Valuation Is Overrated. Here’s What Actually Matters

The untold truth about what really moves stock prices...

Hi, Investor 👋

I’m Jimmy, and welcome back to Jimmy’s Journal. Valuation is a key part of investing - but on its own, it rarely explains performance.

Today’s article is about that broader view. A simple framework that blends the right signals, helping you go beyond the spreadsheet - and closer to what really drives returns.

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

Once, back in my days as an equity analyst, I was in a meeting with a few stakeholders when an equity fund manager dropped this bombshell of a quote:

“If valuation really mattered, Aswath Damodaran would be the greatest fund manager alive.”

It was meant half-jokingly, of course. Damodaran is a titan in the world of valuation, and his frameworks are brilliant.

But behind the provocation was a point worth pondering: if nailing intrinsic value were all it took, professors would outperform practitioners.

They don’t.

Because in investing, valuation is necessary - but never sufficient.

The Puzzle Has More Pieces:

Valuation gives you an anchor - a sense of what something might be worth under a set of assumptions.

But the market is not static. It is a dynamic, noisy, behavior-driven organism.

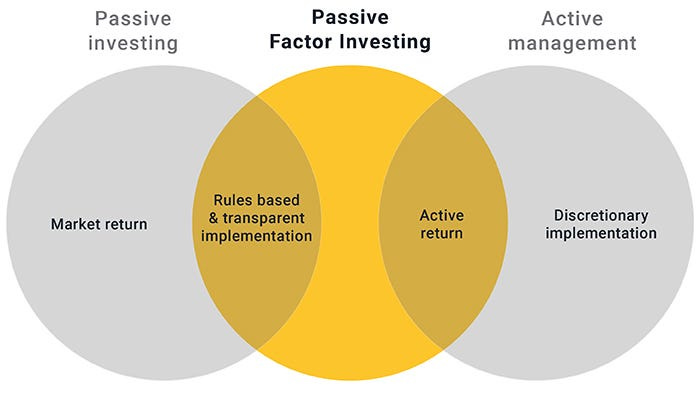

That’s where multi-factor investing enters the picture.

A multifactor model doesn’t rely on a single explanation for why a stock might outperform. Instead, it analyzes a combination of characteristics - called factors - that have been shown, over time, to drive returns in different market regimes.

Think of it like this: if valuation is one lens, a multifactor model is a full set of prescription glasses.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

The Most Common Factors:

Over the years, I’ve come to see factors not just as statistical tools, but as behavioral mirrors.

They capture where the market consistently misprices risk - and where investors consistently fool themselves.

Here are the five that matter most:

Value → when "cheap" is misunderstood

Size → small caps, big swings

Quality → how consistency quietly wins

Momentum → when price becomes its own catalyst

Low Volatility → boring on the surface, powerful underneath

Let’s break them down…

1. Value:

The idea is intuitive: buy companies trading below intrinsic value, wait for the re-rating.

But the trap lies here: not all cheap stocks are mispriced. Some are cheap for good reason.

A business at 5x earnings might deserve it - because the model is broken, margins are collapsing, or the balance sheet is crumbling.

True value comes from misunderstanding, not just mispricing.

The best value is often in the “expensive-looking” stock with underestimated potential.

2. Size:

Yes, small caps historically outperform large caps - but they come with more risk, less liquidity, and less predictability.

You’re not just buying growth. You’re buying uncertainty.

The real edge isn’t in size alone. It’s when size intersects with other factors: small + quality, or small + momentum, for example.

Ask yourself:

Is this a small company with a large future - or just a small company with small problems?

3. Quality:

Quality used to be dismissed as “common sense” - who doesn’t want a great business?

But high-ROIC, stable-margin, low-debt companies tend to quietly outperform, especially in downturns. The market often underestimates consistency.

The biggest misconception is that people treat quality as a “defensive” trait. But quality is offensive - it compounds silently.

4. Momentum:

Momentum is misunderstood because it feels like speculation.

But the data is clear: stocks that are going up often continue going up - for structural, not just behavioral, reasons.

Fund flows chase winners. Managers fear underperformance. Narratives gain traction.

