A Revolution is Underway in US Energy. Here’s What You Need to Know

The rapid rise of U.S. LNG is transforming global energy markets, creating new opportunities and challenges for investors...

Hi, Investor 👋

I’m Jimmy, and welcome to another free edition 🔓 of our newsletter. Today, we’re diving into U.S. LNG and its rapid rise as a global energy powerhouse. With exports set to double by 2028, LNG is transforming markets and creating major investment opportunities.

We’ll cover key projects, geopolitical shifts, and the companies positioned to benefit.

Enjoy the insights! And if it resonates, share it with friends and fellow investors.

In case you missed it, here are some recent insights:

Broadcom ($AVGO) Deep Dive: Where AI and Hyperscalers Converge

I'm Doubling Down on MELI. Here's Why: MercadoLibre, Inc. ($MELI) Deep Dive

Subscribe now and never miss a single report:

Natural gas is a fossil fuel composed primarily of methane (CH₄), along with smaller amounts of natural gas liquids (NGLs) and non-hydrocarbon gases such as carbon dioxide and water vapor.

It is formed over millions of years from the remains of ancient marine organisms that were buried under layers of sediment and rock. Under intense heat and pressure, these organic materials transformed into hydrocarbons, creating vast deposits of oil and natural gas.

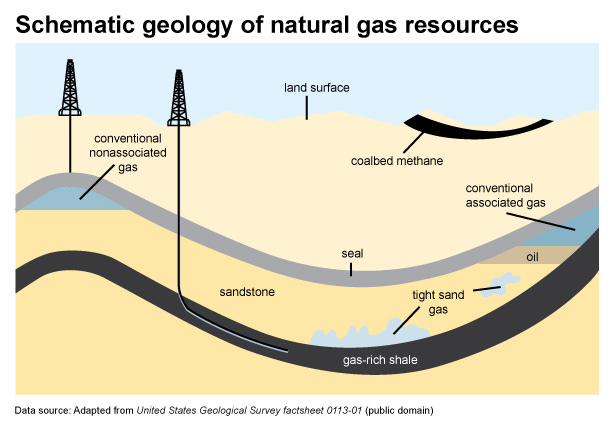

Natural gas can be found in different geological formations:

Conventional Natural Gas – Found in large reservoirs with permeable rock formations, allowing easy extraction.

Shale Gas and Tight Gas – Found in fine-grained sedimentary rocks with low permeability, requiring advanced extraction methods such as hydraulic fracturing.

Associated Natural Gas – Found alongside crude oil deposits.

Coalbed Methane – Found trapped within coal seams.

Once extracted, natural gas is processed to remove impurities such as water, carbon dioxide, and sulfur compounds before undergoing liquefaction.

This multi-stage cooling process, conducted at specialized plants near coastal regions with access to global shipping routes, uses heat exchangers and refrigerants to convert the purified gas into LNG.

By reducing its volume by approximately 600 times, LNG becomes significantly more efficient to store and transport over long distances where pipelines are not feasible.

Here is a great video that shows how this process works:

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

Infrastructure Required:

The LNG supply chain requires a highly specialized infrastructure, including:

Liquefaction Facilities – Large processing plants that convert natural gas into LNG for storage and export.

LNG Carriers – Specially designed ships equipped with insulated cryogenic tanks that maintain LNG at ultra-low temperatures during maritime transport.

Regasification Terminals – Facilities at import destinations where LNG is converted back into its gaseous state before entering pipeline networks.

Cryogenic Storage Tanks – Used at both liquefaction and regasification terminals to maintain LNG in its liquid state before processing or transport.

The ability to transport LNG by sea has transformed global energy markets, enabling producers to reach distant consumers and reducing the dependency on fixed pipeline infrastructure.

The United States, with its vast shale gas reserves and growing LNG export capacity, has become a dominant force in the global LNG trade, supplying markets in Europe, Asia, and Latin America.

Global Energy Transition:

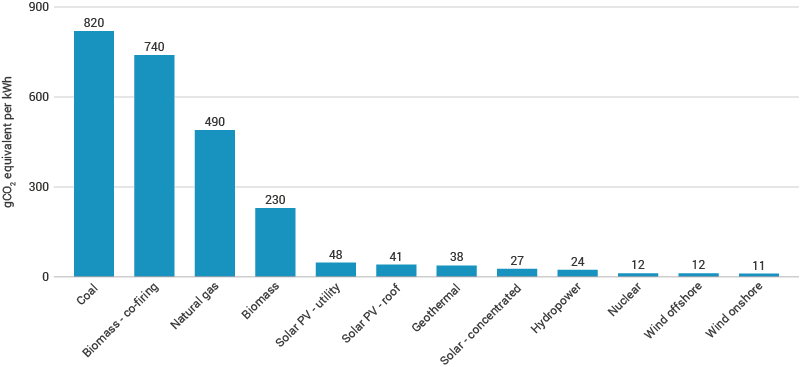

As the world moves toward a more sustainable energy mix, LNG serves as a bridge fuel, offering a lower-carbon alternative to coal and oil.

Natural gas emits about 50% less carbon dioxide than coal when burned for electricity generation, making LNG an attractive option for countries seeking to reduce emissions while maintaining reliable energy supplies.

In Asia, nations like China, Japan, and South Korea have turned to LNG to complement their renewable energy strategies, reducing reliance on coal and mitigating air pollution.

