AppLovin ($APP) Investment Thesis: Expensive, but Unstoppable?

AppLovin ($APP): a high-multiple stock backed by strong AI-driven growth and expanding margins...

Hi, Investor 👋

I’m Jimmy, and welcome to another free edition 🔓 of our newsletter. Today, we’re deep-diving into AppLovin ($APP) - a company that’s surged +400% over the past year, driven by AI-powered ad optimization and the strong growth of mobile advertising.

Hope you enjoy it! And if you do, feel free to share it with fellow investors.

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

Our deep dive is divided into twelve sections:

Sector Overview

The History of AppLovin

Corporate Governance

Business Model

AXON, The Heart of AppLovin’s Platform

Main Segments

Value Proposition

Competitive Advantages & Landscape

What’s Next?

Unit Economics: Revenue and Costs

Valuation

Main Risks & Investment Thesis

🌐 Sector Overview:

The digital advertising market now dominates global ad spending, rapidly outpacing traditional media. In 2024, digital ad spend is estimated at $740.3 billion, an 8.9% increase from 2023. By 2028, it is expected to reach $965.6 billion, reinforcing its role as the primary growth driver.

This shift is fueled by changing consumer behavior, with more time spent on mobile devices, social media, and streaming platforms. Search advertising remains the largest segment, with $306.7 billion in projected spend this year, or 41.4% of total digital ad spending.

Mobile in-app advertising is among the fastest-growing segments, driven by higher smartphone penetration, app engagement, and programmatic ad adoption. Advertisers are shifting budgets to in-app placements, creating significant opportunities for ad tech platforms that optimize performance at scale.

Total Addressable Market (TAM) for mobile ad tech is massive, with mobile gaming alone generating over $100 billion in annual revenue.

The decline of traditional media, especially print newspapers and magazines, accelerated post-pandemic. In the US, digital now dominates media consumption, a trend mirrored globally as advertisers prioritize mobile, programmatic, and AI-driven ad platforms.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

📖 The History of AppLovin:

Founded in 2011, AppLovin started as a platform to help mobile developers acquire users and monetize apps.

The founders, themselves developers, identified the discovery and monetization challenge in the congested app ecosystem and built AppLovin Core Technologies to solve it.

