The 5 Most Dangerous Biases in Investing (And How to Avoid Them)

How behavioral biases sabotage your investments - and what to do about it...

Hi, Investor 👋🏻

I’m Jimmy, and welcome to another edition of Jimmy’s Journal. Today’s topic isn’t about markets or metrics - it’s about your own brain.

Because while we often think investing is about spreadsheets, strategy, and stock screens - the real battle happens inside your own head.

Let me show you why.

In case you missed it, here are some recent insights:

Subscribe now and never miss a single report:

Because your brain is brilliant… and also very sneaky.

Let’s start with something a little uncomfortable:

You're not as rational as you think.

Neither am I.

Neither is George Soros and Warren Buffett.

Neither is anyone.

And that’s not a flaw - it’s how we’re wired.

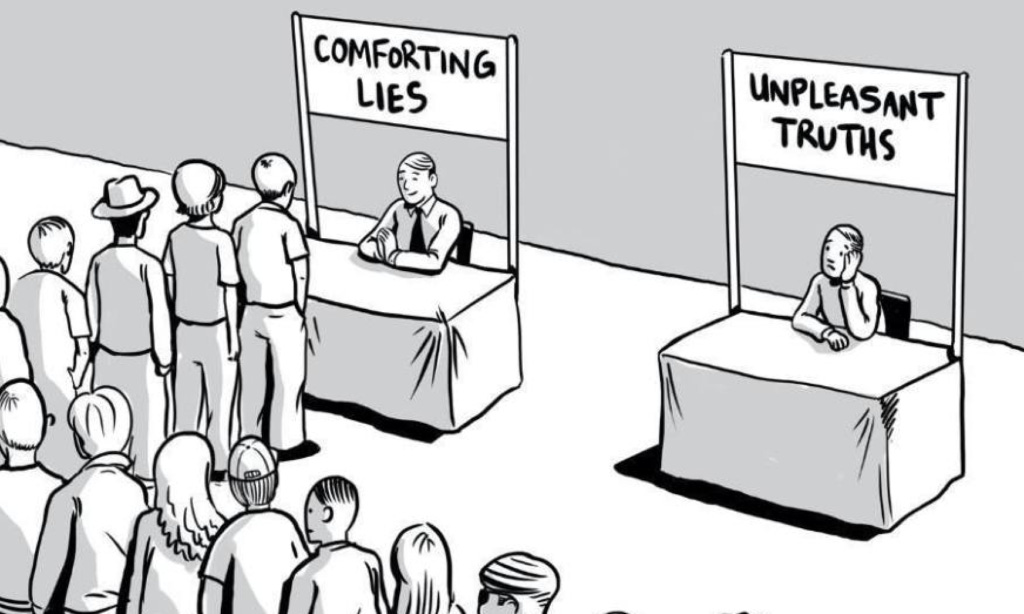

As investors, we often think we’re driven by data, strategy, and discipline. But beneath it all, a quieter force shapes many of our decisions: our own brain’s shortcuts.

These shortcuts, or cognitive biases, helped our ancestors survive. But in today’s markets, they often backfire - leading to poor decisions and missed opportunities.

So today, I’ll show you the five most dangerous investing biases - and more importantly, how to fight them.

And at the root of it all is one simple principle…

WYSIATI: What You See Is All There Is

Coined by Nobel laureate Daniel Kahneman in Thinking, Fast and Slow, WYSIATI explains how your brain builds a full story from partial information.

Picture this:

You glance at a few numbers;

Skim a headline;

Hear a friend mention a stock; and

Suddenly, your brain constructs a complete narrative:

“This stock is a great buy.”

But in reality, you only saw part of the picture.

You feel like you understand the whole thing… but that feeling is the trap.

WYSIATI is a reminder: you don’t feel what’s missing.

Your brain hides the gaps and fills them in without asking your permission.

Being aware of this bias is an act of kindness to yourself. That illusion of completeness can cost you real money…

Once you accept that your brain has blind spots, you can learn to work around them.

Spotting WYSIATI is step one.

But there are five more traps you need to know - and they’re costing you more than you think…

Found this free content useful? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

The Biases Quietly Sabotaging You:

Here are some of the most common behavioral biases that affect investors - and simple ways to fight back.

1. Confirmation Bias:

You seek out evidence that confirms what you already believe - and conveniently ignore everything else.

Bought a stock you’re excited about? Suddenly every article that praises it feels credible. Every warning sign feels “overblown.”

📍 Survival Tip:

Before buying a stock, force yourself to write down three reasons not to invest.

If you can’t, you’re probably too emotionally invested in the idea.

