My Portfolio

Platforms and the New Economy: rethinking how value is created...

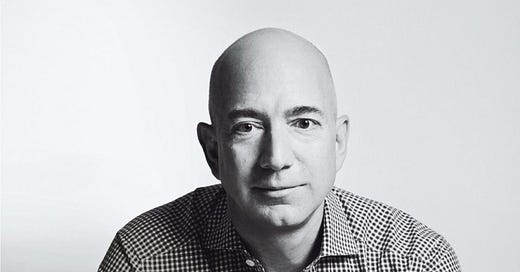

Hi, Investor 👋

I’m Jimmy, and welcome to another edition of our newsletter. Today, we’re diving into why I’m betting on platforms - and why you might want to, too.

We’ll explore how this business model quietly took over the economy, disrupted entire industries, and redefined how value is created in the digital age.

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

1. From Factories to Platforms:

In the not-so-distant past, the most valuable companies in the world were defined by their tangible assets:

Factories;

Inventories;

Oil reserves.

Today, they are defined by something far more elusive: connections.

Platforms, those business models built to facilitate interactions between two or more user groups, have rewritten the rules of value creation, competition, and growth.

Uber owns no fleet, yet it’s one of the most recognized names in transportation.

Airbnb doesn't own a single property, but it offers more accommodations than the largest hotel chains.

Amazon, once just an online bookstore, now orchestrates a massive ecosystem of sellers, buyers, creators, and developers.

These aren’t traditional companies. They are platforms.

Platforms now represent over 32% of my personal portfolio (with a bias toward increasing that allocation)...

The three platforms we currently hold in our portfolio have delivered a return of +922% over the past 10 years, equating to nearly 25% annualized!!!

Over the same period, the S&P 500 returned +215% (11.9% annualized).

They outperformed for a reason.

And that’s exactly what we’re going to explore in this article...

Keep reading with a 7-day free trial

Subscribe to Jimmy's Journal to keep reading this post and get 7 days of free access to the full post archives.