Amazon Logistics: Building the Moat of the Future

Deep dive into Amazon Logistics: Unlocking the future of supply chain dominance

Hi, Investor 👋

I’m Jimmy, and welcome to another edition of our newsletter. Today, we’re diving deep into Amazon Logistics ($AMZN) – exploring the logistics empire that’s transforming global supply chains.

From its unmatched scale and speed to its bold push into Logistics-as-a-Service (LaaS), we’ll break down why Amazon Logistics is becoming one of the company’s strongest long-term growth drivers and a near-impenetrable moat.

Hope you enjoy this analysis! And if you do, feel free to share it with your friends and fellow investors.

In case you missed it, here are some recent insights:

Nubank (NU) Stock Analysis: Redefining Banking in Latin America - A High-Growth Investment Opportunity

NVIDIA (NVDA) Stock Analysis: A Deep Dive Into Its Future Growth Potential and Market Dominance

How to Define the Total Addressable Market (TAM): Uber's Case Study

Subscribe now and never miss a single report:

Amazon has long been a pioneer in e-commerce, but its logistics operations are quietly becoming the foundation of a much larger ambition: dominating global logistics.

With 7 billion+ Same-Day/1-Day (SD1D) deliveries in 2023, an unmatched regionalized network, and a burgeoning Logistics-as-a-Service (LaaS) strategy, Amazon Logistics is not just serving its own needs; it’s positioning itself as the go-to logistics provider for businesses everywhere. Let’s dive deeper into this transformation and why it represents a growing moat for Amazon.

From Logistics Investment to Efficiency Gains

Amazon’s logistics network has undergone an extraordinary evolution over the past few years. During the pandemic, the company doubled its fulfillment footprint, creating a last-mile transport network rivaling UPS and a regionalized sortation system to speed up long-distance deliveries. By 2023, 76% of orders were being fulfilled from regional facilities, up from 62% in 2022, reducing the cost per unit by $0.45 year-over-year in the U.S.

This regionalization effort didn’t just lower costs; it also cut package touches by 20% and delivery miles by 19%, while driving the fastest delivery speeds in Amazon’s history. The company plans to double its SD1D facilities, which are not only critical for fast delivery but are also the least expensive facilities in Amazon’s network. These moves ensure Amazon can deliver goods faster, cheaper, and more efficiently than competitors, while increasing purchase frequency and customer satisfaction.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

Logistics-as-a-Service: A New Pillar of Growth

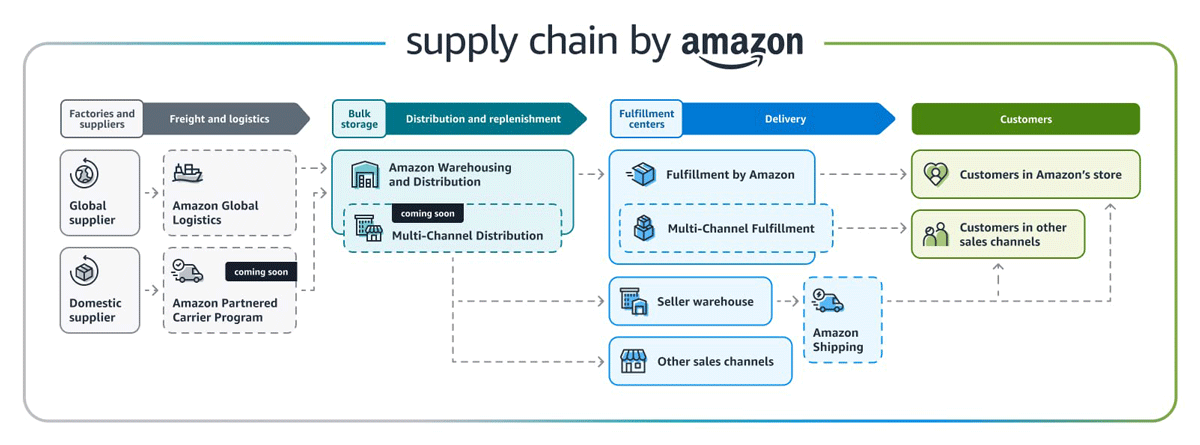

Amazon is now taking its logistics capabilities to the next level by offering them to third-party businesses through its Logistics-as-a-Service (LaaS) platform. Initiatives such as Amazon Shipping, Supply Chain by Amazon, Amazon Warehousing & Distribution (AWD), and the Buy With Prime Shopify integration are designed to attract businesses of all sizes.