You don’t need to chase blindly. But when momentum confirms your thesis, it’s worth paying attention.

5. Low Volatility:

Low-volatility stocks are the tortoises of the market - boring, slow, and often overlooked. But over time, they deliver strong risk-adjusted returns.

Investors crave excitement. But markets reward resilience.

Alpha doesn’t always wear a cape. Sometimes it wears a utility vest.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe now and stay updated.

What Really Moves Stocks:

Valuation can help you identify what's cheap. But cheap isn't enough.

Momentum tells you what the market believes.

Quality tells you how the business performs.

Size and volatility tell you about the risk structure.

It's the interaction of these factors that tells the full story.

A cheap stock with improving fundamentals? That’s value + quality.

A small-cap outperforming on strong earnings? Size + momentum.

A high-quality compounder breaking out of a base? Quality + momentum.

Relying on just one signal is like flying with one eye closed.

And please - don’t take this as some kind of quant evangelism or a call to blindly follow factor-based investing.

I’m not that kind of investor. Quite the opposite, actually.

This article is simply a reminder that valuation, while essential, becomes far more powerful when combined with other dimensions of analysis.

And that’s exactly what multifactor models make explicit.

You don’t need to be a quant to use these ideas. In fact, you can blend two or three factors into your own philosophy and still operate with a human, fundamental approach.

Here at Jimmy’s Journal, you already know what we lean on:

Value + Quality - and sometimes, a little Momentum when it feels right.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

A Real-World Lesson:

My first real lesson in this direction came back in 2015, right at the start of my career as an equity analyst.

At the time, there was no talk of quantitative analysts or factor investing in the circles I was in. These concepts hadn’t gone mainstream - not in the way they are today.

But the market has a funny way of teaching you things, even when you don’t have the vocabulary for it yet.

And this particular case made it painfully clear: valuation alone doesn’t capture the full picture.

I remember looking at Microsoft in 2015. On a traditional valuation screen, it didn’t pop. It wasn’t obviously cheap. The P/E wasn’t screaming “buy me.” And to a lot of value investors at the time, it felt too expensive, too mature, too boring.

But something about it felt different…

Without knowing it then, I was applying a multifactor lens:

Margins were improving quarter after quarter → a sign of quality.

Satya Nadella had just taken over, and the company’s culture, product vision, and narrative were shifting fast → momentum was building.

More importantly, Microsoft was transitioning its entire model toward cloud and subscription revenue → an inflection point most people hadn’t fully priced in.

It wasn’t a deep-value stock. But it was deeply underappreciated.

And the lesson stuck with me: sometimes, what doesn’t look cheap on paper can be a phenomenal investment - if you know what to look for.

Valuation Is a Compass, Not a Map:

I still build valuation models.

I still believe intrinsic value matters.

But I’ve learned this the hard way:

The market doesn’t care about your price target.

It cares about perception, positioning, and performance.

Being “right” too early is the same as being wrong.

Being “cheap” without momentum can mean years of underperformance.

Being “high quality” without a catalyst can leave you in limbo.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe now and stay updated.

What Really Matters:

Valuation matters. Always will.

But if you want to outperform, survive drawdowns, and build a robust process - you need to expand your lens.

As Warren Buffett once put it:

“Price is what you pay. Value is what you get.”

But performance comes from understanding what drives both.

So yes, learn to value businesses. But also learn to recognize patterns. Learn what the market rewards - and when. Because the best investors don’t rely on one truth.

They use many.

If you’d like to dive deeper into both topics, consider reading the following books:

Your Complete Guide to Factor-Based Investing - The way smart money invests today.

The Little Book of Valuation - How to value a company, pick a stock, and profit. Ideal for beginners.

Investment Valuation (University Edition) - Tools and techniques for valuing any asset. Recommended for advanced investors.

Thanks for reading this far.

Cheers,

Jimmy

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.

Buffett & Munger tell different stories.

Really thoughtful breakdown — love how you demystified the five core factors. It’s so true that focusing only on ‘value’ can make you miss some of the biggest winners. Some of the best compounders never looked cheap but had that momentum and quality edge. This post really helps investors look through a clearer lens - thanks for sharing it!