In Europe, the urgency to diversify energy sources, especially in light of the Russia-Ukraine conflict, has positioned U.S. LNG as a crucial supply alternative to Russian pipeline gas.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

U.S. Investments:

The U.S. LNG industry has undergone rapid expansion since the first export facility at Sabine Pass came online in 2016. The country has invested heavily in LNG infrastructure, including liquefaction terminals, pipelines, and storage facilities. Key investment highlights include:

Massive Capacity Expansion: more than 70 million tons per year (mmtpa) of new LNG export capacity is currently under construction at projects such as Golden Pass, Corpus Christi Stage 3, Plaquemines, Port Arthur, and Rio Grande.

$40 Billion in Investments: these projects have attracted significant debt and equity financing, securing long-term supply contracts with global buyers.

Doubling Export Capacity by 2028: U.S. LNG export capacity is projected to exceed 160 mmtpa by 2028, surpassing Qatar’s output and making the United States the dominant supplier of LNG globally.

U.S. LNG Export Terminals:

The U.S. hosts several major LNG export terminals that have transformed the country into the leading global LNG supplier. These terminals are strategically located to serve both Atlantic and Pacific markets efficiently.

Major LNG Export Terminals and Their Capacities:

Sabine Pass LNG (Louisiana): operated by Cheniere Energy, this was the first major U.S. LNG export facility and remains one of the largest. It has a total export capacity of approximately 30 million tons per annum (mmtpa).

Freeport LNG (Texas): a key export hub with a capacity of 20 mmtpa, providing a critical supply to Europe and Asia.

Cameron LNG (Louisiana): a joint venture facility with an export capacity of 15 mmtpa, strategically positioned to supply multiple global markets.

Corpus Christi LNG (Texas): another Cheniere Energy facility, boasting an export capacity of 15 mmtpa, with expansion plans underway.

Golden Pass LNG (Texas): a project under development with a projected capacity of 18 mmtpa, expected to play a major role in future U.S. LNG exports.

Elba Island LNG (Georgia): a smaller-scale facility with a capacity of 2.5 mmtpa, primarily serving niche markets.

Calcasieu Pass LNG (Louisiana): a newly developed terminal with an operational capacity of 10 mmtpa, expanding the U.S. LNG export footprint.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

Pipelines Under Construction:

To support growing LNG exports, several major pipeline projects are underway, ensuring seamless transport of natural gas from production regions to liquefaction terminals. Notable pipeline developments include:

Rio Bravo Pipeline – Supplying natural gas to the Rio Grande LNG project in Texas.

Driftwood Pipeline – Connecting Permian Basin gas to future LNG export facilities.

Gulf Coast Express Expansion – Increasing pipeline capacity to serve Gulf Coast LNG plants.

Geopolitical Implications of U.S. LNG:

U.S. LNG exports have reshaped global energy geopolitics, providing allies with an alternative to Russian gas and strengthening U.S. economic ties with key importers.

European Energy Security: following the reduction of Russian gas supplies, European nations have significantly increased LNG imports from the U.S., ensuring energy stability and reducing dependence on Moscow.

Asia-Pacific Demand: countries like China and India have signed long-term LNG contracts with U.S. suppliers to secure stable energy sources for their expanding economies.

Middle East Competition: the U.S. competes with traditional LNG exporters like Qatar and Australia, altering global trade flows and pricing structures.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe now and stay updated.

Publicly Traded Companies Benefiting from LNG Growth:

Several publicly traded companies have significantly benefited from the expansion of U.S. LNG exports. Below are key players and their investment theses:

Cheniere Energy (NYSE: LNG): as the first company to export LNG from the U.S., Cheniere is the largest LNG producer in the country. Its long-term contracts and continued expansion at Sabine Pass and Corpus Christi provide strong revenue visibility.

Sempra Energy (NYSE: SRE): Sempra has invested heavily in LNG infrastructure, including Cameron LNG and future projects in Mexico and the U.S. Gulf Coast. The company benefits from rising global demand and strategic partnerships.

Tellurian Inc. (NASDAQ: TELL): focused on the development of the Driftwood LNG project, Tellurian offers exposure to the growing U.S. LNG market, though it remains a high-risk, high-reward investment due to its financing needs.

Kinder Morgan (NYSE: KMI): a major midstream player, Kinder Morgan owns and operates key natural gas pipelines that supply LNG export terminals, making it a key beneficiary of increased LNG shipments.

NextDecade Corporation (NASDAQ: NEXT): developing the Rio Grande LNG project, NextDecade aims to provide low-carbon LNG solutions, leveraging carbon capture technologies to enhance its environmental appeal.

ExxonMobil (NYSE: XOM): with investments in Golden Pass LNG, ExxonMobil is expanding its LNG footprint as part of its broader energy transition strategy, providing long-term exposure to global gas markets.

ESG Considerations:

Despite the economic and geopolitical advantages of LNG, concerns persist over its environmental impact. Critics argue that increased LNG exports could prolong fossil fuel dependency and undermine climate goals. Key environmental issues include:

Methane Emissions: natural gas production and transportation contribute to methane leaks, a potent greenhouse gas.

Lifecycle Carbon Footprint: some studies suggest that LNG’s total emissions - including extraction, liquefaction, transport, and combustion - could be comparable to coal under certain conditions.

Regulatory Uncertainty: the Trump administration faces pressure from environmental groups to curb LNG expansion, while industry advocates stress its role in energy security and economic growth.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

Conclusion:

The rise of U.S. LNG has profoundly impacted the global energy market, providing economic benefits, strengthening geopolitical ties, and offering a pathway to lower-carbon energy.

As investments in LNG infrastructure continue and demand grows, the industry’s role in global energy security and the transition to a sustainable future remains critical.

Policymakers must balance economic and environmental considerations to ensure LNG continues to be a strategic asset for the United States and the world.

What’s your take on the future of LNG? I’d love to hear your thoughts.

See you next time,

Jimmy

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.