Amazon Shipping: Allows businesses to ship orders sold both on and off Amazon at competitive rates, leveraging Amazon’s vast logistics network.

AWD & Supply Chain by Amazon: These tools enable sellers to manage inventory, replenish stock automatically, and streamline multi-channel distribution, all from Amazon’s infrastructure.

Buy With Prime: This integration empowers Shopify merchants to offer Amazon’s Prime benefits directly on their own websites, increasing shopper conversion rates by 25% on average.

Amazon’s massive scale enables cost advantages that traditional carriers like UPS or FedEx struggle to match, especially for small and mid-sized businesses (SMBs). This differentiation positions Amazon as the logistics partner of choice, further enhancing its network efficiency and economies of scale.

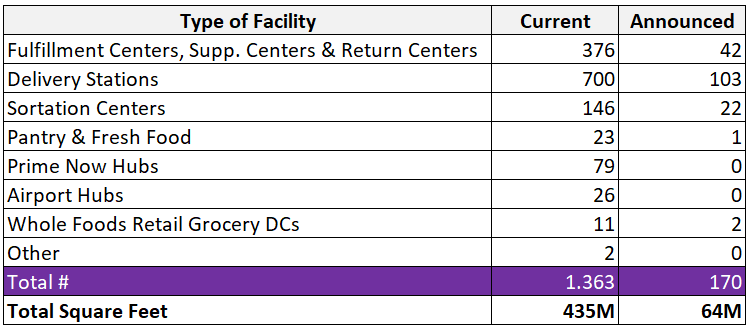

In total, Amazon’s logistics network spans 1,363 facilities and 435 million square feet of operational space in the U.S., with an additional 170 facilities and 64 million square feet announced, reflecting significant growth in infrastructure.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