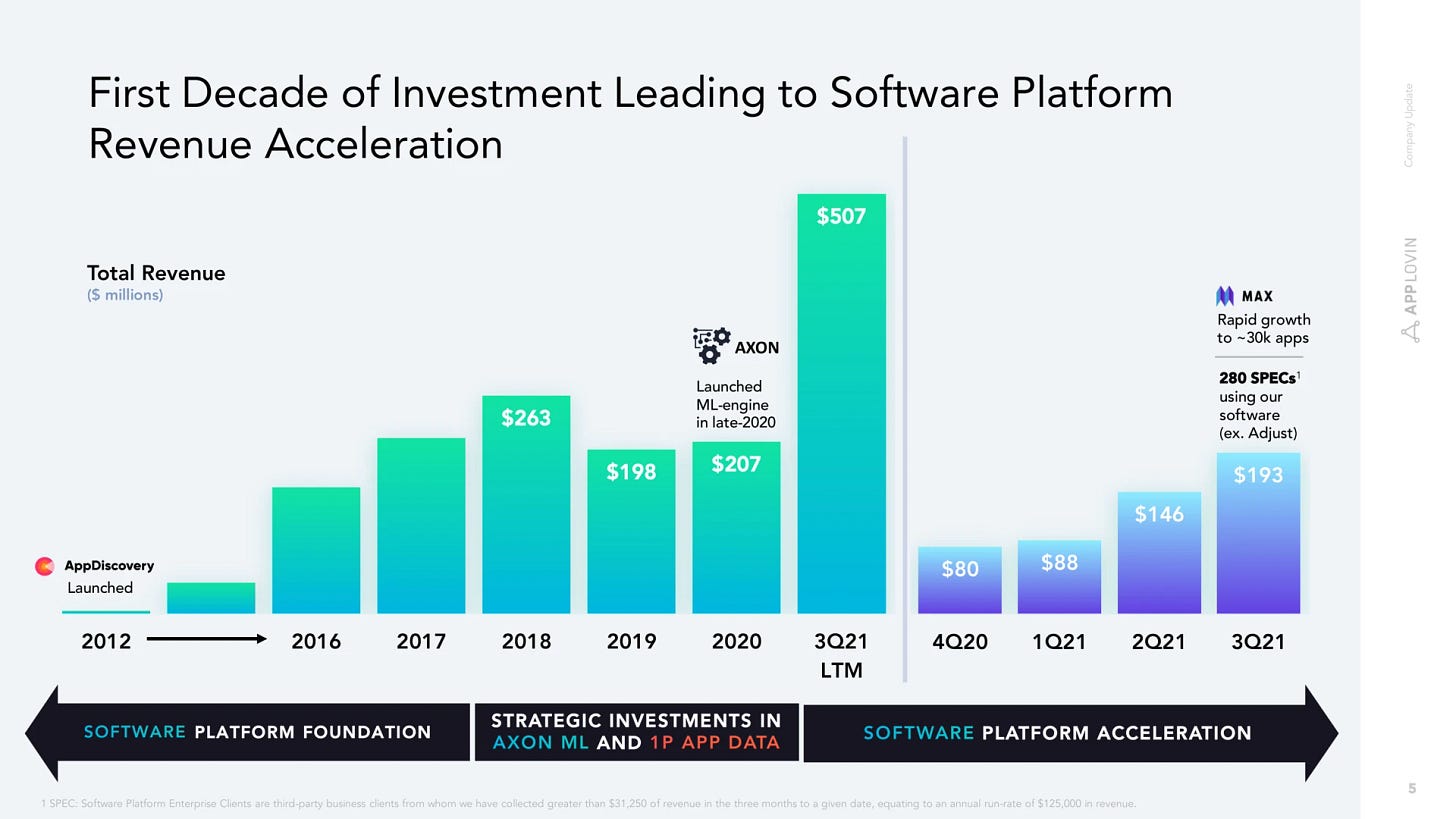

2012: Launched AppDiscovery, its marketing solution, on Android and iOS.

2014: Opened its first international office in Europe.

2018: Expanded into mobile gaming with AppLovin Apps, acquiring PeopleFun and other studios.

2018: Acquired MAX, its ad mediation platform, to enhance monetization.

2020: Launched AXON, its AI-powered ad optimization engine.

2024: Sold its Apps business for $900M, becoming a pure-play AdTech company.

👔 Corporate Governance:

AppLovin's corporate governance structure includes a diverse Board of Directors and an experienced executive team, ensuring strategic oversight and operational efficiency.

Board of Directors:

The board is led by Adam Foroughi, co-founder and CEO of AppLovin since 2011. Other board members include Craig Billings, Herald Chen, Margaret Georgiadis, Alyssa Harvey Dawson, Barbara Messing, Todd Morgenfeld, Edward Oberwager, and Eduardo Vivas, each bringing expertise from various industries.

Adam Foroughi: CEO & Co-Founder

Adam Foroughi has been the driving force behind AppLovin since its founding. Under his leadership, the company evolved from a mobile ad network into a leading AI-driven adtech platform, helping app developers maximize monetization.

His deep understanding of adtech, machine learning, and mobile ecosystems has been key to AppLovin’s rapid growth. Before founding AppLovin, Foroughi was a successful entrepreneur with ventures in mobile and online advertising.

Main Shareholders:

AppLovin’s ownership structure includes a mix of institutional investors and insiders. Major shareholders include:

Adam Foroughi: holds approximately 11.4% of the company, reinforcing his significant influence over strategic decisions.

Tang Hao: owns 6.93% of shares.

Ling Tang: holds 6.13% of shares.

Andrew Karam: owns 5.86% of shares.

The Vanguard Group, Inc.: one of the largest asset managers, with 5.72% ownership.

💼 Business Model:

AppLovin ($APP) operates at the intersection of (i) mobile advertising and (ii) app monetization, leveraging AI-driven technology to help developers acquire users and maximize revenue.

Keep reading with a 7-day free trial

Subscribe to Jimmy's Journal to keep reading this post and get 7 days of free access to the full post archives.