Quick Pitch #2: AppFolio ($APPF) and The Future of Property Management

A high-growth SaaS company transforming property management with AI and automation...

Hi, Investor 👋

I’m Jimmy, and welcome to another free edition 🔓 of our newsletter. Today, we’re diving into a company that is redefining property management through software: AppFolio (APPF).

Enjoy the insights! And if it resonates, don’t forget to share it with friends and fellow investors.

In case you missed it, here are some recent insights:

Broadcom ($AVGO) Deep Dive: Where AI and Hyperscalers Converge

I'm Doubling Down on MELI. Here's Why: MercadoLibre, Inc. ($MELI) Deep Dive

Subscribe now and never miss a single report:

Our quick pitch is divided into 6 sections:

Industry Overview

AppFolio: The Future of Property Management Software

Competitive Advantages: Why AppFolio Stands Out

Financials

Risks & Challenges

Valuation & Investment Thesis

1. Industry Overview:

The real estate industry is undergoing a technological shift, and property management software (PMS) is at the heart of this transformation.

Traditionally, property management was fragmented, with landlords and property managers relying on spreadsheets, manual processes, and outdated software.

Now, cloud-based PMS is streamlining operations, increasing efficiency, and improving tenant experiences.

The global property management software market is expected to grow at a CAGR of 8.2%, reaching $4.7 billion by 2028. Growth drivers include:

The increasing adoption of cloud-based solutions.

The demand for automation in rent collection, maintenance tracking, and leasing.

The shift towards AI-powered analytics and tenant engagement tools.

Given these tailwinds, companies offering best-in-class software solutions for property managers are positioned to benefit immensely.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

2. AppFolio: The Future of Property Management Software

Founded in 2006, AppFolio (NASDAQ: APPF) provides an all-in-one cloud platform for real estate professionals. It allows landlords and property managers to automate operations, streamline leasing, and enhance tenant engagement. Unlike legacy competitors, AppFolio is fully cloud-native, leveraging AI and automation to reduce inefficiencies.

Key products and features include:

AI Leasing Assistant (LISA): Automates tenant inquiries and scheduling.

Smart Maintenance: Uses AI to manage maintenance requests.

Integrated Payments & Accounting: Simplifies rent collection and financial reporting.

Real-Time Analytics: Provides actionable insights for property owners.

With over 8.7 million rental units managed on its platform, AppFolio has built a loyal customer base and a strong recurring revenue stream.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

3. Competitive Advantages: Why AppFolio Stands Out

I. Vertical Focus & Deep Expertise:

Unlike horizontal SaaS companies, AppFolio is deeply specialized in real estate. Its platform is designed exclusively for property managers, giving it an edge over broader, less tailored solutions.

By focusing solely on property management, AppFolio understands the industry's pain points and tailors its features to solve sector-specific challenges. This specialization enables the company to provide an end-to-end solution that integrates seamlessly with the needs of landlords, property managers, and tenants.

Additionally, AppFolio’s vertical focus means that its product roadmap aligns closely with industry trends, ensuring that new features and improvements address real-world property management issues effectively.

II. AI & Automation Leadership:

AppFolio is ahead of the curve in AI adoption within property management. The company’s AI-driven tools reduce manual work, lower costs, and improve operational efficiency - a major selling point in an industry that historically lags in digital adoption.

Its AI Leasing Assistant, LISA, automates tenant communication, helping property managers process applications faster and schedule showings without human intervention. Smart Maintenance further streamlines operations by automatically prioritizing and routing service requests, reducing response times and improving tenant satisfaction.

With real-time analytics powered by AI, AppFolio allows property managers to make data-driven decisions, optimizing occupancy rates and revenue generation. This level of automation not only reduces overhead costs but also enables property managers to scale operations efficiently without a proportional increase in staffing.

III. Strong Retention & High Switching Costs:

Property management software is a sticky business. Once a company adopts a platform, switching is costly and disruptive. AppFolio benefits from long-term customer relationships and recurring subscription revenue.

The deep integration of AppFolio's software into a property manager's workflow makes migrating to a competitor cumbersome and time-consuming, especially given the complexity of data migration and process realignment.

Moreover, the more a customer engages with AppFolio’s value-added services - such as integrated payments, screening, and insurance - the harder it becomes to transition away.

Additionally, AppFolio’s continuous innovation and feature expansion further increase customer retention, ensuring that existing users always have access to cutting-edge tools that competitors may struggle to replicate. This results in high net revenue retention and a customer base that remains engaged for the long term.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