Amazon's Growing Share of the Parcel Market

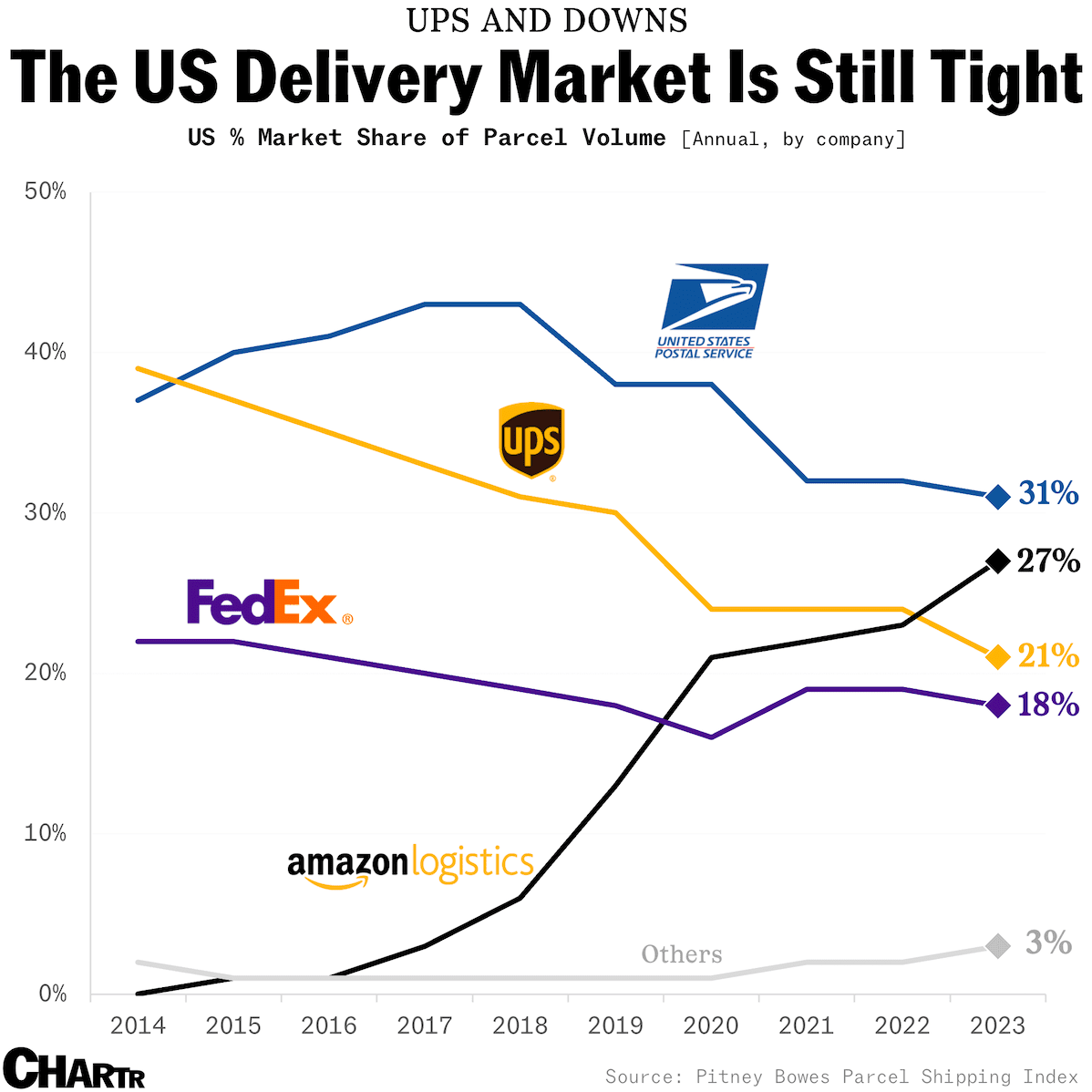

In 2023, Amazon Logistics handled 5.9 billion packages, capturing 27% of U.S. parcel volumes, a share that now rivals USPS (31%) and surpasses UPS and FedEx. This dominance stems from Amazon’s ability to innovate at scale, leveraging its logistics backbone to handle not only its own orders but also those from third parties.

The growing integration of third-party sellers into Amazon’s fulfillment ecosystem is driving this shift. Today, 61% of units sold on Amazon come from third-party sellers, and 70% of 3P transactions rely on Amazon’s logistics services, which offer a blended take rate of ~30% on 3P sales. As LaaS offerings expand, this percentage is likely to increase, further reinforcing Amazon’s competitive edge.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

Unlocking Long-Term Pricing Power and Revenue Growth

Amazon’s logistics initiatives aren’t just about cost savings; they’re about creating a sustainable competitive advantage. The scale of Amazon’s operations allows the company to build an ecosystem effect, where every new business that joins the platform increases the efficiency and profitability of the entire network.

As logistics volumes grow, Amazon gains leverage to optimize pricing, enhance service offerings, and strengthen customer loyalty. The addition of GenAI and tech infrastructure investments, which are driving a projected $65 billion in capex for 2024 (+35% YoY), underscores Amazon’s commitment to staying ahead of competitors.

These investments will enable Amazon to continue innovating in automation, robotics, and inventory optimization, ensuring that its logistics operations remain not only efficient but also adaptable to the ever-changing demands of e-commerce.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Subscribe to the newsletter now and stay updated. It’s quick, free, and delivered straight to your inbox!

Why Amazon Logistics is the Moat of the Future

Amazon’s logistics strategy represents a multi-faceted moat that is difficult to replicate:

Scale and Speed: With over 435 million square feet of logistics facilities in the U.S. alone, Amazon operates at a scale that no competitor can match. Its ability to deliver SD1D services to 110+ metro areas ensures that it stays ahead of customer expectations.

Integration with Prime: The seamless integration of logistics capabilities with Amazon’s Prime membership program strengthens customer loyalty while driving higher purchase frequency and spend.

Expanding Third-Party Services: By offering logistics solutions to external businesses, Amazon not only monetizes its infrastructure but also deepens its competitive advantage, creating a flywheel effect that benefits its core e-commerce business.

Technological Leadership: Investments in AI, automation, and robotics ensure that Amazon remains at the cutting edge of logistics innovation, further enhancing efficiency and scalability.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

The Long-Term Opportunity

Amazon Logistics is no longer just a means to serve its own customers - it’s becoming a platform in its own right. As businesses increasingly turn to Amazon for their logistics needs, the company’s ability to capture additional market share and generate revenue from LaaS will only grow.

We believe Amazon’s Logistics-as-a-Service could become a major pillar of monetization, driving sustained revenue growth and profitability for years to come. By leveraging its unmatched scale, cutting-edge technology, and relentless focus on efficiency, Amazon is building a logistics empire that will be nearly impossible to dislodge.

The moat is growing - and it’s only getting deeper.

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.

They are absolutely killing UPS, DHL and FedEx

I can’t comment much on this but I view this article as being highly insightful.

It’s about giving other companies the basic building blocks and Jassy’s recent shareholder letter confirms some of your thinking.

Thanks for the great write up!