2. Anchoring Bias:

You fixate on irrelevant reference points, especially the price you paid for a stock.

“I can’t sell at $80 - I bought it at $100.” (I’ve caught myself saying that too)

The market doesn’t care what you paid. And neither should you.

"The stock doesn't know you own it, and it doesn't care what you paid for it." - Warren Buffett

📍 Survival Tip:

Ask yourself: Would I buy this stock today at its current price?

If the answer is no, you should probably sell - regardless of where you bought in.

Average cost doesn't exist!!!

3. Overconfidence Bias:

You think you know more than you do. That you're the exception. That this time, you’re right.

But here’s the kicker:

Most investors think they’re above average. That math doesn’t check out.

📍 Survival Tip:

Keep a decision log.

Review your past calls.

Your own track record is often the humblest teacher.

4. Loss Aversion:

You fear losses more than you value gains.

This fear drives impulsive decisions, like panic-selling during a dip… or holding onto losers far too long.

📍 Survival Tip:

Focus on long-term process over short-term pain.

Acknowledge that small losses are a natural part of smart investing.

5. Recency Bias:

You assume that what just happened will keep happening.

If markets are up, you expect more upside. If they’re down, you expect doom. It’s a dangerous trap.

📍 Survival Tip:

Zoom out.

Look at the full market cycle.

The last few weeks don’t define the future - trends fade, and reversals happen.

Found this free content valuable? Upgrade your subscription to access premium insights - offered at just a fraction of their true worth.

And the Biggest of Them All…

And the biggest of them all - the one that often blends all the others together - is herd behavior.

When everyone’s buying, you feel the urge to buy.

When everyone’s selling, you feel the urge to run too.

You don’t fully understand the stock, but everyone’s talking about it.

You tell yourself it must be safe - after all, the crowd can’t be wrong… right?

(Spoiler: it often is.)

📍 Survival Tip:

Ask yourself: Would I make this same decision if no one else knew I made it?

If the answer is no, you're likely being pulled by the herd - not your own conviction.

Before we continue, just a quick note...

🚨 P.S.

Starting July 1st, our monthly plan jumps to $9.99/month - meaning a full year of access will soon cost nearly $120.

But right now, and only until June 30th, you can lock in the annual plan for just $59.99.

That’s 50% OFF! what future members will pay - and your rate stays locked!!!

The value we deliver every month - deep dives, mental models, frameworks, behavioral insights, real tools - is easily worth 10x that. And this is just the beginning.

✅ Commit now.

✅ Think better.

✅ Stay ahead - with us.

👉 Join the Annual Plan Before the Price Goes Up

Let’s keep sharpening your edge - together.

Let’s move on. Here’s our survival kit…

Your Behavioral Survival Kit:

That’s a simple 5-step routine…

You don’t need to be a psychologist to beat your biases. You just need to be intentional. Here's a simple checklist to help you stay on track:

1. Pause Before You Act:

Feel an urge to buy or sell?

Don’t click immediately. Wait 24 hours!!!

Give your rational brain a chance to catch up with your emotional one.

2. Write It Down:

What’s your investment thesis?

Why this company, this price, this moment?

If you can’t explain it clearly, don’t invest yet.

3. Play Devil’s Advocate:

List reasons against your idea.

Look for data that challenges your assumptions.

Bias hates resistance.

4. Track Your Past Decisions:

Keep a log of what you bought, why you bought it, and how it turned out.

Review it regularly - your past self has plenty to teach your future self.

5. Stay Humble:

No one avoids all biases.

The best investors don’t eliminate them - they manage them.

Treat discipline like a muscle: train it every day.

Found this free content useful? Share it with your network! Help others discover these insights by sharing the newsletter. Your support makes all the difference!

Be Kind to Your Brain…

You’re not weak for falling into these traps. You’re human.

This guide isn’t about becoming a robot. It’s about investing with awareness, with clarity, and with compassion for yourself.

Because the truth is: you’ll never outsmart every bias. But if you create habits that account for them, you give yourself a lasting edge.

And remember - What you see is NOT all there is.

So look deeper, think slower, and build a strategy that respects your greatest asset and your biggest risk:

Your own mind.

Thanks for reading this far.

Until next time,

Jimmy

Disclaimer

As a reader of Jimmy’s Journal, you agree with our disclaimer. You can read the full disclaimer here.

This is a powerful breakdown—confirmation bias and overconfidence especially feel like silent killers in live markets. How do you personally train yourself to notice when one of these is creeping in mid-trade? Would love to hear if you use any frameworks or prompts to de-bias in real time.

Excellent!