4. Financials:

I. Consistent Growth & Expanding Margins:

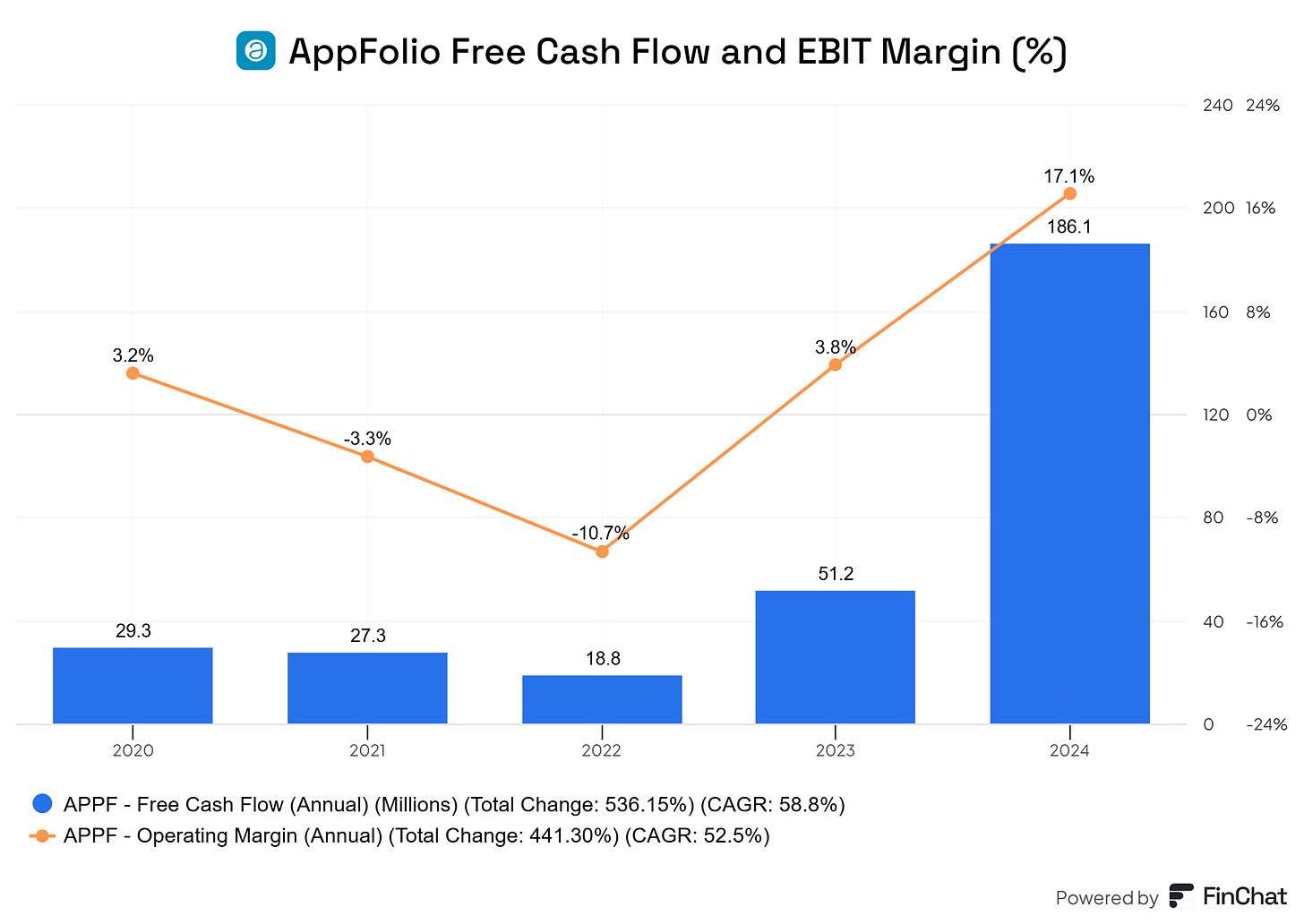

AppFolio has delivered consistent revenue growth, with sales increasing at a 3-year CAGR of 28%. Gross margins are expanding as the company scales, and its recent focus on operational efficiency is driving profitability.

II. Transition to Higher-Margin Business Model:

In the past, AppFolio focused on lower-margin services, but recent strategy shifts towards premium AI-powered solutions and financial services have improved its margin profile.

III. Balance Sheet Strength:

With zero debt and a strong cash position, AppFolio has the flexibility to invest in growth without taking on financial risk.

Enjoying the content? Don’t miss out on more exclusive insights and analyses. Upgrade to paid now and stay updated.

5. Risks & Challenges:

I. Competition from Legacy & New Entrants:

While AppFolio is a leader, it faces competition from Yardi, RealPage, and Entrata. However, its tech-first approach and AI differentiation help it stay ahead.

II. Real Estate Cyclicality:

A downturn in the real estate market could impact AppFolio’s growth, particularly if rental property managers cut spending. However, its software is seen as a cost-saving tool, which provides some resilience.

Found this content valuable? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

6. Valuation & Investment Thesis:

At ~$220 per share, AppFolio trades at a forward EV/Sales multiple of ~9x, reflecting its high growth and strong unit economics. Given its leadership in AI-powered property management, expanding margins, and secular industry tailwinds, the stock presents an attractive long-term opportunity.

Why AppFolio?

Massive TAM & Industry Tailwinds: The shift to cloud-based PMS is accelerating.

AI-Driven Competitive Edge: Automation is a key differentiator.

Recurring Revenue Model: High retention and expanding margins.

Founder-Led, Execution-Focused Team: Proven ability to scale.

AppFolio is transforming property management the same way Shopify transformed e-commerce. For investors looking for a high-quality SaaS company with long-term growth potential, APPF is worth a closer look.

Did you like this quick pitch? Comment below if AppFolio deserves a deep dive in our newsletter!

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.

Interesting, I would not expect this business to be protected by moat, it feels like you can ask ChatGPT to write a real estate management app :)